PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842694

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842694

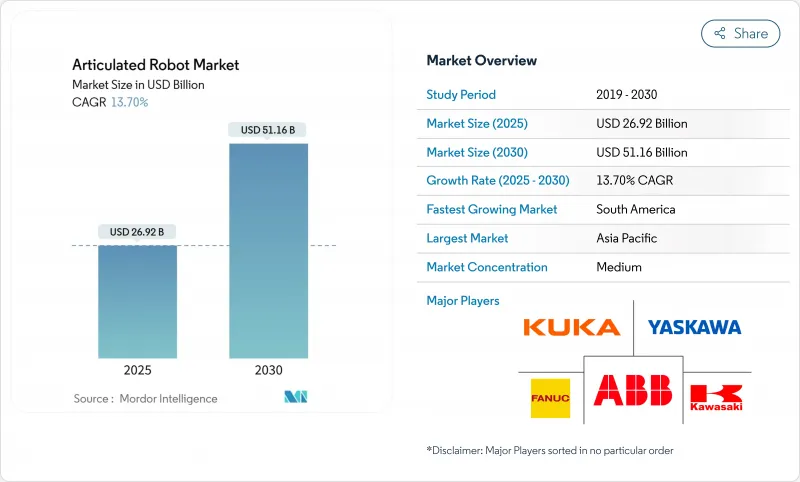

Articulated Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Articulated Robot Market size is estimated at USD 26.92 billion in 2025, and is expected to reach USD 51.16 billion by 2030, at a CAGR of 13.70% during the forecast period (2025-2030).

Surging demand for smart manufacturing solutions, sovereign production policies, and AI-enabled collaborative systems underpin this expansion. Intensifying capital expenditure in electric-vehicle production, sustained warehouse automation roll-outs by e-commerce majors, and growing precision-oriented food applications further reinforce momentum. Meanwhile, component makers are responding to semiconductor and servo-motor bottlenecks with vertical-integration strategies, and energy-efficient robotic designs are gaining traction as users chase lower operating costs. Competitive strategies are bifurcating: incumbents such as ABB pursue structural spin-offs to sharpen focus, while start-ups leverage cloud-connected platforms to shorten deployment times.

Global Articulated Robot Market Trends and Insights

Shift toward Industry 4.0-led automation

Manufacturers are linking articulated robots with AI analytics and IoT sensors to create closed-loop production ecosystems that self-optimise quality, uptime, and energy consumption. Foxconn's lights-off sites cut headcount by 150,000 yet sustained output by embedding predictive-maintenance algorithms in robotic workcells. Xiaomi's 24/7 smartphone facility demonstrates the scalability of such dark-factory models. These deployments shift automation economics from manpower substitution to product-mix agility, enabling rapid re-tooling for customised lots and variant introductions.

Rising labor cost and skilled-worker shortage

Robot operating costs of USD 1.60-2.00 per hour now undercut human wages exceeding USD 5.50 in many regions, tilting ROI calculations decisively toward automation. General Motors and John Deere trimmed welding labor expenses by 50% and defects by 25% after adopting robotic welding cells. Warehouse operators such as GXO Logistics have turned to Apollo humanoids to bridge head-count gaps while improving safety metrics. Ageing demographics in Europe and East Asia anchor this driver for the long term.

High upfront acquisition and integration cost

Total cost of an articulated robot cell can double once integration, safety equipment, and training are included, discouraging smaller enterprises. Latin American SMEs cite limited access to integrators and finance as key barriers to adoption. Robots-as-a-Service models mitigate this restraint by converting cap-ex into opex; Formic reported 200,000 contracted production hours at 99.8% uptime, highlighting investor appetite for pay-per-use automation.

Other drivers and restraints analyzed in the detailed report include:

- Government incentives for smart manufacturing

- Automotive e-mobility cap-ex boom

- Servo-motor and semiconductor supply bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The <= 16 kg class is projected to outpace all others at a 16.1% CAGR on the back of electronics, pharma, and collaborative deployments, whereas the 16-60 kg segment retained 32.6% of articulated robot market share in 2024. Users favour lighter platforms for speed, energy thrift, and human-adjacent safety. Freedom Fresh Australia's macadamia line runs 0.39-second cycles with a lightweight SCARA unit, underscoring productivity gains in food packing. Energy-efficiency pressures are driving material innovations: carbon-fibre arms from Cognibotics cut consumption by 90% while maintaining rigidity.

Demand for 60-225 kg and > 225 kg robots remains stable in automotive body-shop and foundry tasks, yet growth decelerates as OEMs sweat installed assets rather than expand footprint. High-payload arms increasingly integrate shape-memory alloy grippers that slash pneumatic energy use by 90%. Over 2025-2030, the articulated robot market size for heavy-duty classes is forecast to expand at single-digit rates, supported by EV battery pack lifting and wind-turbine component handling.

Six-axis models captured 51.8% of revenue in 2024, anchoring the articulated robot market as the de-facto workhorse for welding, painting and precision assembly. Cost points now span under USD 5,000 for light units to beyond USD 500,000 for clean-room variants. Modular controllers are shrinking installation footprints, a boon for SMEs with space constraints.

Seven-axis and hyper-dexterous formats are the fastest-rising niche, charting a 16.5% CAGR. Yamaha's YA series elbows rotate around confined fixtures, enabling shorter takt times in dense production cells. Parallel-topology robots studied by MDPI promise higher stiffness-to-weight ratios for pick-and-place cycles. As automotive interiors grow more complex and consumer electronics trend toward miniaturisation, demand for extra axes to navigate tight envelopes will intensify.

Articulated Robot Market is Segmented by Payload Capacity (Up To 16 Kg, 16 - 60 Kg, and More), Axis Type (4-Axis, 5-Axis, and More), Application (Material Handling, Welding and Soldering, Assembly, Painting and Dispensing, and More), End-User Industry (Automotive, Electrical and Electronics, Metals and Machinery, Pharmaceutical and Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained its dominance with 42.4% revenue in 2024, propelled by China's scale and Japan's innovation ecosystems. Regional governments fund lighthouse projects that accelerate SME uptake, stabilising articulated robot market size gains even as domestic wage growth tempers cost advantages. Japan's Robot Tax Credit and Korea's AI Voucher Scheme keep pipeline activity robust.

South America is forecast to grow the fastest at 15.3% CAGR through 2030, underwritten by foreign direct investments in automotive electrification and agri-automation. Brazil's SOLIX field robot shows how AI vision extends articulated design into open-field crop management. Case IH's USD 20 million Sorocaba upgrade embeds AI to command 90% harvester functions, demonstrating regional appetite for advanced robotics.

North America posted 12% year-on-year installation growth in 2024-totaling 44,303 units-supported by federal reshoring incentives and EV supply-chain projects. Europe faces energy-price headwinds yet invests in local capacity; Yaskawa's EUR 31.5 million Slovenian hub will localise 80% of EMEA robot deliveries by 2027. The Middle East and Africa remain nascent but attract pilots in construction and petrochemical maintenance, laying the groundwork for long-run articulated robot market adoption.

- ABB Ltd.

- FANUC Corporation

- Yaskawa Electric Corp.

- KUKA AG

- Kawasaki Heavy Industries Ltd.

- Mitsubishi Electric Corp.

- Nachi-Fujikoshi Corp.

- DENSO Corp.

- Seiko Epson Corp.

- Staubli International AG

- Hyundai Robotics Co., Ltd.

- Comau SpA

- Omron Adept Technology Inc.

- Universal Robots A/S

- Durr AG (Paint Robots)

- Estun Automation Co., Ltd.

- SIASUN Robot & Automation Co.

- JAKA Robotics Ltd.

- Techman Robot Inc.

- Precise Automation Inc.

- CMA Robotics SpA

- Gudel Group AG

- IAI Corporation

- Aubo Robotics Inc.

- Robot Industrial Association (RIA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward Industry 4.0-led automation

- 4.2.2 Rising labor cost and skilled-worker shortage

- 4.2.3 Government incentives for smart manufacturing

- 4.2.4 Automotive e-mobility cap-ex boom

- 4.2.5 AI-enabled adaptive articulated cobots

- 4.2.6 Fulfilment-center automation by e-commerce majors

- 4.3 Market Restraints

- 4.3.1 High upfront acquisition and integration cost

- 4.3.2 Scarcity of system-integration talent

- 4.3.3 Cyber-security risk in connected robot controllers

- 4.3.4 Servo-motor and semiconductor supply bottlenecks

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Payload Capacity

- 5.1.1 Up to 16 kg

- 5.1.2 16 - 60 kg

- 5.1.3 60 - 225 kg

- 5.1.4 Above 225 kg

- 5.2 By Axis Type

- 5.2.1 4-Axis

- 5.2.2 5-Axis

- 5.2.3 6-Axis

- 5.2.4 7-Axis and Above

- 5.3 By Application

- 5.3.1 Material Handling

- 5.3.2 Welding and Soldering

- 5.3.3 Assembly

- 5.3.4 Painting and Dispensing

- 5.3.5 Packaging and Palletizing

- 5.3.6 Inspection and Quality Assurance

- 5.3.7 Others

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Metals and Machinery

- 5.4.4 Pharmaceutical and Medical Devices

- 5.4.5 Food and Beverages

- 5.4.6 E-commerce and Logistics

- 5.4.7 Other End-User Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 FANUC Corporation

- 6.4.3 Yaskawa Electric Corp.

- 6.4.4 KUKA AG

- 6.4.5 Kawasaki Heavy Industries Ltd.

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Nachi-Fujikoshi Corp.

- 6.4.8 DENSO Corp.

- 6.4.9 Seiko Epson Corp.

- 6.4.10 Staubli International AG

- 6.4.11 Hyundai Robotics Co., Ltd.

- 6.4.12 Comau SpA

- 6.4.13 Omron Adept Technology Inc.

- 6.4.14 Universal Robots A/S

- 6.4.15 Durr AG (Paint Robots)

- 6.4.16 Estun Automation Co., Ltd.

- 6.4.17 SIASUN Robot & Automation Co.

- 6.4.18 JAKA Robotics Ltd.

- 6.4.19 Techman Robot Inc.

- 6.4.20 Precise Automation Inc.

- 6.4.21 CMA Robotics SpA

- 6.4.22 Gudel Group AG

- 6.4.23 IAI Corporation

- 6.4.24 Aubo Robotics Inc.

- 6.4.25 Robot Industrial Association (RIA)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment