PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842704

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842704

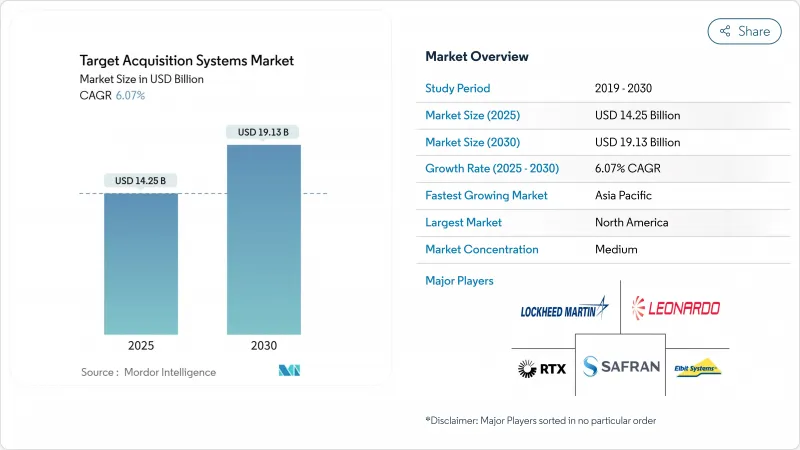

Target Acquisition Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The target acquisition systems market size is estimated at USD 14.25 billion in 2025 and is forecasted to expand to USD 19.13 billion by 2030 at a 6.07% CAGR.

Heightened geopolitical tensions and the spread of unmanned aerial threats have pushed governments to accelerate force-modernization programs, especially those aimed at network-centric operations. NATO members have pledged to keep annual defense outlays above the 2% of GDP threshold, ensuring a dependable funding stream for new detection, tracking, and fire-control technologies. Land platforms hold the widest installed base, yet airborne systems are growing fastest as armies demand persistent, multi-domain surveillance. Electro-optical/infrared (EO/IR) sensors retain the largest share, although rapid adoption of AI-enabled multi-sensor fusion suites is reshaping competitive dynamics. Thanks to major US programs, North America remains the biggest regional spender, while Asia-Pacific leads growth because of record budgets in China, Japan, and India.

Global Target Acquisition Systems Market Trends and Insights

Modernization of land forces to support network-centric warfare capabilities

Network-centric doctrine now guides every upgrade plan, compelling armed forces to link previously standalone sensors with digital command networks. The US Army's Autonomous Multi-Domain Launcher demonstrations underline this shift, showing how target acquisition nodes must feed distributed fire-control chains in seconds. European programs mirror the trend: Germany digitizes Puma infantry vehicles with HENSOLDT vision suites so crews can share sensor feeds across battle groups. Retrofit packages are complex because legacy hardware often runs on analog backbones that need secure, low-latency gateways. Operational lessons from recent conflicts confirm that real-time data fusion delivers decisive tactical advantages, accelerating adoption cycles even inside traditionally slow procurement cultures.

Urgent defense requirements for rapid counter-UAS detection and tracking solutions

Commercial drones have exposed gaps in classical air-defense layers, prompting militaries to purchase counter-UAS kits under streamlined contracting rules. Systems such as Teledyne FLIR's Cerberus XL blend radar, EO/IR, and RF detection to follow quadcopters and fixed-wing UAS at standoff ranges in cluttered airspace. The US Army awarded contracts worth over USD 400 million for such solutions in 2024 alone. Algorithms must separate hobby drones from hostile platforms while surviving electronic-warfare noise, which drives heavy investment in AI-based signal classification and sensor fusion. Acoustic arrays and passive RF analyzers increasingly complement radar to cut false-alarm rates in urban terrain.

Prolonged defense procurement timelines and shifting budgetary priorities delay system adoption

The US Government Accountability Office notes that even marquee programs like hypersonic weapons lack formal acquisition baselines, complicating industry investment cases. Political turnovers redirect funds mid-cycle, forcing prime contractors to stretch milestones or accept scope cuts. Multinational projects face extra layers of review, since every partner must align export-licensing terms before production can start. When timelines exceed commercial technology refresh rates, systems risk entering service with obsolescent electronics, eroding lifecycle value.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of AI-driven sensor fusion for autonomous threat recognition and cueing

- Advancements in EO/IR sensor miniaturization enabling dismounted soldier integration

- Regulatory challenges in spectrum allocation constrain active radar integration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Land platforms dominated 40.90% of 2024 revenue, yet airborne assets post the strongest 8.23% CAGR to 2030 as forces seek continuous overwatch across contested zones. Therefore, the target acquisition systems market is transitioning from single-domain emphasis to integrated asset portfolios that pair ground radar with high-altitude imaging. Armored fighting vehicles remain the biggest land sub-segment, propelled by Germany's Leopard 2 ARC 3.0 retrofit that fuses counter-drone sensors and anti-tank sights.

The USD 13 million United States orders for SMASH 2000L fire-control sights show the rapid uptake of soldier-portable kits that let infantry neutralize micro-drones. On the airborne side, Lockheed Martin's IRST21 reached Initial Operational Capability on F/A-18s in early 2025, underscoring naval aviation's appetite for passive long-range detection. Unmanned aircraft also accelerate demand; General Atomics is integrating EagleEye radar into the Gray Eagle 25M, advancing endurance surveillance at the brigade level.

EO/IR devices held a 42.17% share in 2024 because they work day or night and resist jamming. Still, fusion suites grow at a 7.26% CAGR as militaries connect radar, optical, laser, and acoustic channels in one processor. That evolution pushes the target acquisition systems market toward software-centric architectures that update via code rather than hardware swaps. GhostEye AESA radar exemplifies radar progress, leveraging gallium-nitride power amps for sharper resolution.

Laser rangefinders remain indispensable; in 2024, Safran won a USD 275 million US Army sustainment contract, ensuring field units can still designate platoon-level precision munitions. HENSOLDT's CERETRON software platform processes streams from disparate sensors, proving that real-time fusion lifts the probability of correct identification under heavy clutter.

The Target Acquisition Systems Market Report is Segmented by Platform (Land, Airborne, and Naval), Sensor Type (Electro-Optical/Infrared, Radar, Laser Rangefinders and Designators, Acoustic and Seismic, and More), Range Capability (Short Range, Medium Range, and More), End User (Military and Homeland Security), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 34.52% of 2024 turnover due to the United States' unmatched R&D ecosystem and procurement heft. Pentagon programs such as the USD 6.9 billion hypersonic portfolio drive continuous requirements for guidance computers, inertial navigation units, and multi-physics sensor heads. Canada's focus on Arctic sovereignty leads to sensor packages built to survive snow, ice, and magnetic anomalies, evidenced by Rheinmetall Mission Master CXT testing. Mexican border surveillance must add small but steady orders, mainly for EO/IR towers and portable acoustic detectors.

Asia-Pacific records the highest trajectory at 7.81% CAGR. China's USD 314 billion budget overshadows peers, yet the market remains inward-looking. Japan's 21% uplift to USD 55.3 billion funds interceptor radars and distributed EO nodes for island defense. India advances indigenous design, signing a USD 3.6 billion quick-reaction missile contract and placing follow-on orders for tube-artillery sights valued at USD 850 million. Australia and South Korea collaborate on maritime-patrol sensor kits, opening export lanes to Southeast Asia.

Europe retains a sizeable share rooted in cooperative ventures. The European Sky Shield program pools orders across states to field layered air defenses around shared architectures. Germany's EUR 200 million (USD 234.43 million) frigate-radar contract underscores cross-border teaming between HENSOLDT and Israel Aerospace Industries. NATO DIANA's EUR 1.1 billion (USD 1.29 billion) fund accelerates dual-use ISR payloads that can migrate from commercial drones to armored vehicles. Eastern European nations step up buys of counter-UAS radar-optical hybrids in response to nearby conflicts, tightening delivery schedules for suppliers.

- ASELSAN A.S.

- BAE Systems plc

- Elbit Systems Ltd.

- HENSOLDT AG

- Israel Aerospace Industries Ltd.

- Leonardo S.p.A

- Lockheed Martin Corporation

- RTX Corporation

- Rheinmetall AG

- Safran SA

- Thales Group

- Northrop Grumman

- L3Harris Technologies, Inc.

- Teledyne Technologies Incorporated

- Hanwha System (Hanwha Group)

- Bharat Electronics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Modernization of land forces to support network-centric warfare capabilities

- 4.2.2 Urgent defense requirements for rapid counter-UAS detection and tracking solutions

- 4.2.3 Adoption of AI-driven sensor fusion for autonomous threat recognition and cueing

- 4.2.4 Advancements in EO/IR sensor miniaturization enabling dismounted soldier integration

- 4.2.5 Increased dual-use technology funding for ISR payloads through NATO DIANA initiatives

- 4.2.6 Rising demand for border surveillance and tactical situational awareness in asymmetric zones

- 4.3 Market Restraints

- 4.3.1 Prolonged defense procurement timelines and shifting budgetary priorities delay system adoption

- 4.3.2 Regulatory challenges in spectrum allocation constrain active radar integration

- 4.3.3 Bottlenecks in sourcing III-V semiconductor focal-plane arrays impact production scalability

- 4.3.4 Increased vulnerability of Increased vulnerability of digital targeting systems to cyber and electronic-warfare threats digital targeting systems to cyber and electronic warfare threats

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Platform

- 5.1.1 Land

- 5.1.1.1 Armored Fighting Vehicles (AFVs)

- 5.1.1.2 Soldier Portable/Infantry Systems

- 5.1.1.3 Artillery and Missile Launcher Integrated

- 5.1.2 Airborne

- 5.1.2.1 Fixed-Wing Aircraft

- 5.1.2.2 Rotary-Wing Aircraft

- 5.1.2.3 Unmanned Aerial Vehicles (UAVs)

- 5.1.3 Naval

- 5.1.3.1 Surface Combatants

- 5.1.3.2 Submarines

- 5.1.3.3 Unmanned Surface/Underwater Vehicles

- 5.1.1 Land

- 5.2 By Sensor Type

- 5.2.1 Electro-Optical/Infrared (EO/IR)

- 5.2.2 Radar

- 5.2.3 Laser Rangefinders and Designators

- 5.2.4 Acoustic and Seismic

- 5.2.5 Multi-Sensor Fusion Suites

- 5.3 By Range Capability

- 5.3.1 Short

- 5.3.2 Medium

- 5.3.3 Long

- 5.4 By End User

- 5.4.1 Military

- 5.4.1.1 Army

- 5.4.1.2 Air Force

- 5.4.1.3 Navy

- 5.4.1.4 Special Operations Forces

- 5.4.2 Homeland Security

- 5.4.1 Military

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ASELSAN A.S.

- 6.4.2 BAE Systems plc

- 6.4.3 Elbit Systems Ltd.

- 6.4.4 HENSOLDT AG

- 6.4.5 Israel Aerospace Industries Ltd.

- 6.4.6 Leonardo S.p.A

- 6.4.7 Lockheed Martin Corporation

- 6.4.8 RTX Corporation

- 6.4.9 Rheinmetall AG

- 6.4.10 Safran SA

- 6.4.11 Thales Group

- 6.4.12 Northrop Grumman

- 6.4.13 L3Harris Technologies, Inc.

- 6.4.14 Teledyne Technologies Incorporated

- 6.4.15 Hanwha System (Hanwha Group)

- 6.4.16 Bharat Electronics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment