PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844469

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844469

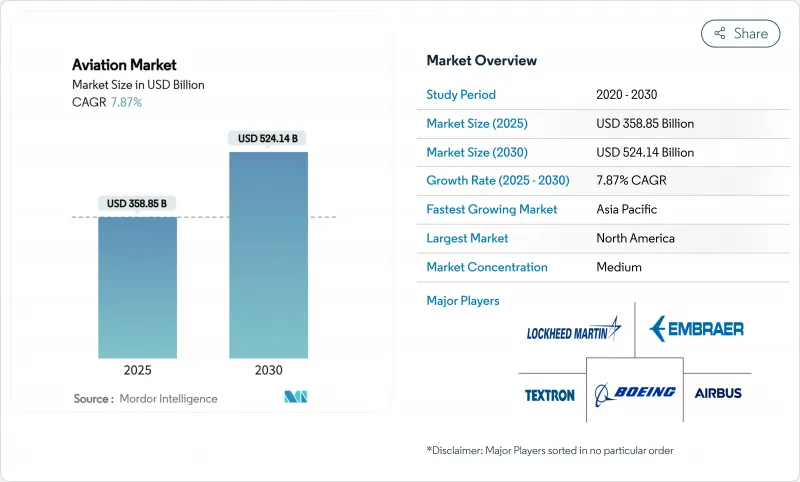

Aviation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aviation market is valued at USD 358.85 billion in 2025 and will expand to a market size of USD 524.14 billion by 2030, reflecting a 7.87% CAGR.

The aviation market benefits from renewed passenger demand, accelerated fleet modernization, and record public- and private-sector investment in sustainable propulsion. Airlines and manufacturers are pivoting from sheer capacity growth to value optimization by prioritizing fuel-efficient aircraft, advanced digital maintenance, and alternative power sources that cut emissions and lower unit costs. The aviation market is also shaped by surging e-commerce volumes that lift dedicated cargo traffic, governmental net-zero mandates that spur sustainable aviation fuel (SAF) uptake, and intensified competition from new electric-aircraft entrants. Technology convergence with the automotive and energy sectors, particularly around batteries and hydrogen, further widens the opportunity set for stakeholders that can manage complex certification pathways and supply-chain risk.

Global Aviation Market Trends and Insights

Fleet Modernization Driven by Fuel Efficiency and Cost Optimization

Airlines are replacing legacy fleets earlier than planned to lock in 20-30% fuel-burn savings promised by next-generation narrow-body families. The aviation market now prices fuel efficiency as a strategic hedge against volatile jet fuel, which can equal 30% of total airline costs. Predictive maintenance suites in new aircraft reduce unplanned downtime, while cabin upgrades lift ancillary revenue per seat. Low-cost carriers and legacy flag carriers alike face rising competitive pressure as newer fleets enable profitable thin routes at lower load factors, reshaping global network design.

Rising Passenger Traffic Across Emerging and Mature Aviation Markets

IATA's 2025 outlook indicates aggregate passenger traffic growing 4.7% annually through 2043, yet APAC drives more than half that increment alone. Chinese carriers will double their fleets by 2043, and India's domestic market is now the world's third-largest. Africa's annual growth rate of 6.4% underpins demand for 1,170 new aircraft even as infrastructure constraints channel investment toward smaller, fuel-efficient types. Mature regions regain pre-pandemic premium-cabin demand, with corporate travel spend rebounding to USD 1.5 trillion in 2024.

Persistent Supply Chain Disruptions Delaying Aircraft Deliveries

Airframe and engine OEMs still wrestle with shortages in castings, forgings, and avionics chips, extending delivery schedules by 6-18 months. Boeing's USD 4.7 billion purchase of Spirit AeroSystems is emblematic of vertical integration used to regain control over critical fuselage sections. Airlines respond by keeping older aircraft longer, inflating maintenance spend, and dampening capacity growth-a drag on the aviation market's near-term trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Growth in E-commerce Catalyzing Demand for Air Cargo and Freighter Conversions

- Rebound in Business Travel Fueling Commercial Aviation Recovery

- Volatile Jet Fuel Prices Putting Pressure on Operator Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Commercial aviation retained a 61.56% share of the aviation market in 2024, supported by global passenger traffic normalization and targeted capacity discipline that restores pricing power. The aviation market size for commercial aviation is projected to grow from USD 221.0 billion in 2025 to USD 308.9 billion in 2030 at a 6.90% CAGR. Network carriers pivot toward more efficient narrow-bodies, while low-cost carriers steadily raise average stage length to tap cross-border leisure demand.

Advanced air mobility (AAM) represents the industry's most disruptive vector, clearing 18.90% CAGR through 2030 as municipalities approve vertiport frameworks and first-generation eVTOL prototypes log meaningful flight hours. Dubai's plan to launch Joby services by 2026 illustrates the push to integrate urban air taxis into multimodal transport grids. Although current AAM revenue is minimal, its high growth rate compels incumbents to invest in minority stakes or joint ventures to preserve future relevance.

Turbofan engines held 52.67% of the aviation market size in 2024, buoyed by the prolific A320neo and B737 MAX programs. LEAP and GTF engine families drive double-digit order books as airlines prize double-digit fuel savings. Yet, electric propulsion is scaling at 15.76% CAGR, focusing first on sub-200 nm regional segments where battery mass trade-offs are feasible.

NASA's Electric Propulsion Flight Demonstration program with industry partners targets commercial-service entry by 2030. GE Aerospace allocates USD 1 billion in 2025 to additive manufacturing lines that will produce next-generation electrical machines. Hybrid-electric systems bridge today's range limitations, combining turbogenerator sets with battery packs to cut fuel burn 30% on 400 nm sectors-a pathway sustains turbofan supply chains while advancing electrification.

The Aviation Market Report is Segmented by Type (Commercial Aviation, Military Aviation, General Aviation, Unmanned Aerial Systems, and Advanced Air Mobility), Propulsion Technology (Turboprop, Turbofan, Piston Engine, and More), Power Source (Conventional Fuel, Fuel Cell, and More), Fit (Line Fit, and Retrofit), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's aviation market size was USD 134.8 billion in 2025 and will advance to USD 175.3 billion by 2030 at a 5.4% CAGR. The United States drives most of this value, leveraging B737 MAX recovery, an expanding defense backlog for the T-7A trainer, and aftermarket revenue from a fleet of 9,600 registered commercial jets. Canada's aerospace hubs in Quebec and Ontario diversify regional propulsion research, especially in hydrogen storage and fuel-cell testing. Mexico's free-trade zones attract tier-2 suppliers for wiring harnesses and interiors, improving supply-chain resilience.

Asia-Pacific adds USD 88.5 billion of incremental value between 2025 and 2030, reflecting the fastest growth among major blocs. China's Civil Aviation Administration simplifies type-certificate validation for the C919, while India's Airports Authority earmarks USD 11.8 billion in green-field developments to alleviate metro congestion. Japan's electrified regional-aircraft venture and Australia's SAF hub in Queensland further enlarge the aviation market footprint. ASEAN regionals such as Thailand and Vietnam pivot to cargo-focused models amid e-commerce booms, employing passenger-to-freighter conversions of A321s to serve intra-Asia logistics corridors.

Europe maintains a balanced growth trajectory at 6.1% CAGR, underpinned by Airbus's Hamburg and Toulouse production ramp that supports widebody A350 slate extensions. The continent is also the first to propose a binding 2% SAF mandate in 2025, rising to 70% by 2050, pressuring regional airlines to sign long-term offtake deals. Eastern European low-cost carriers enlarge their fleets, encouraging second-line airports to invest in new aprons and maintenance bays. South America rebounds as low-cost penetration exceeds 40% of passenger volumes, with airports from Bogota to Lima advancing USD 24.4 billion in modernization projects that unlock additional slots for narrowbody aircraft.

The Middle East and Africa contributed a combined aviation market size of USD 47.6 billion in 2025, climbing to USD 70.2 billion by 2030. Gulf carriers reinvest pandemic-era windfalls into A350 and B777X orders, while African carriers benefit from the Single African Air Transport Market, which harmonizes bilateral agreements. Airbus projects the African commercial fleet to surge from 1,250 aircraft in 2025 to 2,650 by 2043, enabling connectivity growth on the continent's 20 busiest intra-regional routes.

- The Boeing Company

- Airbus SE

- Lockheed Martin Corporation

- Textron Inc.

- Embraer S.A.

- Bombardier Inc.

- Pilatus Aircraft Ltd.

- Leonardo S.p.A

- Gulfstream Aerospace Corporation

- Dassault Aviation

- Commercial Aircraft Corporation of China (COMAC)

- ATR

- United Aircraft Corporation

- Honda Aircraft Company

- Piper Aircraft, Inc.

- Cirrus Aircraft Corporation

- Diamond Aircraft Industries

- Eve Holding, Inc.

- SZ DJI Technology Co., Ltd.

- Parrot Drones SAS

- AeroVironment, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fleet modernization driven by fuel efficiency and cost optimization

- 4.2.2 Rising passenger traffic across emerging and mature aviation markets

- 4.2.3 Growth in e-commerce catalyzing demGrowth in e-commerce catalyzing demand for air cargo and freighter conversionsand for air cargo and freighter conversions

- 4.2.4 Rebound in business travel fueling commercial aviation recovery

- 4.2.5 Integration of drone-aircraft teaming concepts in military aviation programs

- 4.2.6 Corporate sustainability targets accelerating adoption of SAF-compatible aircraft

- 4.3 Market Restraints

- 4.3.1 Persistent supply chain disruptions delaying aircraft deliveries

- 4.3.2 Volatile jet fuel prices putting pressure on operator margins

- 4.3.3 Limited availability of sustainable aviation fuel constraining adoption

- 4.3.4 Air traffic congestion and slot scarcity impacting operational efficiency

- 4.4 Market Trends

- 4.5 Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Buyers/Consumers

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Commercial Aviation

- 5.1.1.1 Narrowbody

- 5.1.1.2 Widebody

- 5.1.1.3 Regional Jets

- 5.1.2 Military Aviation

- 5.1.2.1 Combat

- 5.1.2.2 Transport

- 5.1.2.3 Special Missions

- 5.1.2.4 Helicopters

- 5.1.3 General Aviation

- 5.1.3.1 Business Jets

- 5.1.3.2 Commercial Helicopters

- 5.1.4 Unmanned Aerial Systems

- 5.1.4.1 Civil and Commercial

- 5.1.4.2 Defense and Government

- 5.1.5 Advanced Air Mobility (AAM)

- 5.1.5.1 eVTOL

- 5.1.5.2 Urban Air Mobility (UAM)

- 5.1.1 Commercial Aviation

- 5.2 By Propulsion Technology

- 5.2.1 Turboprop

- 5.2.2 Turbofan

- 5.2.3 Piston Engine

- 5.2.4 Turboshaft

- 5.2.5 Turbojet

- 5.2.6 Hybrid-Electric

- 5.2.7 Electric

- 5.3 By Power Source

- 5.3.1 Conventional Fuel

- 5.3.2 SAF-Based

- 5.3.3 Fuel Cell

- 5.3.4 Battery Powered

- 5.3.5 Solar Powered

- 5.4 By Fit

- 5.4.1 Line Fit

- 5.4.2 Retrofit

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Qatar

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 The Boeing Company

- 6.4.2 Airbus SE

- 6.4.3 Lockheed Martin Corporation

- 6.4.4 Textron Inc.

- 6.4.5 Embraer S.A.

- 6.4.6 Bombardier Inc.

- 6.4.7 Pilatus Aircraft Ltd.

- 6.4.8 Leonardo S.p.A

- 6.4.9 Gulfstream Aerospace Corporation

- 6.4.10 Dassault Aviation

- 6.4.11 Commercial Aircraft Corporation of China (COMAC)

- 6.4.12 ATR

- 6.4.13 United Aircraft Corporation

- 6.4.14 Honda Aircraft Company

- 6.4.15 Piper Aircraft, Inc.

- 6.4.16 Cirrus Aircraft Corporation

- 6.4.17 Diamond Aircraft Industries

- 6.4.18 Eve Holding, Inc.

- 6.4.19 SZ DJI Technology Co., Ltd.

- 6.4.20 Parrot Drones SAS

- 6.4.21 AeroVironment, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK