PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842696

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842696

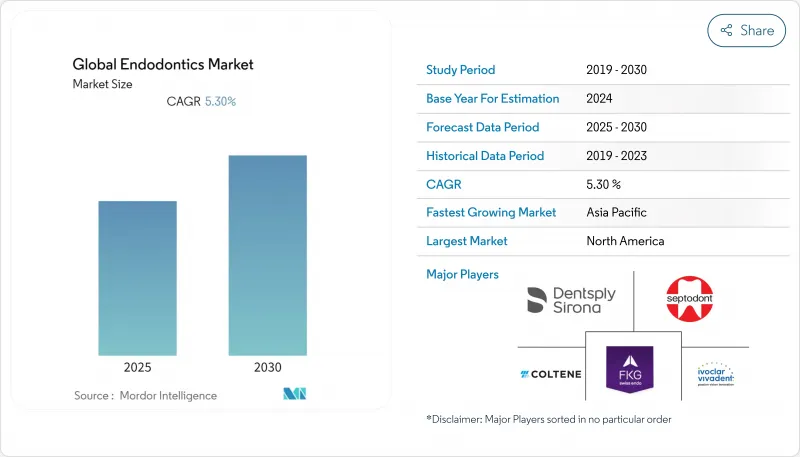

Global Endodontics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global Endodontics Market size is estimated at USD 2.05 billion in 2025, and is expected to reach USD 2.62 billion by 2030, at a CAGR of 5.10% during the forecast period (2025-2030).

Growth stems from the high prevalence of periodontal disease, wider acceptance of minimally invasive techniques, and steady gains in disposable income that support elective dental care. Technological progress-especially real-time navigation and ultrasonic irrigation-raises procedural success and shortens chair time, making complex treatments more accessible. Aging populations in developed economies keep demand elevated because tooth preservation is now preferred over extraction. Meanwhile, emerging economies are investing in digital dentistry, accelerating equipment turnover and consumables usage. Competitive intensity is moderate, with established brands leaning on regulatory expertise while younger entrants differentiate through niche software-hardware bundles.

Global Endodontics Market Trends and Insights

Increasing Periodontal Disease and the Aging Population

CDC surveillance shows that 42% of U.S. adults aged 30 and above present with periodontitis, and prevalence rises to 60% among those aged 65 and older . Smokers and people with diabetes display even higher rates, underscoring a steady, demographically anchored patient pool. As oral-health awareness improves, clinicians emphasize tooth retention, and root-canal volume grows in tandem. The trend shapes procurement choices toward efficient obturation systems and single-use files, bolstering the endodontic device market.

Technological Advancements in Endodontic Therapy

Recent FDA clearances for navigated treatment systems exemplify the shift toward computer-assisted endodontics. Devices such as Navident EVO allow real-time tracking of file position inside canals, enhancing precision and reducing procedural missteps. Ultrasonic irrigant activation, validated by peer-reviewed evidence, improves debridement efficiency without lengthening chair time. In aggregate, these technologies expand the endodontic device market by attracting general practitioners who previously referred complex cases.

Stringent Regulatory Policies for the Approval of Products

The FDA's current guidance stipulates that 510(k) submissions for endodontic devices demonstrate substantial equivalence through granular mechanical-property datasets and, increasingly, human-factors validations. Sponsors introducing novel features-such as dynamic navigation or adaptive reciprocation-often confront additional clinical-evidence requirements that elongate timelines and inflate development budgets.

A latent effect of this expanded evidentiary bar is the emergence of strategic partnerships between device manufacturers and university hospitals. By embedding trial protocols into residency programs, companies can generate regulatory-grade data while seeding product familiarity among tomorrow's key opinion leaders. Industry observers note that these alliances also serve as de-risking tools for venture investors, who view early FDA feedback as a predictor of international market clearances.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Awareness Toward Oral Hygiene and Dental Tourism

- Shift Toward Minimally Invasive Endodontics

- Side Effects and Risks Associated with Endodontic Treatment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The consumables segment captured 61.60% of 2024 revenue, underlining the repetitive nature of files, sealers, and irrigation solutions. Each root-canal visit consumes a full set of single-use items, ensuring a dependable reorder rhythm that anchors the endodontic device market size for disposable products. Digital obturation guns and thermoplastic carriers further boost unit volumes as practitioners migrate from traditional hand-pluggers. Instruments and equipment, although representing a smaller revenue base, are projected to post the fastest 5.90% CAGR because cone-beam guidance, torque-controlled motors, and apex locators shorten chair time, thereby improving practice throughput. Integration with chair-side imaging enables real-time length verification, lowering retreatment rates and generating return on investment within two years. The emphasis on ergonomic handpieces and low-vibration ultrasonic units supports premium pricing while maintaining upgrade cycles.

The mid-term outlook indicates that improved nickel-titanium metallurgy will sustain demand for heat-treated file systems capable of navigating calcified canals. Simultaneously, open-platform obturation machines that sync with practice-management software are emerging as a differentiator. Suppliers that bundle software licenses with hardware upgrades gain recurring revenue while simplifying calibration compliance. Price sensitivity may rise in developing economies, but tiered portfolios offer entry-level options that lock in brand loyalty for amortized replacements. Collectively, these trends reinforce the ascendancy of both disposable and capital-equipment segments within the endodontic device market.

The Endodontic Devices Market Report Segments the Industry Into by Product Type (Consumables, Instruments), by End User (Dental Clinics, Dental Hospitals and More) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.71% of 2024 revenue, strengthened by robust dental insurance coverage and early adoption of digital solutions. CDC data confirm that 46% of U.S. adults aged 30 and older experience periodontitis. Productivity losses equate to USD 46 billion annually through school and work interruptions, incentivizing insurers to reimburse efficient treatments. The United States accounts for most regional sales of cone-beam navigation units, and Canada follows closely in adopting bioceramic sealers. Market leaders invest in clinical-education hubs to showcase new file geometries, reinforcing premium-brand segmentation within the endodontic device market.

Asia-Pacific is projected to climb at a 6.35% CAGR to 2030, benefiting from rising middle-class income and expanding urban clinics. Government-backed oral-health campaigns in China elevate public awareness, while India's private dental colleges graduate nearly 30,000 dentists yearly, increasing equipment penetration. Thailand and Vietnam leverage competitive pricing to attract foreign patients, and that tourism network fuels standardized device demand across multiple currencies. Supply chains are localizing nickel-titanium file production to shorten lead times, enabling price-point flexibility that broadens access to the endodontic device market size.

Europe represents a mature yet innovative environment, combining high reimbursement with stringent material safety regulations. Germany leads sales of obturation systems, supported by a dense network of insurance-affiliated practices. The UK's outbound tourism pressure has prompted domestic clinics to advertise same-day root-canal packages featuring guided access systems and single-visit crowns, mitigating leakage of high-value procedures. Eastern European nations, including Poland and Romania, invest in digital imaging to attract medical tourists, carving niches within the broader endodontic device market. EU-wide software standards foster interoperability, easing cross-border device servicing and widening the sales footprint of multinationals.

- Dentsply Sirona

- Kerr Corporation.

- Septodont

- Coltene Group

- Brasseler USA

- Ivoclar Vivadent

- EdgeEndo

- Ultradent Products

- VDW GmbH

- FKG Dentaire

- Mani Inc.

- Micro-Mega

- DiaDent Group

- SS White Dental

- J Morita Corp.

- Hu-Friedy-Group (STERIS)

- Neolix

- Poldent

- Tri Hawk

- Henry Schein Endo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Incidence of Periodontal Diseases and Rising Geriatric Population

- 4.2.2 Technological Advancements in Endodontic Therapy

- 4.2.3 Rise in Awareness Towards Oral Hygience and Growing Dental Tourism

- 4.2.4 Shift Toward Minimally Invasive Endodontics

- 4.3 Market Restraints

- 4.3.1 Side Effects and Risks Associated with Endodontic Treatment

- 4.3.2 Stringent Regulatory Policies for the Approval of Products

- 4.3.3 Limited Insurance Coverage for Retreatment and 3-D Imaging Reducing Patient Uptake

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porters Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Consumables

- 5.1.1.1 Endodontic Burs

- 5.1.1.2 Obturation Materials

- 5.1.1.3 Endodontic Files and Shaper

- 5.1.1.4 Irrigation Solutions & Lubricants

- 5.1.2 Instruments / Equipment

- 5.1.2.1 Apex Locator

- 5.1.2.2 Lasers

- 5.1.2.3 Machine Assisted Obturation Systems

- 5.1.2.4 Scalers

- 5.1.2.5 Others

- 5.1.1 Consumables

- 5.2 By End-User

- 5.2.1 Dental Clinics

- 5.2.2 Dental Hospitals

- 5.2.3 Academic & Research Institutes

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Dentsply Sirona

- 6.4.2 Kerr Corporation.

- 6.4.3 Septodont Holding

- 6.4.4 Coltene Group

- 6.4.5 Brasseler USA

- 6.4.6 Ivoclar Vivadent

- 6.4.7 EdgeEndo

- 6.4.8 Ultradent Products

- 6.4.9 VDW GmbH

- 6.4.10 FKG Dentaire

- 6.4.11 Mani Inc.

- 6.4.12 Micro-Mega

- 6.4.13 DiaDent Group

- 6.4.14 SS White Dental

- 6.4.15 J Morita Corp.

- 6.4.16 Hu-Friedy-Group (STERIS)

- 6.4.17 Neolix

- 6.4.18 Poldent

- 6.4.19 Tri Hawk

- 6.4.20 Henry Schein Endo

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment