PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842654

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842654

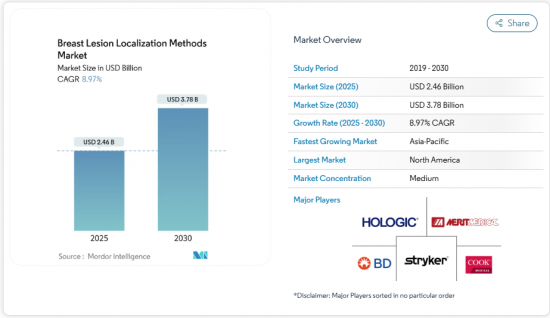

Breast Lesion Localization Methods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The breast lesion localization methods market size was valued at USD 2.46 billion in 2025 and is forecast to reach USD 3.78 billion by 2030, advancing at an 8.97% CAGR.

Rising breast-cancer incidence, expanding screening programs, and a clear migration toward wire-free seed, radiofrequency, and radar systems are the primary expansion catalysts. Magnetic localization in particular eliminates the same-day surgery constraint of wires, supporting the shift toward outpatient breast-conserving surgery. European movement away from radioactive isotopes and North American reimbursement incentives for same-day discharge reinforce the appeal of wireless solutions. Asia-Pacific provides significant volume upside as national screening campaigns identify earlier-stage, non-palpable lesions in large urban populations.

Global Breast Lesion Localization Methods Market Trends and Insights

Rising Breast-Cancer Incidence & Screening Intensity

Escalating breast-cancer diagnoses are translating directly into higher procedure volumes for the breast lesion localization methods market. Population aging in developed countries and the proliferation of government-funded mammography programs in China, India, and Southeast Asia are unveiling large pools of previously undetected, non-palpable lesions. Urban screening centers in Mumbai, Shanghai, and Bangkok are reporting record detection rates, and smaller tumors require more precise localization to avoid excessive tissue removal. Earlier detection also increases the proportion of candidates for breast-conserving surgery, further boosting demand for accurate lesion marking. As imaging sensitivity grows, the average lesion size encountered in surgery continues to fall, making reliable pre-operative localization indispensable.

Shift Toward Breast-Conserving Surgeries (BCS

Clinical evidence demonstrating oncologic equivalence between mastectomy and BCS, coupled with better cosmetic outcomes, has accelerated the global pivot toward conservation procedures. China's BCS usage climbed from 1.53% to 11.88% within ten years, and Japan sustains near-40% adoption. Younger, well-informed patients actively seek breast preservation, prompting hospitals to overhaul surgical workflows around precise localization. Europe leads the embrace of magnetic seeds as wire replacements, driven by initiatives to curtail patient discomfort and scheduling bottlenecks. Neoadjuvant chemotherapy further enlarges the pool of BCS candidates by shrinking tumors, yet that benefit is contingent upon highly accurate lesion marking so surgeons can target residual disease margins.

Complex Multi-Jurisdiction Device Approvals

The European Union Medical Device Regulation extends evidence requirements and lengthens conformity assessments, delaying wireless platform launches by up to four years. Innovative localization technologies often lack predicate devices under the U.S. 510(k) rule, necessitating larger clinical data sets to prove substantial equivalence. Emerging economies introduce additional registration layers that demand localized safety testing, straining mid-sized vendors. Larger corporations with dedicated regulatory teams navigate these hurdles but pass added costs downstream, potentially slowing adoption in resource-limited settings. As regions tighten post-market surveillance, manufacturers remain exposed to recall risks that can erode clinician confidence.

Other drivers and restraints analyzed in the detailed report include:

- Outpatient Lumpectomies Push for Quicker Set-ups

- Integration of Localization Data with OR Navigation Software

- High Capital & Tag Cost of Wireless Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wire guidance held 35.76% of the breast lesion localization methods market share in 2024, reflecting its entrenched status, low upfront cost, and universal availability. Wire use persists in large public hospitals that prioritize proven instruments and operate under tight capital controls. Yet, magnetic seed adoption is rising swiftly, propelled by 10.11% CAGR, as randomized studies report lower patient anxiety, simplified scheduling, and reduced operative delays. Radioactive methods are retreating in Europe where regulators favor radiation-free environments, and Germany's planned 2028 ban will likely redirect demand to magnetic and radar systems. RFID tags such as LOCalizer and radar-based SAVI SCOUT offer accurate depth detection without ionizing radiation, gaining favor among breast surgeons who balance workflow convenience with margin precision. The breast lesion localization methods market benefits as hospitals retrofit radiology suites with seed placement imaging software that integrates seamlessly with PACS architectures. Magnetic platforms increasingly bundle console-agnostic detection probes, enabling cross-department utilization that spreads capital cost across multiple surgical teams. As product portfolios mature, vendors highlight complementary disposables that generate recurring revenue streams, ensuring continued investment in console upgrades.

Magnetic seed localization carries minimal patient discomfort because seeds are scarcely palpable and remain stable for weeks, allowing flexibility in scheduling surgery in high-volume centers. In the breast lesion localization methods market size for magnetic systems, revenue is projected to climb significantly by 2030. Wire device designers counter with thinner, kink-resistant wires and integrated imaging markers, but these incremental tweaks hardly offset the workflow superiority of wire-free options. Radar systems capitalise on real-time in-field guidance, providing visual and auditory cues that shorten procedure times. Radiology departments often adopt a mixed-modal portfolio-maintaining wires for cost-sensitive cases while transitioning complex or cosmetic priority cases to seeds-creating hybrid demand patterns. Vendors that integrate magnetic probes with fluorescence or ultrasound visualization aim to future-proof their products against next-generation image-guided surgery modalities now entering clinical evaluation at tertiary centers.

The Breast Lesion Localization Methods Market Report is Segmented by Localization Method (Wire-Guided Localization, Radioactive-Based Localization [RSL and ROLL], and More), Usage (Tumor Identification and More), End-User (Hospitals, Ambulatory Surgical Centers (ASCs), and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.32% share of the breast lesion localization methods market in 2024 owing to mature screening infrastructure, high BCS adoption, and favorable reimbursement structures. The United States extends Medicare mammography coverage with no patient copay, generating a consistent influx of early detections requiring localization. Private insurers mirror these benefits, accelerating procedural growth in suburban outpatient centers. Canadian provinces expand mobile imaging fleets, enhancing access in rural communities and boosting wire demand where capital budgets lag. Mexico's Seguro Popular reforms incorporate mammography in the basic benefit package, gradually stimulating seed imports as tertiary hospitals in Mexico City pilot RFID platforms. Across the region, 64% of mastectomies have shifted to outpatient settings, reinforcing seed uptake that supports flexible scheduling. Market participants prioritize FDA-cleared products because the 510(k) pathway expedites upgrades when incremental detector refinements emerge.

Europe advances at 8.56% CAGR through 2030 underpinned by regulatory emphasis on patient safety and environmental considerations. Germany's pending radiation-protection regulation accelerates the transition from radioactive seeds to magnetic and radar modalities. The United Kingdom's National Health Service adopted magnetic localization pilots in 2025 that demonstrate shorter wait times and higher patient-reported comfort, driving broader regional interest. France and Italy assess cost-effectiveness of magnetic systems within diagnosis-related group budgets, while Spain leverages EU structural funds to retrofit provincial hospitals. Under the Medical Device Regulation, suppliers must expand clinical evidence dossiers, but early compliance confers competitive advantage. Pan-European distributor agreements consolidate logistics networks, improving product availability even in smaller Baltic and Balkan markets.

Asia-Pacific represents the fastest-growing territory at 9.78% CAGR, propelled by sharp rises in breast-cancer incidence and expanding hospital capacity. China's provincial screening programs contributed to BCS rate leaps and triggered bulk procurement of magnetic seeds at top cancer centers in Beijing and Shanghai. India witnesses state-level public-private partnerships funding mobile mammography buses, yet adoption of wireless tags remains concentrated in tier-1 metropolitan hospitals. Japan maintains 40% BCS penetration and serves as a technology launchpad; its surgeons publish comparative studies that influence neighboring South Korea and Taiwan. Australia embraces radar localization technology because reimbursement pathways under the Medicare Benefits Schedule recognize wireless tags. Southeast Asian countries, including Thailand and Vietnam, pivot toward seeds when external donor grants offset capital purchases, intertwining technology diffusion with broader health-system strengthening. The breast lesion localization methods industry tailors training modules to local surgical volumes and language needs, partnering with academic societies to standardize seed placement curricula.

- Anchor Dx Sciences LLC

- Argon Medical Devices

- Beckton Dickinson

- Cianna Medical Inc.

- Cook Group

- Devicor Medical Products

- Elucent Medical Inc.

- GE Healthcare

- Hologic

- Intramedical Imaging LLC

- IsoAid LLC

- Danaher

- Merit Medical Systems

- MOLLI Surgical Inc.

- Ranfac

- Siemens Healthineers

- Sirius Medical BV

- SOMATEX Medical Technologies GmbH

- Stryker

- Trefle Medical Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising breast-cancer incidence & screening intensity

- 4.2.2 Shift toward breast-conserving surgeries (BCS)

- 4.2.3 Outpatient Lumpectomies push for quicker set-ups, driving ASC migration

- 4.2.4 Favorable reimbursement for localization consumables

- 4.2.5 Integration of localization data with OR navigation software

- 4.2.6 National no-radioisotope mandates

- 4.3 Market Restraints

- 4.3.1 Complex multi-jurisdiction device approvals

- 4.3.2 High capital & tag cost of wireless systems

- 4.3.3 MRI artefacts of paramagnetic seeds hamper follow-up imaging

- 4.3.4 Supply-chain risk for rare-earth magnetic alloys

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Localization Method

- 5.1.1 Wire-Guided Localization (WGL)

- 5.1.2 Radioactive-Based Localization

- 5.1.2.1 Radioactive Seed Localization (RSL)

- 5.1.2.2 Radioguided Occult Lesion Localization (ROLL)

- 5.1.3 Magnetic Seed Localization

- 5.1.4 Radiofrequency and Radar-Based Localization

- 5.1.5 Other Methods

- 5.2 By Usage

- 5.2.1 Tumor Identification

- 5.2.2 Sentinel Lymph-Node Identification

- 5.2.3 Other Usages

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers (ASCs)

- 5.3.3 Specialty Clinics

- 5.3.4 Academic & Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Competitive Benchmarking

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Anchor Dx Sciences LLC

- 6.4.2 Argon Medical Devices Inc.

- 6.4.3 Becton, Dickinson and Company

- 6.4.4 Cianna Medical Inc.

- 6.4.5 Cook Medical LLC

- 6.4.6 Devicor Medical Products Inc.

- 6.4.7 Elucent Medical Inc.

- 6.4.8 GE Healthcare

- 6.4.9 Hologic Inc.

- 6.4.10 Intramedical Imaging LLC

- 6.4.11 IsoAid LLC

- 6.4.12 Danaher Corporation

- 6.4.13 Merit Medical Systems Inc.

- 6.4.14 MOLLI Surgical Inc.

- 6.4.15 Ranfac Corporation

- 6.4.16 Siemens Healthineers AG

- 6.4.17 Sirius Medical BV

- 6.4.18 SOMATEX Medical Technologies GmbH

- 6.4.19 Stryker Corporation

- 6.4.20 Trefle Medical Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment