PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842666

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842666

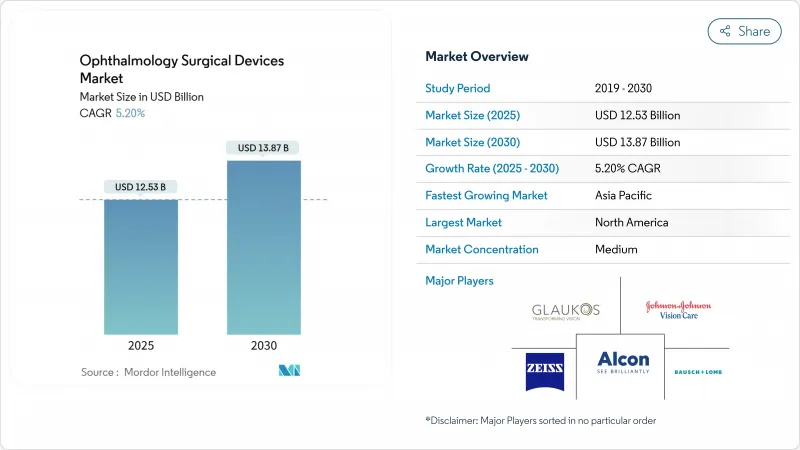

Ophthalmology Surgical Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ophthalmic surgical devices market size stands at USD 12.53 billion in 2025 and is projected to reach USD 13.87 billion by 2030, reflecting a 5.20% CAGR over the forecast period.

Sustained demand is linked to the global surge in age-related eye disorders, expanding surgical coverage, and steady gains in healthcare spending across emerging economies. Robust product pipelines-especially in phaco systems, image-guided microscopes, and minimally invasive glaucoma implants-are enabling providers to improve outcomes while raising procedure throughput. Rising adoption of ambulatory surgical centers (ASCs) in North America, favorable reimbursement adjustments, and growing availability of purpose-built low-cost platforms in Asia Pacific are further widening access. Meanwhile, consolidation among key manufacturers is yielding integrated digital ecosystems that combine diagnostics, planning, and surgery into a single workflow, enhancing surgeon productivity and differentiating premium offerings.

Global Ophthalmology Surgical Devices Market Trends and Insights

Global Cataract-Surgery Surge Driven by Aging Demographics and Widening Surgical Coverage

Cataract procedure volumes are forecast to rise 128% by 2036, with patients aged 85+ generating the greatest incremental demand. Japan's elderly population already exceeds 20%, creating broad momentum for surgical capacity expansion. National programs tackling surgical backlogs-from WHO's Vision 2030 to country-specific blindness-prevention schemes-are improving coverage in many lower-income regions. Persistent disparity is still evident: a 2025 Australian study found Indigenous cataract surgical coverage at 68% versus 88.4% in non-Indigenous groups, underscoring the need for targeted outreach. Mobile theaters and public-private partnerships are therefore emerging to address underserved communities and sustain growth in the ophthalmic surgical devices market.

Accelerating Adoption of Minimally Invasive Glaucoma Surgeries and Combination Cataract-Glaucoma Procedures

MIGS implants such as iStent and Hydrus deliver 20% intraocular-pressure (IOP) reductions in more than 75% of treated eyes at 24 months, transforming the risk-benefit profile of glaucoma surgery. The INTEGRITY study reported 78.2% of iStent infinite eyes meeting the >=20% IOP-reduction threshold with a 3.3% complication rate, well below conventional trabeculectomy. Bundling MIGS with cataract extraction allows surgeons to address two diseases in a single sitting, shortening patient recovery and cutting payor costs. Reimbursement codes covering combination procedures are now standard in the United States and parts of Europe, accelerating MIGS penetration and supporting steady expansion of the ophthalmic surgical devices market.

High Upfront Capital and Maintenance Costs for Advanced Laser and Phaco Systems Challenging ROI for Mid-Size Providers

State-of-the-art femtosecond lasers and digital microscopes command outlays beyond USD 500,000, with annual service contracts topping USD 50,000. Mid-size clinics face stretched payback horizons as downward reimbursement pressure erodes margins, especially where case volumes are modest. Staffing costs compound the burden; shortages of certified technicians force centers to offer premium wages and invest in lengthy training, delaying profitability. Limited capital access in rural territories widens geographic inequality and tempers installation rates, placing a brake on the ophthalmic surgical devices market.

Other drivers and restraints analyzed in the detailed report include:

- Digital-OR and Image-Guided Technologies Raising Premium-Procedure Uptake

- Expansion Of ASCs And Day-Care Reimbursement Models Lowering Procedure Costs and Boosting Volume

- Divergent and Tightening Regulatory Regimes Prolonging Approval Timelines and Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cataract systems represented 41.6% of the ophthalmic surgical devices market in 2024, anchored by more than 20 million annual procedures worldwide. Advanced fluidics platforms such as Alcon's CENTURION Vision System with ACTIVE SENTRY maintain more physiologic intraocular pressure, decreasing endothelial cell loss and expediting recovery. Digital workflow suites bundle biometry, formula calculators, and cloud transfer, elevating throughput and surgeon consistency. Premium femtosecond lasers and toric IOL injectors attract affluent urban centers, whereas purpose-built low-cost phaco packs target volume programs in emerging economies.

Glaucoma surgery devices, especially trabecular micro-bypass stents, are the fastest-growing category with an 8.9% CAGR projected for 2025-2030. Widespread MIGS training, maturing long-term safety data, and pairing with cataract removal expand candidacy. Refractive and vitreo-retinal platforms hold smaller shares yet benefit from innovations such as Zeiss VISUMAX 800 with SMILE pro software, which cuts lenticule creation time below 10 seconds, and dual-mode lasers that bridge cataract and retinal applications. Device makers therefore pursue cross-segment synergies to defend margins and expand the ophthalmic surgical devices market.

The Ophthalmic Surgical Devices Market Report is Segmented by Product (Refractive Surgery Devices, Glaucoma Surgery Devices, Cataract Surgery Devices, and Other Surgical Devices), End-User (Hospitals, Specialty Ophthalmic Clinics, Ambulatory Surgery Centers (ASCs), and Other End-Users), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 32.1% of global revenue in 2024, underpinned by mature reimbursement frameworks, early adopter surgeon bases, and dense ASC networks. Medicare's 2.9% ASC fee boost for 2025 and sustained capital budgets at leading academic centers anchor regional stability. Nonetheless, premium IOL reimbursement compression is pressuring pricing, prompting hospitals to renegotiate supply contracts and consolidate purchasing.

Asia Pacific is projected to post a 6.0% CAGR from 2025 to 2030, the fastest pace worldwide. Public blindness-prevention drives in China and India are expanding eligibility, and domestic firms are scaling low-cost phaco units that operate on portable power. Private ophthalmology chains in India secured fresh equity infusions in 2025, earmarked for regional clinic rollouts and training centers. Alongside rising disposable income and urbanization, these factors sustain double-digit unit growth in cataract kits, supporting the broader ophthalmic surgical devices market.

Europe, the Middle East & Africa, and South America collectively represent the remaining share. Europe's stringent MDR rules have lengthened certification cycles, yet the region continues to innovate in digital microscopes and regenerative corneal implants. Gulf Cooperation Council nations are funding flagship eye institutes that import top-tier systems, whereas many sub-Saharan nations rely on charity-supported mobile theaters to serve remote areas. Brazil and Argentina lead South America in device adoption, but currency swings raise procurement risk and hinder consistent expansion. Across regions, outpatient migration and digital integration remain unifying themes in the ophthalmic surgical devices market.

- Alcon

- Johnson & Johnson Vision Care

- Carl Zeiss

- Bausch + Lomb Corp.

- Hoya Corp.

- Glaukos Corp.

- STAAR Surgical Co.

- Topcon Corp.

- NIDEK Co. Ltd.

- Lumenis

- Ziemer Group

- Rayner Intraocular Lenses Ltd.

- Nova Eye Medical Ltd.

- Santen Pharmaceutical Co.

- BVI Medical

- Medicel AG

- Oertli Instrumente AG

- AJL Ophthalmic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Cataract-Surgery Surge Driven by Aging Demographics and Widening Surgical Coverage

- 4.2.2 Accelerating Adoption of Minimally Invasive Glaucoma Surgeries (MIGS) And Combination Cataract-Glaucoma Procedures

- 4.2.3 Digital-OR And Image-Guided Technologies (Femtosecond Laser, OR-A Digital Microscopes, AI-Driven Planning) Raising Premium-Procedure Uptake

- 4.2.4 Expansion Of Ambulatory Surgical Centres (Ascs) And Day-Care Reimbursement Models Lowering Procedure Costs and Boosting Volume

- 4.2.5 Purpose-Built Low-Cost Phaco Platforms and Single-Use Cataract Packs Enabling Rapid Penetration of High-Growth Emerging Markets

- 4.2.6 Vision-Care Initiatives (WHO Vision 2030, National Blindness-Prevention Programmes) Catalysing Public Investment in Surgical Capacity

- 4.3 Market Restraints

- 4.3.1 High Upfront Capital and Maintenance Costs for Advanced Laser and Phaco Systems, Challenging ROI For Mid-Size Providers

- 4.3.2 Divergent And Tightening Regulatory Regimes (EU MDR, China NMPA Clinical Evidence Mandates) Prolonging Approval Timelines and Compliance Costs

- 4.3.3 Limited Pool of Fellowship-Trained Ophthalmic Surgeons in Low- And Middle-Income Countries Constraining Device Utilisation

- 4.3.4 Reimbursement Compression and Pricing Caps on Premium Intra-Ocular Lenses and Adjunct Devices In Major Markets (E.G., U.S. CMS, Japan NHI, China NRDL)

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Refractive Surgery Devices

- 5.1.2 Glaucoma Surgery Devices

- 5.1.3 Cataract Surgery Devices

- 5.1.4 Other Surgical Devices

- 5.2 By End-user

- 5.2.1 Hospitals

- 5.2.2 Specialty Ophthalmic Clinics

- 5.2.3 Ambulatory Surgery Centers (ASCs)

- 5.2.4 Other End-users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Alcon Inc.

- 6.3.2 Johnson & Johnson Vision Care

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 Bausch + Lomb Corp.

- 6.3.5 Hoya Corp.

- 6.3.6 Glaukos Corp.

- 6.3.7 STAAR Surgical Co.

- 6.3.8 Topcon Corp.

- 6.3.9 NIDEK Co. Ltd.

- 6.3.10 Lumenis Ltd.

- 6.3.11 Ziemer Ophthalmic Systems AG

- 6.3.12 Rayner Intraocular Lenses Ltd.

- 6.3.13 Nova Eye Medical Ltd.

- 6.3.14 Santen Pharmaceutical Co.

- 6.3.15 BVI Medical

- 6.3.16 Medicel AG

- 6.3.17 Oertli Instrumente AG

- 6.3.18 AJL Ophthalmic SA

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment