PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842648

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842648

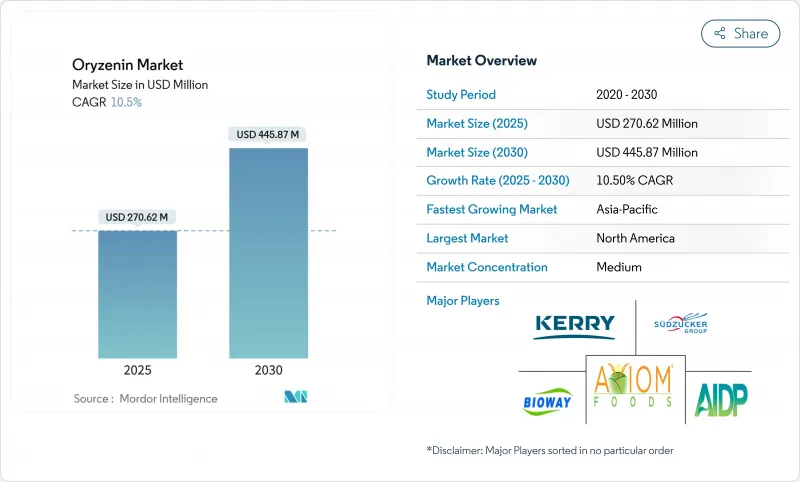

Oryzenin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The oryzenin market is valued at USD 270.62 million in 2025 and is projected to reach USD 445.87 million by 2030, growing at a CAGR of 10.50%.

The market growth is driven by oryzenin's hypoallergenic properties, plant-based nature, and suitability for clean-label and allergen-free products. The increasing prevalence of food allergies has led manufacturers and consumers to adopt rice-derived proteins like oryzenin as a safe, digestible, and non-GMO alternative. The market expansion is supported by growing consumer preference for sustainable, vegan, and organic diets across functional foods, nutraceuticals, infant nutrition, and sports supplements. Strict regulations in developed markets regarding ingredient labeling and clean-label requirements enhance oryzenin's market position. Improvements in extraction methods, microencapsulation, and enzymatic hydrolysis have enhanced product quality, taste, and solubility, making oryzenin a viable alternative to whey, casein, and pea proteins. The market continues to grow through product innovation, regulatory compliance, and increased adoption by major food and beverage manufacturers.

Global Oryzenin Market Trends and Insights

Rising Demand for Hypoallergenic Plant Proteins in Infant Nutrition

Infant nutrition applications are driving oryzenin adoption as manufacturers respond to increasing food allergies and regulatory requirements for safer formulations. Rice protein's hypoallergenic properties make it advantageous compared to traditional allergens, with clinical studies showing similar muscle-building efficacy to whey protein without dairy allergen risks. While concerns about lead content in plant-based protein powders have emerged, rice protein producers like Axiom Foods have developed products such as Oryzatein 2.0 with no detectable lead levels, meeting Proposition 65 requirements . Elemental formulas, primarily amino acid-based, are increasingly prescribed for pediatric conditions like cow's milk allergy and eosinophilic esophagitis, creating demand for hypoallergenic protein sources that support growth without adverse reactions. The Food and Drug Administration (FDA)'s enhanced GRAS review requirements, though extending development timelines, benefit established rice protein suppliers with proven safety profiles. This regulatory framework creates barriers to entry for new market participants while maintaining higher safety standards in infant nutrition.

Increasing Adoption of Rice Protein in Texturized Meat Analogues

Meat alternative manufacturers choose rice protein to solve taste and texture problems that have slowed plant-based meat growth. Rice protein's neutral flavor masks taste better than pea and soy alternatives. The International Food Information Council (IFIC) reports that in 2024, 71% of consumers want more protein in their diet . However, taste issues have caused the plant-based protein market to stall, which is why manufacturers are turning to rice protein's mild flavor. Companies are developing new heat treatment methods to improve rice protein's solubility while keeping its emulsification properties, making it work better in meat alternatives that need specific textures. Manufacturers are also creating hybrid formulas by mixing rice and pea proteins, which research shows improves texture and keeps more beneficial compounds when processed at low temperatures. New precision fermentation techniques are making rice protein even better. These advances make rice protein a crucial ingredient in new meat alternatives that offer both good nutrition and taste that consumers enjoy.

Unpleasant Off-Flavour and Poor Solubility Limiting Use in Beverages

Rice protein faces challenges in beverage applications due to its flavor profile and solubility limitations, despite improvements in processing methods. While rice protein has a milder taste than pea protein, its chalky texture and slight bitterness affect consumer acceptance in clear beverages. Companies such as Sensient and Cargill are developing flavor masking solutions using yeast extracts and modulation compounds, combined with sweeteners to enhance mouthfeel and taste. Processing methods, including enzymatic hydrolysis and lactic acid bacteria fermentation, have demonstrated effectiveness in reducing off-flavors by decreasing hexanal compounds. Beverage manufacturers are increasingly using hybrid protein formulations that combine rice protein with other sources to address these challenges while maintaining clean-label requirements.

Other drivers and restraints analyzed in the detailed report include:

- Growing Application in Sports Nutrition and Dietary Supplements

- Expansion of Functional Food and Beverage Product Portfolios

- Higher Production Costs Compared to Soy and Pea Protein

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Isolates command the largest market share at 45.13% in 2024, due to their high protein content and functional properties that meet requirements in sports nutrition and meat alternatives. The isolate segment's dominance is based on protein content and refined processing that removes most non-protein components, making it suitable for applications requiring high protein density and neutral flavor profiles. Concentrates represent the fastest-growing segment at 12.46% CAGR through 2030, as manufacturers seek balanced functionality at lower price points for bakery and confectionery applications. Hydrolysates serve a specialized niche, targeting applications requiring enhanced digestibility and rapid absorption, particularly in sports nutrition and clinical nutrition formulations where bioavailability is essential.

The product type segmentation shows market maturity, with manufacturers selecting protein forms based on specific functional requirements rather than cost alone. Isolates benefit from processing technologies that improve solubility and reduce off-flavors. Concentrates gain market share through processing methods that maintain nutritional value while reducing production costs, making them suitable for mass-market applications. The hydrolysates segment maintains premium pricing due to specialized processing requirements and applications in clinical and performance nutrition markets where enhanced bioavailability supports higher costs.

The Oryzenin Market is Segmented by Type (Isolates, Concentrates, and Hydrolysates), by Form (Dry, and Liquid), by Application (Bakery and Confectionery, Beverages, Sports and Energy Nutrition, Dairy Alternatives, Meat Substitutes, and Other Applications), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains market leadership with a 31.83% share in 2024, supported by regulatory classification for rice protein and established supply chain infrastructure. The region's efficient distribution network serves diverse application segments. Consumer preference for clean-label products and hypoallergenic protein alternatives drives market growth, particularly in sports nutrition and functional food applications. The Department of Health and Human Services (HHS) decision to eliminate self-affirmed GRAS pathways strengthens established rice protein suppliers while creating entry barriers for new companies. The region's advanced food processing capabilities and innovation ecosystem enable continuous product development and market expansion.

Asia-Pacific demonstrates the fastest growth at 11.91% CAGR through 2030. This growth stems from proximity to rice production sources, increasing plant-based protein demand, and government support for domestic protein production. The region benefits from cultural familiarity with rice and established processing infrastructure, resulting in lower production costs. Singapore's USD 14.8 million investment in the Centre for Precision Fermentation and Sustainability indicates regional commitment to alternative protein development. The development of drought-resistant rice varieties that require less water while maintaining yields offers solutions for stable raw material supply and market growth.

Europe presents strategic growth opportunities, characterized by strict regulatory requirements and increasing demand for sustainable, clean-label ingredients. The European Union's initiative to enhance domestic plant-based protein supply creates opportunities for rice protein integration, exemplified by Germany's EUR 38 million allocation for sustainable protein initiatives in 2023. European regulations favor natural additives and clean-label products, enhancing rice protein's potential in functional food applications. Research focusing on developing high-protein rice varieties through conventional breeding methods aligns with non-GMO regulations and positions Europe for domestic rice protein production to reduce import dependency.

- Kerry Group PLC

- Axiom Foods Inc.

- AIDP Inc.

- Sudzucker AG

- Bioway Organic Group Ltd.

- The Green Labs LLC

- Shafi Gluco Chem (Pvt.) Ltd.

- Gulshan Polyols Ltd.

- Oryza Oil & Fat Chemical Co., Ltd

- Ingredion Incorporated

- Afzal Industries

- Zedira Gmbh

- Ribus Inc.

- Golden Grain Group Limited

- FUJIFILM Wako Pure Chemical Corporation

- Healy Group

- Shandong Jinyuan Biotech Co. Ltd.

- RiceBran Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Hypoallergenic Plant Proteins in Infant Nutrition

- 4.1.2 Increasing Adoption of Rice Protein in Texturized Meat Analogues

- 4.1.3 Growing Application in Sports Nutrition and Dietary Supplements

- 4.1.4 Expansion of Functional Food and Beverage Product Portfolios

- 4.1.5 Regulatory approvals and GRAS status accelerating global commercialization

- 4.1.6 Growing Demand for Clean Label and Sustainable Ingredients

- 4.2 Market Restraints

- 4.2.1 Unpleasant Off-Flavour and Poor Solubility Limiting Use in Beverages

- 4.2.2 Higher Production Costs Compared to Soy and Pea Protein

- 4.2.3 Climate-Driven Variability in Rice Production Affecting Raw Material Pricing

- 4.2.4 Technical challenges in extraction and processing of oryzenin from rice

- 4.3 Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Isolates

- 5.1.2 Concentrates

- 5.1.3 Hydrolysates

- 5.2 By Form

- 5.2.1 Dry

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Beverages

- 5.3.3 Sports and Energy Nutrition

- 5.3.4 Dairy Alternatives

- 5.3.5 Meat Substitutes

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Ranking Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 Kerry Group PLC

- 6.3.2 Axiom Foods Inc.

- 6.3.3 AIDP Inc.

- 6.3.4 Sudzucker AG

- 6.3.5 Bioway Organic Group Ltd.

- 6.3.6 The Green Labs LLC

- 6.3.7 Shafi Gluco Chem (Pvt.) Ltd.

- 6.3.8 Gulshan Polyols Ltd.

- 6.3.9 Oryza Oil & Fat Chemical Co., Ltd

- 6.3.10 Ingredion Incorporated

- 6.3.11 Afzal Industries

- 6.3.12 Zedira Gmbh

- 6.3.13 Ribus Inc.

- 6.3.14 Golden Grain Group Limited

- 6.3.15 FUJIFILM Wako Pure Chemical Corporation

- 6.3.16 Healy Group

- 6.3.17 Shandong Jinyuan Biotech Co. Ltd.

- 6.3.18 RiceBran Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK