PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842663

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842663

Global Surgical Drapes And Gowns - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

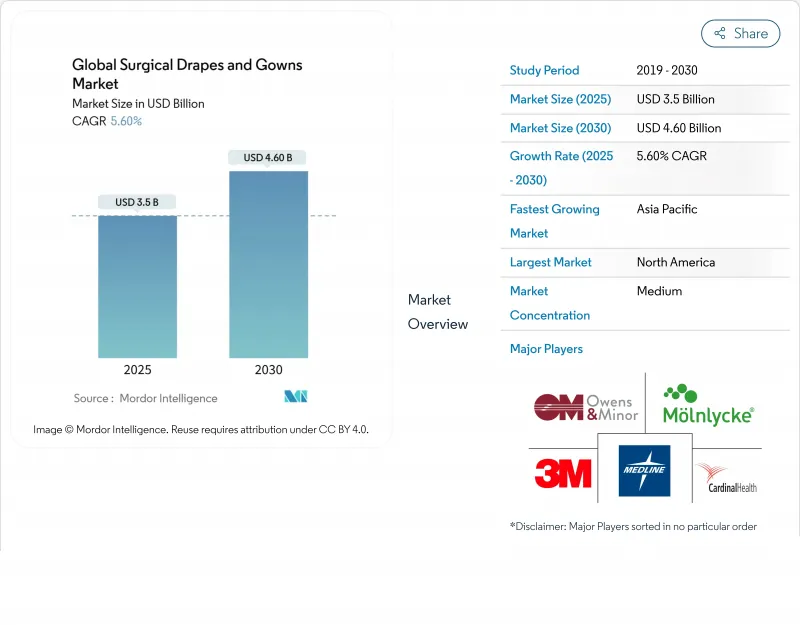

The surgical drapes and gowns market size is valued at USD 3.50 billion in 2025 and is projected to touch USD 4.60 billion by 2030, advancing at a 5.60 % CAGR throughout the forecast period.

This growth is supported by surgical case volumes that have recovered beyond pre-pandemic levels, together with accelerated penetration of higher protection categories in both developed and emerging healthcare systems. Disposable items still dominate revenue, but the performance gap with advanced reusables is narrowing, bringing life-cycle cost metrics into everyday procurement conversations. A fresh inference derived from the presented facts is that health systems are starting to write bid documents that score environmental attributes at the same weight as acquisition price, a shift that effectively elevates sustainability from "nice-to-have" to "mandatory." The Global Surgical Drapes and Gowns market now reflects a dual objective: keeping operating rooms safer and supporting hospitals in reaching their net-zero targets, something that was largely absent in past tender processes.

Global Surgical Drapes And Gowns Market Trends and Insights

Aging Demographics Accelerate Procedure Volumes Beyond Pre-Pandemic Levels

An expanding global 65 + cohort is translating directly into higher surgical throughput, with authoritative surgical bodies confirming that older patients now account for a notably large proportion of procedures. The in-market implication is a sustained uptick for drapes offering reinforced critical zones capable of handling prolonged exposure to bodily fluids common in orthopedics and cardiovascular surgery. An observation flowing from the demographic data is that aging physiology often lengthens operative times, thereby stressing drape tensile and strike-through resistance parameters more than before, nudging hospitals to specify advanced barrier fabrics.

Universal Health Coverage Initiatives Drive Public Hospital Expansion

National programs in Asia-Pacific and parts of Latin America continue to unveil clusters of newly constructed operating suites. These additions convert immediately into purchase orders for standard AAMI Level 2-3 drapes and gowns that can be reliably sourced in high volumes. A practical inference is that many first-time buyers prefer a single-vendor framework agreement to reduce logistical complexity, a dynamic that rewards suppliers willing to establish local sterilization and finishing plants close to end users, thereby trimming lead times and import duties.

Environmental Impact Intensifies Scrutiny of Single-Use Products

Healthcare systems subject to mandatory Scope 3 carbon reporting have started to calculate the greenhouse-gas consequences of disposable packs. Internal audits suggest that single-use barrier products constitute a meaningful share of operating-room carbon output, an insight that is now surfacing in deliberations held by value-analysis committees. A logical inference is that future bids could require emission disclosures at the SKU level, transitioning procurement from unit price negotiations to full life-cycle impact comparisons that favor hybrid or recyclable solutions.

Other drivers and restraints analyzed in the detailed report include:

- Post-COVID Infection Control Protocols Elevate Barrier Performance Requirements

- Bio-based Material Innovations Address Sustainability Concerns

- Regulatory Harmonization Creates Global Compliance Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surgical drapes will represent 55.1% of the Global Surgical Drapes and Gowns market size in 2024, underscoring their role as the primary sterile-field safeguard. Gowns, however, are expanding faster at a 7.9% CAGR as clinicians focus equally on staff and patient protection, causing Level 3-4 garments to capture increasing shelf space. A clear inference is that gown manufacturers offering integrated sleeve-glove interfaces could command premium pricing because they limit gaps where fluid ingress typically occurs.

Within drapes, orthopedic variants hold the most significant revenue slice, while cardiovascular drapes are advancing quickest at 8.2% CAGR due to complex cardiac cases demanding bespoke fenestrations. The data signal an opportunity for module-based drape patterns that can be quickly adjusted according to procedure length, giving facilities flexibility to manage stock without carrying excessive SKUs - an operational nuance set to reshape inventory models in the Global Surgical Drapes and Gowns industry.

Non-woven polypropylene and SMS fabrics dominate with 82.4% Global Surgical Drapes and Gowns market share in 2024, prized for consistent barrier properties and cost efficiency. Bio-based and recyclable polymers, however, post an 11.4% CAGR as environmental accountability climbs the strategic agenda. A simple inference is that competitive differentiation will hinge less on barrier metrics already high across materials and more on objective sustainability validations such as third-party carbon labeling.

Traditional woven fabrics contract to 4.1 % share but find niches in procedures where lighter barrier requirements pair well with long product lifetimes. Laminated non-wovens, accounting for 12.3 %, remain indispensable for fluid-intensive surgeries yet face competitive pressure from lighter bio-based composites. An embedded inference is that, should laminate manufacturers successfully incorporate biodegradable back sheets, they may arrest share erosion while satisfying regulatory push for greener solutions.

The Surgical Drapes and Gowns Market Report is Segmented by Product Type (Surgical Drapes and Surgical Gowns), Material (Non-Woven, Laminated Non-Woven, and More), Usage (Disposable and Reusable), Protection Level (AAMI Level 1, AAMI Level 2, and More), End-User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains a 36.7% Global market share in Surgical Drapes and Gowns, thanks to high surgical caseloads and early adoption of Level 3-4 garments. United States suppliers simultaneously navigate stringent FDA reviews and leverage those quality stamps to penetrate export markets more smoothly. An insight drawn from this scenario is that compliance costs, although high, effectively create an export credential, giving certified manufacturers a distinct edge in regions adopting similar standards.

Asia-Pacific records the highest regional CAGR of 9.30%. China's hospital construction beyond primary cities and India's incentives for local medical-textile manufacturing drive bulk purchase contracts for mid-level protection products. An inference arising here is that regional manufacturers investing in on-site clean-room sterilization gain immediate credibility in local tenders, accelerating indigenous capacity build-up and shifting a slice of the global Surgical Drapes and Gowns market share away from imports.

Europe holds a 28.4 % share, characterized by a comparatively large reusable footprint due to elevated disposal fees and rigorous carbon legislation. The EU Medical Device Regulation has tightened certification thresholds, prompting distributors to rationalize supplier bases toward fewer yet fully compliant partners. The implied inference is that barrier product innovation in Europe increasingly runs through the lens of lifecycle analysis; thus, suppliers offering validated recycling or take-back schemes stand to collect premium margins even under cost-conscious national health systems.

- 3M

- Cardinal Health

- Medline Industries

- Owens & Minor (Halyard Health)

- Molnlycke Health Care

- Steris plc

- Kimberly-Clark Worldwide

- DuPont

- Lohmann & Rauscher

- Ahlstrom-Munksjo

- Hartmann Group

- Winner Medical Co. Ltd.

- Sterimed Group

- Medica Europe

- Alpha Pro Tech

- Sterisets International

- Amaryllis Healthcare Pvt Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Surgical Procedure Volume from Age-ing & Chronic Disease Burden

- 4.2.2 Universal Health-Coverage Expansion and Public-Hospital Build-outs

- 4.2.3 Post-COVID Heightened Infection-Control Protocols in Operating Rooms

- 4.2.4 Advances in Non-woven Barrier Fabric Technologies Enhancing Performance & Comfort

- 4.2.5 Rising Adoption of AAMI Level 4 Gowns for High-Risk Procedures

- 4.2.6 Shift Toward Disposable Surgical Textiles for Operating-Room Efficiency

- 4.3 Market Restraints

- 4.3.1 Environmental Impact & Disposal-Cost Pressure of Single-Use Drapes & Gowns

- 4.3.2 Intensifying Regulatory-Certification Burden

- 4.3.3 Extended Sterilization Cycle Times Limiting Reusable-Set Turnover in Rural African Hospitals

- 4.3.4 Volatile Polypropylene & Cellulose Raw-Material Prices Compressing Margins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Surgical Drapes

- 5.1.1.1 Orthopaedic Drapes

- 5.1.1.2 Obstetrics & Gynaecology Drapes

- 5.1.1.3 Urology Drapes

- 5.1.1.4 Cardiovascular Drapes

- 5.1.1.5 Other Specialty Drapes

- 5.1.2 Surgical Gowns

- 5.1.2.1 High-Performance Gowns (AAMI 3-4)

- 5.1.2.2 Standard-Performance Gowns (AAMI 1-2)

- 5.1.1 Surgical Drapes

- 5.2 By Material

- 5.2.1 Non-woven (SMS, Spunlace)

- 5.2.2 Laminated Non-woven

- 5.2.3 Woven (Cotton, Polyester Blends)

- 5.2.4 Bio-based & Recyclable Polymers

- 5.3 By Usage

- 5.3.1 Disposable

- 5.3.2 Reusable

- 5.4 By Protection Level

- 5.4.1 AAMI Level 1

- 5.4.2 AAMI Level 2

- 5.4.3 AAMI Level 3

- 5.4.4 AAMI Level 4

- 5.5 By End-User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Specialty Clinics

- 5.5.4 Home Healthcare & Hospice

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 3M

- 6.3.2 Cardinal Health

- 6.3.3 Medline Industries Inc.

- 6.3.4 Owens & Minor (Halyard Health)

- 6.3.5 Molnlycke Health Care AB

- 6.3.6 Steris plc

- 6.3.7 Kimberly-Clark Corporation

- 6.3.8 DuPont de Nemours Inc.

- 6.3.9 Lohmann & Rauscher GmbH & Co. KG

- 6.3.10 Ahlstrom-Munksjo

- 6.3.11 Paul Hartmann AG

- 6.3.12 Winner Medical Co. Ltd.

- 6.3.13 Sterimed Group

- 6.3.14 Medica Europe BV

- 6.3.15 Alpha Pro Tech

- 6.3.16 Sterisets International BV

- 6.3.17 Amaryllis Healthcare Pvt Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment