PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842698

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842698

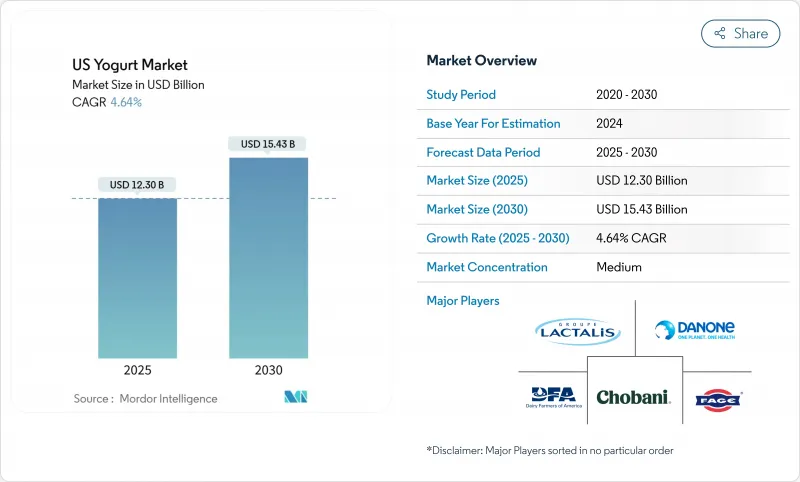

US Yogurt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The United States Yogurt Market size is estimated at USD 12.30 billion in 2025, and is expected to reach 15.43 billion by 2030, at a CAGR of 4.64% during the forecast period (2025-2030).

The United States yogurt market is growing as consumers seek nutrient-rich snacks for multiple consumption occasions. Market forecasts indicate growth through 2030, driven by protein additions, digestive health benefits, and flavor innovations. The FDA's March 2024 health claim linking yogurt to reduced type 2 diabetes risk provided validation, impacting retail strategies and sales. Retailers have adjusted product placement to prioritize health-benefit yogurts to meet demand for wellness options. Consumers now view yogurt as a wellness necessity rather than a treat, increasing its use across meal occasions. Growth stems from on-the-go breakfast trends, plant-based alternatives, and regenerative agriculture investments, maintaining volumes despite milk price changes. The market shows increased infrastructure investments, while health messaging positions yogurt as a dietary essential rather than a discretionary purchase.

US Yogurt Market Trends and Insights

Rising Demand for High-Protein Greek Yogurt Among United States Millennials

The high-protein yogurt segment leads growth in the United States yogurt market, reflecting consumers' increasing preference for nutritious options. Manufacturers are expanding their protein-enriched product lines in response to this demand. In October 2024, Chobani introduced a new range of high-protein Greek yogurt cups and drinks in the United States, featuring products with varying protein content, including 20g Protein Greek Yogurt cups and 15g, 20g, and 30g Protein Drinks. Millennials demonstrate significant interest in increasing their protein intake, driving market growth. Manufacturers now position Greek yogurt as a daily nutrition product, broadening its appeal beyond the athletic and fitness consumer segments. In the dairy aisle, protein content has become a crucial factor in consumer decision-making. Consumers now weigh nutritional benefits equally with flavor when selecting yogurt products, indicating a fundamental shift in purchase criteria. This emphasis on protein content reflects its importance in modern dietary preferences and consumers' desire for products that deliver both nutrition and taste.

Flavor Innovation Using Local Fruits Accelerating Yogurt Uptake

Flavor innovation serves as a key differentiator in the yogurt market, with manufacturers incorporating both traditional and exotic fruit varieties to meet consumer preferences. Taste remains a primary factor in consumer purchasing decisions, particularly among health-conscious individuals. The increasing yogurt consumption is largely driven by taste preferences. In response to consumer demand for new taste experiences, yogurt brands have expanded their product ranges. Additionally, dessert-inspired varieties such as strawberry cheesecake and almond chocolate yogurt offer consumers healthier alternatives to traditional desserts. This expansion of flavor offerings enables manufacturers to drive market growth by attracting both regular yogurt consumers and individuals seeking novel taste experiences. For instance, in April 2024, Danone North America introduced new yogurt flavors under its Oikos REMIX line. These include Coco Almond Chocolate (coconut nonfat yogurt with honey praline almonds and dark chocolate mix-ins), S'mores (vanilla nonfat yogurt with graham cookies, dark chocolate, and toasted marshmallow bark mix-ins), and Salted Caramel (salted caramel nonfat yogurt with sea salt praline pretzels, dark chocolate, and butter toffee mix-ins).

Volatile U.S. Milk Prices Compressing Dairy-Based Yogurt Margins

The United States Department of Agriculture (USDA) 2025 Dairy Market Outlook reveals significant challenges in the dairy industry due to milk price fluctuations affecting processor margins. The volatility, combined with increased feed costs and disease outbreaks, has compelled dairy manufacturers to modify their promotional approaches to protect profit margins. The rising feed prices have intensified economic pressure on dairy farms, affecting livestock health and production output. In response, manufacturers have reduced promotional activities that do not generate immediate returns. For instance, in September 2024, General Mills divested its North American yogurt division, indicating potential margin improvements under specialized dairy companies better positioned to manage the yogurt market. The persistent price instability has led manufacturers to streamline their product portfolios, concentrating on core products while pursuing sustainable profitability. These adjustments demonstrate the industry's ability to adapt and maintain operational stability during challenging conditions.

Other drivers and restraints analyzed in the detailed report include:

- Growth of On-the-Go Breakfast Occasion Boosting Drinkable Yogurt Formats

- Surge in Lactose-Free and Digestive-Health Claims

- Rising Popularity of Low-Carb and Keto Diets Curtailing Sweetened Yogurt Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Danone S.A

- Chobani LLC

- Lactalis Groupe (Stonyfield, siggi's, Redwood Hill)

- FAGE International S.A.

- Dairy Farmers of America Inc.

- Tillamook County Creamery Association

- Lakeview Farms, LLC (Noosa Yoghurt)

- Forager Project LLC

- Hain Celestial Group (Greek Gods)

- Anderson Erickson Dairy

- Hiland Dairy Foods Company

- Prairie Farms Dairy Inc.

- Arethusa Farm

- Stonyfield Farm, Inc.

- The Fynder Group, Inc.(Nature's Friend)

- Ehrmann Commonwealth Dairy

- Fairlife LLC (Coca-Cola Co.)

- Groupe Sodiaal

- Alpina Productos Alimenticios S.A.

- La Fermiere

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for High-Protein Greek Yogurt Among United States Millennials

- 4.2.2 Flavor Innovation Using Local Fruits Accelerating Yogurt Uptake

- 4.2.3 Growth of On-the-Go Breakfast Occasion Boosting Drinkable Yogurt Formats

- 4.2.4 Surge in Lactose-Free and Digestive Health Claims Accelerating Non-Dairy Alternatives

- 4.2.5 Clean-Label and Locally Sourced Ingredients Aligning with Sustainability Preferences

- 4.2.6 Functional Fortification (Probiotics, Immunity) Dominating New Product Launches

- 4.3 Market Restraints

- 4.3.1 Volatile Milk Prices Compressing Dairy-Based Yogurt Margins

- 4.3.2 Import Tariffs on Probiotic Cultures Raising SME Costs

- 4.3.3 High Cold-Chain Logistics Costs Hindering Profitability of E-Commerce Channels

- 4.3.4 FDA Added-Sugar Labelling Rules Limiting Formulation Flexibility for Flavored SKUs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD BILLION)

- 5.1 By Category

- 5.1.1 Dairy-based Yogurt

- 5.1.2 Non-dairy/Plant-based Yogurt

- 5.2 By Product Form

- 5.2.1 Spoonable/Set Yogurt

- 5.2.2 Drinkable Yogurt

- 5.3 By Flavor Profile

- 5.3.1 Plain/Natural

- 5.3.2 Flavored

- 5.4 By Packaging Type

- 5.4.1 Cups, Containers and Tubs

- 5.4.2 Bottles

- 5.4.3 Tetra Packs and Pouches

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 Off-Trade

- 5.5.1.1 Supermarkets/Hypermarkets

- 5.5.1.2 Convenience Stores

- 5.5.1.3 Online Retail

- 5.5.1.4 Other Distribution Channels

- 5.5.2 On-Trade

- 5.5.1 Off-Trade

- 5.6 By Geography

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Danone S.A

- 6.4.2 Chobani LLC

- 6.4.3 Lactalis Groupe (Stonyfield, siggi's, Redwood Hill)

- 6.4.4 FAGE International S.A.

- 6.4.5 Dairy Farmers of America Inc.

- 6.4.6 Tillamook County Creamery Association

- 6.4.7 Lakeview Farms, LLC (Noosa Yoghurt)

- 6.4.8 Forager Project LLC

- 6.4.9 Hain Celestial Group (Greek Gods)

- 6.4.10 Anderson Erickson Dairy

- 6.4.11 Hiland Dairy Foods Company

- 6.4.12 Prairie Farms Dairy Inc.

- 6.4.13 Arethusa Farm

- 6.4.14 Stonyfield Farm, Inc.

- 6.4.15 The Fynder Group, Inc.(Nature's Friend)

- 6.4.16 Ehrmann Commonwealth Dairy

- 6.4.17 Fairlife LLC (Coca-Cola Co.)

- 6.4.18 Groupe Sodiaal

- 6.4.19 Alpina Productos Alimenticios S.A.

- 6.4.20 La Fermiere

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK