PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842702

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842702

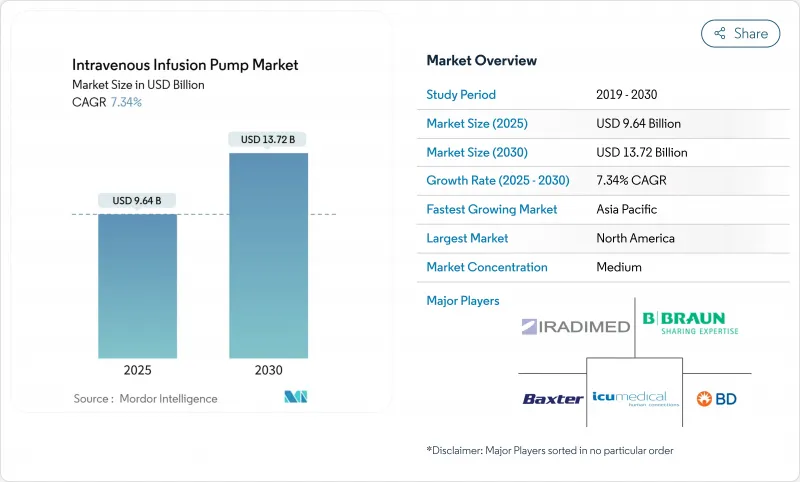

Intravenous Infusion Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Intravenous Infusion Pump Market size is estimated at USD 9.64 billion in 2025, and is expected to reach USD 13.72 billion by 2030, at a CAGR of 7.34% during the forecast period (2025-2030).

The intravenous infusion pump market continues to pivot away from gravity-fed systems toward smart, software-driven platforms that synchronize with electronic medical records and employ artificial intelligence for dose optimization. Aging populations, wider chronic disease prevalence, and the push for digitized, value-based healthcare collectively fuel sustained demand across hospitals, ambulatory centers, and home settings. Adoption in the home environment is rising fastest, helped by cloud-linked monitoring that keeps patients safely on therapy while cutting readmissions. North America remains the primary commercial theater, yet Asia's accelerating infrastructure buildout is beginning to reshape procurement priorities and competitive focus. Supply chain risk surfaced when Hurricane Helene disrupted a key facility, prompting providers to diversify sourcing and prompting manufacturers to regionalize production footprints.

Global Intravenous Infusion Pump Market Trends and Insights

Rising Prevalence of Chronic Diseases

Escalating global incidence of diabetes, cancer, and other long-duration illnesses is transforming medication delivery expectations across the intravenous infusion pump market. More than 537 million adults lived with diabetes in 2024, driving continuous insulin infusion demand that links pump accuracy to real-time glucose readings. Oncology protocols now depend on programmable pumps that adjust flow rates in seconds, ensuring chemotherapeutics remain within tight therapeutic windows while minimizing drug wastage. Device makers are embedding sensors that track heart-rate variability and other biomarkers so algorithms can dynamically shift infusion profiles without clinician intervention. These incremental safeguards not only reduce adverse events but also differentiate premium product lines in price-sensitive tender processes. Manufacturers advancing predictive-analytics firmware position themselves to capture emerging service revenues as health systems move toward outcome-based purchasing models.

Adoption of Home and Alternate-Site Infusion Therapy

Policy incentives that reward reduced inpatient length of stay, combined with widening patient acceptance, place home infusion at the core of future growth. Clinical studies report 100% satisfaction among home users of smart pumps, with patients resolving 97% of alarms on their own, underscoring usability advances that allow complex regimens to leave the ward safely. Battery-powered, lightweight devices calibrated for multi-day operation enable chemotherapy, parenteral nutrition, and antibiotic therapy outside hospitals. In parallel, tele-consult portals feed continuous pump data to clinicians who can intervene early, avoiding costly readmission episodes. Regulatory agencies now release tailored guidance for non-institutional use, shortening clearance timelines for portable systems furnished with lock-out features, tamper-evident cartridges, and instructional interfaces written for laypersons.

High Capital and Maintenance Costs of Smart Pumps

Smart pumps range from USD 3,000 to USD 15,000 per unit, and many providers must also budget 10-15% of purchase price annually for service. When hospitals operate on thin operating margins, finance committees often delay upgrades, sustaining demand for stripped-down volumetric models that still meet minimum safety regulations. Total ownership calculations must factor staff training, software licenses, and replacement batteries, which collectively extend the payback horizon beyond three years for many community facilities. Group purchasing organizations negotiate lower list prices, yet adoption gaps persist in low-resource geographies. Manufacturers strive to soften barriers through leasing programs and step-wise upgrade paths that allow basic devices to receive connectivity modules later when budgets allow.

Other drivers and restraints analyzed in the detailed report include:

- Integration with Electronic Medical Records (EMR) with Smart Pump

- Healthcare Infrastructure Growth in Emerging Markets

- Cybersecurity and Product Recall Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Volumetric units accounted for 36.56% of intravenous infusion pump market share in 2024, reaffirming their versatility for maintenance fluids, antibiotics, and blood products. The intravenous infusion pump market size for volumetric devices reached USD 3.5 billion in 2025 and is forecast to expand at a steady pace as replacement cycles align with tightened alarm-management standards. Hospitals value their robust build and straightforward user interface, especially in high-acuity wards. Nevertheless, smart pumps equipped with Wi-Fi and bidirectional EMR links are projected to post a vigorous 13.27% CAGR, reflecting mounting pressure to capture infusion data in real time. Integration enables centralized drug-library updates, lowering medication error incidence and aligning nurse workflows with digital charting mandates.

Platform evolution now emphasizes modularity. Vendors market controllers that accept volumetric, syringe, and PCA modules, thereby trimming staff training hours and sparing biomedical teams from maintaining multiple device families. Portable units gain traction among ambulatory surgery centers and home infusion providers that require lightweight designs attentive to patient mobility. Implantable pumps, though niche, fill critical roles in chronic pain and intrathecal chemotherapeutic delivery. Enteral pumps, while outside the parenteral domain, share core engineering know-how, allowing manufacturers to leverage common supply chains. Such synergies support margin defense amid rising component costs and cybersecurity compliance spend across the intravenous infusion pump market.

The Intravenous Infusion Pump Market Segments the Industry Into by Pump Type (Volumetric Pumps, Syringe Pumps, Patient-Controlled Analgesia Pumps, and More), Application (Oncology & Chemotherapy, Analgesia, and More), End User (Hospitals, Home Care Settings, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 38.77% of global revenue in 2024, a position attributed to reimbursement models that finance smart pump rollouts and clinical guidelines that prescribe dose-error-reduction software for high-risk medications. The region also benefits from vigorous enforcement of post-market surveillance, which weeds out substandard imports and rewards vendors able to document cybersecurity resilience. Consolidation among health systems yields larger, multi-site tenders, creating leverage for suppliers that can supply integrated product portfolios, training, and analytics services under a single contract.

Asia-Pacific's intravenous infusion pump market is advancing at a 9.78% CAGR, underpinned by national healthcare modernization drives and burgeoning medical tourism. China's "Made in China 2025" program and India's production-linked incentives foster local assembly partnerships that compress lead times and sidestep tariffs. Hospitals in Thailand, Malaysia, and the Philippines increasingly adopt internationally accredited oncology protocols, drawing overseas patients and elevating device expectations. Competitive pricing remains vital, yet buyers emphasize after-sales service networks capable of supplying spare parts and bilingual training to sustain uptime.

Europe maintains a sizeable installed base despite slower growth, benefitting from harmonized Medical Device Regulation across most member states. The United Kingdom's distinct post-Brexit pathway creates dual-compliance complexity, yet novel approval routes occasionally shorten timelines for suppliers targeting NHS trusts. Middle East and Africa exhibit low but rising penetration rates as oil-rich Gulf Cooperation Council nations invest in tertiary oncology centers equipped with US or EU-certified IV pumps. South America's recovery from prior recessions reopens procurement budgets for both public and private hospitals seeking to replace aging volumetric fleets with networkable models.

- B. Braun

- Baxter

- Beckton Dickinson

- ICU Medical

- Smiths Group

- Terumo

- Mindray

- Fresenius

- Medtronic

- IRadimed

- Moog

- Zyno Medical

- Micrel Medical Devices

- Advanced Instrumentations

- InfuSystem Holdings Inc.

- Sino Medical-Device Technology

- Plenum Tech Pvt Ltd

- Nipro

- JMS

- Q-Core Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic Diseases

- 4.2.2 Adoption of Home and Alternate-Site Infusion Therapy

- 4.2.3 Integration with Electronic Medical Records (EMR) with Smart Pump

- 4.2.4 Healthcare Infrastructure Growth in Emerging Markets

- 4.2.5 Rising Use of Specialty Biologics

- 4.2.6 Increased Venture Funding and Innovation

- 4.3 Market Restraints

- 4.3.1 High Capital and Maintenance Costs of Smart Pumps

- 4.3.2 Cybersecurity and Product Recall Risks

- 4.3.3 Stringent Regulatory Oversight

- 4.3.4 Supply Chain Disruptions

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Type

- 5.1.1 Volumetric Pumps

- 5.1.2 Syringe Pumps

- 5.1.3 Patient-Controlled Analgesia (PCA) Pumps

- 5.1.4 Portable Pumps

- 5.1.5 Implantable Pumps

- 5.1.6 Enteral Pumps

- 5.1.7 Insulin IV Pumps

- 5.1.8 Smart/Connected IV Pumps

- 5.2 By Application

- 5.2.1 Oncology & Chemotherapy

- 5.2.2 Analgesia

- 5.2.3 Parenteral Nutrition

- 5.2.4 Gastroenterology

- 5.2.5 Pediatrics

- 5.2.6 Hematology

- 5.2.7 Diabetes Management

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Home Care Settings

- 5.3.3 Ambulatory Surgical & Oncology Centers

- 5.3.4 Specialty Clinics

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 B. Braun Melsungen AG

- 6.3.2 Baxter International Inc.

- 6.3.3 Becton, Dickinson and Company

- 6.3.4 ICU Medical Inc.

- 6.3.5 Smiths Medical

- 6.3.6 Terumo Corporation

- 6.3.7 Shenzhen Mindray Bio-Medical Electronics Co. Ltd

- 6.3.8 Fresenius Kabi AG

- 6.3.9 Medtronic

- 6.3.10 IRadimed Corporation

- 6.3.11 Moog Inc.

- 6.3.12 Zyno Medical

- 6.3.13 Micrel Medical Devices SA

- 6.3.14 Advanced Instrumentations

- 6.3.15 InfuSystem Holdings Inc.

- 6.3.16 Sino Medical-Device Technology Co. Ltd

- 6.3.17 Plenum Tech Pvt Ltd

- 6.3.18 Nipro Corporation

- 6.3.19 JMS Co. Ltd

- 6.3.20 Q-Core Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment