PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842687

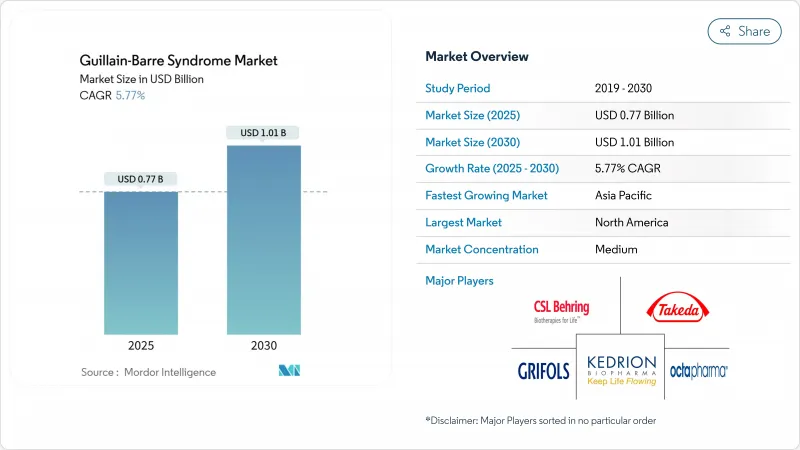

Guillain-Barre Syndrome - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Guillain-Barre Syndrome market stood at USD 767 million in 2025 and is forecast to advance to USD 1.01 billion by 2030, translating into a 5.77% CAGR.

Demand is pivoting from traditional immunomodulators toward precision-targeted biologics, influenced by complement inhibitor breakthroughs, Medicare-backed home infusion coverage, and post-COVID neurological complications that have widened patient pools. IVIG still leads today, yet rising biologic adoption signals an inflection in clinical practice toward disease-specific inhibition strategies. Capacity expansions at fractionation plants, especially in Asia-Pacific, are easing supply bottlenecks while sharpening regional competition. Even so, Europe's continued reliance on US plasma donors underscores structural fragility that may temper global growth despite rising clinical need.

Global Guillain-Barre Syndrome Market Trends and Insights

Rising Global Prevalence of GBS & Ageing Population

Global demographic shifts are reshaping the Guillain-Barre Syndrome market as geriatric patients (>=65 years) represent the fastest-growing group at 8.83% CAGR through 2030. NIH has earmarked USD 3 million to pinpoint genetic susceptibility markers that may refine personalized protocols. Years lived with disability for GBS almost doubled from 2020 to 2021, showing the pandemic's amplifying effect on disease burden. WHO's surveillance in Pune continues to confirm elevated case counts in low-to-middle-income regions, emphasizing the need for tailored immunotherapy pathways.

Sustained Capacity Additions by Plasma Fractionators Are Boosting IVIG Supply

Plasma fractionators are expanding to alleviate chronic IVIG shortages. CSL posted 15% immunoglobulin sales growth, reflecting robust uptake despite historical supply gaps. Indonesia's 600,000-liter fractionation plant marks Southeast Asia's largest build-out and trims regional dependence on imports. Kedrion's FDA-cleared facility underscores quality gains that help stabilize therapeutic protein yields. Yet Europe's need for 2 million more plasma donors shows that structural shortages persist.

Chronic IVIG Shortages & High Therapy Cost

A full IVIG course costs USD 5,000-10,000, imposing heavy budget pressure, especially when supply disruptions arise from quality-related lot withdrawals. Qatar's 10-year audit logged USD 10 million spent on just 669 patients, highlighting economic burdens in emerging systems.

Other drivers and restraints analyzed in the detailed report include:

- Faster Regulatory Pathways Boosting Novel Biologics

- Adverse-Event & Thrombo-Embolism Concerns Limiting Repeat-Dose IVIG

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Intravenous immunoglobulin led the Guillain-Barre Syndrome market with a 72.32% share in 2024, yet complement-inhibitors and other novel biologics are growing at 9.46% CAGR through 2030. The Guillain-Barre Syndrome market size for these targeted biologics is projected to surpass USD 310 million by 2030 as positive Phase 3 data from ANX005 show 2.4-fold functional improvements over placebo. Efgartigimod has delivered compelling results in refractory AMAN cases, confirming the shift toward mechanism-specific intervention.

Traditional plasma exchange remains vital in cost-constrained settings, and its share of the Guillain-Barre Syndrome market is steady where donor plasma availability aligns with treatment protocols. Adjunct supportive care-such as physiotherapy and ventilatory support-continues to integrate with precision dosing analytics to ensure optimal biological exposure. Collectively, these trends illustrate how the Guillain-Barre Syndrome market is transitioning from broad immunomodulation to targeted pathway inhibition.

The intravenous route accounted for 79.21% of the Guillain-Barre Syndrome market in 2024, supported by hospital infrastructure and clinician familiarity. Subcutaneous immunoglobulin, however, is the fastest-growing at 7.78% CAGR, propelled by biweekly dosing regimens under the expanded XEMBIFY label. Manual push Ig20Gly simplifies self-administration and reduces pump costs, broadening adoption among stable patients.

Home-based care is reshaping therapeutic logistics and driving payer alignment with value-based models. Precision dosing further supports subcutaneous uptake by minimizing wastage. The Guillain-Barre Syndrome market size for subcutaneous modalities is forecast to grow steadily as new formulations reach regulatory approval.

Guillain-Barr Syndrome Market Report is Segmented by Therapeutics (Intravenous Immunoglobulin, Plasma Exchange, and More), Route of Administration (Intravenous, Subcutaneous and More), Distribution Channel (Hospital Pharmacies and More), Patient Age Group (Pediatric, Adults and More), Disease Variant (Acute Inflammatory Demyelinating, AMAN and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the Guillain-Barre Syndrome market with a 44.65% share in 2024, supported by Medicare reimbursement for home infusion and ubiquitous access to precision analytics platforms. Granular electronic health records facilitate earlier diagnosis and outcome tracking, reinforcing payer confidence in high-cost biologics. Research consortia, such as those spearheaded by NIH, continue to draw funding into breakout discovery programs that amplify innovation spill-overs across the region.

Europe trails at second but confronts supply fragility, importing roughly 40% of its plasma-derived medicines from the United States. Regulatory agencies are encouraging domestic donor recruitment, yet demographic aging complicates collection targets. Despite advanced healthcare infrastructure, uncertain reimbursement for newer biologics could temper growth.

Asia-Pacific is the fastest-expanding at 8.58% CAGR, powered by large investments in local fractionation capacity such as Indonesia's new 600,000-liter plant. Rising urbanization and improved surveillance reveal a larger underlying patient pool. China's heterogeneous incidence profiles emphasize the need for regionally tailored product portfolios.

Latin America, the Middle East, and Africa follow with niche opportunities. Small-volume plasmapheresis protocols and mobile infusion units reduce infrastructure barriers, offering cost-effective alternatives in resource-limited settings. Collectively, these regions underscore the Guillain-Barre Syndrome market's drive toward localized manufacturing and distribution resilience.

- CSL Behring

- Takeda Pharmaceuticals

- Grifols

- Octapharma

- Kedrion Biopharma

- Baxter

- Biotest

- China Biologic Products Holdings

- Bio Products Laboratory (BPL)

- Sanquin Plasma Products

- Annexon Biosciences

- Argenx SE

- Hansa Biopharma

- Haemonetics Corp.

- Fresenius

- Terumo

- Octapharma Plasma (US)

- Cellenkos Inc.

- ImmunoForge Inc.

- Sobi (Swedish Orphan Biovitrum)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Prevalence Of GBS & Ageing Population

- 4.2.2 Sustained Capacity Additions By Plasma-Fractionators Are Boosting Intravenous Immunoglobulin (IVIG) Supply

- 4.2.3 Faster Regulatory Pathways (E.G., US FDA Fast-Track, Breakthrough) Boosting Novel Biologics

- 4.2.4 Growing IVIG/PLEX Capacity Expansions By Plasma-Fractionators

- 4.2.5 COVID-19-Linked Spike In Post-Infectious GBS Incidence

- 4.2.6 Precision-Dosing Analytics Reducing Wastage & Enabling Payor Uptake

- 4.3 Market Restraints

- 4.3.1 Chronic IVIG Shortages & High Therapy Cost

- 4.3.2 Adverse-Event & Thrombo-Embolism Concerns Limiting Repeat-Dose IVIG

- 4.3.3 Tighter Reimbursement Audits On Off-Label IVIG In LMICs

- 4.3.4 Evidence Of Higher Relapse Risk And Cost-Effectiveness Concerns For Plasma Exchange

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Therapeutics

- 5.1.1 Intravenous Immunoglobulin (IVIG)

- 5.1.2 Plasma Exchange (PLEX)

- 5.1.3 Complement-inhibitors & Novel Biologics

- 5.1.4 Other Adjunct / Supportive Care

- 5.2 By Route of Administration

- 5.2.1 Intravenous

- 5.2.2 Sub-cutaneous

- 5.2.3 Oral / Enteral

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Specialty & Retail Pharmacies

- 5.3.3 Home-Infusion Providers

- 5.4 By Patient Age Group

- 5.4.1 Pediatric (<18 yrs)

- 5.4.2 Adult (18 - 64 yrs)

- 5.4.3 Geriatric (>=65 yrs)

- 5.5 By Disease Variant

- 5.5.1 AIDP (Acute Inflammatory Demyelinating)

- 5.5.2 AMAN (Acute Motor Axonal)

- 5.5.3 AMSAN (Acute Motor-Sensory Axonal)

- 5.5.4 Miller-Fisher Syndrome

- 5.5.5 Other rare variants (PCB, PNC, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 CSL Ltd.

- 6.3.2 Takeda Pharmaceutical

- 6.3.3 Grifols S.A.

- 6.3.4 Octapharma AG

- 6.3.5 Kedrion Biopharma

- 6.3.6 Baxter International

- 6.3.7 Biotest AG

- 6.3.8 China Biologic Products Holdings

- 6.3.9 Bio Products Laboratory (BPL)

- 6.3.10 Sanquin Plasma Products

- 6.3.11 Annexon Biosciences

- 6.3.12 Argenx SE

- 6.3.13 Hansa Biopharma

- 6.3.14 Haemonetics Corp.

- 6.3.15 Fresenius Medical Care

- 6.3.16 Terumo BCT

- 6.3.17 Octapharma Plasma (US)

- 6.3.18 Cellenkos Inc.

- 6.3.19 ImmunoForge Inc.

- 6.3.20 Sobi (Swedish Orphan Biovitrum)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment