PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842701

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842701

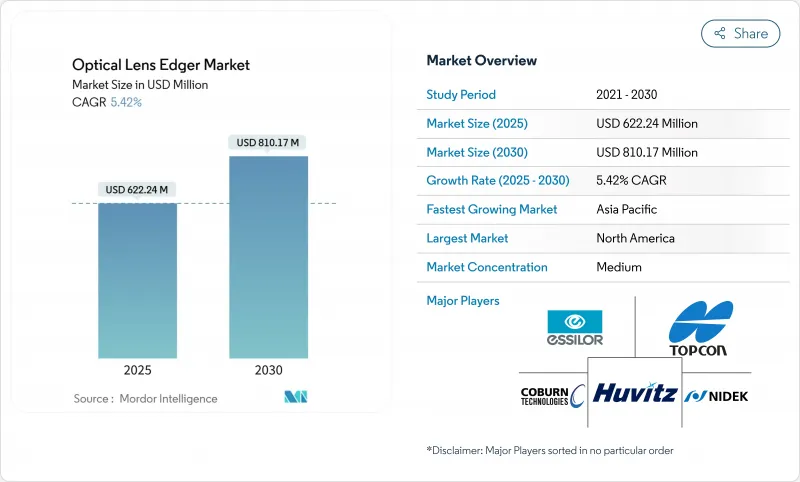

Optical Lens Edger - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The optical lens edger market generated USD 622.24 million in 2025 and is forecast to reach USD 810.17 million by 2030, advancing at a 5.42% CAGR.

The current growth pattern reflects the powerful mix of rising myopia prevalence, a larger presbyopic population, and the widening use of precision optics across consumer and industrial devices. Automatic, pattern-less computer-numerical-control (CNC) units now set the technology benchmark because they reduce finishing errors and accommodate complex freeform lens geometries. Regional retail chains that build in-store finishing labs, smartphone makers that demand ultra-thin camera optics, and hospitals that centralize optical services all feed the demand curve. Supply chain restraints for premium diamond wheels and stricter rules on airborne dust disposal introduce cost headwinds, yet most leading vendors pursue vertical integration to limit risk.

Global Optical Lens Edger Market Trends and Insights

Soaring prevalence of myopia & hyper-screen exposure

Nearly 30% of the world's population lived with myopia in 2020; projections point to 50% by 2050, including 1 billion high myopes who rely on complex prescription lenses . The optical lens edger market benefits because freeform edging allows high-index substrates to retain thin profiles while meeting power requirements. Remote work culture amplifies screen time and shortens outdoor exposure, both linked to faster myopia progression. Economically, Asian adults already spend USD 328 billion yearly on myopia correction, signaling sustained purchasing power for advanced finishing tools. New edgers integrate algorithms to ease blue-light filter lens production, enabling labs to capture premium order value.

Rapid expansion of vision-care retail chains in emerging markets

Regional chains accelerate store rollouts and embed compact edging labs to promise same-day delivery. Paris Miki operates 635 outlets in Japan and 74 abroad, each equipped to finish lenses in-house, cutting external lab fees while improving service speed. In-office systems trim USD 5-15 per job, yielding quick payback when volumes exceed 50 pairs a day. Equipment makers position mid-tier automatic units at the USD 20,000-50,000 range, bridging affordability and precision for new entrants.

Growing preference for contact lenses & LASIK

Daily disposable lenses grew to 78.8% of UK soft-lens fits in 2023, reflecting consumer tilt toward lower maintenance eyewear . Refractive surgery options such as EVO ICL extend spectacle-free intervals for younger users. These shifts temper high-volume lens edging demand in mature retail channels, though industrial and diagnostic optics remain insulated.

Other drivers and restraints analyzed in the detailed report include:

- Uptick in geriatric population with presbyopia

- Rising demand from camera & imaging optics makers

- Plateauing incremental hardware innovation cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic models generated the largest revenue pool and captured 54.81% optical lens edger market share in 2024. Their closed-loop servo motors and patternless tracing shorten finishing time, reduce reject rates, and enable same-day delivery for multifocal lenses. The optical lens edger market size tied to automatic platforms is forecast to expand at 5.8% CAGR through 2030 as mid-tier retailers move away from manual benches. Manual machines persist where capital budgets are tight, yet their share faces erosion as refurbished automatic units enter the secondary market. Semi-automatic systems bridge capability and cost, but only 6.47% share confirms limited long-run appeal. Integrated blocker-edger designs post the highest unit growth because they cut floor space and streamline workflows, a key metric for urban clinics with limited real estate.

Consolidation drives suppliers to bundle software, edging, and coating in one enclosure. Fraunhofer IPT's 48-hour optics cell indicates how factory-ready blocks encompass forming, laser ablation, and edge finishing in a single track, a template that could spur next-generation product lines. Vendors embed AI-driven parameter libraries to switch from CR-39 to polycarbonate with no manual recalibration. Such features underscore why system value rises even as hardware margins compress.

Optical Lens Edger Market is Segmented by Type (Manual, Automatic, and More), Application (Eyeglass Lens, Microscope Lens, and More), by End User (Independent Optical Stores, Ophthalmology Hospitals & Clinics, and Others), and Geography. The Market Provides the Value (in USD Million) for the Above-Mentioned Segments.

Geography Analysis

North America generated the largest revenue slice at 42.72% in 2024. Strong insurance coverage for eye exams, consumer acceptance of premium coatings, and a dense network of independent optometrists fuel equipment turnover. Many practitioners shifted to in-office labs for one-hour service, extending automatic edger penetration. The region also hosts major manufacturers that offer local service hubs; therefore, downtime penalties remain low and encourage technology updates. Safety guidelines on optical-radiation exposure tighten dust-extraction standards, pushing labs to modern enclosed systems.

Asia-Pacific is the fastest riser at 7.15% CAGR from 2025-2030. Myopia incidences above 80% among urban teens in markets such as Singapore feed sustained prescription volumes. EssilorLuxottica logged 8.2% revenue lift in the region, mirroring chain expansion that embeds in-store edging. China moderates price pressure through procurement rules that favor value lenses, steering labs toward multifocal finishing to preserve margins. Japan's Paris Miki chain prioritizes precision, spurring demand for AI-enabled blockers. India and Southeast Asia open fresh lanes as disposable incomes permit premium lens upgrades.

Europe exhibits stable demand driven by technology refresh cycles and specialized applications. Rodenstock's migration of finishing to Czech plants underscores cost-optimization, yet quality bars remain high. Contact-lens adoption-up 5.2% across Europe-tempers unit volumes yet stimulates niche opportunities in multifocal hard lenses that need tight concentricity. Latin America and the Middle East start from small installed bases but post double-digit unit growth where public-private partnerships fund vision-screening initiatives.

- EssilorLuxottica

- Topcon Corp.

- Nidek

- Coburn Technologies

- Huvitz Corp.

- MEI Srl

- Santinelli International

- Satisloh (Buhler)

- Schneider Optical Machines

- OptoTech

- Briot-Weco (Luneau Tech)

- Supore Instruments

- National Optronics

- Visslo

- INNOVA Medical Ophthalmics

- Nanjing Laite Optical

- Veer Optronics

- DTC (Delco)

- Marmore Inc.

- Beijing HongDi

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Soaring prevalence of myopia & hyper-screen exposure

- 4.2.2 Rapid expansion of vision-care retail chains in EMs

- 4.2.3 Uptick in geriatric population with presbyopia

- 4.2.4 Rising demand from camera & imaging optics makers

- 4.2.5 Adoption of in-office finishing labs by independents

- 4.2.6 Shift to patternless CNC edgers for complex lenses

- 4.3 Market Restraints

- 4.3.1 Growing preference for contact lenses & LASIK

- 4.3.2 Plateauing incremental hardware innovation cycles

- 4.3.3 Tight supply of premium diamond-abrasive wheels

- 4.3.4 Stricter dust-emission norms for optical workshops

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Type

- 5.1.1 Manual

- 5.1.2 Semi-Automatic

- 5.1.3 Automatic

- 5.1.4 Patternless CNC

- 5.1.5 Integrated Blocker-Edger Systems

- 5.2 By Application

- 5.2.1 Eyeglass Lens

- 5.2.2 Microscope/Scientific Lens

- 5.2.3 Camera & Imaging Lens

- 5.2.4 Smartphone/AR-VR Lens

- 5.3 By End User

- 5.3.1 Independent Optical Stores

- 5.3.2 Ophthalmology Hospitals & Clinics

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 EssilorLuxottica

- 6.3.2 Topcon Corp.

- 6.3.3 NIDEK Co., Ltd.

- 6.3.4 Coburn Technologies

- 6.3.5 Huvitz Corp.

- 6.3.6 MEI Srl

- 6.3.7 Santinelli International

- 6.3.8 Satisloh (Buhler)

- 6.3.9 Schneider Optical Machines

- 6.3.10 OptoTech

- 6.3.11 Briot-Weco (Luneau Tech)

- 6.3.12 Supore Instruments

- 6.3.13 National Optronics

- 6.3.14 Visslo

- 6.3.15 INNOVA Medical Ophthalmics

- 6.3.16 Nanjing Laite Optical

- 6.3.17 Veer Optronics

- 6.3.18 DTC (Delco)

- 6.3.19 Marmore Inc.

- 6.3.20 Beijing HongDi

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment