PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842684

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842684

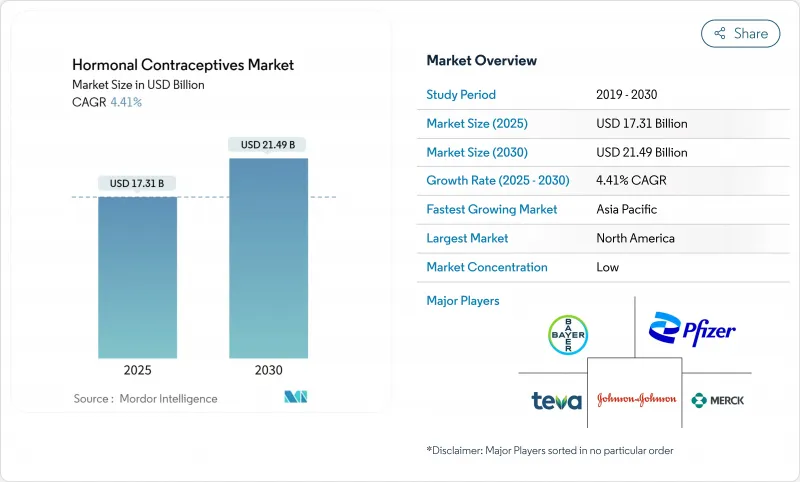

Hormonal Contraceptives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The hormonal contraceptive market is valued at USD 17.31 billion in 2025 and is forecast to reach USD 21.49 billion by 2030, advancing at a 4.41% CAGR.

Expansion is propelled by telehealth-enabled prescription services, the first U.S. OTC daily pill approval, and rising demand for long-acting methods. Online pharmacies already outpace every other channel, expanding at an 8.65% CAGR, while hospital pharmacies still hold the largest 40.1% revenue share. North America commands 41.17% of global revenue thanks to favorable reimbursement frameworks, whereas Asia's 5.10% CAGR underscores significant headroom as urban consumers pivot to long-acting reversible contraceptives (LARCs). Competitive intensity remains moderate; incumbents such as Bayer AG defend share through lifecycle extensions, while newer entrants differentiate on eco-friendly technologies. Throughout 2025, sustainability, digital accessibility, and safety-driven reformulations remain the clearest opportunity lanes for the hormonal contraceptive market.

Global Hormonal Contraceptives Market Trends and Insights

Advancements in Products

Lower-dose formulations aimed at minimizing side effects are redefining product expectations. The drospirenone 3 mg/estetrol 14.2 mg pill-the first combination to feature a novel estrogen in six decades-shows negligible impact on coagulation while preserving cycle control. As brands refocus on active-ingredient profiles, they deliver a differentiated safety narrative attractive to risk-averse users.

High Incidence of Unintended Pregnancies and Supportive Government Policies

Roughly 40% of global pregnancies are unintended, driving public funding for family-planning programs. In the United States, 21 million women received publicly supported contraceptive services in 2025 at a cost of USD 2.1 billion; every dollar spent saves USD 4.26 in healthcare outlays. Federal rules mandating no-cost coverage of FDA-approved methods strengthen baseline demand.

Rising Social Media Backlash on Hormone-Related Side-Effects

Nearly 1 in 5 contraceptive-related social posts discuss adverse events, amplifying discontinuation risk. Influencers with large followings can turn isolated incidents into global talking points within hours, prompting regulators to revisit safety language sooner than planned and compelling brands to invest more in real-time reputation monitoring.

Other drivers and restraints analyzed in the detailed report include:

- Telehealth-Enabled Prescription Fulfillment

- Rising OTC Approval of Oral Contraceptive Pills

- Supply Bottlenecks in Key APIs such as Levonorgestrel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oral pills retained a 43.45% share in 2024, powered by decades of clinical familiarity. OTC status for Opill widens consumer reach and could lift the hormonal contraceptive market share for pills in 2025. Implants, though accounting for a smaller revenue base, grow quickest at 7.55% CAGR on superior compliance. Twirla, a low-dose estrogen patch for users with BMI < 30 kg/m2, revitalizes interest in transdermal delivery.Hormonal IUDs such as Mirena now benefit from FDA-approved use up to eight years, deepening value propositions.

Second-generation vaginal rings, lower-dose injectables, and emergency pills maintain niche relevance by addressing diverse user needs. Collectively, these modalities reinforce method mix depth that sustains the hormonal contraceptive market.

Combined estrogen-progestin products represented 61.23% of 2024 revenue. However, cardiovascular risk dialogues encourage pivot toward progestin-only choices, expected to outpace at 6.65% CAGR. The drospirenone/estetrol pill shows the combined category can still evolve with minimal coagulation effect. Meanwhile, the OTC approval of a progestin-only pill repositions that sub-segment as the safer everyday option, underpinning incremental hormonal contraceptive market size gains.

Hormonal Contraceptives Market Report is Segmented by Product (Hormonal Implants, Vaginal Rings and More), Hormone (Combined and Progestin Only), Usage Duration (SARCs and LARCs), Distribution Channel (Hospital Pharmacies, Retail Pharmacies and More), End-User (Home Use, Community Health Centers and More), Age Group (15 - 24 Years, 25 - 34 Years and More) and Geography. The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.45% of 2024 revenue. The FDA's OTC pill decision and insurance mandates bolster usage. Political uncertainty around Title X funding could temper clinic reach, yet digital fulfillment offsets potential setbacks.

Asia-Pacific, posting a 6.23% CAGR, captures latent demand in urban India, Indonesia, and China. Contraceptive disparities between metropolitan and rural counties highlight infrastructure needs; targeted public programs aim to close gaps, enlarging the hormonal contraceptive market size across the region.

Europe maintains stable uptake under universal coverage, yet stricter antitrust scrutiny challenges pricing flexibility. Latin America benefits from public initiatives, but affordability issues and cultural norms restrain rapid acceleration. The Middle East and Africa display uneven penetration; South Africa and Nigeria emerge as focus markets, aided by donor-supported supply chains. Oceania contributes steady volumes but small absolute value due to the population scale.

- Bayer

- Pfizer

- Teva Pharmaceutical Industries

- Johnson & Johnson

- AbbVie Inc. (incl. Allergan)

- Agile Therapeutics

- TherapeuticsMD

- Organon

- Perrigo Company plc (HRA Pharma)

- Viatris (Mylan)

- The Cooper Companies

- Gedeon Richter Plc

- Afaxys Inc.

- Cipla

- Lupin

- Glenmark Pharmaceuticals

- Amneal Pharmaecuticals

- Sun Pharmaceuticals Industries

- Sandoz Group

- Exeltis USA

- Shanghai Dahua Pharmaceutical Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advancements in Products

- 4.2.2 High Incidence of Unintended Pregnancies and Supportive Government Policies

- 4.2.3 Telehealth-Enabled Prescription Fulfilment

- 4.2.4 Rising OTC Approval of Oral Contraceptive Pills

- 4.2.5 Shift Toward Eco-Friendly, Biodegradable Patch Materials

- 4.2.6 Awareness for Family Planning and Delayed Pregnancy Trend

- 4.3 Market Restraints

- 4.3.1 Rising Social Media Backlash on Hormone-Related Side-Effects

- 4.3.2 Supply Bottlenecks in Key APIs such as Levonorgestrel

- 4.3.3 Price Caps on Essential Drugs Limiting Profit Pools

- 4.3.4 Availability of Alternatives

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Product

- 5.1.1 Oral Contraceptives

- 5.1.2 Transdermal Skin Patches

- 5.1.3 Hormonal Injectables

- 5.1.4 Vaginal Rings

- 5.1.5 Intrauterine Devices (Hormonal)

- 5.1.6 Hormonal Implants

- 5.1.7 Emergency Pills

- 5.1.8 Others

- 5.2 By Hormone

- 5.2.1 Combined (Estrogen + Progestin)

- 5.2.2 Progestin-Only

- 5.3 By Usage Duration

- 5.3.1 Short-Acting Reversible Contraceptives (SARCs)

- 5.3.2 Long-Acting Reversible Contraceptives (LARCs)

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies & E-commerce

- 5.4.4 NGOs and Public Health Clinics

- 5.5 By End User

- 5.5.1 Hospitals and Gynecology Clinics

- 5.5.2 Household / At-home Use

- 5.5.3 Community Health Centers

- 5.6 By Age Group

- 5.6.1 15- 24 Years

- 5.6.2 25 -34 Years

- 5.6.3 35- 44 Years

- 5.6.4 Above 44 Years

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bayer AG

- 6.4.2 Pfizer Inc.

- 6.4.3 Teva Pharmaceutical Industries Ltd.

- 6.4.4 Johnson & Johnson Services, Inc.

- 6.4.5 AbbVie Inc. (incl. Allergan)

- 6.4.6 Agile Therapeutics

- 6.4.7 TherapeuticsMD Inc.

- 6.4.8 Organon & Co.

- 6.4.9 Perrigo Company plc (HRA Pharma)

- 6.4.10 Viatris (Mylan)

- 6.4.11 CooperSurgical Inc.

- 6.4.12 Gedeon Richter Plc

- 6.4.13 Afaxys Inc.

- 6.4.14 Cipla Limited

- 6.4.15 Lupin Limited

- 6.4.16 Glenmark Pharmaceuticals Ltd.

- 6.4.17 Amneal Pharmaecuticals

- 6.4.18 Sun Pharmaceutical Industries Ltd.

- 6.4.19 Sandoz

- 6.4.20 Exeltis USA Inc.

- 6.4.21 Shanghai Dahua Pharmaceutical Co. Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment