PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842643

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842643

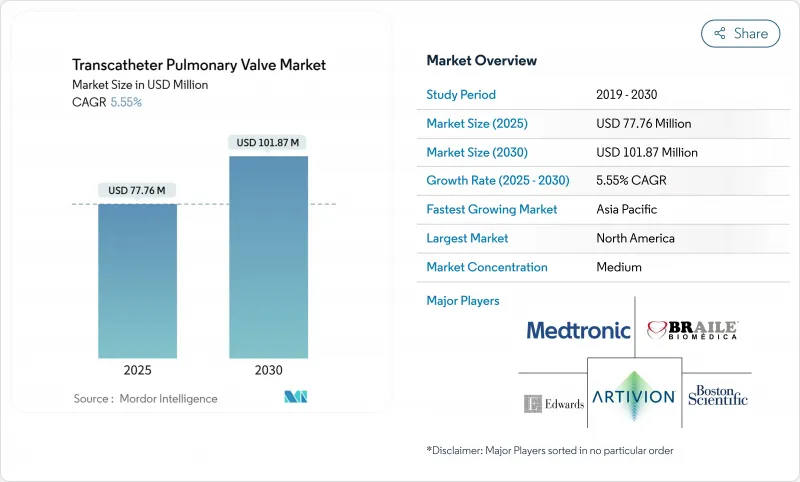

Transcatheter Pulmonary Valve - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global transcatheter pulmonary valve market is valued at USD 77.76 million in 2025 and is projected to reach USD 101.87 million by 2030, expanding at a 5.55% CAGR over the forecast horizon.

An expanding cohort of adult survivors of congenital heart disease (CHD), rapid device approvals, and supportive reimbursement updates are sustaining demand. Self-expanding platforms are doubling the addressable patient pool by treating large native right ventricular outflow tracts (RVOT), while balloon-expandable valves remain indispensable for conduit-based anatomies. Payer policies increasingly reward outpatient cath-lab procedures, accelerating the shift from tertiary surgical centers to ambulatory facilities. Regulatory vigilance around durability and endocarditis continues to temper near-term adoption but also drives sustained R&D investment in advanced tissue processing and anti-calcification technologies.

Global Transcatheter Pulmonary Valve Market Trends and Insights

Rising Adult-Survivor CHD Population

Adults living with congenital heart defects now exceed 1 million in the United States, 20% of whom require complex cardiac re-interventions. Hospitalizations are 91% higher and average USD 81,332 per stay versus USD 49,000 for non-congenital heart failure, incentivizing payers to endorse less invasive options. Strong long-term tissue durability-99.3% freedom from structural deterioration over eight years-supports device longevity expectations. The demographic trajectory ensures persistent case flow across developed markets.

Rapid Approvals of Self-Expanding TPV Platforms

Multicenter registry data covering 243 U.S. patients recorded 98% acceptable hemodynamics and 99% freedom from major composite events at one-year follow-up. UK regulators granted exceptional approval for the Venus P-valve despite a pending CE mark, signaling readiness to fast-track solutions addressing unmet needs. Ability to land securely in large native RVOT anatomies effectively doubles the clinical universe.

Durability and Strict Post-Market Surveillance

FDA registries logged 631 adverse events for Melody implants, including stent fragment embolization. Ten-year freedom from dysfunction sits at 53% in pediatric cohorts, driving regulatory calls for harmonized durability definitions. Although RESILIA tissue shows encouraging eight-year durability, pulmonary positioning evidence remains early stage.

Other drivers and restraints analyzed in the detailed report include:

- Patient and Clinician Shift to Minimally Invasive Therapies

- Investment Surge from Leading Med-Tech Strategics

- Endocarditis Uptick Triggering Caution in Key Centers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Global revenue remains anchored by balloon-expandable devices, which commanded 58.35% of the transcatheter pulmonary valve market share in 2024. Precise conduit sizing, immediate anchoring, and robust long-term data sustain clinician confidence. The Edwards SAPIEN 3 system achieved 98.1% device success and 100% freedom from surgical reintervention at one year. At the same time, self-expanding solutions are advancing at 12.25% CAGR through 2030, transforming therapeutic possibilities for enlarged native RVOT anatomies. One-year registry follow-up showed 96% freedom from composite events with acceptable hemodynamics in 98% of cases. The Venus P-valve and Harmony systems now anchor treatment algorithms in Asia and North America respectively, with CE certification further broadening access.

Pulmonary regurgitation generated 45.53% of 2024 procedure volume, reflecting historical focus on volume-overload correction. Nonetheless, pulmonary stenosis indications are forecast to post a 10.85% CAGR, the strongest trajectory within the transcatheter pulmonary valve market. Earlier intervention strategies that aim to pre-empt right-ventricular compromise underpin this acceleration, especially for repaired Tetralogy of Fallot patients. Comparative trials such as COMPASS will clarify optimal timing and modality selection, potentially increasing stenosis-related volumes.

The Transcatheter Pulmonary Valve Market Report is Segmented by Technology (Balloon-Expanded Valve and Self-Expanded Valve), Application (Pulmonary Stenosis, Pulmonary Regurgitation, and More), End-User (Pediatric Hospitals, Pulmonary Regurgitation, and More), RVOT Anatomy (Conduit-Based RVOT and Native / Enlarged RVOT), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.82% of global revenue in 2024, buoyed by advanced centers, widespread payer support, and active clinical-trial pipelines. CMS's 2.9% outpatient payment hike and new device categories accelerate catheter-lab uptake. Canada and Mexico are scaling specialist capabilities, supported by cross-border training and regional clinical studies.

Europe sustains mid-single-digit growth, underpinned by mature infrastructure and adaptable regulators willing to expedite devices with demonstrable need. Exceptional UK approval of Venus P-valve underscores demand-driven flexibility. Health-economic studies from Spain showed favorable EUR 6,952 per QALY, reinforcing payer confidence.

Asia-Pacific represents the fastest regional expansion at 10.61% CAGR. Domestic innovators such as Venus Medtech tailor self-expanding valves for prevalent anatomical features in Chinese and Indian populations. Japan's registry exceeding 8,000 transcatheter aortic cases provides a procedural blueprint for pulmonary adoption. Government initiatives to expand cardiac catheterization labs in South Korea and Australia further catalyze uptake.

South America and the Middle East & Africa trail but show rising interest as referral pathways mature. Partnerships with global device makers and training exchanges with European centers are improving procedural readiness. Incremental gains in reimbursement coverage, especially for pediatric CHD, are expected to translate into a steady but smaller share of the transcatheter pulmonary valve market by 2030.

- Medtronic

- Edward Lifesciences

- Boston Scientific

- Abbott Laboratories

- Venus MedTech (Hangzhou) Inc.

- Artivion, Inc.

- Jenavalve Technology

- LivaNova

- Braile Biomedica

- PolyVascular Inc.

- Xeltis AG

- MicroPort CardioFlow Medtech Corp.

- Terumo

- Meril Life Sciences Pvt Ltd (MyVal)

- T&N Medical (Pulsta Valve)

- Lepu Medical

- BIOTRONIK

- Peijia Medical Ltd.

- OrbusNeich Medical Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adult-Survivor CHD Population

- 4.2.2 Rapid Approvals Of Self-Expanding TPV Platforms

- 4.2.3 Patient & Clinician Shift To Minimally-Invasive Therapies

- 4.2.4 Investment Surge From Leading Med-Tech Strategics

- 4.2.5 Expansion Of Outpatient Cath-Lab Reimbursement Codes

- 4.3 Market Restraints

- 4.3.1 Durability & Strict Post-Market Surveillance

- 4.3.2 Surgical Alternatives (Ross, Homografts) Remain Viable

- 4.3.3 Endocarditis Uptick Triggering Caution In Key Centers

- 4.4 Porter's Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Balloon-Expandable Valve

- 5.1.2 Self-Expanding Valve

- 5.2 By Application

- 5.2.1 Pulmonary Stenosis

- 5.2.2 Pulmonary Regurgitation

- 5.2.3 Tetralogy-of-Fallot Post-Repair

- 5.2.4 Others

- 5.3 By End-User

- 5.3.1 Pediatric Hospitals

- 5.3.2 Adult Congenital Heart Centers

- 5.3.3 Ambulatory Surgical Centers

- 5.4 By RVOT Anatomy

- 5.4.1 Conduit-Based RVOT

- 5.4.2 Native / Enlarged RVOT

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic PLC

- 6.3.2 Edwards Lifesciences Corporation

- 6.3.3 Boston Scientific Corporation

- 6.3.4 Abbott Laboratories

- 6.3.5 Venus MedTech (Hangzhou) Inc.

- 6.3.6 Artivion, Inc.

- 6.3.7 JenaValve Technology, Inc.

- 6.3.8 LivaNova PLC

- 6.3.9 Braile Biomedica

- 6.3.10 PolyVascular Inc.

- 6.3.11 Xeltis AG

- 6.3.12 MicroPort CardioFlow Medtech Corp.

- 6.3.13 Terumo Corporation

- 6.3.14 Meril Life Sciences Pvt Ltd (MyVal)

- 6.3.15 T&N Medical (Pulsta Valve)

- 6.3.16 Lepu Medical Technology Co., Ltd.

- 6.3.17 Biotronik SE & Co. KG

- 6.3.18 Peijia Medical Ltd.

- 6.3.19 OrbusNeich Medical Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment