PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842652

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842652

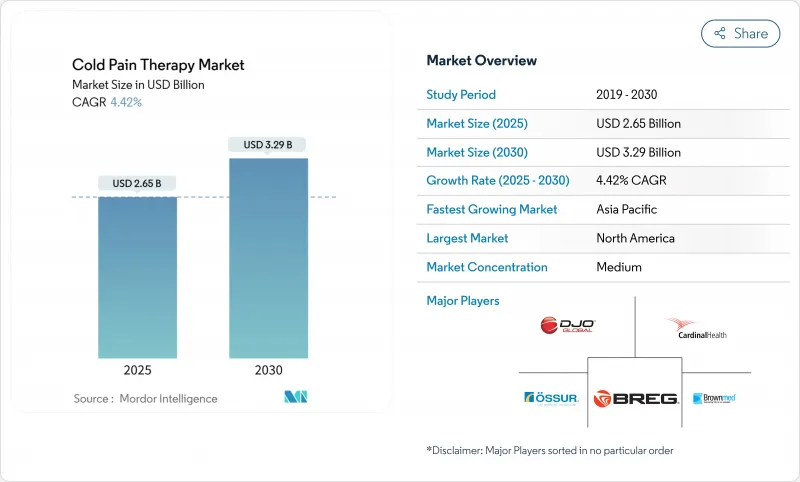

Cold Pain Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cold pain therapy market size reached USD 2.65 billion in 2025 and is forecast to climb to USD 3.29 billion by 2030, reflecting a 4.42% CAGR through the period.

Demand pivots from simple ice packs to connected, temperature-controlled wearables that deliver consistent therapy guided by artificial intelligence . Rising musculoskeletal disease prevalence-osteoarthritis alone affected 607 million people worldwide in 2021-intensifies the need for drug-free pain relief. At the same time, patients increasingly favor self-care solutions that lower healthcare costs and offer immediate relief. Integration of real-time temperature monitoring into flexible wearables further differentiates premium devices, while regulatory clarity from the FDA on thermal evaluation standards lowers market entry barriers for innovators.

Global Cold Pain Therapy Market Trends and Insights

Rising Incidence of Sports & Road-Traffic Injuries

Professional leagues and amateur athletes now treat acute injuries within six hours using portable cryotherapy units because evidence shows that recovery outcomes improve when tissue temperature is lowered quickly. Sports bodies mandate on-site cold therapy, shifting budgets from disposable ice toward programmable devices that maintain therapeutic ranges without refills . Urban traffic congestion also raises collision rates, widening the market for first-response kits fitted with compact cooling wraps. As a result, the cold pain therapy market increasingly serves emergency care and sporting venues with quick-deployment solutions.

Growing Prevalence of Arthritis & Other MSDs in Ageing Population

During the last 25 years, osteoarthritis cases among working-age adults more than doubled, intensifying the economic burden of chronic pain. Elderly users gravitate toward wrap-around devices that are lightweight, easy to fasten and capable of maintaining set temperatures for extended periods . Emerging cryoneurolysis techniques offer knee-specific relief by cooling targeted sensory nerves, enabling mobility gains without systemic analgesics. Manufacturers position geriatric-friendly designs with intuitive controls to tap this long-term growth driver.

Limited or Absent Third-Party Reimbursement

US Medicare classifies most cooling devices as "not medically necessary," shifting full cost to patients despite favorable trial data. Insurers cite inconsistent outcomes to justify denials, while some regional payers rely on orthopedic society statements that favor simpler ice over motorized systems. Hospitals therefore limit purchases, slowing high-value device adoption in the cold pain therapy market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Consumer Shift Toward Self-Care & OTC Topical Analgesics

- Increase in Post-Surgical Procedures Requiring Cold Therapy

- Low Patient & Clinician Awareness in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

OTC solutions controlled 65.25% of cold pain therapy market share in 2024 as consumers favored accessible sprays, gels and patches available without medical oversight. Creams and gels continue to anchor pharmacy aisles, while controlled-release patches win customers who prefer longer relief intervals. The cold pain therapy market size for OTC formats is projected to grow steadily but at a slower pace than technologically sophisticated prescription devices.

Prescription devices, led by motorized circulation systems, exhibit a 5.23% CAGR to 2030. Hospitals adopt these platforms to standardize postoperative protocols that demand precise temperature windows and automated shut-offs. Software-enabled pumps transmit usage logs to electronic health records, helping providers validate adherence for quality metrics. As a result, the cold pain therapy market increasingly bifurcates: mass-market OTC goods dominate volume, whereas high-margin prescription units capture institutional budgets seeking outcome-based solutions.

Sports medicine retained 38.43% of cold pain therapy market revenue in 2024, driven by mandatory cryotherapy access across professional leagues and expanding amateur participation. Portable sleeve systems that fit knees, ankles and shoulders now travel with teams, replacing ice coolers on the sidelines. However, neuropathic & chronic pain cases expand at a 5.29% CAGR as TRPM8 research validates cold modulation for complex pain mechanisms.

Post-operative therapy remains critical, with hospital protocols requiring cold application after replacement surgeries to curb swelling. In trauma & orthopedics, aging populations boost fracture and joint repair volumes, keeping demand high for durable wraps and non-motorized packs. These shifts spread adoption across acute injury management and long-duration chronic care, broadening the cold pain therapy market footprint beyond athletics.

The Cold Pain Therapy Market is Segmented by Product (OTC Products and Prescription Products), Application (Sports Medicine and More), Distribution Channel (Retail Pharmacies & Drug Stores and More), Age Group (Adults, Geriatric, and Pediatric), and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 40.44% of the cold pain therapy market in 2024, supported by high healthcare spending and FDA guidance that eliminates regulatory ambiguity for device submissions. The United States leads prescription device adoption, though reimbursement gaps temper hospital uptake. Canada's single-payer model provides steadier funding for medically necessary cooling systems, while Mexico's growing middle class boosts OTC category sales.

Europe follows with mature distribution networks and harmonized Medical Device Regulation that eases cross-border sales. Germany and the United Kingdom spearhead adoption of connected wraps that integrate with digital monitoring platforms, reflecting strong telehealth penetration. Southern European markets expand sports medicine segments due to professional football and cycling culture, while the European Medicines Agency's digital health initiatives encourage further IoT integration.

Asia-Pacific is the fastest-growing region with a 5.49% CAGR to 2030, driven by ageing populations in China and India and high technology acceptance in Japan and South Korea. Local investors back start-ups producing affordable smart cuffs marketed through regional e-commerce giants. Australia acts as a clinical-trial hub for next-generation cooling wearables, leveraging its sports-science expertise. However, limited reimbursement frameworks in parts of Southeast Asia keep adoption below potential, signaling long-run upside for companies that localize education and financing solutions in the cold pain therapy market.

- Breg

- Brownmed

- Cardinal Health

- Enovis Corp. (DJO Global)

- Ossur

- Performance Health

- Medline Industries

- IceWraps LLC

- Compass Health

- Hisamitsu Pharmaceutical Co.

- Romsons

- Unexo Life Sciences

- Sanofi

- Pfizer

- Johnson & Johnson (Chattanooga / Icy Hot)

- Solventum

- Zimmer MedizinSysteme

- BTL

- CoolSystems Inc. (Game Ready)

- CynoSure (Lutronic Cryo)

- Beiersdorf AG (Voltaren Emulgel)

- Metrum Cryoflex

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of sports & road-traffic injuries

- 4.2.2 Growing prevalence of arthritis & other MSDs in ageing population

- 4.2.3 Rapid consumer shift toward self-care & OTC topical analgesics

- 4.2.4 Increase in post-surgical procedures requiring cold therapy

- 4.2.5 IoT-enabled smart wearables offering real-time temperature control

- 4.2.6 Next-gen TRPM8-modulating cooling compounds in R&D pipeline

- 4.3 Market Restraints

- 4.3.1 Limited or absent third-party reimbursement

- 4.3.2 Low patient & clinician awareness in emerging economies

- 4.3.3 Dermatologic adverse events triggering tighter formulation rules

- 4.3.4 Substitution threat from laser, contrast & heat-alternation therapies

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 OTC Products

- 5.1.1.1 Creams

- 5.1.1.2 Gels

- 5.1.1.3 Patches

- 5.1.1.4 Sprays & Roll-ons

- 5.1.1.5 Wraps & Pack Systems

- 5.1.1.6 Other OTC Products

- 5.1.2 Prescription Products

- 5.1.2.1 Motorized Devices

- 5.1.2.2 Non-motorized Devices

- 5.1.1 OTC Products

- 5.2 By Application

- 5.2.1 Sports Medicine

- 5.2.2 Post-operative Therapies

- 5.2.3 Trauma & Orthopaedics

- 5.2.4 Neuropathic & Chronic Pain

- 5.2.5 Other Applications

- 5.3 By Distribution Channel

- 5.3.1 Retail Pharmacies & Drug Stores

- 5.3.2 Hospital Pharmacies

- 5.3.3 E-commerce

- 5.3.4 Sports & Specialty Stores

- 5.4 By Age Group

- 5.4.1 Adults

- 5.4.2 Geriatric

- 5.4.3 Pediatric

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.2 GCC

- 5.5.4.3 South Africa

- 5.5.4.4 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Breg Inc.

- 6.3.2 Brownmed Inc.

- 6.3.3 Cardinal Health Inc.

- 6.3.4 Enovis Corp. (DJO Global)

- 6.3.5 Ossur hf

- 6.3.6 Performance Health

- 6.3.7 Medline Industries LP

- 6.3.8 IceWraps LLC

- 6.3.9 Compass Health Brands

- 6.3.10 Hisamitsu Pharmaceutical Co.

- 6.3.11 Romsons

- 6.3.12 Unexo Life Sciences

- 6.3.13 Sanofi SA

- 6.3.14 Pfizer Inc.

- 6.3.15 Johnson & Johnson (Chattanooga / Icy Hot)

- 6.3.16 Solventum

- 6.3.17 Zimmer MedizinSysteme

- 6.3.18 BTL Industries

- 6.3.19 CoolSystems Inc. (Game Ready)

- 6.3.20 CynoSure (Lutronic Cryo)

- 6.3.21 Beiersdorf AG (Voltaren Emulgel)

- 6.3.22 Metrum Cryoflex

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment