PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842646

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842646

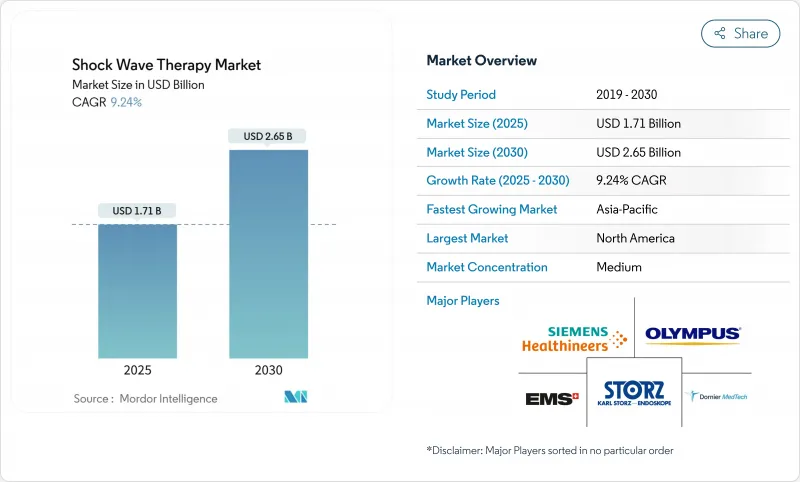

Shock Wave Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Shock Wave Therapy Market size is estimated at USD 1.71 billion in 2025, and is expected to reach USD 2.65 billion by 2030, at a CAGR of 9.24% during the forecast period (2025-2030).

Demand accelerates as hospitals, sports clinics and home-care providers embrace non-invasive pain solutions that shorten recovery time and reduce opioid reliance. Expanding clinical evidence across orthopedics, cardiology and wound care underpins physician confidence, while the FDA's class II clearance for chronic wounds signals regulatory tailwinds. Johnson & Johnson's USD 13.1 billion purchase of Shockwave Medical confirms large-cap interest in intravascular lithotripsy and reinforces investor optimism about the future scale of the shock wave therapy market. Growing geriatric populations, especially in Asia-Pacific, further support long-term procedure volume as age-related musculoskeletal and vascular disorders rise.

Global Shock Wave Therapy Market Trends and Insights

Escalating Prevalence of Musculoskeletal & Chronic Pain Disorders

Growing caseloads of plantar fasciitis, rotator cuff disease and tendinopathies place sustained pressure on orthopedic services. Meta-analyses confirm that extracorporeal shock wave therapy reduces pain and improves function more effectively than standard physiotherapy across these conditions.Mechanistic studies reveal that acoustic pulses trigger growth-factor release such as BMP, TGF-B and VEGF, positioning the modality as regenerative rather than palliative. Health systems seeking opioid-sparing strategies increasingly include ESWT within multimodal pain pathways. Early-stage trials in spinal cord injury rehabilitation and aesthetic hair regrowth broaden the addressable pool of patients and strengthen the long-run outlook for the shock wave therapy market.

Rapid Growth in Geriatric Population

Population aging boosts procedure demand because many elderly patients are poor surgical candidates yet remain physically active. Randomized studies in knee osteoarthritis report significant WOMAC score improvement after focused shock wave therapy with negligible adverse events. In cardiology, intravascular lithotripsy softens calcified plaques common among seniors, improving vessel compliance without high-pressure balloons. Protocols tailored to lower-energy pulses and longer treatment intervals enhance safety for frail cohorts. Integration into geriatric care pathways aligns with value-based models that emphasize mobility and independence.

High Upfront Cost of Shock Wave Systems & Procedures

Clinic owners often face capital expenses exceeding mid-five-figure USD amounts for professional systems. Maintenance, hand-piece replacements and training further elevate total cost of ownership. Vendors counteract with lease plans and pay-per-treatment models, yet cash-flow constraints persist in smaller practices. Portable consumer devices such as PulseWave MiniWave, rated for 1 million pulses, signal a shift toward affordability. Cost-effectiveness studies showing surgery avoidance up to 30 months post-therapy support broader procurement, tempering the restraint over time.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Non-Invasive Pain-Management Alternatives

- Increasing Adoption in Sports Medicine & Rehabilitation Clinics

- Limited or Patchy Reimbursement Coverage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radial pressure wave devices captured 40.87% of the shock wave therapy market share in 2024, reflecting their affordability and simple workflow. The shock wave therapy market size for radial systems is set to expand steadily as portable hand-held designs enable use in outpatient and home environments. Piezoelectric platforms exhibit the fastest 10.23% CAGR because precise focus and deeper penetration benefit complex orthopedic and vascular cases. Electromagnetic emitters maintain a loyal base among high-volume spine and sports centers, whereas electrohydraulic units, though clinically proven, are gradually relegated to specialty lithotripsy suites.

Device evolution emphasizes weight reduction, digital touchscreens and AI-guided dose algorithms. Radial manufacturers integrate app-based protocols that adjust frequency and bar-pressure in real time, enhancing consistency across operators. Focused piezoelectric systems add high-resolution imaging to target deep lesions, reducing repeat sessions. Competitive pricing, subscription hand-pieces and bundled service contracts support wider adoption across physiotherapy chains, thereby reinforcing the multi-segment expansion of the shock wave therapy market.

The Shockwave Therapy Market Report Segments the Industry Into Technique (Electrohydraulic Shock Waves, Piezoelectric Shock Waves, and More), Application (Orthopedics & Sports Injuries, Cardiology, and More), End User (Hospitals, Specialty & Sports Medicine Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35.67% of global revenue in 2024 as orthopedic surgeons, sports physicians and wound-care nurses embrace evidence-based protocols. Breakthrough-device designations from the FDA, such as EDAP TMS's Focal One for endometriosis, accelerate portfolio diversification. Cardiovascular deployments benefit from strong catheter-lab infrastructure, and Boston Scientific cited double-digit growth in IVL catheters during Q1 2025 earnings. Reimbursement gaps persist yet pioneer clinics leverage outcome data to negotiate local coverage, sustaining steady expansion in the shock wave therapy market.

Asia-Pacific records the fastest 11.64% CAGR, propelled by aging populations, rising disposable income and rapid technology transfer from Western markets. Chinese research output rivals the United States in ESWT publications, fostering domestic device innovation. Health ministries in Japan and South Korea fund pilot programs for diabetic-foot wound management, while private hospitals in India adopt radial devices for cash-pay sports medicine services. Manufacturer joint ventures in Shenzhen and Seoul cut price points, enabling broader hospital and clinic uptake.

Europe maintains robust demand through well-regulated medical device pathways and rigorous evidence standards. Switzerland's public insurers cover prostate HIFU, setting a precedent that could spill into focused ESWT reimbursement. German sickness funds reimburse up to three plantar fasciitis sessions, supporting outpatient clinics. Middle East and Africa, though representing a small base, show growing interest as Gulf states expand sports and wellness infrastructure. Latin America gains traction via Brazilian orthopedic societies' continuing-education modules, yet currency volatility and import tariffs temper immediate shock wave therapy market penetration.

- EMS Electro Medical Systems

- Dornier MedTech

- Karl Storz SE & Co. KG (Storz Medical)

- Siemens Healthineers

- BTL

- Zimmer MedizinSysteme

- EDAP TMS SA

- Boston Scientific

- Olympus Corp.

- Inceler Medikal

- Chattanooga (Enovis)

- Richard Wolf

- PulseVet (Zoetis)

- MTS Medical Ug

- WIKKON Medical

- Elettronica Pagani Srl

- Shenzhen Huikang Medical

- ELvation Medical

- Guidoni Medical Devices

- Quatron Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Prevalence of Musculoskeletal & Chronic Pain Disorders

- 4.2.2 Rapid Growth in Geriatric Population

- 4.2.3 Rising Demand for Non-Invasive Pain-Management Alternatives

- 4.2.4 Increasing Adoption in Sports Medicine & Rehabilitation Clinics

- 4.2.5 Synergistic Use of ESWT With Biologics

- 4.2.6 Commercialisation of Portable Low-Cost Radial Devices for Home Physio

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost of Shockwave Systems & Procedures

- 4.3.2 Limited or Patchy Reimbursement Coverage

- 4.3.3 Regulatory Scrutiny on Direct-To-Consumer ED Devices

- 4.3.4 Operator-Dependent Dosing Leads to Inconsistent Outcomes

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Technique

- 5.1.1 Electrohydraulic Shock Waves

- 5.1.2 Piezoelectric Shock Waves

- 5.1.3 Radial / Pneumatic Shock Waves

- 5.1.4 Electromagnetic Shock Waves

- 5.1.5 Other / Hybrid Techniques

- 5.2 By Application

- 5.2.1 Orthopedics & Sports Injuries

- 5.2.2 Cardiology

- 5.2.3 Urology

- 5.2.4 Dermatology & Aesthetics

- 5.2.5 Veterinary Medicine

- 5.2.6 Neurology & Pain Management

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty & Sports Medicine Clinics

- 5.3.3 Ambulatory Surgical Centers

- 5.3.4 Physiotherapy & Rehabilitation Centres

- 5.3.5 Home-care Settings

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 EMS Electro Medical Systems SA

- 6.3.2 Dornier MedTech GmbH

- 6.3.3 Karl Storz SE & Co. KG (Storz Medical)

- 6.3.4 Siemens Healthineers AG

- 6.3.5 BTL Industries

- 6.3.6 Zimmer MedizinSysteme GmbH

- 6.3.7 EDAP TMS SA

- 6.3.8 Boston Scientific Corp.

- 6.3.9 Olympus Corp.

- 6.3.10 Inceler Medikal Co. Ltd

- 6.3.11 Chattanooga (Enovis)

- 6.3.12 Richard Wolf GmbH

- 6.3.13 PulseVet (Zoetis)

- 6.3.14 MTS Medical Ug

- 6.3.15 WIKKON Medical

- 6.3.16 Elettronica Pagani Srl

- 6.3.17 Shenzhen Huikang Medical

- 6.3.18 ELvation Medical

- 6.3.19 Guidoni Medical Devices

- 6.3.20 Quatron Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment