PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844456

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844456

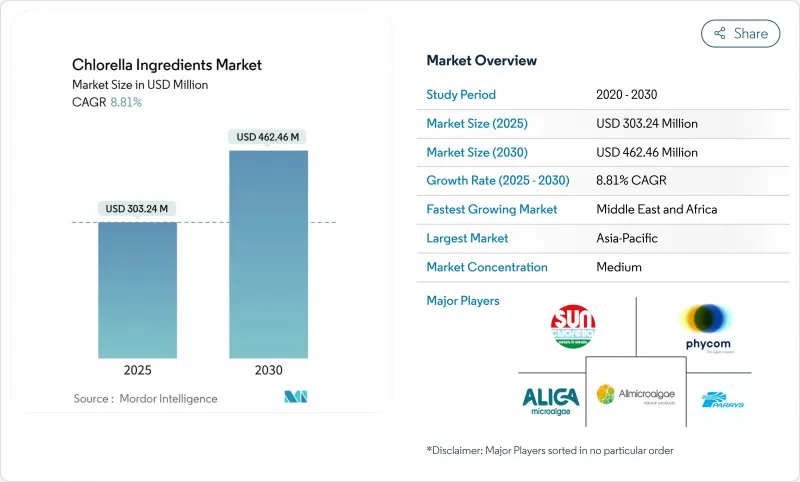

Chlorella Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The chlorella ingredients market is valued at USD 303.24 million in 2025 and is projected to reach USD 462.46 million by 2030, translating to an 8.81% CAGR over the forecast period (2025-2030).

The upward trajectory reflects consumer migration toward natural, sustainable nutrition, expanding use in personal care, and regulatory milestones such as the United States Food and Drug Administration's (FDA) May 2025 approval of algae-based color additives. Intensifying clean-label commitments, maturation of vegan nutrition, and investments in cell-wall disruption technologies are unlocking new product formats and broadening application scope. Asia-Pacific anchors production scale, while North America and Europe accelerate premium demand, creating a balanced global growth profile for the chlorella ingredients market. Competitive focus has shifted toward vertical integration, quality certification, and advanced cultivation to overcome bioavailability barriers and capture emerging cosmetics demand. The chlorella ingredients market is moderately fragmented, allowing opportunities for both established producers and new technology-driven players. Long-standing Asian companies use their years of cultivation experience, unique strains, and knowledge of local regulations to ensure a steady supply.

Global Chlorella Ingredients Market Trends and Insights

Rising adoption of vegan and plant-based nutrition

The global chlorella ingredients market is growing steadily, driven by the increasing popularity of vegan and plant-based diets. In 2024, plant-based product sales experienced double-digit growth, reflecting a strong consumer shift toward healthier and more sustainable food options. According to The Food Institute, global plant-based retail sales reached USD 28.6 billion in 2024, marking a significant rise . This growth is largely influenced by younger, health-conscious individuals and flexitarians who are looking for complete plant-based protein sources. Countries like India (9%), Mexico (9%), Israel (5%), Canada (4.6%), and Ireland (4.1%) have some of the highest percentages of vegans, as reported by the World Population Review for 2025 . Chlorella powder, which contains 40-70% protein by dry weight and provides a full amino acid profile along with vitamin B12, is particularly appealing for addressing nutritional gaps in vegan diets.

Growing popularity of algae-based functional ingredients

The increasing demand for algae-based functional ingredients is driving the widespread use of microalgae like chlorella in various food products. Regulatory approvals, such as GRAS (Generally Recognized as Safe) status in both the EU and the US for several species, have helped microalgae move beyond niche supplements into mainstream food applications . Recent advancements in extraction methods now allow for the preservation of bioactive compounds like lutein, chlorophyll, beta-glucans, and sulfated polysaccharides. These compounds provide health benefits such as antioxidant, anti-inflammatory, and immune system support. Chlorella ingredients are now being used in products like functional flours, dairy alternatives, and nutrient-rich seasoning blends. Food-tech companies are improving chlorella protein isolates and lipid-rich components through fermentation and enzymatic processes. These methods help reduce unwanted flavors and improve the overall taste and texture of products.

Limited shelf life and storage requirements

The chlorella ingredients market faces challenges due to the short shelf life and specific storage needs of chlorella powders. These powders are highly sensitive to factors like oxidation and moisture, which can lead to a decline in quality, including changes in color, taste, and nutrient content. For example, chlorophyll pigments may fade, and heat-sensitive nutrients like vitamin B12 can degrade over time. To preserve product quality, chlorella powders must be stored in cool, dry, and light-protected conditions, which increases packaging and transportation costs, especially in regions with hot or humid climates. Even with advanced packaging solutions like nitrogen-flushed barrier packs, most manufacturers, such as Sun Chlorella Corp., limit the shelf life to 24-36 months. This is significantly shorter compared to synthetic alternatives. These limitations make it difficult to use chlorella in products that require a long shelf life, such as emergency food supplies or military rations.

Other drivers and restraints analyzed in the detailed report include:

- Clean-Label trend boosting demand for natural superfoods

- Expanding Demand for chlorella based dietary supplements in preventive healthcare

- Regulatory complexity around algae ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powder variants accounted for 71.37% of the chlorella ingredients market in 2024, buoyed by easier handling, compatibility with existing dry-mix lines, and competitive shipping economics. Spray-drying improvements that limit heat exposure help preserve chlorophyll integrity, ensuring vibrant color for bakery and confectionery use. Cost-effective packaging lines further entrench powder's convenience for bulk customers. Liquid chlorella is demonstrating the highest 10.11% CAGR, driven by ready-to-drink and functional shot launches that benefit from enhanced bioavailability. Advances in aseptic filling and pH-neutral stabilization reduce microbial risk, broadening channel presence in chilled juice, smoothie, and sports drink aisles. Each format's differentiated value proposition underscores how the chlorella ingredients market is evolving toward application-specific optimization rather than one-size-fits-all solutions.

To address challenges with beverage solubility, powder suppliers are investing in advanced milling techniques and agglomeration processes, which improve how well the powder dissolves in liquids. This has helped overcome previous limitations in using chlorella in clear drinks. Meanwhile, liquid chlorella producers are collaborating with flavor experts to mask its natural marine taste, making it more appealing to a broader audience. For both powder and liquid forms, the process of breaking down chlorella's tough cell walls remains a critical factor in ensuring product quality. Manufacturers that achieve higher levels of cell-wall disruption are able to offer products with better nutrient availability, giving them a competitive edge.

The Chlorella Ingredients Market is Segmented by Form (Powder, Liquid, and More), Application (Dietary Supplements, Food and Beverages, and More), and Geography (North America, Europe, Asia-Pacific, South America and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the chlorella ingredients market in 2024, contributing 34.11% of the total revenue. This dominance is driven by large-scale photobioreactor installations in countries like Japan, China, and Taiwan, where decades of experience in chlorella cultivation have resulted in advanced techniques and strong local consumer trust. In Japan, the Foods with Function Claims program provides a clear framework for promoting health benefits on product labels, which has significantly boosted the growth of dietary supplements. In China, producers are increasingly adopting fermentation methods to conserve freshwater and maximize production efficiency. Government nutrition policies and widespread consumer acceptance in the region ensure that Asia-Pacific remains a hub for innovation in the chlorella ingredients market.

North America presents significant opportunities for high-profit margins, driven by consumer demand for clean-label products and strong purchasing power. The upcoming FDA ruling in May 2025, which supports the use of microalgae as a color additive, is expected to encourage its adoption in mainstream food and beverage categories. This has already led to increased formulation trials by major beverage and confectionery brands. Retailers in the region emphasize transparency in supply chains, with many US buyers requiring detailed documentation and third-party audits to ensure product quality. Partnerships between ingredient manufacturers and consumer-packaged-goods companies, such as Brevel's collaborations, highlight the importance of combining expertise across different segments to drive growth.

In Europe, although the market is heavily regulated, companies that meet compliance standards gain a competitive advantage and secure their position in the market. The region's focus on sustainability aligns well with chlorella's low-carbon footprint, allowing brands to position their products as premium and environmentally friendly. The Middle East and Africa region is experiencing the fastest growth, with a projected CAGR of 10.03%. This growth is fueled by rising disposable incomes, government initiatives to improve food security, and investments in controlled-environment agriculture. Collaborations with Gulf Cooperation Council importers help address logistical challenges, such as maintaining cold chains. In Latin America, the market is still in its early stages but shows potential, particularly in the growing functional beverage sectors in Brazil and Mexico.

- Sun Chlorella Corp

- Tianjin Norland Biotech Co., Ltd.

- FEMICO (Far East Microalgae Ind.)

- Vedan Vietnam Enterprise Corporation Limited

- Aliga Microalgae

- Phycom BV

- Tianjin Norland Biotech

- Allmicroalgae Natural Products S.A.

- Far East Bio-Tec Co., Ltd

- BlueBioTech International GmbH.

- Daesang Corporation

- Shaanxi Green Agri Co., Ltd.

- Green Source Organics

- Giken Bio

- Fuqing King Dnarmsa Spirulina Co., Ltd.

- E.I.D. - Parry (India) Limited

- Algenuity

- Euglena Group

- Dongtai City Spirulina Bio-engineering

- Yaeyama Shokusan Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Clean-Label Trend Boosting Demand for Natural Superfoods

- 4.2.2 Rising Adoption of Vegan and Plant Based Nutrition

- 4.2.3 Growing Popularity of Algae-Based Functional Ingredients

- 4.2.4 Expanding Demand for Chlorella Based Dietary Supplement in Preventive Healtcare

- 4.2.5 Technological Adancement in Cultivation and Processing

- 4.2.6 Demand for Chlorella in Cosmetics and Personal Care Products Due to Antioxidant Properties

- 4.3 Market Restraints

- 4.3.1 Regulatory Complexity Around Algae Ingrediens

- 4.3.2 Limited Shelf Life and Storage Requirements

- 4.3.3 Lack of Standarised Testing and Certification Bodies

- 4.3.4 Poor Solubility in Water-Based Beverage

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Powder

- 5.1.2 Liquid

- 5.1.3 Others

- 5.2 By Application

- 5.2.1 Dietary Supplements

- 5.2.2 Food and Beverages

- 5.2.3 Animal Feed

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Pharmaceutical

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Sun Chlorella Corp

- 6.4.2 Tianjin Norland Biotech Co., Ltd.

- 6.4.3 FEMICO (Far East Microalgae Ind.)

- 6.4.4 Vedan Vietnam Enterprise Corporation Limited

- 6.4.5 Aliga Microalgae

- 6.4.6 Phycom BV

- 6.4.7 Tianjin Norland Biotech

- 6.4.8 Allmicroalgae Natural Products S.A.

- 6.4.9 Far East Bio-Tec Co., Ltd

- 6.4.10 BlueBioTech International GmbH.

- 6.4.11 Daesang Corporation

- 6.4.12 Shaanxi Green Agri Co., Ltd.

- 6.4.13 Green Source Organics

- 6.4.14 Giken Bio

- 6.4.15 Fuqing King Dnarmsa Spirulina Co., Ltd.

- 6.4.16 E.I.D. - Parry (India) Limited

- 6.4.17 Algenuity

- 6.4.18 Euglena Group

- 6.4.19 Dongtai City Spirulina Bio-engineering

- 6.4.20 Yaeyama Shokusan Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK