PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842642

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842642

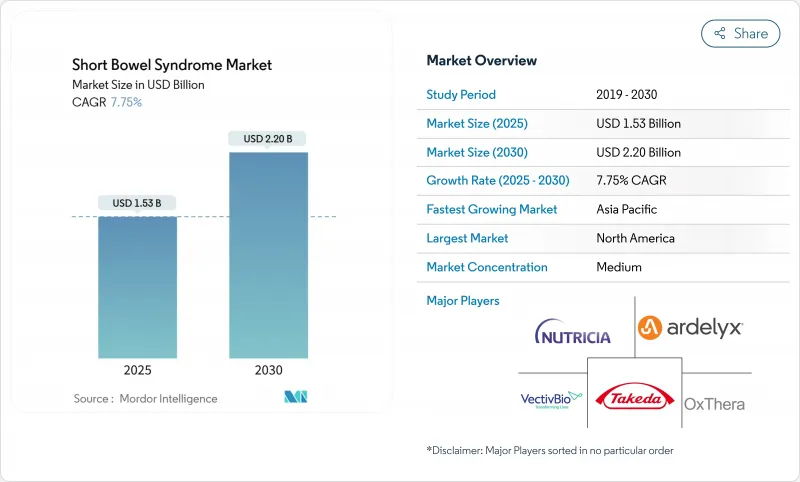

Short Bowel Syndrome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Short Bowel Syndrome market is valued at USD 1.53 billion in 2025 and is forecast to reach USD 2.22 billion by 2030, advancing at a 7.75% CAGR.

Current expansion is propelled by earlier disease recognition, faster orphan-drug approvals, and tissue-engineering breakthroughs that promise anatomical restoration rather than symptomatic relief. New ICD-10 codes introduced by the Centers for Medicare & Medicaid Services (CMS) in October 2023 are uncovering previously unreported cases and widening the treated population. At the same time, digital health platforms are making home parenteral nutrition (PN) feasible for a larger share of patients, lowering inpatient costs and improving adherence. Competitive intensity is moderate because GLP-2 analogs dominate therapy choices, yet manufacturing bottlenecks, long-term safety monitoring, and rising reimbursement scrutiny create palpable risks. Still, regulatory incentives for rare diseases and converging tissue-engineering research are reshaping the Short Bowel Syndrome market outlook over the next five years.

Global Short Bowel Syndrome Market Trends and Insights

Rising Prevalence of SBS & Complex GI Surgeries

Neonatal surgical advances have lifted survival in very low birth-weight infants, yet they have also pushed neonatal SBS incidence to 22.1 per 1,000 NICU admissions in recent cohorts . Adult incidence is rising for similar reasons: oncologic and inflammatory bowel resections are now more radical, preserving life but shortening bowel length. CMS coding changes in 2023 created visibility for these additional cases, encouraging earlier referrals and stimulating demand for novel therapeutics.

Accelerated Approvals & Uptake of GLP-2 Analogs

The FDA expanded teduglutide to children aged >=1 year and granted fast-track status to newer molecules such as apraglutide and sonefpeglutide, creating a virtuous cycle of innovation and access. Takeda's Gattex/Revestive posted JPY 119.3 billion sales in fiscal 2024, up 28.1% year over year . Conversely, Zealand Pharma's glepaglutide received a Complete Response Letter in December 2024, highlighting the market's regulatory volatility.

High Therapy Cost & Limited Access in LMICs

Total annual therapy costs exceed USD 43,000 per patient when factoring PN, monitoring, and complication management. Many LMIC health systems lack reimbursement frameworks or the cold-chain logistics for GLP-2 analogs. Manufacturers are experimenting with tiered pricing, but infrastructure constraints persist, motivating interest in low-cost peptides or simplified PN regimens.

Other drivers and restraints analyzed in the detailed report include:

- Orphan-Drug Incentives & Favorable Reimbursement

- Global Patient-Registry & NGO Awareness Initiatives

- Tissue-Engineered Intestine R&D Breakthroughs

- Serious Long-Term Safety Concerns (e.g., Neoplasia)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

GLP-2 analogs accounted for 96.14% of the Short Bowel Syndrome market in 2024, propelled by teduglutide's robust evidence base. Growth hormone therapies, though smaller in absolute sales, are set for 8.25% CAGR through 2030 as pediatric specialists employ them to spur mucosal adaptation. Weekly and monthly GLP-2 candidates like apraglutide and sonefpeglutide seek to reduce injection burden, whereas OPKO Health and Entera Bio are developing the first oral GLP-2 peptide, a shift that could reposition the Short Bowel Syndrome market size for maintenance therapy. Competitive differentiation now centers on dosing convenience, safety, and incremental PN-reduction data to secure payer acceptance and justify premium prices.

Future uptake will hinge on real-world evidence showing durable PN reduction and manageable colonoscopic surveillance. If next-generation molecules confirm similar efficacy with fewer polyps, the Short Bowel Syndrome market could migrate quickly, fragmenting the current GLP-2 oligopoly. Conversely, any class-wide safety signal could redirect investment toward regenerative or gene-editing modalities.

The Report Covers Malabsorption Syndrome Market Growth & Trends and the Market is Segmented by Drug Class (GLP-2, Growth Hormone, Glutamine, Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Others), Patient Age Group (Adults and Pediatrics) and Geography. The Market Provides the Value (in USD Million) for the Above-Mentioned Segments.

Geography Analysis

North America generated 42.41% of the Short Bowel Syndrome market in 2024, supported by specialized intestinal-failure centers, Medicare PN reimbursement, and early access to GLP-2 analogs. CMS coding updates and commercial coverage expansions ensure treatment visibility and financial viability, yet payer criteria remain stringent and require documentation of 12-month PN dependence in some plans.

Europe retains critical mass through centralized care networks and harmonized guidelines. NICE's commercial arrangement for teduglutide and ESPEN's multidisciplinary standards provide structure and reduce therapeutic variability. EU clinical consortia also drive first-in-human tissue-engineering trials, strengthening the region's innovation footprint.

Asia-Pacific is the fastest-growing territory at 9.34% CAGR through 2030, driven by regulatory modernization in China and increased resection volumes tied to rising colorectal cancer incidence. China's 2023 regulations on special-medical-purpose formula expand access to nutritionally balanced enteral feeds, complementing PN and pharmacotherapy. Japan's inclusion in global apraglutide trials exemplifies the region's integration into pivotal studies, accelerating time-to-approval for novel agents.

- Takeda Pharmaceuticals

- Zealand Pharma

- VectivBio

- Ironwood Pharmaceuticals

- OxThera AB

- Nutrinia Ltd.

- Merck

- Ardelyx Inc.

- Nestle Health Science

- Hanmi Pharmaceutical

- 9 Meters Biopharma

- Opko Health

- Jaguar Health

- Pfizer

- Abbvie

- Kyowa Kirin

- Johnson & Johnson

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of SBS & complex GI surgeries

- 4.2.2 Accelerated approvals & uptake of GLP-2 analogs

- 4.2.3 Orphan-drug incentives & favourable reimbursement

- 4.2.4 Global patient-registry & NGO awareness initiatives

- 4.2.5 Tissue-engineered intestine R&D breakthroughs

- 4.2.6 Remote PN-monitoring digital platforms

- 4.3 Market Restraints

- 4.3.1 High therapy cost & limited access in LMICs

- 4.3.2 Serious long-term safety concerns (e.g., neoplasia)

- 4.3.3 Peptide-manufacturing supply-chain bottlenecks

- 4.3.4 Disruptive competition from microbiome & surgical innovations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Class

- 5.1.1 GLP-2 Analogues

- 5.1.2 Growth Hormone

- 5.1.3 Glutamine

- 5.1.4 Others

- 5.2 By Distribution Channel

- 5.2.1 Hospital Pharmacies

- 5.2.2 Retail Pharmacies

- 5.2.3 Online & Others

- 5.3 By Patient Age Group

- 5.3.1 Adults (>=18 yrs)

- 5.3.2 Pediatrics (<18 yrs)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Takeda Pharmaceutical Co. Ltd.

- 6.3.2 Zealand Pharma

- 6.3.3 VectivBio AG

- 6.3.4 Ironwood Pharmaceuticals

- 6.3.5 OxThera AB

- 6.3.6 Nutrinia Ltd.

- 6.3.7 Merck KGaA

- 6.3.8 Ardelyx Inc.

- 6.3.9 Nestle Health Science

- 6.3.10 Hanmi Pharmaceutical

- 6.3.11 9 Meters Biopharma

- 6.3.12 OPKO Health Inc.

- 6.3.13 Jaguar Health

- 6.3.14 Pfizer Inc.

- 6.3.15 AbbVie Inc.

- 6.3.16 Kyowa Kirin

- 6.3.17 Johnson & Johnson (Janssen)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment