PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842675

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842675

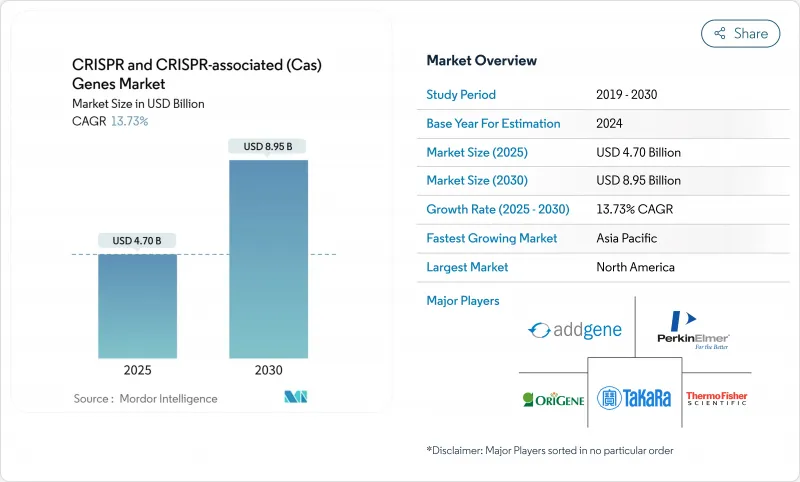

CRISPR And CRISPR-associated (Cas) Genes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The CRISPR market size reached USD 4.70 billion in 2025 and is forecast to rise to USD 8.95 billion by 2030, reflecting a 13.73% CAGR.

The growth arc signals that gene editing has shifted from a specialized research tool toward a validated therapeutic and agricultural platform. Adoption has accelerated since the landmark late-2023 approval of Casgevy for sickle cell disease and beta thalassemia, which created a regulatory precedent and de-risked the clinical pathway for follow-on programs. Investment flows remain strong, supported by 14 FDA review designations granted to CRISPR therapies in 2023, an unusually high figure for a single modality. Agricultural use cases are scaling as the United States and select Asia-Pacific regulators exempt gene-edited crops that mimic conventional breeding, removing significant time and cost barriers. Technology refinement continues, with prime and base editing addressing off-target risks and AI-driven guide design cutting candidate selection cycles from months to weeks.

Global CRISPR And CRISPR-associated (Cas) Genes Market Trends and Insights

FDA Approvals of CRISPR-Based Therapies

The December 2023 approval of Casgevy established a safety and efficacy template that is now guiding at least eight additional late-stage programs worldwide. Prime Medicine soon received clearance for PM359, the first prime-editing therapy to reach human trials, signaling that regulators view next-generation platforms as incremental improvements rather than risks . Intellia Therapeutics advanced two candidates to Phase 3 simultaneously, underscoring the confidence provided by prior approvals. Pricing pressure remains, as the USD 2 million per-dose list price of Casgevy has intensified the hunt for delivery and manufacturing efficiencies.

Advances in Delivery Technologies (Viral and Non-Viral)

Tissue-specific capsid engineering has produced vectors like Sangamo's STAC-BBB, which delivers 700-fold more transgene across the blood-brain barrier than AAV9 and opens lucrative neurology indications. Lipid nanoparticles, refined during COVID-19 vaccine production, now package CRISPR cargos for in-vivo cardiovascular applications at CRISPR Therapeutics. A USD 95 million strategic investment by Regeneron into Mammoth Biosciences targets ultracompact nucleases that fit within viral payload limits while cutting immunogenicity risks. Hybrid systems that marry targeted viral vectors with scalable synthetic carriers are under evaluation to widen organ reach and ease manufacturing bottlenecks.

Off-Target Safety and Ethical Concerns

Regulators require multi-layer detection assays for unintended edits because permanent changes cannot be reversed in vivo, extending pre-clinical development and adding cost. Studies citing myocardial infarction and stroke signals in early immuno-oncology trials have heightened vigilance, with European agencies adopting especially conservative positions for central-nervous-system targets. Ethical debate also surrounds gene-drive proposals for pest control, spilling over into human-health applications and clouding public perception in some regions. Base and prime editing aim to mitigate risk by avoiding double-strand breaks, but multi-year safety datasets will be needed before regulators relax current guardrails

Other drivers and restraints analyzed in the detailed report include:

- Rising R&D Funding and Strategic Partnerships

- AI-Driven sgRNA Design Accelerates Time-to-Lead

- High CMC and Manufacturing Cost Structure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Products controlled 79.10% of total revenue in 2024, reflecting sustained demand for guide RNA kits, Cas enzymes, and transfection reagents used across discovery and translational workflows. Thermo Fisher and Merck KGaA offer catalogue reagents that scale with research throughput, underpinning a predictable revenue base that buffers volatility in therapeutic milestones. Services are pacing at a 14.35% CAGR as biotech clients outsource assay development, cell-line engineering, and GMP viral-vector production to specialist CROs. Charles River Laboratories positions itself as an end-to-end partner from discovery to Phase I manufacturing, mirroring a broader shift in the CRISPR market toward integrated external capabilities.

Growing therapeutic pipelines multiply demand for process development, quality control, and regulatory documentation, lifting service penetration every year of the forecast. Suppliers are bundling reagents, delivery vectors, and analytics software into platform packages to secure switching costs and capture a larger slice of downstream value.

Biomedical programs generated 82.23% of 2024 revenue, sustained by high-value therapies, companion diagnostics, and drug discovery screens that command premium pricing and long-term partnerships. The implicit risk profile is balanced by strong venture capital support and expanding orphan-disease incentives. Agriculture, growing at 15.45% CAGR, benefits from streamlined regulation in the United States where gene-edited plants that could be derived through conventional breeding skip protracted environmental assessments, slashing the time to market and expanding farmer.

China's 2025 guidance encouraging biotech cultivation of wheat, corn, and soy is set to unlock additional volume and reinforce the Asia-Pacific growth story. Synthetic biology use cases such as bio-production of specialty chemicals represent a nascent yet promising niche, though current revenue remains modest. Cross-fertilisation of knowledge between therapeutic and agricultural segments accelerates platform evolution, particularly around delivery vectors and computational design, deepening the overall CRISPR industry ecosystem.

The Global CRISPR and CRISPR-Associated (CAS) Genes Market is Segmented by Component (Product and Services), by Application (Biomedical, Agriculture and More), by End User (Biotechnology & Pharmaceutical Company and More), by Technology Type (CRISPR-Cas9 and More), by Delivery Method (Viral Vectors and Non-Viral) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with 47.56% revenue in 2024 thanks to FDA clarity, deep venture capital pools, and concentration of specialised talent in Boston and the San Francisco Bay Area. The region further benefits from USDA rules that treat certain gene-edited crops like conventionally bred varieties, supporting diversified revenue streams beyond therapeutics. Cost pressure and manufacturing bottlenecks create incentives for firms to establish production sites in lower-cost jurisdictions, slightly tempering growth yet maintaining strategic centrality through 2030.

Asia-Pacific posts the fastest CAGR at 16.23%, led by China's strong state financing, a large talent base, and more than 700 active CRISPR clinical trials that now outnumber those in the United States. Policy initiatives like Japan's Smart Cell Project aim to commercialise gene-engineered cellular factories for pharma and industrial applications, reinforcing a region-wide pivot to high-value biomanufacturing. India wrestles with restrictive licensing regimes that limit farmers' adoption of CRISPR crops, underscoring the importance of intellectual-property frameworks in shaping local trajectories.

Europe holds significant scientific prowess but lags in commercialisation because gene-edited organisms fall under the same stringent rules as traditional GMOs, stretching approval timelines and raising compliance costs. Consequently many European firms conduct clinical trials in North America or Asia while maintaining R&D bases at home. Latin America, the Middle East, and Africa remain emergent; regulatory frameworks are still evolving and healthcare spending is lower, yet early adoption in Brazil's agritech sector suggests future opportunity once global supply chains mature and local policy aligns with scientific progress.

- CRISPR Therapeutic

- Editas Medicine

- Intellia Therapeutics

- Beam Therapeutics

- Caribou Biosciences

- Mammoth Biosciences

- Synthego

- Thermo Fisher Scientific

- Merck

- Agilent Technologies

- Horizon Discovery

- Origene Technologies

- Charles River

- Sangamo Therapeutics

- ERS Genomics

- Aldevron

- Ubigene Biosciences

- Cellecta

- Applied StemCell

- Integrated DNA Technologies

- Verve Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 FDA approvals of CRISPR-based therapies

- 4.2.2 Advances in delivery technologies (viral & non-viral)

- 4.2.3 Rising R&D funding & strategic partnerships

- 4.2.4 Mitochondrial in-vivo CRISPR opens rare-disease pipeline

- 4.2.5 AI-driven sgRNA design accelerates time-to-lead

- 4.2.6 Regulatory easing for gene-edited crops

- 4.3 Market Restraints

- 4.3.1 Off-target safety & ethical concerns

- 4.3.2 High CMC & manufacturing cost structure

- 4.3.3 Supply-chain concentration in Cas nucleases

- 4.3.4 Public backlash over gene-drive ecology risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Component

- 5.1.1 Products

- 5.1.2 Services

- 5.2 By Application

- 5.2.1 Biomedical

- 5.2.2 Agriculture

- 5.2.3 Industrial & Synthetic Biology

- 5.3 By End User

- 5.3.1 Biotechnology & Pharmaceutical Cos.

- 5.3.2 Academic & Government Institutes

- 5.3.3 Contract Research / Manufacturing Orgs.

- 5.4 By Technology Type

- 5.4.1 CRISPR-Cas9

- 5.4.2 Base Editing

- 5.4.3 Prime Editing

- 5.4.4 CRISPR-Cas12/13 & Others

- 5.5 By Delivery Method

- 5.5.1 Viral Vectors

- 5.5.2 Non-viral (LNPs, Electroporation, Nanocarriers)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 CRISPR Therapeutics

- 6.3.2 Editas Medicine

- 6.3.3 Intellia Therapeutics

- 6.3.4 Beam Therapeutics

- 6.3.5 Caribou Biosciences

- 6.3.6 Mammoth Biosciences

- 6.3.7 Synthego

- 6.3.8 Thermo Fisher Scientific

- 6.3.9 Merck KGaA (Sigma-Aldrich)

- 6.3.10 Agilent Technologies

- 6.3.11 Horizon Discovery

- 6.3.12 Origene Technologies

- 6.3.13 Charles River Laboratories

- 6.3.14 Sangamo Therapeutics

- 6.3.15 ERS Genomics

- 6.3.16 Aldevron

- 6.3.17 Ubigene Biosciences

- 6.3.18 Cellecta

- 6.3.19 Applied StemCell

- 6.3.20 Integrated DNA Technologies

- 6.3.21 Verve Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment