PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842691

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842691

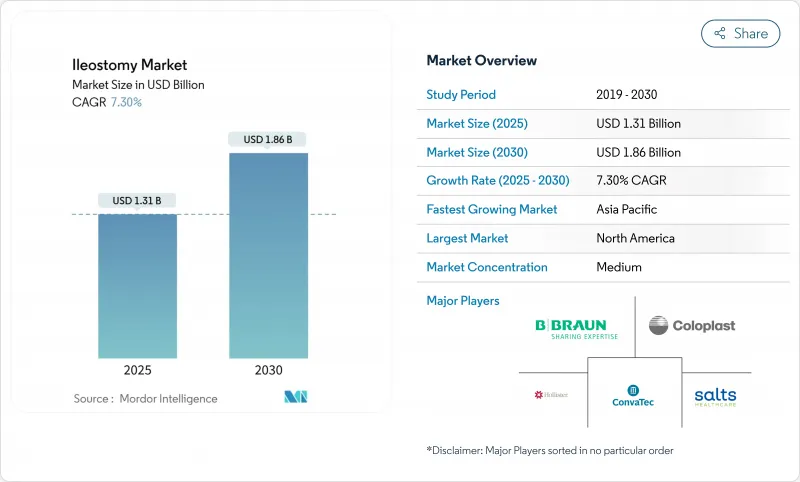

Ileostomy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ileostomy market stood at USD 1.31 billion in 2025 and is predicted to reach USD 1.86 billion by 2030, advancing at a 7.30% CAGR.

The expansion stems from three converging forces: an ageing population with higher inflammatory bowel disease (IBD) incidence, steady colorectal-cancer surgery volumes, and rapid product innovation in two-piece drainable systems. North America remains the largest regional contributor, while Asia-Pacific registers the quickest uptake thanks to hospital-capacity upgrades and growing life expectancy. Procedure patterns are also evolving; surgeons now favour temporary loop ileostomies for bowel preservation, yet permanent end procedures still dominate volumes. Competitive intensity is moderate as leading firms differentiate through digital leakage alerts, mouldable skin barriers, and service-backed care ecosystems.

Global Ileostomy Market Trends and Insights

Rising Prevalence of IBD

Age-standardized IBD incidence climbed from 4.22 to 4.45 per 100,000 between 1990 and 2022. Elderly cohorts show the sharpest rise, with women aged 60-89 exhibiting the greatest case growth. Newly industrialised nations in Asia, Africa, and Latin America are entering an acceleration phase, signalling sustained global demand for advanced stoma solutions. As medical therapy fails for complex cases, permanent or temporary ileostomies become essential, boosting premium product uptake that preserves peristomal skin integrity while accommodating multiple comorbidities.

Growing Colorectal-Cancer Surgical Incidence

Colorectal cancer constitutes 38.5% of the lifetime risk for gastrointestinal tumours worldwide . Early-onset cases are advancing fastest, compelling surgeons to perform protective diverting ileostomies in younger, active patients who prioritise discreet appliances. Colon cancer rates among Asian Americans rose from 155 to 755 per 100,000 between 2017 and 2022, underscoring the shift toward high-quality, lifestyle-compatible systems. Demand centres on devices that simplify short-term use and safeguard skin for planned reversals.

Shift Toward Minimally-Invasive Bowel-Sparing Procedures

Robotic colorectal surgeries now report fewer complications and shorter stays versus open approaches. US data show robotic use rising in stoma reversals, indicating surgeon preference for direct anastomosis when technology reduces risk. Professional guidelines confirm laparoscopic and robotic methods lessen pain and length of stay while maintaining oncologic safety. As proficiency spreads, fewer patients require protective ileostomies, tempering demand in advanced health systems.

Other drivers and restraints analyzed in the detailed report include:

- Ageing Population & Chronic Disease Burden

- Advances in Two-Piece Drainable Bags

- Cost & Reimbursement Gaps in Developing Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

End ileostomy accounted for 62.54% of 2024 revenue, anchoring the ileostomy market with long-term users whose appliance lifespan can exceed a decade. Post-operative complexity and higher stoma output push hospitals to select durable two-piece barriers with reinforced hydrocolloid bases. The competing loop segment, though smaller, posts a 7.81% CAGR as surgeons increasingly construct temporary diversions for low-anterior resections. Quality-improvement projects prove that timely reversal trims 30-day readmissions from 20.10% to 8.75%. Manufacturers therefore design lightweight, skin-gentle systems that simplify changes during the short active period.

The loop surge expands the ileostomy market by recruiting younger patients who value ease of removal before re-anastomosis. Educational apps guide them through emptying schedules, output tracking, and early warning signs. Combined with nurse-led tele-follow-ups, these tools cut emergency visits and reinforce brand loyalty. Consequently, procedure-specific kits with pre-cut sizing and colour-coded panels are gaining traction among colorectal centres.

Stoma bags represented 76.31% of 2024 revenue, confirming their central role in the ileostomy market. High demand persists for drainable pouches with integrated filter membranes that mitigate ballooning and odour. Yet accessories and others segment races ahead at 8.12% CAGR, propelled by barrier wipes, adjustable belts, and deodorising gels. Clinicians now deploy malodour-reducing additives that lower odour intensity scores and enhance social confidence.

Risk-stratified protocols limit peristomal skin complications to 6.2% by 90 days when advanced barrier rings and convex cushions are combined with structured teaching. This evidence encourages suppliers to bundle pouches with accessory starter packs, embedding long-term usage habits and elevating average selling price. The growing accessory mix further diversifies revenue streams within the ileostomy market.

The Market is Segmented by Procedure Type (End Ileostomy, Loop Ileostomy), by Equipment Type, by Disease Type, and by Geography.

Geography Analysis

North America generated 43.28% of 2024 revenue, cementing its leadership through specialist nursing density, widespread insurance coverage, and rapid adoption of digital leakage monitors. FDA alignment with ISO 13485 in 2025 ensures smoother premarket submissions, fostering swift technological upgrades. Despite laparoscopic uptake tempering new stoma creation, premium upselling offsets volume softness, keeping the ileostomy market size resilient.

Asia-Pacific remains the quickest climber with an 8.84% CAGR to 2030. Urban hospitals in China and India now stock convex-fit barriers and adjustable belts, reflecting higher disposable incomes. China's health-spend trajectory towards USD 33.4 trillion by 2060 reinforces structural demand for chronic-care devices. Emerging reimbursement pilots in Thailand and Indonesia further unlock access, although rural distribution gaps persist.

Europe presents a mature yet innovation-minded landscape. The EU Packaging and Packaging Waste Regulation forces all medical packaging to be recyclable by 2030. Producers have responded with thinner, mono-material pouches that sustain barrier properties while cutting plastic weight. Simultaneously, single-use-device reprocessing rules guide safe recycling of support belts and closure clips. These regulatory nudges drive sustainable product redesign within the ileostomy market.

- Coloplast

- Convatec

- Hollister

- B. Braun

- 3M

- Salts Healthcare

- Flexicare Medical

- Marlen Manufacturing

- Smiths Group

- Welland Medical

- Nu-Hope Laboratories Inc.

- Cymed Micro Skin

- Alcare

- Medline Industries

- Torbot Group

- Trio Healthcare

- Safe N Simple LLC

- Fittleworth Medical Ltd

- SecuriCare (Medical) Ltd

- Stomocare International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of inflammatory bowel disease (IBD)

- 4.2.2 Growing colorectal-cancer surgical incidence

- 4.2.3 Ageing population & chronic disease burden

- 4.2.4 Advances in two-piece drainable bags

- 4.2.5 Emergence of digital stoma-monitoring wearables

- 4.2.6 Adoption of 3-D printed custom-fit skin barriers

- 4.3 Market Restraints

- 4.3.1 Shift toward minimally-invasive bowel-sparing procedures

- 4.3.2 Cost & reimbursement gaps in developing economies

- 4.3.3 Supply-chain vulnerability of hydrocolloid adhesives

- 4.3.4 Waste-disposal regulations for single-use ostomy products

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Procedure Type

- 5.1.1 End Ileostomy

- 5.1.2 Loop Ileostomy

- 5.2 By Equipment Type

- 5.2.1 Stoma Bags

- 5.2.2 Belts & Girdles

- 5.2.3 Accessories & Others

- 5.3 By Disease Type

- 5.3.1 Cancer

- 5.3.2 Crohn's Disease

- 5.3.3 Ulcerative Colitis

- 5.3.4 Other Indications

- 5.4 By System Type

- 5.4.1 One-Piece Systems

- 5.4.2 Two-Piece Systems

- 5.5 By Usability

- 5.5.1 Drainable Bags

- 5.5.2 Closed-End Bags

- 5.6 By End User

- 5.6.1 Hospitals

- 5.6.2 Home-care Settings

- 5.6.3 Ambulatory Surgical Centers

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 South Korea

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East & Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East & Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Coloplast A/S

- 6.3.2 ConvaTec Group Plc

- 6.3.3 Hollister Incorporated

- 6.3.4 B. Braun Melsungen AG

- 6.3.5 3M Healthcare

- 6.3.6 Salts Healthcare Ltd

- 6.3.7 Flexicare Medical Ltd

- 6.3.8 Marlen Manufacturing & Development

- 6.3.9 Smith & Nephew Plc

- 6.3.10 Welland Medical Ltd

- 6.3.11 Nu-Hope Laboratories Inc.

- 6.3.12 Cymed Micro Skin

- 6.3.13 ALCARE Co., Ltd.

- 6.3.14 Medline Industries LP

- 6.3.15 Torbot Group Inc.

- 6.3.16 Trio Healthcare

- 6.3.17 Safe N Simple LLC

- 6.3.18 Fittleworth Medical Ltd

- 6.3.19 SecuriCare (Medical) Ltd

- 6.3.20 Stomocare International

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment