PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844449

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844449

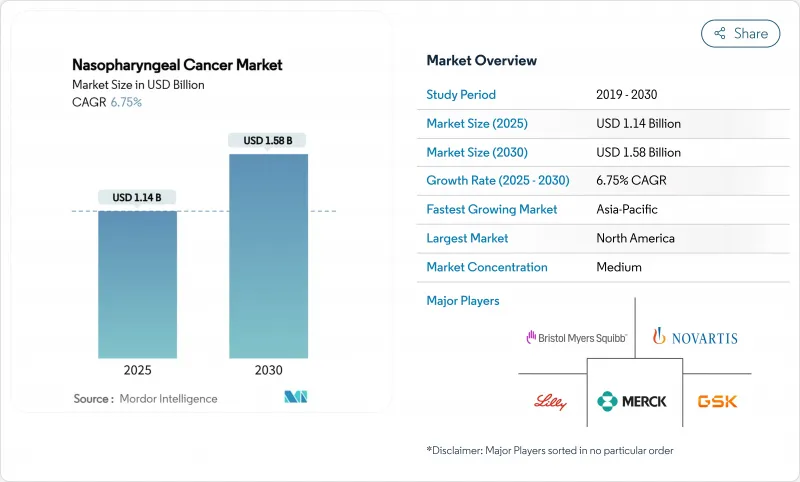

Nasopharyngeal Cancer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The nasopharyngeal cancer market size reached USD 1.14 billion in 2025 and is projected to reach USD 1.58 billion by 2030, advancing at a 6.75% CAGR over the forecast period.

The market's ascent mirrors rapid clinical adoption of PD-1/PD-L1 checkpoint inhibitors, which have shifted the therapeutic focus from exclusive reliance on platinum-based chemotherapy toward durable immunologic control of recurrent and metastatic disease . Rising reimbursement for precision diagnostics, broader inclusion of endemic populations in global trials, and regional manufacturing of immunotherapy biologics further accelerate growth momentum. Competitive dynamics now hinge on combination-therapy life-cycle strategies, while hospital systems increasingly standardize EBV DNA screening to triage patients into risk-stratified care pathways. In parallel, artificial-intelligence tools that automate IMRT contouring reduce clinician workload and raise throughput, reinforcing radiotherapy as a complementary pillar rather than a displaced modality.

Global Nasopharyngeal Cancer Market Trends and Insights

Breakthrough Results of PD-1/PD-L1 Checkpoint Inhibitors

PD-1 antibodies such as toripalimab and penpulimab have produced clinically meaningful extensions in progression-free survival when combined with platinum-based chemotherapy, underscoring their emergence as first-line standards for recurrent or metastatic disease. Phase III evidence documented median PFS of 21.4 months for toripalimab-chemotherapy versus 8.2 months for placebo-chemotherapy in the JUPITER-02 study. The FDA then granted penpulimab breakthrough, orphan, and fast-track statuses, culminating in its April 2025 approval that shortened development timelines by nearly 18 months . Modelling shows that delayed progression lowers cumulative hospitalization spend and raises quality-adjusted life years, reinforcing payer willingness to reimburse immunotherapy in endemic markets. Molecular insights reveal that EBV-driven viral antigens promote a highly inflamed tumor microenvironment, making nasopharyngeal tumors intrinsically sensitive to PD-1 blockade. The resulting paradigm shift places immunotherapy at the center of long-term disease control strategies and injects competitive urgency among developers of next-generation checkpoint modulators.

Rising Incidence in Endemic East & South-East Asia

Global case counts are projected to climb from 133,354 in 2020 to 179,476 by 2040, with Eastern Asia expected to carry 70% of that burden despite comprising only one-fifth of the world's population. Cantonese communities in Guangdong Province post incidence rates 50-100 times higher than Western averages because of gene-environment interactions that include salted-fish consumption and family clustering. Urbanization has improved diagnostic access and stimulated government-funded screening using EBV DNA assays, thereby enlarging the identified patient pool entering guideline-directed therapy. Multinational oncology sponsors are scaling Asia-based pivotal trials to capture these concentrated patient cohorts, accelerating dossier submissions to Chinese and ASEAN regulators. In parallel, local contract-development organizations streamline biologics manufacturing, driving down unit prices and broadening access for lower-income segments.

High Cost of Immuno-Oncology Combinations

Adding PD-1 antibodies to platinum doublets lifts drug-treatment invoices to USD 78,860 per Malaysian patient, roughly six-fold above conventional regimens. The incremental cost-effectiveness ratio of USD 15,103 per QALY exceeds affordability thresholds in several ASEAN economies, leading to unequal access between public and private sectors. Manufacturers are experimenting with tiered-pricing schemes, but international reference pricing and parallel importation constrain flexibility. Philanthropic partnerships and domestic biosimilar development may alleviate sticker-shock over time, yet near-term demand will underperform clinical potential in low-income geographies, tempering the global nasopharyngeal cancer market trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Orphan-Drug & Fast-Track Incentives

- Plasma EBV-DNA Guided Precision Medicine Protocols

- Limited Radiotherapy Infrastructure in Low-Income Nations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Immunotherapy's advent has disrupted entrenched chemotherapy primacy, yet chemotherapy still held the largest 44.89% share of the nasopharyngeal cancer market in 2024. Median overall survival now surpasses 33 months when PD-1 inhibitors are layered onto platinum-based backbones, dwarfing the 12-15-month benchmarks of chemotherapy alone and fuelling a 7.62% CAGR for the immunotherapy segment. The nasopharyngeal cancer market size for immunotherapy applications is anticipated to widen in absolute terms as earlier-line use becomes guideline standard. Targeted therapy remains a smaller but strategically pivotal segment; integration of EGFR inhibitors and anti-angiogenic agents aligns with the EBV-driven molecular landscape and may yield future combination approvals.

Demand for radiation therapy persists given its curative efficacy in stage II-III disease; IMRT achieves 5-year overall survival of 86.5%, outperforming older two-dimensional techniques. AI-enabled auto-contouring and adaptive planning keep radiation competitive by reducing toxicity and resource intensity. Experimental a-emitter constructs, while nascent, carry disruptive potential once isotope supply chains stabilize and late-phase evidence matures, positioning them as prospective wildcards within the broader nasopharyngeal cancer market.

The Nasopharyngeal Cancer Market Report is Segmented by Therapy (Chemotherapy, Targeted Therapy, Immunotherapy, Radiation Therapy, Other Therapies), End-User (Hospitals and Specialty Clinics, Ambulatory Surgery Centres, Other End-Users), Age Group (Adult, Pediatric, Geriatric), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 41.29% of 2024 revenues even though nasopharyngeal incidence remains below 1 per 100,000, a reflection of premium biologic pricing and insurance mechanisms that absorb high drug costs. Robust clinical-trial infrastructure sustains early adoption of investigational combinations, but limited patient growth moderates regional CAGR compared with emerging Asia.

Asia-Pacific anchors both volume and momentum, holding a matching 41.29% share while propelling a 7.98% CAGR that leads all regions. The nasopharyngeal cancer market size in China, Hong Kong, Singapore, and Malaysia rises in tandem with reimbursement expansion and domestic PD-1 approvals that price well below imported analogues. Government-backed EBV DNA screening further enlarges the treated population and solidifies therapy pipelines adapted to local genetic profiles.

Europe maintains a mature but slower-growing landscape characterized by consistent access via national health systems and active participation in multi-center trials. Price-volume agreements constrain biologic spending yet secure equitable patient access. The nasopharyngeal cancer market in Middle East & Africa remains nascent; however, accelerating oncology infrastructure and heightened disease awareness lay the foundation for double-digit growth pockets once radiotherapy capacity improves.

- Merck

- Bristol-Myers Squibb

- Novartis

- Roche

- Pfizer

- AstraZeneca

- GlaxoSmithKline

- Sanofi

- Eli Lilly and Company

- Innovent Biologics

- Junshi Biosciences

- BeiGene

- Hutchmed

- Theravectys

- Cyclacel Pharma

- Biocon

- CSPC ZhongQi

- Qilu Pharma

- ONO Pharma

- Astellas Pharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence in endemic East & South-East Asia

- 4.2.2 Regulatory orphan-drug & fast-track incentives

- 4.2.3 Break-through results of PD-1/PD-L1 checkpoint inhibitors

- 4.2.4 Plasma EBV-DNA guided precision medicine protocols

- 4.2.5 AI-enabled IMRT planning & automated MRI segmentation

- 4.2.6 Accelerating EBV/HPV prophylactic vaccine pipelines

- 4.3 Market Restraints

- 4.3.1 High cost of immuno-oncology combinations

- 4.3.2 Limited radiotherapy infrastructure in low-income nations

- 4.3.3 Supply constraints in ?-emitter radio-isotopes

- 4.3.4 Lack of harmonised EBV-DNA testing standards

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Therapy

- 5.1.1 Chemotherapy

- 5.1.2 Targeted Therapy

- 5.1.3 Immunotherapy

- 5.1.4 Radiation Therapy

- 5.1.5 Other Therapies

- 5.2 By End-User

- 5.2.1 Hospitals and Spcialty Clinics

- 5.2.2 Ambulatory Surgery Centres

- 5.2.3 Other End-Users

- 5.3 By Age Group

- 5.3.1 Adult

- 5.3.2 Pediatric

- 5.3.3 Geriatric

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Merck & Co.

- 6.3.2 Bristol Myers Squibb

- 6.3.3 Novartis

- 6.3.4 F. Hoffmann-La Roche

- 6.3.5 Pfizer

- 6.3.6 AstraZeneca

- 6.3.7 GlaxoSmithKline

- 6.3.8 Sanofi

- 6.3.9 Eli Lilly

- 6.3.10 Innovent Biologics

- 6.3.11 Junshi Biosciences

- 6.3.12 BeiGene

- 6.3.13 Hutchmed

- 6.3.14 Theravectys

- 6.3.15 Cyclacel Pharma

- 6.3.16 Biocon

- 6.3.17 CSPC ZhongQi

- 6.3.18 Qilu Pharma

- 6.3.19 ONO Pharma

- 6.3.20 Astellas Pharma

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment