PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842688

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842688

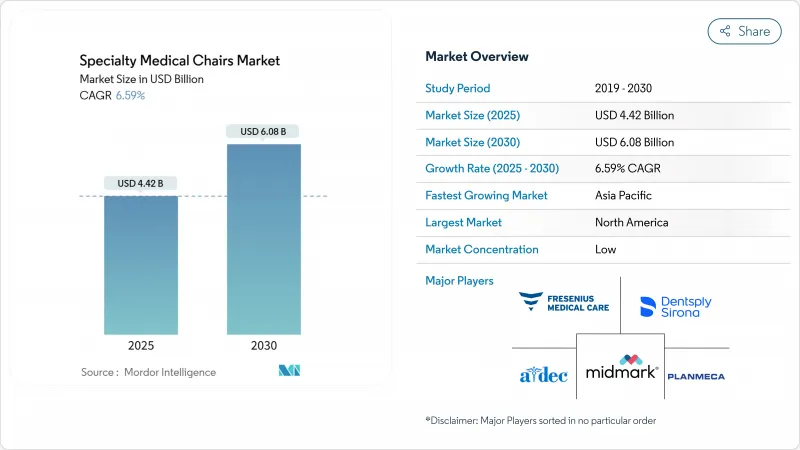

Specialty Medical Chairs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The specialty medical chairs market stood at USD 4.42 billion in 2025 and is on track to reach USD 6.08 billion by 2030, advancing at a 6.59% CAGR.

This momentum reflects the collision of population aging, multimorbidity, and the shift of complex procedures into outpatient and home settings, all of which raise demand for ergonomic, technology-rich seating. Providers are gravitating toward fully-electric, IoT-enabled models that optimize throughput while complying with stricter pressure-injury prevention protocols. Capital budgets are gradually loosening after pandemic-era freezes, yet replacement decisions remain tightly linked to demonstrable ROI, regulatory mandates, and cybersecurity readiness. At the same time, the specialty medical chairs market faces cost headwinds from European MDR rules and fire-safety standards that add 12-15% to upholstery costs, reinforcing the advantage of scale for established manufacturers.

Global Specialty Medical Chairs Market Trends and Insights

Aging & Multimorbidity Burden Accelerates Demand for Dialysis, Chemo & Bariatric Chairs

People aged 85+ use triple the healthcare resources of the 65-74 cohort, and the U.S. centenarian population is projected to quadruple by 2054. This demographic surge pushes dialysis, oncology, and bariatric departments to install chairs engineered for lengthy therapies, higher weight limits, and precision positioning. Medicare-certified ASCs continue to expand capacity to handle age-linked procedures, ensuring sustained pull for premium seating. Health systems also factor in total-cost-of-ownership savings from designs that cut turnover time, lower caregiver strain, and integrate infection-control finishes.

Technology Shift to Fully-Powered, IoT-Enabled Chairs Improves ROI for Providers

Connected chairs feed utilization and maintenance data directly to hospital asset-management platforms, allowing predictive servicing that trims downtime. In emergency departments, IoT integration helped Mt. Sinai cut wait times by 50%. Preset configurations reduce setup time between patients and support standardized care pathways, especially in ophthalmology and dental suites. As cyberattack risks escalate, fully-electric systems equipped with encrypted firmware and network partitioning become essential capital purchases.

Capital-Budget Freezes Post-COVID Reduce Replacement Cycles

Hospital operating margins compressed to 1-2% in 2024, forcing equipment lifecycles to stretch well past prior benchmarks. Although profit pools are forecast to rebound at 7% CAGR by 2027, decision-makers still green-light only purchases tied to either regulatory obligation or measurable throughput gains. Larger health systems secure financing more easily, widening the technology gap with stand-alone rural hospitals that may postpone chair upgrades into the next cycle.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory Pressure-Injury Prevention Protocols in OECD Hospitals

- Home-Based Kidney-Care Models Spur Residential Dialysis Recliners

- Fire-Retardancy & EU MDR Upholstery Compliance Adds 12-15% Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Treatment chairs set the innovation tempo, and the specialty medical chairs market size for this segment is projected to climb at 7.41% CAGR between 2025-2030. Revenue growth stems from dental, ENT, and ophthalmic clinics adopting models that combine imaging ports, AI-guided positioning, and antimicrobial upholstery. Examination chairs retained 38.67% market share in 2024, serving core specialties such as cardiology and dialysis. Their broad installed base anchors replacement demand, yet treatment chairs now spearhead premium margins.

Simulation studies show advanced dental-chair ergonomics can cut lower-back stress on clinicians by 42% while expanding the patient visual field, justifying premium list prices. Manufacturers also target birthing centers with designs that support lateral delivery positions and quick emergency conversion to operating mode. Portable blood-drawing chairs with 400-lb capacities keep penetrating community-based screening programs, reinforcing volume at the value end of the portfolio.

Rehabilitation chairs cater to geriatric and bariatric populations that require patient-lift integration, zero-entry seat heights, and reinforced frames. With global obesity crossing 1 billion adults in 2025, bariatric variants achieve double-digit sub-segment growth. Dialysis recliners benefit from home-therapy expansion, and some models now include Bluetooth-linked blood-pressure cuffs and automated armrest rotation to streamline needle access.

Global Specialty Medical Chairs Market is Segmented by Product Type (Examination Chairs[Cardiac Chairs, Birthing Chairs, and More], Treatment Chairs, and Rehabilitation Chairs), Technology (Manual, Semi-Electric, and Fully-Electric), End-User (Hospitals, Clinics & Dental Practices, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.23% of 2024 revenue, reflecting widespread ASC penetration, aggressive IoT adoption, and early reimbursement for home dialysis. U.S. providers benefit from ESKD Treatment Choices incentives and from VHA pressure-injury mandates that require advanced seating. Canada's provincial plans modernize dialysis units, and Mexican private hospital groups upgrade operatories to capture inbound medical tourism. Collectively, these factors keep capital budgets oriented toward high-end, fully-electric models and fuel recurring software-support contracts tied to connectivity.

Asia-Pacific is the quickest-expanding territory, registering a 7.34% CAGR through 2030. Governments in China, India, and Indonesia are funneling record sums into hospital construction and oncology-day-care centers, each demanding oncology recliners with IV-pole integration and weight-adaptive sensor mats. Australia's Icon Group leveraged cross-border joint ventures to seed chair demand in Malaysia, while Japan accelerates tele-rehabilitation programs that deploy hybrid therapy chairs to homes. Local sourcing strategies and technology-transfer pacts shorten delivery cycles, yet top-tier imports still command premium share in tertiary facilities.

Europe maintains solid, though slower, growth amid stringent MDR and fire-safety compliance. Germany, France, and the United Kingdom channel funds into pressure-injury prevention initiatives and oncology-day-care upgrades, sustaining uptake of smart recliners with microclimate management. Shortage of notified-body capacity extends certification timelines, discouraging smaller suppliers and nudging average unit prices upward. Post-Brexit, UK manufacturers juggle dual regulatory tracks, raising cost-to-serve but preserving market access.

- Dentsply Sirona

- A-dec

- Planmeca

- Midmark

- ATMOS MedizinTechnik

- G. Heinemann Medizintechnik

- DentalEZ

- Hill Laboratories Company

- Topcon Medical Systems Inc.

- Forest Dental

- Fresenius

- Champion Manufacturing Inc.

- Invacare

- Stryker

- Danaher Corporation (Kavo Dental)

- Hill-Rom

- Digiterm Ltd.

- Drive DeVilbiss Healthcare

- Likamed GmbH

- Accora Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging & Multimorbidity Burden Accelerates Demand for Dialysis, Chemo & Bariatric chairs

- 4.2.2 Technology Shift to Fully-powered, IoT-enabled Chairs Improves ROI for Providers

- 4.2.3 Mandatory Pressure-injury Prevention Protocols in OECD Hospitals

- 4.2.4 Home-based Kidney-care Models (ESKD Treatment Choices, US) Spur Residential Dialysis Recliners

- 4.2.5 Oncology-day-care Expansion in Tier-2 APAC Cities

- 4.2.6 Rising Dental & Ophthalmic Procedure Volumes Drive Specialty Chair Upgrades

- 4.3 Market Restraints

- 4.3.1 Capital-budget Freezes Post-COVID Reduce Replacement Cycles

- 4.3.2 Reimbursement Gaps for Examination Chairs Outside Hospitals

- 4.3.3 Fire-retardancy & MDR (EU) Upholstery Compliance Adds 12-15 % Cost

- 4.3.4 High Capital Cost of Specialty Chairs Limits Adoption by Small Practices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value - USD)

- 5.1 By Product Type

- 5.1.1 Examination Chairs

- 5.1.1.1 Cardiac Chairs

- 5.1.1.2 Birthing Chairs

- 5.1.1.3 Blood Drawing Chairs

- 5.1.1.4 Dialysis Chairs

- 5.1.1.5 Others

- 5.1.2 Treatment Chairs

- 5.1.2.1 ENT Chairs

- 5.1.2.2 Ophthalmic Chairs

- 5.1.2.3 Dental Chairs

- 5.1.2.4 Other Treatment Chairs

- 5.1.3 Rehabilitation Chairs

- 5.1.3.1 Geriatric Chairs

- 5.1.3.2 Pediatric Chairs

- 5.1.3.3 Bariatric Chairs

- 5.1.3.4 Others

- 5.1.1 Examination Chairs

- 5.2 By Technology

- 5.2.1 Manual

- 5.2.2 Semi-Electric / Hydraulic

- 5.2.3 Fully-Electric / Programmable

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Clinics & Dental Practices

- 5.3.3 Ambulatory Surgery Centers

- 5.3.4 Home-Care Settings & Long-Term Care

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Dentsply Sirona

- 6.3.2 A-dec Inc.

- 6.3.3 PLANMECA OY

- 6.3.4 Midmark Corporation

- 6.3.5 ATMOS MedizinTechnik GmbH & Co. KG

- 6.3.6 G. Heinemann Medizintechnik GmbH

- 6.3.7 DentalEZ

- 6.3.8 Hill Laboratories Company

- 6.3.9 Topcon Medical Systems Inc.

- 6.3.10 Forest Dental

- 6.3.11 Fresenius Medical Care AG & Co. KGaA

- 6.3.12 Champion Manufacturing Inc.

- 6.3.13 Invacare Corporation

- 6.3.14 Stryker Corporation

- 6.3.15 Danaher Corporation (Kavo Dental)

- 6.3.16 Hill-Rom Holdings Inc.

- 6.3.17 Digiterm Ltd.

- 6.3.18 Drive DeVilbiss Healthcare

- 6.3.19 Likamed GmbH

- 6.3.20 Accora Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment