PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842657

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842657

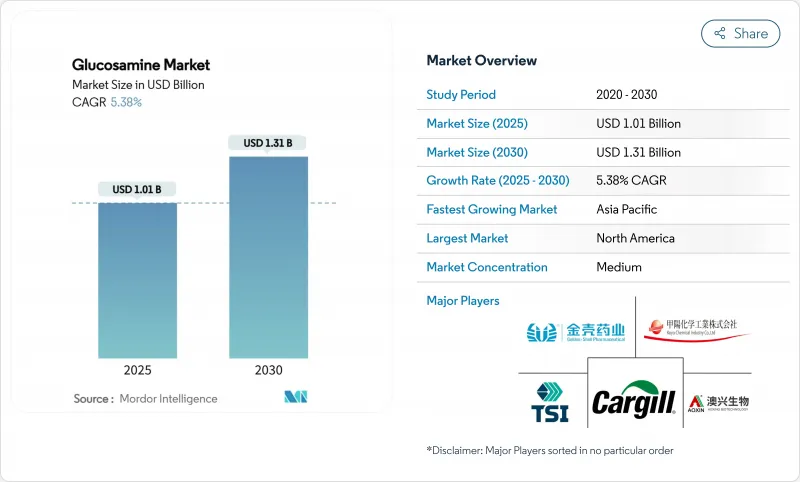

Glucosamine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The glucosamine market is estimated to be valued at USD 1.01 billion in 2025 and is expected to reach USD 1.31 billion by 2030, growing at a CAGR of 5.38%.

The market growth is driven by increased focus on healthy ageing, improved access to preventive healthcare, and evolving regulatory frameworks across regions. North America leads the market due to its established retail pharmacy network and high consumer awareness, while the Asia-Pacific region demonstrates the highest volume growth, supported by increasing disposable incomes and expanding nutraceutical distribution channels. Advancements in fermentation technology reduce allergen risks and ensure stable raw material supply, enhancing cost efficiency. Additionally, the FDA's revised notification procedures in March 2024 have reduced product launch timelines, enabling increased innovation in dosage forms and functional foods .

Global Glucosamine Market Trends and Insights

Rising Prevalence of Osteoarthritis and Aging Population

Osteoarthritis cases worldwide have increased significantly, with higher prevalence rates in developed and developing regions. The condition predominantly affects women and older adults, who require joint-care supplements throughout their lives. As a major cause of global disability, osteoarthritis results in economic losses through reduced workplace productivity, higher healthcare costs, and long-term medical care needs. The persistent health burden, aging global population, and growing awareness of joint health maintain consistent demand for glucosamine products. The chronic nature of osteoarthritis requires continuous management, supporting market stability.

Increasing consumption of nutraceuticals

The United States population regularly incorporates dietary supplements into their health routines. Both young and older adults emphasize preventive healthcare, which increases the sales of combination joint supplements containing glucosamine, chondroitin, and Methylsulfonylmethane (MSM). These supplements support joint health and mobility, particularly among active individuals and aging populations. The rise of personalized nutrition applications, subscription services, and tele-pharmacy platforms drives supplement consumption and expands the glucosamine market through digital channels. These digital platforms enable consumers to access supplements conveniently while receiving personalized recommendations based on their health goals and requirements.

Volatile supply of shellfish-based raw materials

Glucosamine, primarily sourced from shellfish like shrimp and crabs, faces production disruptions and cost inflation due to fluctuations in shellfish availability. Environmental challenges, including ocean pollution, climate change, and rising sea temperatures, have degraded habitats and diminished shellfish populations in numerous regions. Unsustainable harvesting and overfishing practices further deplete the shellfish shells essential for glucosamine extraction. In Southeast Asia, shrimp farms have grappled with disease outbreaks, leading to marked declines in shellfish production. To safeguard marine ecosystems, regulatory measures such as harvesting quotas and seasonal bans have been implemented, but they also curtail supply. Moreover, geopolitical tensions and trade disruptions in major exporting nations, particularly China and Vietnam, introduce unpredictability to the market. Collectively, these factors contribute to supply instability, escalating costs, and challenges in production planning for glucosamine producers.

Other drivers and restraints analyzed in the detailed report include:

- Growing awareness of preventive healthcare and joint health

- Expansion of functional foods and fortified products market

- Availability of Effective Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shellfish-derived glucosamine maintains 79.85% market share in 2024, benefiting from established supply chains and consumer familiarity. Traditional extraction methods from crab and shrimp shells leverage existing seafood processing waste streams, creating cost efficiencies and environmental benefits through waste utilization. However, fermentation-derived alternatives exhibit 7.86% CAGR growth through 2030, driven by allergy avoidance, sustainability concerns, and supply chain diversification strategies.

The development of advanced production methods, including artificial enzymatic biosystems, enables high conversion efficiency from starch to glucosamine through fermentation. This innovative production method significantly reduces environmental impact while maintaining product quality. The fermentation process utilizes renewable resources and controlled manufacturing conditions, resulting in consistent product quality. This production method offers a sustainable alternative that addresses both supply security concerns and consumer preferences, particularly among those seeking environmentally responsible products.

The Glucosamine Market Report is Segmented by Type (Glucosamine Sulfate, Glucosamine Hydrochloride (HCl), and More), Source (Shellfish-Derived, Fermentation-Derived, and Others), Application (Nutritional Supplements, Pet and Veterinary Supplements, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

North America maintains market leadership with 39.21% share in 2024, supported by established healthcare infrastructure, high consumer awareness of joint health supplements, and favorable regulatory frameworks under FDA oversight. The region benefits from extensive clinical research conducted at major medical institutions and strong distribution networks through pharmacy chains and specialized retailers. Consumer spending patterns reflect integration of glucosamine into routine healthcare regimens, with insurance coverage occasionally available for pharmaceutical-grade formulations. The aging baby boomer demographic creates sustained demand, while younger consumers increasingly adopt preventive supplementation strategies influenced by fitness and wellness trends.

Asia-Pacific emerges as the fastest-growing region with 8.15% CAGR through 2030, driven by expanding middle-class populations, increasing healthcare expenditure, and growing awareness of Western nutritional approaches. China and India represent particularly dynamic markets, benefiting from domestic manufacturing capabilities and acceptance of traditional medicine natural health products. Japan's sophisticated functional foods market. The region's manufacturing cost advantages, particularly for fermentation-derived production, position Asia-Pacific as both a consumption and export hub for global glucosamine supply chains.

Europe represents a mature market characterized by stringent regulatory oversight and evidence-based healthcare approaches. The European Food Safety Authority's rigorous evaluation processes for health claims create barriers for new entrants while protecting established products with approved claims. Consumer preferences favor pharmaceutical-grade formulations with clinical documentation, reflecting the region's emphasis on evidence-based medicine. The market benefits from strong research institutions conducting osteoarthritis studies and established distribution through pharmacy channels. Brexit implications continue affecting regulatory harmonization, with the UK developing independent evaluation frameworks for dietary supplements and functional foods.

- Koyo Chemical Co., Ltd.

- Cargill, Inc.

- Zhejiang Aoxing Biotechnology Co., Ltd.

- TSI Group Ltd.

- Golden-Shell Pharmaceutical Co., Ltd.

- Panvo Organics Pvt. Ltd.

- Ethical Naturals, Inc.

- Bioiberica S.A.U.

- Gnosis by Lesaffre

- Alchemy Industries Pvt. Ltd.

- Jiaxing Hengjie Biopharm Co., Ltd.

- Rochem International, Inc.

- Lifecore Biomedical

- Merck KGaA (Chondro-additive)

- Zhengzhou Alfa Chemical Co.,Ltd

- Bio-gen Extracts Pvt. Ltd.

- CAPTEK Softgel International Inc.

- Kraeber & Co GmbH

- Xi'an Tian Guangyuan Biotech Co., Ltd.

- Lifecore Biomedical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of osteoarthritis and aging population

- 4.2.2 Increasing consumption of nutraceuticals

- 4.2.3 Growing awareness of preventive healthcare and joint health

- 4.2.4 Expansion of functional foods and fortified products market

- 4.2.5 Adoption of vegan-fermented glucosamine

- 4.2.6 Growth in pet humanization and veterinary supplements

- 4.3 Market Restraints

- 4.3.1 Risk of shellfish allergies and volatile supply of shellfish-based raw materials

- 4.3.2 Availability of effective alternatives

- 4.3.3 Stringent regulatory frameworks for novel foods and dietary supplements

- 4.3.4 High production costs of vegan/fermentation-derived glucosamine

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Glucosamine Sulfate

- 5.1.2 Glucosamine Hydrochloride (HCl)

- 5.1.3 N-Acetyl-glucosamine

- 5.1.4 Other Types

- 5.2 By Source

- 5.2.1 Shellfish-derived

- 5.2.2 Fermentation-derived

- 5.2.3 Others

- 5.3 By Application

- 5.3.1 Nutritional Supplements

- 5.3.2 Pet and Veterinary Supplements

- 5.3.3 Functional Foods and Fortified Products

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 Italy

- 5.4.2.4 France

- 5.4.2.5 Spain

- 5.4.2.6 Netherlands

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Koyo Chemical Co., Ltd.

- 6.4.2 Cargill, Inc.

- 6.4.3 Zhejiang Aoxing Biotechnology Co., Ltd.

- 6.4.4 TSI Group Ltd.

- 6.4.5 Golden-Shell Pharmaceutical Co., Ltd.

- 6.4.6 Panvo Organics Pvt. Ltd.

- 6.4.7 Ethical Naturals, Inc.

- 6.4.8 Bioiberica S.A.U.

- 6.4.9 Gnosis by Lesaffre

- 6.4.10 Alchemy Industries Pvt. Ltd.

- 6.4.11 Jiaxing Hengjie Biopharm Co., Ltd.

- 6.4.12 Rochem International, Inc.

- 6.4.13 Lifecore Biomedical

- 6.4.14 Merck KGaA (Chondro-additive)

- 6.4.15 Zhengzhou Alfa Chemical Co.,Ltd

- 6.4.16 Bio-gen Extracts Pvt. Ltd.

- 6.4.17 CAPTEK Softgel International Inc.

- 6.4.18 Kraeber & Co GmbH

- 6.4.19 Xi'an Tian Guangyuan Biotech Co., Ltd.

- 6.4.20 Lifecore Biomedical

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK