PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842692

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842692

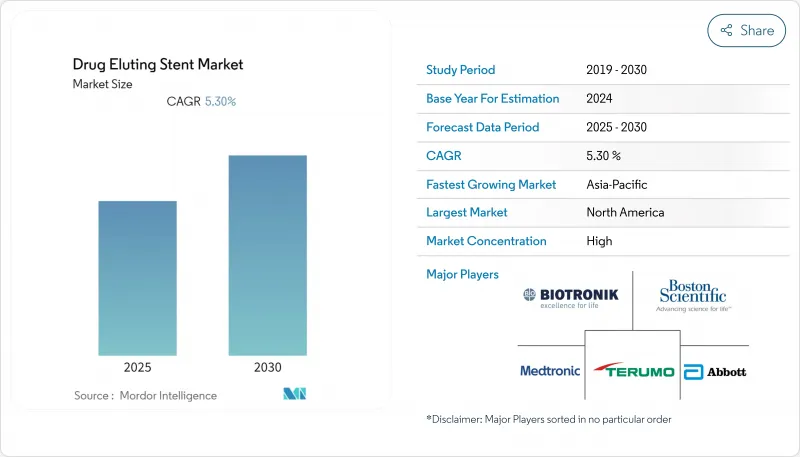

Drug Eluting Stent - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The drug eluting stent (DES) market is valued at about USD 6.35 billion in 2025 and is on course to reach roughly USD 9.47 billion by 2030, reflecting an estimated 8.3% CAGR.

Widening indications for minimally invasive coronary and peripheral procedures are elevating unit demand, while rapid device iteration, particularly thinner strut designs with biocompatible coatings, continues to decrease long-term restenosis and drive hospital purchasing preference toward newer platforms. At the same time, an aging population is expanding the pool of complex cases, prompting health systems to refresh imaging and cath-lab infrastructure in lock-step with stent upgrades. Reimbursement reforms in several emerging economies are broadening access to premium stents, intensifying competition between incumbents and cost-optimized regional suppliers. Finally, price pressure from group-purchasing organizations is nudging manufacturers to bundle inventory-management services with hardware, helping to defend margins even as unit prices edge lower.

Global Drug Eluting Stent Market Trends and Insights

Accelerated PCI Volumes After Cardiac Care Backlog Clearance

Clearing the backlog of deferred elective procedures has lifted PCI throughput well above pre-pandemic baselines, reshaping procurement calendars for stent buyers. As same-day discharge becomes routine, case scheduling is moving from legacy block booking toward demand-driven slotting, which in turn prompts distributors to stock faster-moving SKUs and down-weight slow sellers. Integrated delivery networks that invested early in radial-access training recorded procedure growth that was several percentage points above fragmented provider groups, illustrating how skills acquisition magnifies device pull-through. Industry analysts now view outpatient migration not simply as a cost-containment lever but as a volume-creation engine, because lower facility fees broaden the pool of payers willing to authorize PCI for borderline indications.

Preference Shift to Second- & Third-Generation Drug Eluting Stents (DES)

Clinical-outcome data comparing device generations show conspicuous safety gains with biodegradable or polymer-free coatings, catalyzing a market pivot toward newer platforms. Hospital pharmacy & therapeutics committees increasingly condition formulary approval on evidence of reduced dual-antiplatelet therapy (DAPT) duration, because shorter DAPT lowers bleeding-related readmissions that erode bundled-payment margins. Accordingly, second-generation DES already hold about 70 % share, whereas third-generation solutions are expanding at nearly 12 % CAGR. Tactically, cath-lab managers are rebalancing shelf space: low-traffic first-generation SKUs are being phased out, freeing inventory capital for high-acuity platforms. In practice, this means that tertiary centers run two-tier formularies, value-oriented devices for routine cases and premium stents for complex anatomies, rather than one-size standardization.

Safety Concerns Around Late-Stent Thrombosis

Despite generational design progress, late-stent thrombosis remains a clinical concern, especially for first-generation durable-polymer devices. Regulatory agencies mandate longer follow-up periods for novel platforms, extending development cycles and increasing capitalization requirements for smaller innovators. Clinically, the focus on durable endothelialization is encouraging broader adoption of intravascular imaging. Use of optical coherence tomography (OCT) has grown noticeably in tertiary centers, fostering precise assessments of strut coverage. Interestingly, rising OCT utilization is also shaping material selection: stents offering higher radiopacity gain favor because they pair better with imaging-intensive workflows. Consequently, even marginal improvements in visibility can translate into disproportionate share gains in high-volume centers.

Other drivers and restraints analyzed in the detailed report include:

- National Reimbursement Expansion for DES

- Rapidly-Ageing Global Population

- Margin Compression from Group Purchasing Organizations (GPOs)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polymer-based coatings currently hold roughly 79% of global share in 2024, yet internal sales dashboards show that bioresorbable layers are capturing a steadily larger growth. Operators emphasize the clinical comfort of a polymer that vanishes once drug delivery ends, which, they argue, mitigates inflammatory sequelae long associated with durable chemistries.

Forward-looking manufacturers have begun converting traditional solvent-based coating lines to next-generation spray-droplet systems compatible with thinner, uniform layers. Production engineers note that apart from patient benefits, these upgraded lines yield higher throughput and lower solvent use, driving a cost-efficiency agenda that often offsets incremental R&D outlays.

Everolimus-eluting stents control about 38% of global unit shipments in 2024, but the fastest ascendant subsegment is biolimus-based devices at roughly 13% CAGR. Pharmacokinetic research now centers on crystalline structures that prolong tissue exposure out to nine months, thereby facilitating shorter systemic DAPT.

Hospitals with a high case mix of bleeding-risk patients perceive direct economic value in buying these premium models because reducing bleed-related readmissions preserves bundled-payment margins. As a corollary, P&T committees have begun quantifying stent-related anticoagulant cost offsets when weighing tender responses-a subtle yet influential shift in value-assessment frameworks.

Cobalt-chromium alloys lead at around 47% share in 2024, but platinum-chromium is the fastest riser, expanding near 11% CAGR. Radiopacity gains with platinum-chromium translate into lower contrast volumes, which nephrologists welcome given the renal comorbidity profile of many PCI patients.

Device engineers further exploit alloy strength to trim strut thickness, improving deliverability without radial compromise. By minimizing crossing profiles, such designs unlock otherwise unreachable lesions, expanding the total addressable market for minimally invasive revascularization. Consequently, hospital service-line directors anticipate incremental revenue from converting previously surgical cases to cath-lab interventions, reinforcing the alloy's commercial appeal.

The Drug Eluting Stent Market is Segmented by Coating (Polymer Based Coating [Biodegradable and More] and More), Drug Type (Everolimus, and More), Material (Cobalt-Chromium, and More), Stent Generation (First Generation, and More), Deployment Technique (Self-Expandable, and More) Application (Coronary Artery Disease, and More), End-User (Hospitals, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands about 39% of global DES revenue in 2024. The region benefits from advanced reimbursement mechanisms, early adoption of radiopaque alloys, and rapid peripheral indication approvals. Notably, more than 50% of non-urgent PCI now occurs in outpatient settings, reshaping procurement timeframes: ASCs schedule tender cycles quarterly rather than annually, demanding agile fulfillment. The U.S. Food and Drug Administration's recent nod to peripheral drug-eluting scaffolds adds another demand layer, expanding the region's total procedure base.

Asia-Pacific represents the fastest-growing market, forecast near 10.9% CAGR through 2030. Domestic players in China and India leverage cost-optimized engineering to undercut imports, yet multinationals defend premium tiers via long-term data packages and physician-training alliances. The region's heterogeneity is striking: Japan exhibits saturated penetration and focuses on incremental coating innovation, while India and Indonesia continue migrating from bare metal stents to DES, creating a bifurcated market that supports both price-sensitive and performance-oriented tiers. Manufacturers adept at navigating asynchronous provincial tender calendars maintain continuous production runs, enhancing factory utilization rates that translate into cost efficiencies.

Europe's blended procurement model, featuring centralized national tenders alongside hospital-level autonomy, produces a uniquely competitive environment where over 30 DES brands jostle for formulary inclusion. Clinical societies in the region often publish practice-changing evidence ahead of global counterparts, influencing perception of acceptable safety margins. Recent ten-year outcome data from multicenter trials revealed negligible differences in long-term major adverse cardiac events between various polymer strategies, encouraging payers to base purchasing decisions more on cost and deliverability than on coating chemistry alone. This environment accelerates price compression yet stimulates device makers to invest in platform versatility, such as deliverability in severe calcification, to escape the commodity trap.

- Abbott Laboratories

- Boston Scientific

- Medtronic

- Terumo

- BIOTRONIK

- Biosensors International Group, Ltd.

- MicroPort

- Cook Group

- Lepu Medical

- Meril Life Science

- Cordis

- Sahajanand Medical Technologies Ltd.

- OrbusNeich Medical Group

- Hexacath

- B. Braun

- SINOMED

- Alvimedica Medical Technologies Inc.

- Balton Sp. z o.o.

- Relisys Medical Devices Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly-Ageing Global Population

- 4.2.2 Accelerated PCI Volumes After Cardiac Care Backlog Clearance

- 4.2.3 Preference Shift to Second- & Third-Generation Drug Eluting Stents (DES)

- 4.2.4 National Reimbursement Expansion for DES

- 4.2.5 Domestic Manufacturing Incentives for DES

- 4.2.6 Hospital-Owned Cath-Lab Network Growth Across Global Countries

- 4.3 Market Restraints

- 4.3.1 Safety Concerns Around Late-Stent Thrombosis

- 4.3.2 Margin Compression from Group Purchasing Organisations (GPOs)

- 4.3.3 Scarcity of Interventional Cardiologists

- 4.3.4 Long Device Approval Timelines for New DES

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Coating

- 5.1.1 Polymer-Based Coating

- 5.1.1.1 Biodegradable

- 5.1.1.2 Non-biodegradable

- 5.1.2 Polymer-Free Coating

- 5.1.1 Polymer-Based Coating

- 5.2 By Drug Type

- 5.2.1 Everolimus

- 5.2.2 Zotarolimus

- 5.2.3 Sirolimus

- 5.2.4 Paclitaxel

- 5.2.5 Biolimus

- 5.2.6 Others

- 5.3 By Material

- 5.3.1 Cobalt-Chromium

- 5.3.2 Platinum-Chromium

- 5.3.3 Stainless Steel

- 5.3.4 Nickel-Titanium (Nitinol)

- 5.3.5 Others

- 5.4 By Stent Generation

- 5.4.1 First Generation

- 5.4.2 Second Generation

- 5.4.3 Third Generation

- 5.5 By Deployment Technique

- 5.5.1 Balloon-Expandable

- 5.5.2 Self-Expandable

- 5.6 By Application

- 5.6.1 Coronary Artery Disease

- 5.6.2 Peripheral Artery Disease

- 5.7 By End-User

- 5.7.1 Hospitals

- 5.7.2 Cardiac Catheterization Labs

- 5.7.3 Ambulatory Surgical Centers

- 5.8 Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 Europe

- 5.8.2.1 Germany

- 5.8.2.2 United Kingdom

- 5.8.2.3 France

- 5.8.2.4 Italy

- 5.8.2.5 Spain

- 5.8.2.6 Rest of Europe

- 5.8.3 Asia-Pacific

- 5.8.3.1 China

- 5.8.3.2 Japan

- 5.8.3.3 India

- 5.8.3.4 Australia

- 5.8.3.5 South Korea

- 5.8.3.6 Rest of Asia-Pacific

- 5.8.4 Middle East and Africa

- 5.8.4.1 GCC

- 5.8.4.2 South Africa

- 5.8.4.3 Rest of Middle East and Africa

- 5.8.5 South America

- 5.8.5.1 Brazil

- 5.8.5.2 Argentina

- 5.8.5.3 Rest of South America

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Medtronic PLC

- 6.3.4 Terumo Corporation

- 6.3.5 Biotronik SE & Co. KG

- 6.3.6 Biosensors International Group, Ltd.

- 6.3.7 MicroPort Scientific Corporation

- 6.3.8 Cook Medical

- 6.3.9 Lepu Medical Technology Co., Ltd.

- 6.3.10 Meril Life Sciences Pvt. Ltd.

- 6.3.11 Cordis

- 6.3.12 Sahajanand Medical Technologies Ltd.

- 6.3.13 OrbusNeich Medical Group

- 6.3.14 Hexacath

- 6.3.15 B. Braun Melsungen AG

- 6.3.16 SINOMED

- 6.3.17 Alvimedica Medical Technologies Inc.

- 6.3.18 Balton Sp. z o.o.

- 6.3.19 Relisys Medical Devices Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment