PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844467

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844467

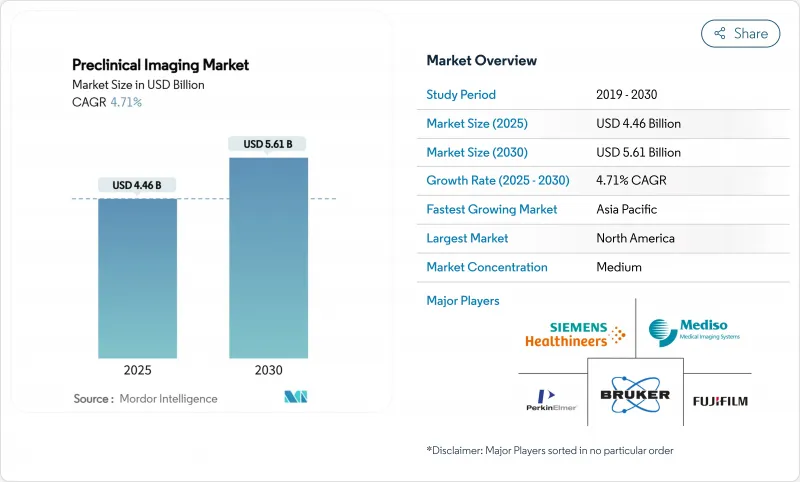

Preclinical Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Preclinical Imaging Market size is estimated at USD 4.46 billion in 2025, and is expected to reach USD 5.61 billion by 2030, at a CAGR of 4.71% during the forecast period (2025-2030).

Momentum is anchored in rising adoption of AI-powered multimodal systems, sustained pharmaceutical R&D spending, and steady public investment in imaging infrastructure. Optical modalities continue to dominate because of their lower cost and real-time visualization advantages, yet hybrid platforms are gaining traction as researchers seek richer datasets in a single session. Contract research organizations (CROs) command growing attention, offering turnkey access to cutting-edge equipment and regulatory know-how that many drug developers lack in-house. North America remains the epicenter of demand, but Asia's rapid infrastructure build-out is closing the gap and reshaping global supply chains in the preclinical imaging market.

Global Preclinical Imaging Market Trends and Insights

AI-Augmented Multimodal Imaging: Redefining Research Capabilities

Automated image acquisition and cross-modality analysis powered by artificial intelligence now cut processing times by as much as 70%, freeing scientists to focus on interpretation rather than data wrangling. The technology enables synchronized anatomical, functional, and molecular readouts within the same animal, boosting statistical power while reducing cohort sizes. Fluorescence microscopy paired with 3T-7T MRI furthers insight into ionic shifts in cardiac and neurologic tissue, demonstrating the preclinical imaging market's push toward non-invasive, longitudinal observation of disease progression. Commercial platforms embedding AI pipelines also simplify onboarding for less-experienced laboratories, widening the user base and injecting fresh demand into the preclinical imaging market.

Expansion of Cell & Gene Therapy Pipelines Driving Demand for Longitudinal In-vivo Tracking

Sixteen U.S. approvals for cell and gene therapies through 2024 created ripple effects that permeate discovery and toxicology workflows. Academic hubs such as Stanford's Center for Cell and Gene Therapy illustrate how reporter gene imaging allows transplanted cells to be followed for months, providing safety and persistence data that regulators require. These needs translate to sustained orders for multimodal scanners capable of sensitive, whole-body tracking, reinforcing long-term growth in the preclinical imaging market.

Scarcity of Skilled Operators for Multimodal Systems in Emerging Markets

Hybrid scanners demand cross-training in MRI, PET, optics, and data science, skills rarely found in a single individual. Laboratory downtime arises when qualified staff migrate to higher-paying hubs, constraining capacity expansion. Vendors respond with cloud-based remote operation dashboards that stretch expert support across facilities, yet talent shortages persist, tempering the pace of new installations in parts of Asia, Latin America, and Africa.

Other drivers and restraints analyzed in the detailed report include:

- Government-Sponsored National Preclinical Imaging Infrastructure Programs

- Increase in Preclinical Research Funding from Private and Public Organizations

- Strict Regulations in Preclinical Research

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Optical systems retained 35.32% of the preclinical imaging market in 2024, benefiting from affordability, intuitive operation, and real-time readouts that suit routine oncology and infectious-disease studies. The segment's installed base remains pivotal for high-throughput screening, yet its CAGR lags emerging alternatives. Hybrid systems, notably PET/SPECT/CT and PET/MR, are forecast to grow 9.82% annually through 2030 as investigators seek multi-parametric insights without multiple anesthetic events. Advanced devices such as the MILABS VECTor integrate functional and anatomical imaging down to 4 µm, expanding experimental design latitude. Revvity's IVIS SpectrumCT 2 exemplifies the convergence trend by adding CT attenuation correction to optical data, thereby enhancing quantification accuracy and boosting the preclinical imaging market size for hybrid platforms.

Falling component costs and improved workflow automation further accelerate hybrid adoption. Research consortia in Asia and Europe increasingly mandate multimodal capabilities when procuring shared equipment, highlighting the strategic shift from single-modality reliance. These preferences feed recurring demand for service contracts and software upgrades, deepening vendor revenue streams across the preclinical imaging market.

The Preclinical Imaging Market Report is Segmented by Modality (Optical Imaging Systems, Nuclear Imaging Systems, Micro-MRI, Micro-CT, and More), Application (Oncology, Neurology, Cardiovascular Disorders, and More), End User (Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 48.18% of the preclinical imaging market in 2024. Federal grants like SBIR and sustained venture capital inflows finance a dense network of academic-industry collaborations. Centers such as MD Anderson Cancer Center house 7 T MRI and tri-modality PET/SPECT/CT systems, underlining the region's commitment to maintaining technological edge. Breakthroughs such as integrated photoacoustic tomography-MRI workflows have emerged from U.S. labs, enabling concurrent vascular and metabolic imaging that refines tumor characterization.

Asia is the fastest-growing region with a 9.53% CAGR through 2030. China and Japan spearhead investment in sophisticated facilities, while national funding schemes streamline procurement approvals. Hong Kong Polytechnic University's installation of 7 T MRI and advanced photoacoustic ultrasound reflects the region's rapid capability build-up. Governments also nurture domestic CROs, offering subsidies that offset high import tariffs on imaging components, expanding regional participation in the preclinical imaging market.

Europe maintains robust share through well-coordinated public-private partnerships. Stringent animal welfare regulations accelerate demand for non-invasive modalities that reduce animal numbers, aligning ethical and scientific priorities. Investment vehicles like Discovery Park Ventures' stake in Vox Imaging Technology channel fresh capital into MRI miniaturization, ensuring a pipeline of home-grown innovation. Vendors emphasize harmonized software platforms across preclinical and clinical lines: United Imaging's translational architecture lets data flow seamlessly from rodent to human studies, reinforcing Europe's focus on clinically predictive imaging workflows.

- Bruker

- PerkinElmer

- FUJIFILM

- Siemens Healthineers

- Mediso

- MR Solutions

- Aspect Imaging

- Trifoil Imaging

- Miltenyi Biotec B.V. & Co. KG

- United Imaging Healthcare

- Rigaku

- MILabs

- VisualSonics Inc. (FUJIFILM Sonosite)

- Photon etc.

- AXT Pty Ltd

- IVIM Technology

- Advanced Molecular Vision

- Cubresa Inc.

- Scanco Medical AG

- Thermo Fisher Scientific

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of AI-Augmented Multimodal Imaging Platforms for Small-Animal Studies

- 4.2.2 Expansion of Cell & Gene Therapy Pipelines Driving Demand for Longitudinal In-vivo Tracking

- 4.2.3 Government-Sponsored National Preclinical Imaging Infrastructure Programs

- 4.2.4 Increase in Preclinical Research Funding, by Both Private and Public Organizations

- 4.2.5 Miniaturization of High-Field MRI Magnets Enabling Point-of-Need Rodent Imaging

- 4.2.6 Integration of Molecular Imaging with CRISPR-Based Animal Models

- 4.3 Market Restraints

- 4.3.1 Scarcity of Skilled Operators for Multi-modal Systems in Emerging Markets

- 4.3.2 Strict Regulations in Preclinical Research

- 4.3.3 High Installation and Operational Costs associated with Preclinical Imaging Modalities

- 4.3.4 Limited Standardization Across Imaging Modalities and Protocols

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Modality

- 5.1.1 Optical Imaging Systems

- 5.1.2 Nuclear Imaging Systems (PET/SPECT)

- 5.1.3 Micro-MRI

- 5.1.4 Micro-CT

- 5.1.5 Micro-Ultrasound

- 5.1.6 Photoacoustic Imaging Systems

- 5.1.7 Hybrid & Multi-modal Platforms

- 5.1.8 Other Modalities

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Neurology

- 5.2.3 Cardiovascular Disorders

- 5.2.4 Immunology & Infectious Diseases

- 5.2.5 Metabolic Disorders

- 5.2.6 Others

- 5.3 By End User

- 5.3.1 Pharmaceutical & Biotechnology Companies

- 5.3.2 Academic & Research Institutions

- 5.3.3 Contract Research Organizations

- 5.3.4 Government & Non-profit Labs

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Bruker Corporation

- 6.3.2 PerkinElmer Inc.

- 6.3.3 FUJIFILM Holdings Corporation

- 6.3.4 Siemens Healthineers AG

- 6.3.5 Mediso Ltd

- 6.3.6 MR Solutions Ltd

- 6.3.7 Aspect Imaging Ltd

- 6.3.8 Trifoil Imaging

- 6.3.9 Miltenyi Biotec B.V. & Co. KG

- 6.3.10 United Imaging Healthcare Co. Ltd

- 6.3.11 Rigaku Corporation

- 6.3.12 MILabs B.V.

- 6.3.13 VisualSonics Inc. (FUJIFILM Sonosite)

- 6.3.14 Photon etc.

- 6.3.15 AXT Pty Ltd

- 6.3.16 IVIM Technology Corp.

- 6.3.17 Advanced Molecular Vision, Inc.

- 6.3.18 Cubresa Inc.

- 6.3.19 Scanco Medical AG

- 6.3.20 Thermo Fisher Scientific Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment