PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842712

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842712

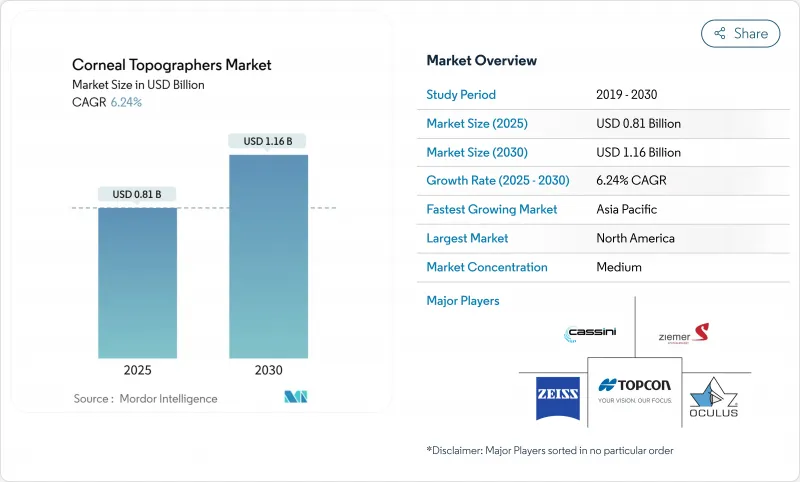

Corneal Topographers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The corneal topographers market is valued at USD 0.81 billion in 2025 and is expected to reach USD 1.16 billion by 2030, advancing at a 6.24% CAGR.

Growth is propelled by the shift from single-purpose keratometry to comprehensive anterior-segment imaging that unites morphological and biomechanical assessment. Rising global myopia prevalence, an aging population demanding premium cataract and refractive procedures, and rapid integration of artificial intelligence are the chief engines of adoption. Cloud-connected, smartphone-based devices are bringing corneal analysis into primary care, while government-backed vision-screening programs create new purchase channels. Competitive intensity stays moderate; incumbents defend positions through portfolio expansions that combine Scheimpflug, Placido, and OCT technologies and through strategic acquisitions targeting workflow integration.

Global Corneal Topographers Market Trends and Insights

Rising burden of myopia and keratoconus in paediatric and young-adult cohorts

Half the global population is projected to be myopic by 2050, and recent Chinese cross-sectional surveys already report 50.93% prevalence among schoolchildren, with urban rates even higher. Early-stage keratoconus detection is gaining urgency as paediatric incidence reveals under-diagnosed disease, prompting clinicians to widen screening protocols. The corneal topographers market benefits because orthokeratology fitting requires precise elevation maps and axial length measurement to validate myopia-control efficacy. OCULUS introduced Pentacam AXL Wave software in 2025, merging tomography with axial length for integrated myopia management. Lifelong monitoring needs in younger cohorts yield recurrent imaging demand, bolstering device utilization across primary care and specialty clinics.

Aging demographic fuelling cataract and refractive surgeries

The United States 65-plus population is forecast to climb from 56.1 million in 2020 to 73.1 million by 2030, pushing surgical volumes upward. Global cataract procedures are set to rise from 31 million in 2024 to 37 million in 2029, each case mandating corneal mapping to optimise toric and multifocal lens selection. Integration of corneal tomography with optical biometry, exemplified by Pentacam AXL, cuts chair time and heightens refractive predictability. Premium IOL adoption, which commands higher out-of-pocket spending, raises patient expectations for error-free outcomes, preserving demand for high-resolution topography. Consequently, the corneal topographers market secures a stable revenue base in advanced economies with aging demographics.

High acquisition and maintenance cost of advanced systems

Flagship hybrid platforms list between USD 80,000 and USD 150,000, a figure that can climb 25-40% after import duties in price-sensitive markets. Semiconductor shortages, which shaved 3-5% off some manufacturers' 2024 revenue, keep component costs elevated, while sophisticated optics demand periodic calibration and proprietary software subscriptions. Total cost of ownership discourages smaller practices from system upgrades, nudging them to defer purchases or select lower-spec alternatives. Leasing and usage-based models relieve upfront expenditure, yet recurring fees stretch operating budgets. As the corneal topographers market tilts toward cloud-delivered analytics, operating costs risk offsetting capex savings, sustaining price as a long-run restraint.

Other drivers and restraints analyzed in the detailed report include:

- Government-funded vision screening and tele-ophthalmology roll-outs

- AI-enhanced corneal tomography for early ectasia detection

- Shortage of skilled ophthalmologists and optometrists in emerging markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Placido reflection systems held a commanding 35.82% share in 2024, benefiting from affordability and entrenched clinical workflows. However, their curve-based algorithms struggle with posterior corneal irregularities, nudging ophthalmologists toward elevation-based imaging. Hybrid multi-modal platforms that meld Placido with Scheimpflug or OCT record an 8.82% CAGR, the fastest pace within the corneal topographers market. These workstations deliver pachymetry, posterior curvature, and anterior-segment tomography in a single capture, condensing pre-surgical evaluation into minutes. Scheimpflug-only systems retain relevance for premium intraocular lens planning, yet vendors augment them with AI modules to maintain competitiveness. LED color reflection solutions such as Cassini improve accuracy for post-surgical or scarred corneas by compensating for tear-film artefacts. Smartphone attachments and compact slit-scanning units occupy niche positions targeting primary care and mobile outreach. Continuous firmware upgrades that unlock new analytics postpone hardware obsolescence, binding users to brand ecosystems and reinforcing stickiness across the corneal topographers industry.

The vendor landscape coalesces around integrated imaging suites rather than stand-alone devices. Carl Zeiss Meditec's Cirrus platform combines topography with OCT; Topcon bundles keratometers with slit-lamp cameras. Competitive stakes lie in algorithmic precision as much as optical hardware, prompting players to invest heavily in deep-learning datasets. Supply chain resilience, particularly access to high-grade image sensors, has become a differentiator after 2024 shortages. As cloud connectivity spreads, secure data pipelines and HIPAA-compliant storage emerge as purchase criteria alongside optical fidelity. Overall, technology diversification within the corneal topographers market fosters tiered pricing that aligns with facility budgets while preserving a premium niche for all-in-one surgical planning stations.

The Corneal Topographers Market is Segmented by Technology (Placido Reflection Systems, Scanning Slit Systems, and More), Application (Refractive Surgery Planning, Contact Lens Fitting [Soft & RGP Lens Fitting, Orthokeratology Lens Fitting], End User (Hospitals, Ambulatory Surgical Centers, and More], and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 38.81% share in 2024 underscores its mature payer environment, rich R&D ecosystem, and early AI device adoption. Medicare coverage for topography when used for keratoconus or complex IOL planning softens out-of-pocket impact, while private insurers gradually expand indications. Alcon devoted USD 828 million to R&D in 2023, demonstrating industry commitment to continuous innovation. Regulatory scrutiny is rigorous, yet the FDA's 2025 AI guidance lends transparency, encouraging manufacturers to accelerate algorithm submissions. Market saturation tempers growth, but replacement cycles for systems installed a decade earlier sustain steady demand. Institutions prioritise cybersecurity, pushing vendors to certify data-protection protocols before purchase. Although hospital budget pressure persists, reimbursement alignment preserves the corneal topographers market's North American revenue base.

Asia-Pacific records the fastest 9.14% CAGR between 2025 and 2030. Skyrocketing myopia prevalence in urban children, exceeding 80% in some East Asian cities, drives parental willingness to pay for ortho-K assessments and early screening. China's device-approval agency cleared Zeiss Visumax 800 for SMILE pro in February 2025, signalling regulatory openness to advanced refractive technology. India's middle class spends more on preventive eye care as disposable income rises, while the Asian Development Bank's USD 75 million health-tech investment facility eases financing for public hospitals. Local manufacturing clusters in Shenzhen and Pune shorten lead times and cut import tariffs, enhancing price competitiveness. However, clinician shortages and uneven reimbursement slow adoption in rural provinces, necessitating mobile screening units and tele-ophthalmology hubs that further diversify the corneal topographers market.

Europe maintains moderate expansion anchored in preventive medicine and ageing demographics. Harmonised MDR regulations streamline conformity assessment, yet Brexit adds complexity for UK market entry. Public health systems fund corneal imaging for cataract and keratoconus indications, though austerity budgets cap premium device penetration in Southern Europe. Middle East and Africa remain nascent but show momentum as oil-exporting nations diversify health spending and training programs expand. South America's rebound from recent economic soft patches supports ophthalmology equipment tenders in Brazil and Argentina. Across regions, policy directives that valorise early intervention and digital health bolster a consistent upswing in the corneal topographers market.

- Topcon

- Carl Zeiss

- Nidek

- Oculus Optikgerate GmbH

- Haag-Streit AG

- Cassini Technologies B.V.

- Ziemer Group

- Luneau Technology Group (Visionix)

- Medmont International

- Tomey

- Optos

- Alcon Inc (WaveLight)

- Canon

- Bausch Health

- Essilor Instruments

- Tracey Technologies Corp.

- Eyenuk

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising burden of myopia & keratoconus in paediatric & young-adult cohorts

- 4.2.2 Aging demographic fuelling cataract & refractive surgeries

- 4.2.3 Government-funded vision-screening & tele-ophthalmology roll-outs

- 4.2.4 AI-enhanced corneal tomography for early ectasia detection

- 4.2.5 Cloud-connected smartphone topographers opening primary-care channel

- 4.2.6 Contact-lens industry demand for ortho-K fitting data integration

- 4.3 Market Restraints

- 4.3.1 High acquisition & maintenance cost of advanced systems

- 4.3.2 Shortage of skilled ophthalmologists & optometrists in EMs

- 4.3.3 Limited reimbursement for standalone corneal imaging

- 4.3.4 Substitution threat from multi-modal anterior-segment OCT devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Placido Reflection Systems

- 5.1.2 Scanning Slit Systems

- 5.1.3 Scheimpflug Imaging Systems

- 5.1.4 Hybrid Multi-modal Systems

- 5.1.5 Other Technologies

- 5.2 By Application

- 5.2.1 Refractive Surgery Planning

- 5.2.2 Cataract Surgery IOL Selection

- 5.2.3 Keratoconus & Ectasia Diagnosis

- 5.2.4 Corneal Edema & Dystrophy Assessment

- 5.2.5 Contact Lens Fitting

- 5.2.5.1 Soft & RGP Lens Fitting

- 5.2.5.2 Orthokeratology Lens Fitting

- 5.2.6 Dry Eye & Ocular Surface Evaluation

- 5.2.7 Research & Academic Use

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Ophthalmology Clinics

- 5.3.4 Optometry & Vision-care Centers

- 5.3.5 Academic & Research Institutes

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Topcon Medical Systems Inc

- 6.3.2 Carl Zeiss Meditec AG

- 6.3.3 NIDEK Co., Ltd.

- 6.3.4 Oculus Optikgerate GmbH

- 6.3.5 Haag-Streit AG

- 6.3.6 Cassini Technologies B.V.

- 6.3.7 Ziemer Ophthalmic Systems AG

- 6.3.8 Luneau Technology Group (Visionix)

- 6.3.9 Medmont International Pty Ltd

- 6.3.10 Tomey Corporation

- 6.3.11 Optos plc

- 6.3.12 Alcon Inc (WaveLight)

- 6.3.13 Canon Inc

- 6.3.14 Bausch & Lomb Incorporated

- 6.3.15 Essilor Instruments

- 6.3.16 Tracey Technologies Corp.

- 6.3.17 Eyenuk Inc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment