PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842690

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842690

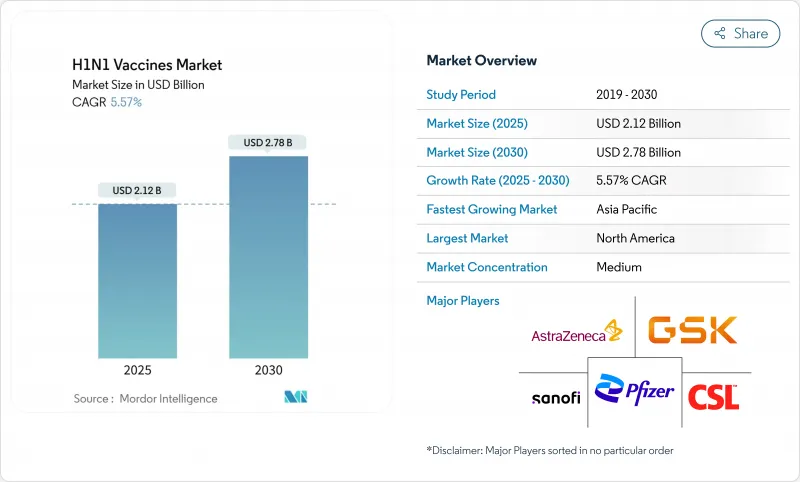

H1N1 Vaccines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The H1N1 vaccines market is valued at USD 2.12 billion in 2025 and is forecast to reach USD 2.78 billion by 2030, advancing at a 5.57% CAGR.

Demand remains resilient because recurring epidemic waves and waning immunity require annual reformulation, while advances in mRNA and recombinant platforms shorten development timelines and improve antigen matching. Government stockpiling mandates tied to expiry-driven replenishment cycles anchor predictable procurement, and investments exceeding USD 2 billion in domestic capacity strengthen surge readiness. Live attenuated and recombinant products are gaining momentum, yet inactivated, egg-based vaccines continue to dominate due to large installed manufacturing bases and well-established safety profiles. Regionally, North America leads on the back of BARDA funding and established distribution networks, while Asia-Pacific posts the fastest growth as manufacturing hubs expand and healthcare budgets rise.

Global H1N1 Vaccines Market Trends and Insights

Rising Epidemic H1N1 Infection Waves & Waning Immunity

Record hospitalizations during the 2024-2025 season, with influenza A H1N1 as the dominant strain, reaffirm the need for yearly vaccination to prevent healthcare system stress. Vaccine effectiveness slipped to 42% in 2023-2024, highlighting immunity decay that fuels consistent revaccination cycles. Zoonotic spill-over events, such as Vietnam's swine-origin H1N1 case in August 2024, keep pandemic preparedness on policy agendas . Variant detections in Brazil and Spain underscore the importance of global surveillance and rapid strain updates. These recurring threats stabilize revenue streams and incentivize platform investments that cut adaptation time.

Rapid Advances in Vaccine Platform Technologies

mRNA, recombinant, and cell-based systems now challenge egg-based dominance. Moderna's mRNA-1083 Phase 3 data showed stronger immune responses than licensed comparators while enabling refrigerator storage. The U.S. government's USD 176 million grant for Moderna's pandemic influenza program demonstrates institutional commitment to next-generation platforms. Cell-based production from CSL Seqirus improved effectiveness across age bands and avoided egg-adaptation drift . Recombinant approaches shorten lead times and bypass poultry supply vulnerabilities accentuated by recent H5N1 outbreaks. Early adopters gain agility advantages, prompting legacy players to upgrade or risk erosion.

High Vaccine Cost & Reimbursement Gaps

Adult coverage in India remains only 1.5% despite 21% 2025 growth, showing affordability barriers in emerging economies. The U.S. Medicare 2025 final rule sets a USD 33.71 fee for administration in rural clinics, reflecting ongoing policy work to close payment gaps. Economic models in 88% of LMIC scenarios find vaccination cost-effective, yet budget constraints delay adoption. Private-sector uptake is rising at 6.39% CAGR as employers promote onsite clinics, but premium-priced combination vaccines still struggle for reimbursement. Access challenges slow penetration despite strong clinical value propositions.

Other drivers and restraints analyzed in the detailed report include:

- Government Stockpiling Mandates & Expiry-Driven Replenishment Cycles

- Expansion of Contract Fill-Finish Capacity for Surge Production

- Lengthy, Complex Manufacturing Processes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inactivated vaccines accounted for 86.12% of the H1N1 vaccines market in 2024, confirming their entrenched role in mass programs built on decades of safety data. Live attenuated formulations, however, post the fastest 6.23% CAGR to 2030 as intranasal delivery and strong mucosal immunity enhance uptake. The Serum Institute's Nasovac(R) deployment to more than 2.5 million individuals during the 2009 pandemic validated large-scale live attenuated use. Regulatory alignment with the 2024-2025 move to trivalent compositions affects both product classes equally, pushing manufacturers to refine strain selection without B/Yamagata. Pediatric and needle-phobic adult populations increasingly favor intranasal formats, boosting segment momentum.

Live attenuated manufacturers differentiate by emphasizing convenience and reduced staffing needs, advantageous in low-resource contexts. Post-marketing data confirm favorable safety profiles, encouraging expansion into larger age brackets. Despite regulatory vigilance on reversion risks, the segment's agility in updating antigens positions it for share gains when rapid response is critical. Consequently, market entrants focusing on intranasal platforms may capture incremental volumes even as inactivated products remain the backbone of seasonal campaigns.

Egg-based production held 75.23% of the H1N1 vaccines market share in 2024, but recombinant platforms are advancing at a 6.21% CAGR through 2030 amid mounting supply-chain and antigenic drift concerns. Recombinant systems avoid egg adaptation, enabling closer antigen fidelity and quicker scale-up. The University at Buffalo's nanoliposome hexaplex candidate illustrates superior H1N1 protection over current recombinant comparators. Cell-based technologies occupy a middle ground, offering improved effectiveness yet retaining existing regulatory precedents, easing adoption for large producers.

Investment programs from WHO and Gavi are guiding technology transfer to emerging markets, narrowing capacity gaps that threaten equitable pandemic access. Leading recombinant manufacturers leverage flexible single-use bioreactors, contributing to faster changeover between seasons. As evidence grows on improved immunogenicity, payer willingness to reimburse at modest premiums supports a gradual share shift toward recombinant and cell-based candidates.

The H1N1 Vaccines Market is Segmented by Product Type (Inactivated Vaccine and Live Attenuated Vaccine), Technology (Egg-Based, Cell-Based, and More), Route of Administration (Intradermal, and More), Age Group (Pediatric, Adult, and Geriatric), Distribution Channel (Public and Private) and Geography (North America, Europe, Asia-Pacific, and More). The Market and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the H1N1 vaccines market with a 40.44% share in 2024. The region benefits from BARDA contracts exceeding USD 2 billion that support capacity expansion, including CSL Seqirus's Holly Springs plant capable of producing 150 million doses within six months. FDA fast-track designations for combination vaccines accelerate approvals, and recent USD 176 million federal funding for Moderna's mRNA program signals sustained commitment to technological leadership. Nevertheless, declining uptake among seniors and children challenges public health targets, prompting renewed educational campaigns.

Asia-Pacific is the fastest-growing region at a 6.54% CAGR, propelled by local manufacturing investments and heightened urban health awareness. India's 2025 influenza market expanded 21%, though only 1.5% of adults aged 45+ were vaccinated, indicating vast latent potential. The Serum Institute can scale output from 300,000 to beyond 1 million doses, showcasing regional production scalability. China is gradually recognizing foreign clinical data to expedite approvals, while South Korea's active surveillance demonstrates regulatory maturity.

Europe represents a mature but innovative market. EMA guidance released in January 2025 streamlines updated strain approvals, cutting administrative lead times. The UK's purchase of 5 million pandemic doses underscores ongoing preparedness, and EU cohesion funds back cross-border capacity investments. While growth is slower than in emerging regions, demand for combination and high-dose products sustains revenue.

- Sanofi

- GlaxoSmithKline

- CSL Ltd (Seqirus)

- AstraZeneca

- Pfizer

- Abbott Laboratories

- Novavax

- Moderna

- Serum Institute of India

- Bharat Biotech

- Emergent Bio Solutions

- CPL Biologicals Pvt Ltd

- Mitsubishi Tanabe Pharma

- Sinovac Biotech

- Zydus Lifesciences

- Zhejiang Tianyuan Bio-Pharmaceutical

- Hualan Biological Engineering

- Valneva

- SK Bioscience Co.

- Daiichi Sankyo Co.

- BioDiem Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Epidemic H1N1 Infection Waves & Waning Immunity

- 4.2.2 Rapid Advances in Vaccine Platform Technologies

- 4.2.3 Government Stockpiling Mandates & Expiry-Driven Replenishment Cycles

- 4.2.4 Expansion of Contract Fill-Finish Capacity for Surge Production

- 4.2.5 Adoption of Needle-Free Micro-Array Patch Delivery in LMICs

- 4.2.6 Development of Influenza-SARS-Cov-2 Combo Vaccines Boosting Volumes

- 4.3 Market Restraints

- 4.3.1 High Vaccine Cost & Reimbursement Gaps

- 4.3.2 Lengthy, Complex Manufacturing Processes

- 4.3.3 Social-Media-Driven Antivaccine Sentiment Targeting Flu Shots

- 4.3.4 Supply-Chain Fragility for Eggs & Cell-Culture Media During Avian Outbreaks

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Inactivated Vaccine

- 5.1.2 Live Attenuated Vaccine

- 5.2 By Technology

- 5.2.1 Egg-based

- 5.2.2 Cell-based

- 5.2.3 Recombinant

- 5.3 By Route of Administration

- 5.3.1 Intradermal

- 5.3.2 Intramuscular

- 5.3.3 Intranasal

- 5.4 By Age Group

- 5.4.1 Pediatric

- 5.4.2 Adult

- 5.4.3 Geriatric

- 5.5 By Distribution Channel

- 5.5.1 Public

- 5.5.2 Private

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Sanofi

- 6.3.2 GlaxoSmithKline plc

- 6.3.3 CSL Ltd (Seqirus)

- 6.3.4 AstraZeneca

- 6.3.5 Pfizer Inc.

- 6.3.6 Abbott Laboratories

- 6.3.7 Novavax Inc.

- 6.3.8 Moderna Inc.

- 6.3.9 Serum Institute of India

- 6.3.10 Bharat Biotech

- 6.3.11 Emergent BioSolutions

- 6.3.12 CPL Biologicals Pvt Ltd

- 6.3.13 Mitsubishi Tanabe Pharma

- 6.3.14 Sinovac Biotech Ltd.

- 6.3.15 Zydus Lifesciences

- 6.3.16 Zhejiang Tianyuan Bio-Pharmaceutical

- 6.3.17 Hualan Biological Engineering

- 6.3.18 Valneva SE

- 6.3.19 SK Bioscience Co.

- 6.3.20 Daiichi Sankyo Co.

- 6.3.21 BioDiem Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment