PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844466

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844466

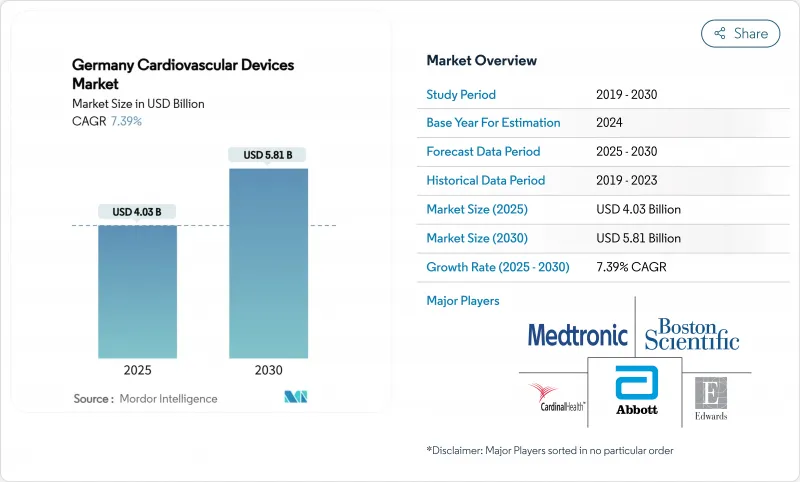

Germany Cardiovascular Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Germany cardiovascular devices market size is USD 3.76 billion in 2024 and is forecast to expand at a 7.39% CAGR to reach USD 5.81 billion by 2030.

Higher procedure volumes, an aging population, and expanding remote-monitoring mandates anchor long-term demand. Hospitals continue to invest in structural-heart and rhythm-management systems as DRG payments favor catheter-based interventions over conservative therapy. At the same time, mandatory telemonitoring of chronic heart-failure patients generates recurring revenue for implantable loop recorders and cloud analytics, turning the Germany cardiovascular devices market into a data-driven services arena. EU-MDR compliance costs eliminate many low-margin SKUs, shifting innovation toward AI-enabled diagnostics, minimally invasive systems, and fully implantable pumps that shorten inpatient stays. Although pharmacological advances temper device uptake in early-stage disease, Germany's super-aged demographic keeps replacement and upgrade cycles brisk, sustaining a predictable mid-single-digit revenue trajectory through 2030.

Germany Cardiovascular Devices Market Trends and Insights

Rapid Expansion of Reimbursed Cardiovascular Procedures

Germany's DRG system rewards hospitals for interventional care, lifting procedure counts for transcatheter aortic valve implantation beyond 100,000 cumulative cases. Catheter laboratories continue to replace surgical suites, and reimbursement parity between valve surgery and TAVI compresses payback periods for capital equipment. As 95% of octogenarian patients now receive TAVI, device makers bundle valves with embolic-protection filters to enlarge average selling prices while helping hospitals meet stroke-reduction quality metrics

Mandatory Remote Heart-Failure Telemonitoring

Since 2023, statutory insurers must cover remote telemetry for chronic heart-failure patients, motivating adoption of implantable loop recorders and non-invasive hemodynamic sensors. University centers have established command hubs that analyze continuous data feeds and trigger early outpatient interventions, cutting readmissions and freeing inpatient beds. Vendors offer subscription packages that integrate hardware, analytics dashboards, and reimbursement coding support, encouraging hospitals to migrate from episodic follow-up to always-on monitoring workflows.

EU-MDR Post-Market Costs

The 2021 MDR raised evidence thresholds and introduced intensive post-market surveillance, raising recertification costs by up to 300% for some small firms. With only 43 notified bodies to assess 500,000 devices EU-wide, certification queues stretch into 2026. Many German SMEs drop low-volume catheters rather than fund new trials, consolidating purchasing toward large multinationals and reducing product variety for niche applications.

Other drivers and restraints analyzed in the detailed report include:

- Germany's Highest PCI per-Capita Rate Sustains Drug-Eluting-Stent & Guidewire Replacement Cycles

- Krankenhaus-Zukunft Act Spurs Digital ICU/OR Hemodynamic-Monitoring Upgrades

- Pharmacotherapy Advances Moderating Device Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Therapeutic and Surgical Devices captured 69.20% Germany cardiovascular devices market share in 2024, boosted by 164 TAVI cases per million residents. Growing reliance on drug-eluting stents, left-atrial appendage occluders, and VADs underscores hospitals' preference for minimally invasive solutions that shorten intensive-care occupancy. Despite the maturity of percutaneous coronary intervention, high-risk subsets such as calcified lesions sustain demand for lithotripsy catheters reimbursed under new OPS codes.

Diagnostic and Monitoring Devices, although smaller, will expand at 6.33% CAGR to 2030, buoyed by AI-driven ECG analytics and mandatory heart-failure telemonitoring.

The Germany Cardiovascular Devices Market Report Segments the Industry Into by Device Type (Diagnostic and Monitoring Devices [Electrocardiogram (ECG), Remote Cardiac Monitoring, Other Diagnostic and Monitoring Devices], Therapeutic and Surgical Devices [Cardiac Assist Devices, Cardiac Rhythm Management Device, Catheter, Grafts, Heart Valves, Stents, Other Therapeutic and Surgical Devices]).

List of Companies Covered in this Report:

- Medtronic

- Abbott Laboratories

- Boston Scientific

- BIOTRONIK

- B. Braun

- Edwards Lifesciences Corp.

- Siemens Healthineers

- GE HealthCare Technologies Inc.

- Koninklijke Philips

- Terumo Corp.

- LivaNova

- Getinge AB (Maquet Cardiopulmonary)

- Zoll Medical Corp.

- Schiller

- Dragerwerk

- Straub Medical

- Lepu Medical

- CardioFocus Inc.

- MicroPort Scientific Corp.

- W. L. Gore & Associates

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Expansion of Reimbursed TAVI & TMVR Procedures Boosting Transcatheter Heart Valve Demand

- 4.2.2 Mandatory Remote Heart-Failure Telemonitoring (G-BA 2022) Accelerating Implantable Loop Recorder Uptake

- 4.2.3 Germany's Highest PCI per-Capita in EU Sustaining DES & Guidewire Replacement Cycles

- 4.2.4 Super-Aged Demographics in Southern & Eastern States Driving Pacemaker & VAD Implant Volumes

- 4.2.5 R&D Tax Incentives & MDR Transition Supporting Domestic Innovators (e.g., BIOTRONIK)

- 4.2.6 Krankenhaus-Zukunft Act Funding Digital ICU / OR Hemodynamic Monitoring Systems

- 4.3 Market Restraints

- 4.3.1 EU-MDR Post-Market Costs Forcing SMEs to Withdraw Legacy Cardiovascular SKUs

- 4.3.2 DRG Budget Caps Curbing Ventricular Assist Device Implant Adoption Beyond University Centers

- 4.3.3 Value-Based Procurement Driving Price Erosion in Stents & Balloons

- 4.3.4 Pharmacotherapy Advances (e.g., SGLT2i) Moderating Device Therapy Volumes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 Diagnostic & Monitoring Devices

- 5.1.1 ECG Systems

- 5.1.2 Remote Cardiac Monitor

- 5.1.3 Cardiac MRI

- 5.1.4 Cardiac CT

- 5.1.5 Echocardiography / Ultrasound

- 5.1.6 Fractional Flow Reserve (FFR) Systems

- 5.2 Therapeutic & Surgical Devices

- 5.2.1 Coronary Stents

- 5.2.1.1 Drug-Eluting Stents

- 5.2.1.2 Bare-Metal Stents

- 5.2.1.3 Bioresorbable Stents

- 5.2.2 Catheters

- 5.2.2.1 PTCA Balloon Catheters

- 5.2.2.2 IVUS/OCT Catheters

- 5.2.3 Cardiac Rhythm Management

- 5.2.3.1 Pacemakers

- 5.2.3.2 Implantable Cardioverter Defibrillators

- 5.2.3.3 Cardiac Resynchronization Therapy Devices

- 5.2.4 Heart Valves

- 5.2.4.1 TAVR/TAVI

- 5.2.4.2 Mechanical Valves

- 5.2.4.3 Tissue/Bioprosthetic Valves

- 5.2.5 Ventricular Assist Devices

- 5.2.6 Artificial Hearts

- 5.2.7 Grafts & Patches

- 5.2.8 Other Cardiovascular Surgical Devices

- 5.2.1 Coronary Stents

- 5.3 By Application

- 5.3.1 Coronary Artery Disease

- 5.3.2 Arrhythmia

- 5.3.3 Heart Failure

- 5.3.4 Structural Heart Disease

- 5.3.5 Hypertension

- 5.3.6 Others

- 5.4 By End user

- 5.4.1 Hospitals

- 5.4.2 Home-Care Settings

- 5.4.3 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Medtronic plc

- 6.3.2 Abbott Laboratories

- 6.3.3 Boston Scientific Corporation

- 6.3.4 BIOTRONIK SE & Co. KG

- 6.3.5 B. Braun Melsungen AG

- 6.3.6 Edwards Lifesciences Corp.

- 6.3.7 Siemens Healthineers AG

- 6.3.8 GE HealthCare Technologies Inc.

- 6.3.9 Philips Healthcare

- 6.3.10 Terumo Corp.

- 6.3.11 LivaNova PLC

- 6.3.12 Getinge AB (Maquet Cardiopulmonary)

- 6.3.13 Zoll Medical Corp.

- 6.3.14 Schiller AG

- 6.3.15 Dragerwerk AG & Co. KGaA

- 6.3.16 Straub Medical AG

- 6.3.17 Lepu Medical Technology

- 6.3.18 CardioFocus Inc.

- 6.3.19 MicroPort Scientific Corp.

- 6.3.20 W. L. Gore & Associates Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment