PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842660

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842660

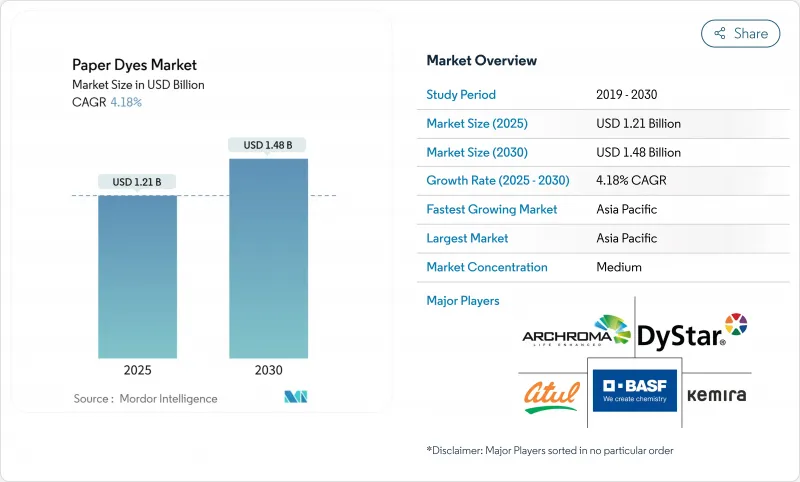

Paper Dyes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global paper dyes market stood at USD 1.21 billion in 2025 and is forecast to reach USD 1.48 billion by 2030, advancing at a 4.18% CAGR.

This steady trajectory reflects the market's resilience in digital-document substitution, supported by the structural migration from plastic to paper-based packaging and rising demand for vivid, brand-consistent graphics in e-commerce shipments. Liquid formulations that integrate seamlessly with modern inkjet lines are helping converters reduce downtime, while capacity additions by major dye makers keep raw material supply balanced. Regulatory tailwinds that restrict single-use plastics and brand owners' preference for renewable substrates underpin an expansionary outlook even as graphic-paper volumes contract. Investments in lignin-compatible and nano-encapsulated chemistries further differentiate suppliers, positioning them to capture premium orders in food-contact and high-speed digital applications.

Global Paper Dyes Market Trends and Insights

Shift from Plastic to Paper-Based Packaging

Retail brands continue to replace petroleum-based substrates with recyclable, fiber-based formats to comply with single-use plastic bans and to meet consumer preference for paper. Nestle, Unilever, and other multinationals now eliminate up to 97% of plastic from certain SKUs, accelerating orders for high-performance dyes that remain stable through multiple recycling loops. Regulatory certainty created by the European Union's Single-Use Plastics Directive supports capital investment in converters that require food-contact-compliant, migration-safe colorants. Consumer willingness to pay premiums for sustainable packaging has held steady, allowing dye producers to defend pricing for novel, colorfast formulations that tolerate alkaline de-inking and oxidative bleaching in recovered-fiber systems.

E-commerce-Fueled Boom in Corrugated & Mailer Demand

Over 80% of online orders ship in corrugated formats, and parcel volumes continue to rise-particularly in Asia-Pacific and North America-creating concentrated demand for vivid graphics that elevate the unboxing experience. Fulfillment centers require rapid-turn inkjet lines that run on liquid dyes engineered for low-maintenance printheads, enabling same-day personalization at scale. Building leases for packaging plants rose 45% above the 20-year average in 2024, a clear signal of structural capacity expansion that will sustain the paper dyes market over the forecast horizon.

Paperless Office & Digital Documents Adoption

Graphic-paper demand contracted sharply after corporate and educational users accelerated digital workflows. The Confederation of European Paper Industries recorded a 13% fall in paper and board production in 2023, with graphic grades alone down 28%. Remote-work protocols that cut printing volumes by 50-70% remain in force, while e-signature platforms reduce the need for hard copies. Although packaging dyes offset some losses, graphic-paper contraction limits overall tonnage growth, particularly in mature regions.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Expansions by Major Dye Manufacturers

- Breakthroughs in Bio-Based Lignin-Compatible Dyes

- Toxic Amines & Rising REACH Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid offerings held 51.92% of 2024 revenue and are projected to expand at a 6.40% CAGR, reinforcing their pivotal role in high-speed inkjet lines that power versioned e-commerce packaging. Powder grades, although easier to transport in bulk, must contend with dust-exposure rules and slower dispersion times. Nano-encapsulated liquid systems now enable print-head duty cycles exceeding 1,000 hours, minimizing maintenance shutdowns and improving OEE for converters. Stable viscosity across temperature swings supports automated dosing, aligning with just-in-time production targets.

Ongoing advances in mini-emulsion and microfluidic encapsulation increase shelf life, preserving hue intensity for over 12 months when stored at 25 °C, compared with six months for standard formulations. As a result, converters see reduced write-offs from expired stocks. Powder suppliers respond with compaction and dust-suppressant technologies but still trail liquid rivals in digitally enabled plants.

Direct dyes, favored for cost-efficient exhaust processes, commanded 28.45% of 2024 sales, maintaining dominance in high-volume linerboard mills. Yet the reactive segment is advancing at a 5.90% CAGR on the strength of superior wash-fastness, an attribute prized by premium folding-carton users who require graphics to survive recycling. According to fiber-specific trials, cotton-fiber-rich specialty grades register dye uptake of 41.45% with reactivatives versus 35.68% for other chemistries.

Suppliers reduce typical reactive-bath temperatures from 90 °C to 60 °C without sacrificing fixation, lowering energy loads, and broadening adoption in mills constrained by decarbonization targets. Direct dyes remain a staple because they attach readily under neutral pH, but their market share is gradually ceded to higher-value chemistries that align with circular-economy mandates.

The Paper Dyes Market Report Segments the Industry by Form (Powder and Liquid), Type (Acidic, Basic, and More), Origin (Organic and Synthetic), Application (Printing and Writing, Packaging, Specialty, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained leadership with 44.79% of 2024 revenue and is forecast to rise at a 5.70% CAGR to 2030, reflecting its status as a global manufacturing nucleus and fast-expanding consumer market. China's chemical champions-Hengli, Wanhua, and peers-channel government incentives into fine-chemical projects that lift regional self-sufficiency. Vietnam, hosting 7,500 textile enterprises employing 4.3 million workers, boosts regional consumption of corrugated and specialty papers, translating into higher local dye usage.

North America ranks second by value, propelled by e-commerce fulfillment growth and aggressive plastic-reduction pledges from food and beverage multinationals. Archroma's South Carolina site and Solenis's Virginia complex provide localized supply, while regulatory clarity on PFAS pushes converters to adopt compliant, water-based systems. Although graphic-paper contraction tempers total tonnage, premium-grade orders that favor environmentally optimized dyes support above-inflation price realization.

Europe grapples with stringent REACH amendments and pulp-price volatility-Northern Bleached Softwood Kraft touched EUR 1,380 / t in April 2024-pressuring operating margins. Yet the bloc's leadership in circular-economy regulation and R&D funding for lignin-derived colorants positions local suppliers at the forefront of high-value, eco-optimized offerings. Converters invest in closed-loop water treatment to meet discharge permits, raising demand for low-salt, high-exhaustion dyes that align with zero-liquid-discharge ambitions.

- Archroma

- Ashok Alco-chem

- Atul Ltd.

- BASF

- Celanese Corporation

- ChromaScape

- DyStar Singapore Pte Ltd

- Kemira Oyj

- Kiri Industries Limited

- Lonza

- Merck KGaA

- Milliken

- Nitin Dye Chem Pvt. Ltd

- Setas Kimya

- Standard Colors, Inc.

- Steiner-Axyntis

- Sudarshan Chemical Industries Limited.

- Synthesia, a.s.

- Thermax Limited

- Vipul Organics Ltd.

- Zhejiang Longsheng

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift from plastic to paper-based packaging

- 4.2.2 E-commerce-fuelled boom in corrugated & mailer demand

- 4.2.3 Capacity expansions by major dye manufacturers

- 4.2.4 Breakthroughs in bio-based lignin-compatible dyes

- 4.2.5 Nano-encapsulated dyes enabling digital inkjet printing on paper

- 4.3 Market Restraints

- 4.3.1 Paperless office & digital documents adoption

- 4.3.2 Toxic amines & rising REACH compliance costs

- 4.3.3 Volatility in wood-pulp availability & pricing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.2 By Type

- 5.2.1 Acidic

- 5.2.2 Basic

- 5.2.3 Direct

- 5.3 By Origin

- 5.3.1 Organic

- 5.3.2 Synthetic

- 5.4 By Application

- 5.4.1 Printing and Writing

- 5.4.2 Packaging

- 5.4.3 Specialty

- 5.4.4 Others (Tissue and Hygiene)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Archroma

- 6.4.2 Ashok Alco-chem

- 6.4.3 Atul Ltd.

- 6.4.4 BASF

- 6.4.5 Celanese Corporation

- 6.4.6 ChromaScape

- 6.4.7 DyStar Singapore Pte Ltd

- 6.4.8 Kemira Oyj

- 6.4.9 Kiri Industries Limited

- 6.4.10 Lonza

- 6.4.11 Merck KGaA

- 6.4.12 Milliken

- 6.4.13 Nitin Dye Chem Pvt. Ltd

- 6.4.14 Setas Kimya

- 6.4.15 Standard Colors, Inc.

- 6.4.16 Steiner-Axyntis

- 6.4.17 Sudarshan Chemical Industries Limited.

- 6.4.18 Synthesia, a.s.

- 6.4.19 Thermax Limited

- 6.4.20 Vipul Organics Ltd.

- 6.4.21 Zhejiang Longsheng

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment