PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842667

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842667

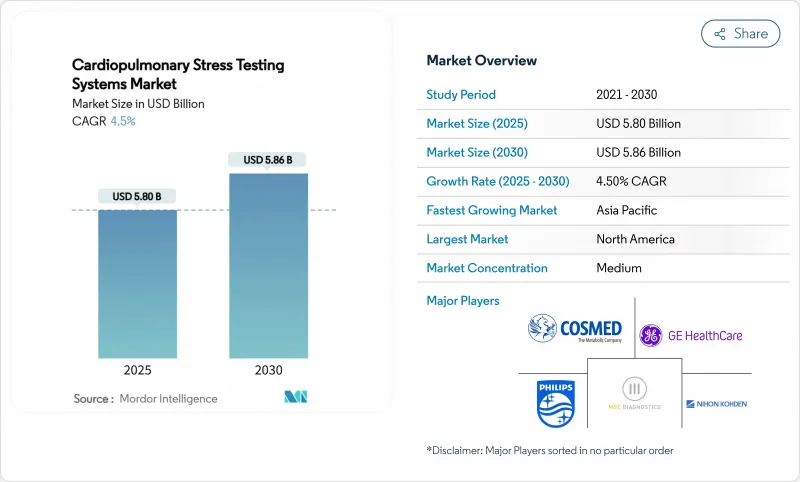

Cardiopulmonary Stress Testing Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiopulmonary exercise testing market is valued at USD 5.80 billion in 2025 and is forecast to reach USD 5.86 billion by 2030, advancing at a 4.5% CAGR.

Growth rests in the broader shift from volume-based diagnostics to precision cardiopulmonary evaluation, helped by AI-enabled real-time VO2 analytics that shorten interpretation time and raise diagnostic consistency. Hospitals, sports laboratories, and rehabilitation centers also view these systems as strategic assets because early physiological insights reduce downstream treatment costs. Portable CPET platforms extend testing into home-based rehabilitation, while wearable sensors feed continuous data to cloud algorithms, linking disease diagnostics with fitness monitoring. North American reimbursement clarity, rising Asia-Pacific chronic-disease burden, and steady European clinical research activity collectively underpin demand for the expanding fleet of AI-ready devices. Meanwhile, mid-tier device makers face a regulatory maze that lengthens launch cycles, keeping bargaining power with hospitals moderate, even as user expectations for seamless workflow integration rise.

Global Cardiopulmonary Stress Testing Systems Market Trends and Insights

Rise in Global Healthcare Expenditure

Expanding health budgets are shifting hospital decisions away from cost-containment toward value-based procurement of advanced CPET systems that package metabolic carts, stress ECG, and cloud analytics into one console. Medicare's 2024 upgrade to cardiac rehabilitation billing further raises the economic case to deploy such platforms, giving providers long-run revenue certainty. Emerging economies replicate this approach as multi-clinic groups co-finance shared CPET suites to widen access. Lower amortized unit cost plus higher throughput help facilities justify the replacement of legacy ergometers with AI-ready devices.

Rising Prevalence of Cardiopulmonary Disorders

Around 48.6% of US adults lived with cardiovascular disease, while fewer than 24.2% met activity guidelines, pushing hospitals to adopt physiologically rich testing to separate cardiac from pulmonary sources of exercise intolerance.Integrating CPET with invasive hemodynamic monitoring allows earlier detection of exercise pulmonary hypertension, which in turn guides targeted therapy. Aging populations and multimorbidity reinforce the need for comprehensive load-response insight that plain stress ECG misses.

Stringent Multi-Region Device Approval Pathways

The European Medical Device Regulation demands extensive bench data even for incremental upgrades. At the same time, US post-market surveillance can trigger costly recalls, as seen with Vyaire's Twin Tube incident in April 2024. Divergent cybersecurity requirements further extend timelines for AI-enabled systems, often forcing smaller firms to stage launches region by region.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Stress-ECG & Metabolic Carts

- Favorable Reimbursement Policies for Diagnostic Testing

- High Capital & Lifecycle Costs of Integrated CPET Labs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cardiopulmonary exercise-testing systems generated 25.8% of 2024 revenue, and this category is pacing the field with 11.1% CAGR. The cardiopulmonary exercise testing market size linked to these systems will expand as integrated gas analyzers and stress ECG modules converge into touchscreen carts that auto-score data. Metabolic carts now self-calibrate in 90 seconds, reducing downtime. Meanwhile, stress blood-pressure monitors and entry-level ECG ergometers retain demand in clinics where budgets cannot yet stretch to full platforms.

Algorithm-based interpretation cements this leadership: random-forest classifiers find mechanical-ventilatory bottlenecks that trainees might overlook, and automated ventilatory-threshold detection supports precise exercise prescriptions. Providers therefore prefer single-vendor bundles that cover cardiopulmonary exercise testing market compliance and remote-monitoring extensions in one purchase.

Hospitals controlled 28.3% expenditure in 2024, yet sports-performance and research labs headline growth at 10.2% CAGR, reflecting rising elite-fitness budgets and university studies. The cardiopulmonary exercise testing market benefits from pro-team demand for daily readiness scoring, and cycle-ergometer protocols fine-tuned to altitude camps. Rehabilitation centers follow suit, folding CPET into post-operative care plans reimbursed under newly expanded cardiac-rehab codes.

Unlike hospital procurement, sports facilities favor portability and rapid setup. Vendors are responding with backpack analyzers weighing under 400 g, Bluetooth-linked to tablets that parse breath-by-breath data through cloud AI, keeping the cardiopulmonary exercise testing market aligned with field-based applications while still compliant with clinical standards.

The Cardiopulmonary Stress Testing Systems Market is Segmented by Product Type (Stress Blood Pressure Monitors, Stress ECG Systems, and More), End User (Specialty & Cardiology Clinics, and More), Application (Disease Diagnostics, Pre-Operative Risk Evaluation, and More), Technology (Treadmill-Based, and More), and Geography (North America, Europe, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 29% of 2024 revenue. Adoption is buoyed by CMS rules that reimburse CPET for unexplained dyspnea, plus academic trials that bundle CPET endpoints into cardiovascular drug studies. GE Healthcare's March 2025 release of Revolution Vibe CT illustrates the region's appetite for AI-rich cardiology diagnostics that integrate seamlessly with CPET-derived risk scores. Canadian health networks invest in mobile units serving rural communities, broadening access while preserving provincial cost controls.

Asia Pacific is the fastest mover at 8.5% CAGR, propelled by chronic disease growth and hospital build-outs. China's provincial tenders now stipulate VO2max capability in county cardiac centers, while Japanese teaching hospitals employ CPET in oncology rehab pathways. India's tier-two cities add dual-use CPET labs serving both clinical referrals and sports academies, further lifting cardiopulmonary exercise testing market penetration.

Europe maintains robust demand, helped by harmonised clinical guidelines that embed CPET into surgical clearance algorithms. Germany's DiGA fast-track process incentivises vendors to pair CPET outputs with digital-therapeutic coaching apps, giving patients integrated post-test pathways. The UK National Health Service funds CPET slots in cardiac-rehab settings, citing reductions in unplanned readmissions. Southern Europe relies on EU structural funds to refresh metabolic-cart inventories, ensuring parity with northern centers.

- GE Healthcare

- Koninklijke Philips

- COSMED Srl

- MGC Diagnostics Corp.

- Schiller

- Baxter (Q-Stress / Welch Allyn)

- Vyaire Medical

- Nihon Kohden Corp.

- Hillrom Holdings Inc.

- OSI Systems

- Allengers Medical Systems

- Cardioline

- Morgan Scientific

- Geratherm Respiratory

- Vyntus (Vyaire)

- CareFusion (BD)

- Clarity Medical

- Innomed Medical

- CardioMed Treadmills

- Compumed Inc.

- Spacelabs Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise In Global Healthcare Expenditure

- 4.2.2 Rising Prevalence Of Cardiopulmonary Disorders

- 4.2.3 Technological Advances In Stress-ECG & Metabolic Carts

- 4.2.4 Favorable Reimbursement Policies For Diagnostic Testing

- 4.2.5 AI-Enabled Real-Time VO? Analytics Adoption

- 4.2.6 Home-Based Rehab Programs Needing Portable CPET Devices

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Region Device Approval Pathways

- 4.3.2 High Capital & Lifecycle Costs Of Integrated CPET Labs

- 4.3.3 Shortage Of Trained CPET Technologists

- 4.3.4 Wearable Multiparametric Diagnostics Diverting Demand

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Stress Blood-Pressure Monitors

- 5.1.2 Stress ECG Systems

- 5.1.3 Exercise Testing Systems

- 5.1.4 Cardiopulmonary Exercise-Testing (CPET) Systems

- 5.1.5 Metabolic Carts & Gas-Analysis Modules

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Specialty & Cardiology Clinics

- 5.2.3 Ambulatory Surgical & Day-Care Centers

- 5.2.4 Rehabilitation Centers

- 5.2.5 Sports-Performance & Research Labs

- 5.3 By Application

- 5.3.1 Disease Diagnostics

- 5.3.2 Pre-operative Risk Evaluation

- 5.3.3 Cardiac & Pulmonary Rehabilitation

- 5.3.4 Sports & Human-Performance Assessment

- 5.3.5 Critical-Care & ICU Monitoring

- 5.4 By Technology

- 5.4.1 Treadmill-based Stress Testing

- 5.4.2 Cycle-Ergometer-based Testing

- 5.4.3 Robotics-Assisted Tilt-Table (RATT)

- 5.4.4 Wearable / Patch-based CPET

- 5.4.5 Pharmacologic Stress Testing Platforms

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE Healthcare

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 COSMED Srl

- 6.3.4 MGC Diagnostics Corp.

- 6.3.5 Schiller AG

- 6.3.6 Baxter (Q-Stress / Welch Allyn)

- 6.3.7 Vyaire Medical

- 6.3.8 Nihon Kohden Corp.

- 6.3.9 Hillrom Holdings Inc.

- 6.3.10 OSI Systems Inc.

- 6.3.11 Allengers Medical Systems

- 6.3.12 Cardioline SpA

- 6.3.13 Morgan Scientific

- 6.3.14 Geratherm Respiratory

- 6.3.15 Vyntus (Vyaire)

- 6.3.16 CareFusion (BD)

- 6.3.17 Clarity Medical

- 6.3.18 Innomed Medical

- 6.3.19 CardioMed Treadmills

- 6.3.20 Compumed Inc.

- 6.3.21 Spacelabs Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment