PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842683

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842683

Breast Reconstruction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

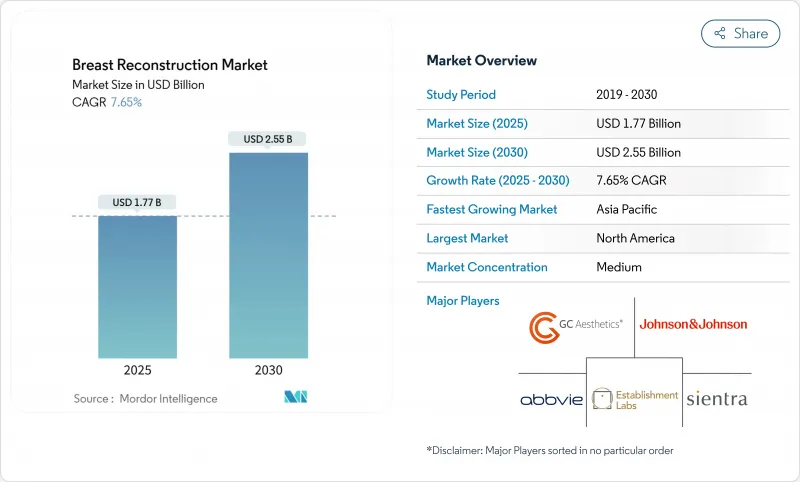

The breast reconstruction market is valued at USD 1.77 billion in 2025 and is on track to reach USD 2.55 billion by 2030, advancing at a 7.65% CAGR.

This growth links directly to rising breast-cancer incidence, expanding reimbursement mandates, and innovations such as artificial-intelligence (AI) imaging and 3-D bioprinted scaffolds. A 91% five-year survival rate in major oncology regions enlarges the eligible patient pool, while emerging tissue-engineering platforms reduce revision surgeries and improve long-term outcomes. Market leadership currently rests with implants, yet rapid gains in regenerative products and biologic meshes are shifting surgeon preference toward hybrid procedures that blend form stability with natural tissue integration. Geographically, North America holds a 37.72% breast reconstruction market share in 2024, and Asia-Pacific is advancing at 9.22% CAGR, supported by the World Health Organization's forecast of a 38% global breast-cancer case rise by 2050.

Global Breast Reconstruction Market Trends and Insights

Rising Incidence Of Breast Cancer

The World Health Organization projects 3.2 million new breast-cancer diagnoses per year by 2050, up 38% from current levels. Asia accounted for 985,400 new cases in 2022, a number expected to cross 1.4 million by 2050. Younger women under 50 and Asian American/Pacific Islander populations have shown the steepest incidence upticks, leading to longer survivorship and higher reconstruction uptake. In China and India, value-driven hospital systems are opening new operating-room slots for implant-based and hybrid procedures, creating white-space growth pockets for device makers able to offer cost-effective solutions at scale. The demographic expansion is therefore not merely numerical; it also shifts product-mix demand toward durable, low-complication implants that minimize lifetime revision risk.

Growing Reimbursement Mandates & Awareness

The Women's Health and Cancer Rights Act guarantees comprehensive reconstruction benefits across US group health plans, and February 2025 billing-code preservation for DIEP and GAP flaps underscores regulator commitment to advanced autologous techniques. State-level actions, such as California's July 2024 Medi-Cal policy update, broaden access to implant procedures for lower-income patients. Major private payers have redefined reconstruction as medically necessary, covering symmetry surgeries and complication management. As ambulatory centers embrace value-based payment models, surgeons gain financial incentives to adopt technologies that reduce operative time and downstream revisions, accelerating demand for AI-guided sizing software paired with cohesive-gel implants.

High Procedure & Device Costs In Emerging Markets

Average out-of-pocket costs for implant reconstruction in Southeast Asia exceed 45% of median annual income, limiting uptake outside major urban centers. Local payers seldom reimburse advanced biomaterials, forcing surgeons to rely on saline implants that carry higher revision risk. Multinational device firms must localize manufacturing or offer tiered price structures to penetrate these cost-sensitive regions. Government pilot programs in India and Thailand to subsidize reconstruction for low-income patients have shown positive early results but remain limited in scope.

Other drivers and restraints analyzed in the detailed report include:

- Advancements In Cohesive-Gel & Gummy-Bear Implants

- Surge In Nipple-Sparing & Pre-Pectoral Mastectomies

- Implant-Safety Concerns (BIA-ALCL, Capsular Contracture)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Breast implants retained 43.55% share of the breast reconstruction market in 2024, driven by broad surgeon familiarity and predictable outcomes. Yet 3-D bioprinted scaffolds and regenerative implants are growing at a 15.25% CAGR, signaling a pivot to tissue-engineering platforms that minimize foreign-body responses and enable personalized shapes. Traditional tissue expanders still bridge staged reconstructions, but their role is narrowing as pre-pectoral, single-stage procedures gain popularity.

The breast reconstruction industry increasingly values devices that reduce revision rates. AI-guided sizing software pairs with cohesive-gel implants to deliver custom profiles, while poly-4-hydroxybutyrate scaffolds support natural tissue ingrowth. BD's STANCE trial on GalaFLEX LITE highlights bioabsorbable meshes that address the 54% capsular-contracture recurrence in revision surgeries. Such innovations are reshaping hospital procurement criteria toward long-term cost savings and patient-reported outcomes.

Silicone held 45.53% of breast reconstruction market share in 2024, backed by decades of refinement and recent FDA clearances for larger-volume options. Biologic mesh, however, leads growth at 9.15% CAGR as surgeons seek materials that promote vascularized tissue integration and reduce chronic inflammation. Saline implants remain relevant for patients with specific safety concerns but are gradually losing ground.

In parallel, synthetic meshes face heightened scrutiny over permanence and infection risk, spurring demand for biodegradable alternatives. Research into environmental footprints of implant supply chains also favors biologic and biodegradable materials with lower carbon impacts, aligning procurement policies with hospital ESG targets.

The Breast Reconstruction Market Report is Segmented by Product (Breast Implants, Tissue Expanders, and More), Material Type (Silicone, Saline, and More), Reconstruction Technique (Implant-Based, and More), End User (Hospitals, Ambulatory Care Centers, and More), Application (Post-Mastectomy Cancer Reconstruction, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the breast reconstruction market with 37.72% share in 2024, underpinned by federal coverage mandates and a dense network of board-certified plastic surgeons. The region also hosts many pivotal trials, allowing earlier access to next-generation implants and biologic meshes. Market expansion is expected to remain steady as AI-guided planning tools penetrate large hospital systems and ambulatory surgery centers.

Asia-Pacific is the fastest-growing region, forecast at 9.22% CAGR through 2030. Rising breast-cancer prevalence, expanding middle-class incomes, and cultural normalization of reconstruction fuel procedure volumes, while Japan's immediate-reconstruction rate of 11.2% illustrates latent upside. Government initiatives to subsidize mastectomy care in China and India are slowly being extended to reconstruction, opening a path for cost-optimized implants and locally manufactured meshes.

Europe sustains moderate growth under universal healthcare frameworks that ensure baseline access, though procedure uptake varies by country. Latin America and the Middle East/Africa remain nascent markets, with growth contingent on surgical-infrastructure build-out and clinician-training partnerships. Multinational firms that localize production and align product portfolios with regional reimbursement tiers will capture early mover advantages.

- AbbVie (ALLERGAN)

- Johnson & Johnson

- Sientra

- Establishment Labs

- GC Aesthetics plc

- Polytech Health & Aesthetics

- RTI Surgical

- Groupe Sebbin

- Integra LifeSciences

- Silimed

- Laboratoires Expanscience

- Ideal Implant Inc.

- BellaSeno GmbH

- CollPlant Biotechnologies

- Stratasys

- HansBiomed Co. Ltd.

- Motiva USA LLC

- Tissue Regenix

- Decomedical S.r.l.

- Implantech Associates

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence Of Breast Cancer

- 4.2.2 Growing Reimbursement Mandates & Awareness

- 4.2.3 Advancements In Cohesive-Gel & Gummy-Bear Implants

- 4.2.4 Surge In Nipple-Sparing & Pre-Pectoral Mastectomies

- 4.2.5 3-D Bioprinted Regenerative Implants Entering Clinical Trials

- 4.2.6 AI-Guided Imaging & Sizing Reducing Revision Surgeries

- 4.3 Market Restraints

- 4.3.1 High Procedure & Device Costs In Emerging Markets

- 4.3.2 Implant-Safety Concerns (BIA-ALCL, Capsular Contracture)

- 4.3.3 Shortage Of Microsurgical Expertise For Autologous Flaps

- 4.3.4 ESG-Driven Silicone & ADM Supply-Chain Disruptions

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Breast Implants

- 5.1.2 Tissue Expanders

- 5.1.3 Acellular Dermal Matrices (Biologic, Synthetic)

- 5.1.4 3-D Bioprinted Scaffolds & Regenerative Implants

- 5.1.5 Other Adjunct Products (NAC prosthetics, fixation devices)

- 5.2 By Material Type

- 5.2.1 Silicone

- 5.2.2 Saline

- 5.2.3 Autologous Tissue

- 5.2.4 Biologic Mesh

- 5.2.5 Synthetic Mesh

- 5.3 By Reconstruction Technique

- 5.3.1 Implant-based

- 5.3.2 Autologous Tissue

- 5.3.3 Hybrid

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgery Centers

- 5.4.3 Specialty Aesthetic Clinics

- 5.5 By Application

- 5.5.1 Post-mastectomy Cancer Reconstruction

- 5.5.2 Prophylactic Mastectomy

- 5.5.3 Trauma & Congenital Deformity

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie (ALLERGAN)

- 6.3.2 Johnson & Johnson (Mentor Worldwide)

- 6.3.3 Sientra Inc.

- 6.3.4 Establishment Labs SA

- 6.3.5 GC Aesthetics plc

- 6.3.6 Polytech Health & Aesthetics GmbH

- 6.3.7 RTI Surgical Inc.

- 6.3.8 Groupe Sebbin SAS

- 6.3.9 Integra LifeSciences

- 6.3.10 Silimed

- 6.3.11 Laboratories Arion

- 6.3.12 Ideal Implant Inc.

- 6.3.13 BellaSeno GmbH

- 6.3.14 CollPlant Biotechnologies

- 6.3.15 Stratasys Ltd.

- 6.3.16 HansBiomed Co. Ltd.

- 6.3.17 Motiva USA LLC

- 6.3.18 Tissue Regenix Group plc

- 6.3.19 Decomedical S.r.l.

- 6.3.20 Implantech Associates

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment