PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842640

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842640

Global Viral Inactivation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

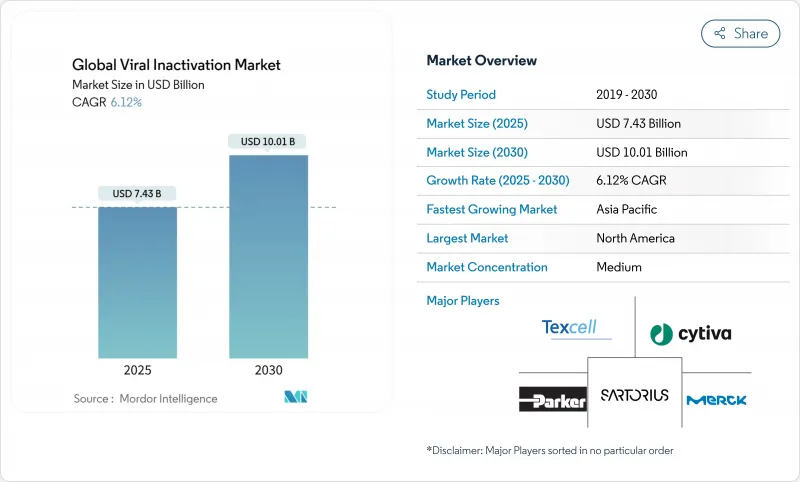

The viral inactivation market stood at USD 7.43 billion in 2025 and is projected to advance at a 6.12% CAGR, reaching USD 10.01 billion by 2030.

Heightened biologics output, rising cell and gene therapy (CGT) volumes, and stricter global safety expectations give the market its present momentum. Demand accelerates as regulators phase out legacy detergents such as Triton X-100, steering manufacturers toward environmentally compatible chemistries and heat-based approaches. Outsourcing of viral clearance work to specialist laboratories is rising in parallel with rapid CDMO expansion, especially in Asia-Pacific, where large-scale viral vector capacity is being built to attract Western biopharma projects. Competitive intensity continues to climb as leading filtration, reagent, and service suppliers broaden portfolios through targeted acquisitions aimed at the fast-growing CGT opportunity. The combined effect of these factors cements the viral inactivation market as an essential enabler of biopharmaceutical productivity and patient safety.

Global Viral Inactivation Market Trends and Insights

Expansion of Biologics and Gene Therapy Pipelines

Pipeline growth remains the prime catalyst for the viral inactivation market. More than 1,200 active US CGT clinical studies were registered in 2024, underlining unprecedented therapeutic breadth. CGT approvals, now totaling 37 in the United States, multiply viral clearance workloads because each vector platform must satisfy orthogonal inactivation tests. The pivot from treating rare disorders toward prevalent diseases such as heart failure demands higher batch volumes, forcing manufacturers to implement scalable safety solutions early in development. Adeno-associated virus programs illustrate the complexity, often requiring low-pH, solvent-detergent, and heat-hold combinations to satisfy regulators. As CGT facilities proliferate worldwide, every incremental clinical candidate feeds steady service revenue for viral inactivation experts.

Rising Incidence of Viral Contamination Recalls

Manufacturing lapses continue to trigger costly drug recalls, with 2,900 sterile product withdrawals recorded globally between 2018 and 2023. Warning letters sent to multinational producers in 2024 and 2025 show that inadequate clearance protocols remain an issue even in mature plants. A single contamination event can halt multi-site production and generate USD 100 million or more in corrective costs, making redundancy a better economic choice than remediation. Firms now implement continuous in-line virus filters, automated sampling, and environmental monitoring to cut incident probability. Insurance carriers have started linking policy premiums to validated viral safety infrastructure, adding financial motivation to upgrade processes swiftly.

High Capital Expenditure for Advanced Inactivation Infrastructure

Full-scale viral safety suites incorporating BSL-2 labs, heat-hold tanks, nanofiltration skids, and orthogonal testing instruments can exceed USD 50 million, putting the build-or-buy decision under intense scrutiny for small entities. Cash-constrained sponsors often defer investment, but late retrofits risk launch delays if clearance studies fail to meet regulatory acceptance criteria. Even after equipment purchase, ongoing calibration, biosafety certification, and skilled personnel costs remain high. The burden widens the capability gap between large integrated biopharma groups and emerging enterprises, accelerating outsourcing and market consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Global Regulatory Mandates for Viral Safety

- Shift Toward Single-Use Bioprocessing Platforms

- Complex and Lengthy Validation and Regulatory Approval Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solvent-detergent procedures secured 46.43% of revenue in 2024, affirming their role as the default approach for lipid-enveloped viral clearance in plasma-derived and recombinant protein products. Their validated performance profile sustains adoption, particularly where legacy processes face minimal changes. However, pasteurization and related heat modalities are advancing at an 8.65% CAGR as sustainability imperatives reshape process selection. This growth elevates the viral inactivation market size for heat-based equipment suppliers, supported by improved formulations that protect labile proteins during 60 °C holds. Parallel interest in low-pH and caprylate methods persists for monoclonal antibodies where gentle conditions guard Fc functionality.

The European prohibition of Triton X-100 accelerates uptake of alternatives such as Virodex(TM) detergents and Deviron(R) reagents, yet heat remains the most regulation-agnostic route. Manufacturers adopt hybrid strategies combining a detergent step with terminal pasteurization to secure orthogonal log reduction credits. Research efforts exploring high hydrostatic pressure for viral vaccines suggest longer-term method diversification opportunities that could widen the viral inactivation market, provided scalability hurdles are addressed.

Kits and reagents delivered 41.45% revenue in 2024, reflecting baseline consumable demand across every licensed bioprocess. Concentrated formulations and single-use conditioning bags sustain volume despite detergent reformulation mandates. Validation and testing services, on the other hand, are forecast to grow 8.93% annually, lifting the viral inactivation market size for external laboratories that offer end-to-end clearance packages. Their appeal rises as regulatory guidance intensifies data expectations and as in-house BSL-2 capacity remains scarce.

Leading providers supply modular study designs, predictive viral reduction modeling, and GMP-compliant reporting templates, eliminating months from project timelines. Demand for virus inactivation systems-closed-loop heaters, nanofilters, and skid-mounted low-pH reactors-also expands in synchrony with the single-use movement, but services capture disproportionate growth because they embed technical expertise that is difficult to replicate in silico or on-premise.

The Viral Inactivation Market Report is Segmented by Method (Solvent-Detergent, Low-PH Adjustment, and More), Product (Viral Inactivation Systems and Accessories, and More), Application (Vaccines & Therapeutics, and More), End-User (Biopharma & Biotechnology Companies, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America preserved 42.12% revenue share in 2024 and continues to anchor the viral inactivation market through advanced CGT clusters in Massachusetts, North Carolina, and California. FDA enforcement, exemplified by Q5A(R2), drives rapid adoption of orthogonal inactivation and inline nanofiltration, sustaining premium demand for high-specification consumables. Strategic capital projects such as Novo Nordisk's USD 4.1 billion fill-finish expansion in Clayton, North Carolina, embed large-scale viral safety suites that lock in multiyear consumable spend. Thermo Fisher Scientific's USD 4.1 billion purchase of Solventum's Purification & Filtration portfolio in February 2025 further concentrates capability in the region and augments integrated clearance solutions.

Asia-Pacific registers the steepest trajectory with a 7.45% CAGR to 2030, buoyed by local policy incentives that accelerate biologics self-sufficiency. India's CDMO market, valued at USD 15.63 billion in 2023 and headed for USD 26.73 billion by 2028, fuels a rapid rise in BSL-2 laboratory construction and integrated viral clearance services. Meanwhile, China's Anti-Espionage Law, effective July 2023, complicates foreign GMP inspections, pushing Western buyers to diversify supply chains, yet domestic demand for viral clearance technologies remains robust amid the country's Five-Year Biotech Plan. Japanese regulators' early endorsement of Triton-X alternatives accelerates heat-based process validation in local plasma plants, highlighting varied regional technology preferences.

Europe delivers modest but steady expansion as the REACH directive spurs detergent reformulation projects that translate directly into viral inactivation market demand for validation studies. Companies such as Croda and Asahi Kasei lead the response by launching compliant surfactants and ultrafast Planova FG1 filters designed for high-volume monoclonal antibody facilities. State-sponsored innovation grants in Germany and France encourage local SMEs to pilot continuous viral inactivation reactors, although capital intensity constrains scale-up pace relative to North American initiatives.

- Charles River

- Clean Cells

- Cytiva

- Merck

- Sartorius

- Thermo Fisher Scientific

- Wuxi Biologics

- Lonza Group

- Catalent

- Cygnus Technologies

- Texcell

- Vironova

- Rad Source Technologies

- Parker Hannifin

- Pall

- Meissner Filtration

- Repligen

- Getinge

- Asahi Kasei Medical

- Sartorius BIA Separations

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Biologics and Gene Therapy Pipelines

- 4.2.2 Rising Incidence of Viral Contamination Recalls

- 4.2.3 Stringent Global Regulatory Mandates For Viral Safety

- 4.2.4 Shift Toward Single-Use Bioprocessing Platforms

- 4.2.5 Phase-Out of Triton X-100 Driving Alternative Inactivation Solutions

- 4.2.6 Venture Capital Funding For Viral Vector CDMOs and Start-Ups

- 4.3 Market Restraints

- 4.3.1 High Capital Expenditure For Advanced Inactivation Infrastructure

- 4.3.2 Complex and Lengthy Validation And Regulatory Approval Cycles

- 4.3.3 Supply Chain Volatility of GMP-Grade Detergents And Filters

- 4.3.4 Technical Challenges in Continuous Inline Viral Inactivation Integration

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Method

- 5.1.1 Solvent-Detergent

- 5.1.2 Low-pH Adjustment

- 5.1.3 Pasteurization / Heat

- 5.1.4 Other Methods

- 5.2 By Product

- 5.2.1 Viral Inactivation Systems and Accessories

- 5.2.2 Kits & Reagents

- 5.2.3 Validation & Testing Services

- 5.2.4 Other Products

- 5.3 By Application

- 5.3.1 Vaccines & Therapeutics

- 5.3.2 Blood & Plasma Products

- 5.3.3 Cellular & Gene-Therapy Products

- 5.3.4 Other Applications

- 5.4 By End-User

- 5.4.1 Biopharma & Biotechnology Companies

- 5.4.2 Contract Development & Manufacturing Organisations (CDMOs)

- 5.4.3 Contract Research Organisations (CROs)

- 5.4.4 Other End-Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Charles River Laboratories

- 6.3.2 Clean Cells

- 6.3.3 Cytiva (Danaher)

- 6.3.4 Merck KGaA

- 6.3.5 Sartorius AG

- 6.3.6 Thermo Fisher Scientific, Inc.

- 6.3.7 WuXi Biologics

- 6.3.8 Lonza Group

- 6.3.9 Catalent Inc.

- 6.3.10 Cygnus Technologies

- 6.3.11 Texcell SA

- 6.3.12 Vironova AB

- 6.3.13 Rad Source Technologies

- 6.3.14 Parker Hannifin

- 6.3.15 Pall Corporation

- 6.3.16 Meissner Filtration

- 6.3.17 Repligen Corporation

- 6.3.18 Getinge AB

- 6.3.19 Asahi Kasei Medical

- 6.3.20 Sartorius BIA Separations

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment