PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842655

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842655

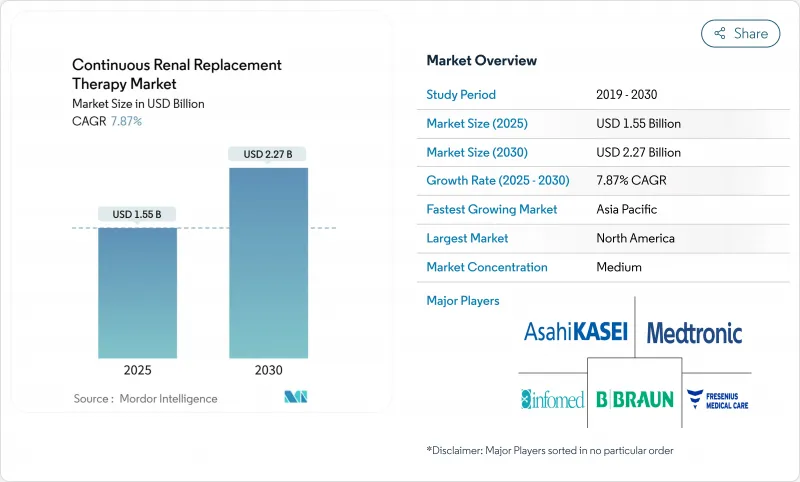

Continuous Renal Replacement Therapy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Continuous Renal Replacement Therapy Market size is estimated at USD 1.55 billion in 2025, and is expected to reach USD 2.27 billion by 2030, at a CAGR of 7.87% during the forecast period (2025-2030).

Robust demand stems from the rising burden of acute kidney injury in aging, multimorbid populations, surging sepsis cases in intensive-care units, and steady innovation in systems that now deploy artificial-intelligence dosing algorithms for individualized therapy planning. Higher ICU admissions, greater procedural safety thanks to single-use disposables, and an institutional push to shorten inpatient stays further energize adoption. Portable machines, cloud-linked analytics, and cytokine-adsorbing membranes are broadening the modality's reach beyond renal replacement into multimodal organ support, attracting entrants from both dialysis and acute-care device segments. Sepsis-related multi-organ dysfunction drives persistent use, while AI-guided precision dosing and automation help mitigate workload pressures created by nursing shortages.

Global Continuous Renal Replacement Therapy Market Trends and Insights

Rising Incidence of Acute Kidney Injury Due to an Aging and Comorbid Population

Clinicians observe more acute kidney injury as populations age and accumulate chronic conditions such as diabetes, hypertension, and cardiovascular disease, elevating the continuous renal replacement therapy market trajectory. Multimorbid patients exhibit higher mortality once AKI develops, intensifying demand for continuous therapies that provide hemodynamic stability. Extended survival after critical illness also exposes survivors to chronic kidney disease, linking short-term therapy decisions to long-term healthcare planning. Machine-learning models trained on electronic records can now identify high-risk patients before creatinine rises, enabling earlier intervention that may lower dependence on CRRT while protecting renal function. At the same time, widespread polypharmacy raises nephrotoxic exposure, keeping the treatment curve upward despite predictive analytics.

Continuous Technological Improvements in CRRT Equipment and Dialysate Solutions

Manufacturers speed R&D cycles to embed digital health tools and advanced membranes in new machines. AI-powered algorithms translate real-time vital signs and lab values into on-the-fly dose adjustments, replacing empiric protocols with precision dosing that limits fluid imbalance and solute swings. Cytokine-adsorbing membranes such as AN69ST extend use from renal clearance to immunomodulation in sepsis, offering clear clinical differentiation. Technologies like the NxStage Cartridge Express with Speedswap allow a filter exchange in about four minutes compared with conventional 20-minute downtime, keeping therapy continuous and optimizing nurse productivity. Coupled with cloud-based alerts, these functions ease staffing constraints and improve safety, giving vendors with proven outcome data a competitive edge.

Higher Treatment Costs of CRRT Compared to Intermittent Renal Replacement Therapy

Budgetary reviews reveal weekly CRRT outlays between CAD 3,486 (USD 2,541) and CAD 5,117 (USD 3,730) versus CAD 1,342 (USD 978) for intermittent hemodialysis, prompting finance teams to scrutinize utilization. Insurer payments diverge sharply: private plans average USD 10,149 per patient-month, tripling Medicare outlays and complicating reimbursement models. Hospitals answer with value-based purchasing frameworks that weigh total-care savings from faster renal recovery against higher procedural costs. Vendors counter by automating tasks to curb labor expense and by offering subscription models that bundle disposables and analytics.

Other drivers and restraints analyzed in the detailed report include:

- Increase in Sepsis-Related Multi-Organ Dysfunction Fueling Therapy Demand

- Ongoing Expansion of Intensive Care Unit Capacity in Emerging Economies

- Shortage of Adequately Trained Nursing Staff for CRRT Administration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Continuous venovenous hemodialysis secured the largest slice of the continuous renal replacement therapy market at 35.67% in 2024, reflecting clinician familiarity and broad protocol adoption. Continuous venovenous hemodiafiltration, with its 10.38% CAGR, benefits from superior cytokine and middle-molecule clearance, making it the preferred choice for septic shock or hyper-inflammatory presentations. The continuous renal replacement therapy market size for hemodiafiltration is set to rise rapidly as AI-enabled software models integrate dynamic flow calculations that fine-tune convection and diffusion rates in real time.

Machine-learning algorithms achieving 84.8% prediction accuracy for survival help physicians align modality choice with individual physiologic profiles. Hybrid circuits that add cytokine-adsorbing cartridges further push adoption in ICUs where immunomodulation is central. Slow continuous ultrafiltration retains a clinical niche in fluid-overloaded cardiac patients, whereas continuous venovenous hemofiltration remains useful for high-volume convective clearance when metabolic control overrides solute specificity.

The Continuous Renal Replacement Therapy Market Report is Segmented by Mode (Continuous Venovenous Hemodialysis, Continuous Venovenous Hemofiltration, and More), Product Type (Dialysate & Replacement Fluids, Hemofilters & Cartridges, and More), End User (Hospital, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 44.81% of continuous renal replacement therapy market revenue in 2024 thanks to early AI adoption, favorable reimbursement, and the presence of leading manufacturers. Hurricanes and other extreme events, however, exposed supply chain fragility, prompting diversification across multiple production hubs. Canada's and Mexico's modernization efforts add incremental volume as they standardize critical-care practices.

Asia-Pacific leads growth at 11.15% CAGR. China's long-term spending plan allocates billions to critical-care suites, and India's national dialysis program embeds CRRT capability inside new tertiary units. Rising diabetes and cardiovascular prevalence, coupled with aging demographics, solidify demand. Local companies partner with global OEMs to co-produce fluids and disposables, insulating supply chains.

Europe delivers steady gains, leveraging health-technology assessments to justify purchases while aligning reimbursement. CE marking pathways shorten time-to-market for updated machines, and cross-border research projects accelerate cytokine-filter trials. South America and the Middle East & Africa show early-stage uptake tied to broader hospital-build agendas, though human-resource gaps temper near-term penetration.

- Asahi Kasei Medical

- Baxter (Vantive)

- B. Braun

- Fresenius

- Nipro

- Medtronic

- Toray Medical

- Infomed

- Medica

- Cytosorbents Corp.

- Jafron Biomedical

- Medical Components Inc.

- Ningbo David Medical

- Rockwell Medical

- Torayvino Hemodiafiltration

- SeaStar Medical

- Beckton Dickinson

- Terumo Blood & Cell Technologies

- Outset Medical

- Genrui Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Acute Kidney Injury (AKI) Due to an Aging and Comorbid Population

- 4.2.2 Continuous Technological Improvements in CRRT Equipment and Dialysate Solutions

- 4.2.3 Increase In Sepsis-Related Multi-Organ Dysfunction Fueling Therapy Demand

- 4.2.4 Ongoing Expansion of Intensive Care Unit (ICU) Capacity in Emerging Economies

- 4.2.5 Adoption of AI-Based Algorithms for Personalized CRRT Dosing

- 4.2.6 Growing Interest in Cytokine-Adsorbing Filters for Managing Hyper-Inflammatory States

- 4.3 Market Restraints

- 4.3.1 Higher Treatment Costs of CRRT Compared to Intermittent Renal Replacement Therapy (IRRT)

- 4.3.2 Complex Regulatory Requirements for Devices and Replacement Fluids

- 4.3.3 Shortage of Adequately Trained Nursing Staff for CRRT Administration

- 4.3.4 Fragile Global Supply Chains Affecting Availability of Ready-To-Use Premixed Fluids

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Mode

- 5.1.1 Continuous Venovenous Hemodialysis (CVVHD)

- 5.1.2 Continuous Venovenous Hemofiltration (CVVH)

- 5.1.3 Continuous Venovenous Hemodiafiltration (CVVHDF)

- 5.1.4 Slow Continuous Ultrafiltration (SCUF)

- 5.2 By Product Type

- 5.2.1 Dialysate & Replacement Fluids

- 5.2.2 Hemofilters & Cartridges

- 5.2.3 Disposables

- 5.2.4 CRRT Systems / Monitors

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Specialty Renal Centres

- 5.3.3 Ambulatory Surgical Centres

- 5.3.4 Home Care Settings

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Asahi Kasei Medical

- 6.3.2 Baxter (Vantive)

- 6.3.3 B. Braun Melsungen

- 6.3.4 Fresenius Medical Care

- 6.3.5 Nipro Corporation

- 6.3.6 Medtronic

- 6.3.7 Toray Medical

- 6.3.8 Infomed SA

- 6.3.9 Medica SpA

- 6.3.10 Cytosorbents Corp.

- 6.3.11 Jafron Biomedical

- 6.3.12 Medical Components Inc.

- 6.3.13 Ningbo David Medical

- 6.3.14 Rockwell Medical

- 6.3.15 Torayvino Hemodiafiltration

- 6.3.16 SeaStar Medical

- 6.3.17 Becton, Dickinson and Company

- 6.3.18 Terumo Blood & Cell Technologies

- 6.3.19 Outset Medical

- 6.3.20 Genrui Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment