PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844476

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844476

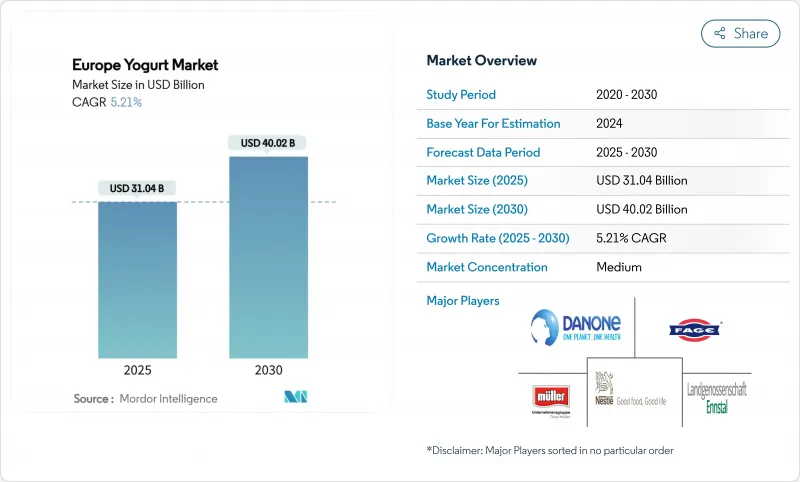

Europe Yogurt - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The European yogurt market size is projected to reach a valuation of USD 31.04 billion by 2025 and is expected to grow further to USD 40.02 billion by 2030, registering a compound annual growth rate (CAGR) of 5.21%.

This growth highlights the increasing consumer demand for functional and protein-rich foods. The popularity of high-protein dairy products has surged, and this trend is driven by major manufacturers focusing on health-oriented recipes, the significant rise in demand for high-protein Greek yogurt, and consistent investments in sustainable packaging solutions. The market is also witnessing rapid diversification. Plant-based yogurt options are growing quickly, drinkable yogurt products are becoming popular for on-the-go consumption, and tetra-pack packaging is gaining traction due to stricter environmental regulations. Germany holds the largest share of the market, while the United Kingdom is experiencing the fastest growth, supported by favorable regulations for protein-related claims. The market faces challenges such as fluctuating milk prices and complex labeling requirements. The European yogurt market is moderately fragmented. Large-scale players benefit from their purchasing power and extensive marketing budgets, while smaller, niche companies stand out by offering organic products, regionally sourced ingredients, or yogurt backed by gut-health research.

Europe Yogurt Market Trends and Insights

Rising demand for high protein Greek yogurt among millennials

Millennials are playing a significant role in changing Europe's yogurt market by choosing high-protein options that match their active lifestyles and health-focused priorities. This shift has led to strong growth in the market, with protein-rich dairy products seeing a notable increase in sales. Millennials are looking for functional benefits, such as helping with muscle recovery and providing long-lasting energy, rather than just focusing on traditional taste preferences. The growing interest in fitness culture, flexible work-life routines, and the need for convenient, on-the-go snacks are further driving this demand. As of 2024, data from the OECD shows that 15% of Europe's population meets the World Health Organization's recommended levels of physical activity, which supports the rising demand for functional foods like high-protein yogurt . Additionally, regulatory changes, such as the FDA's review of protein labeling standards, are expected to influence similar reforms in the European Union, making it easier for companies to highlight the health benefits of their products. Leading yogurt brands in Europe are taking advantage of this trend by using influencer marketing and promoting wellness-focused messages.

Growth of on-the-go breakfast occasion boosting drinkable yogurt formats

The rise of busy urban lifestyles and flexible work arrangements is driving the demand for quick and convenient breakfast options. As of 2025, many European workers are allowed to work remotely for 2-3 days a week, accounting for 40%-60% of their working time, according to Eurofund . This shift has made drinkable yogurt increasingly popular across Europe, especially in cities where long commutes and hybrid work schedules make portable and time-saving food choices essential. Companies like Danone are responding to this trend by expanding their drinkable yogurt offerings, such as the Actimel and HiPRO Drink lines, which are designed for on-the-go consumption. These products are marketed as convenient and functional, allowing brands to charge premium prices. Innovative packaging, like resealable caps and ergonomic bottle designs, makes these products easier to carry and use. Drinkable yogurt also provides an opportunity to include functional ingredients, such as added caffeine, probiotics, and vitamins, catering to consumers who want a complete and nutritious breakfast solution that fits their busy routines.

High cold-chain logistics costs hindering profitability of e-commerce channels

Rising costs in cold-chain logistics are creating significant challenges for yogurt sales through e-commerce channels in Europe. The increasing energy prices, driven by factors like geopolitical tensions such as the Ukraine conflict, have made refrigerated transport more expensive. This issue is particularly severe in regions like the Iberian Peninsula, where limited refrigerated transport capacity adds to the problem. Online grocery platforms face higher operational costs compared to physical stores because delivering perishable dairy products requires intensive refrigeration and efficient last-mile delivery. Smaller yogurt brands that rely on direct-to-consumer models are feeling the pressure even more. High minimum order requirements and infrequent delivery schedules make it harder for these brands to reach customers effectively. To address these challenges, companies are turning to advanced technologies like AI-based demand forecasting and route optimization.

Other drivers and restraints analyzed in the detailed report include:

- Flavor innovation using local fruits accelerating yogurt uptake

- Surge in lactose-free and digestive health claims accelerating non-dairy alternatives

- Volatile milk prices compressing dairy-based yogurt margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The European yogurt market size for dairy-based products accounted for 92.05% of the total category revenue in 2024. Dairy-based yogurts continue to dominate the market due to their widespread consumer acceptance, nutritional benefits, and established supply chains. However, the market is evolving as consumer preferences shift toward healthier and more sustainable options. Plant-based alternatives are gaining traction, but dairy remains a staple for its high protein content and versatility. Large manufacturers are focusing on innovation in flavors and packaging to maintain their stronghold in this segment.

Non-dairy/plant-based yogurt products, while still a smaller segment, are expected to grow at a CAGR of 7.55% through 2030, driven by increasing awareness of lactose intolerance and the environmental benefits of plant-based diets. Improved fermentation techniques have significantly enhanced the texture and taste of plant-based options, making them more appealing to consumers. Popular bases like oat, almond, and coconut are leading this growth, offering a variety of choices for health-conscious buyers. Hybrid products that combine dairy and plant-based ingredients are also gaining popularity, catering to flexitarian consumers who seek a balance between nutrition and sustainability. However, EU regulations restricting the use of terms like "milk" for plant-based products present marketing challenges.

Spoonable/set yogurts continued to dominate the European yogurt market in 2024, accounting for 79.33% of the total revenue. This dominance is largely due to their strong association with traditional breakfast habits across the region. Consumers prefer spoonable yogurts for their versatility, as they can be paired with fruits, granola, or other toppings. Additionally, the wide variety of flavors and health-focused options, such as low-fat or high-protein variants, further drive their popularity. Despite their established position, brands are innovating within this segment by introducing functional ingredients like probiotics and vitamins to cater to health-conscious consumers. The convenience of single-serve packaging also appeals to busy individuals, ensuring spoonable yogurts remain a staple in the market.

On the other hand, drinkable yogurts are gaining traction, growing at a CAGR of 7.04%. This growth is fueled by the increasing demand for convenient, on-the-go options, especially among younger, urban consumers. The introduction of resealable PET bottles and portable packaging has made drinkable yogurts a popular choice for commuters and those with busy lifestyles. Brands are also capitalizing on this trend by incorporating functional ingredients, such as immunity-boosting nutrients and low-sugar formulations, to appeal to health-conscious buyers. The strongest sales growth is observed in regions like Scandinavia and the United Kingdom, where mobility during the workday is high.

The Europe Yogurt Market Report is Segmented by Category (Dairy-Based Yogurt and Non-dairy/Plant-based Yogurt), by Product Form (Spoonable/Set Yogurt and More), by Flavour Profile (Plain/Nature and Flavored), by Packaging Type (Bottles, and More), by Distribution Channel (On-Trade and Off-Trade) and by Geography (United Kingdom, Germany, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tonnes).

List of Companies Covered in this Report:

- Danone SA

- Nestle SA

- FAGE International S.A

- Landgenossenschaft Ennstal e.Gen.

- Theo Muller Group

- First Milk Limited

- Arla Foods amba

- Groupe Lactalis S.A.

- Emmi Group

- Yeo Valley Organic Limited

- Royal FrieslandCampina N.V.

- Valio Ltd.

- Ehrmann SE

- Roros Dairy AS

- Andros SNC

- Bakoma Sp. z o. o. ul.

- Oatly Group AB

- The Coconut Collaborative Ltd.

- Molkerei Sobbeke GmbH

- Savencia Fromage & Dairy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for High-Protein Greek Yogurt Among Millennials

- 4.2.2 Flavor Innovation Using Local Fruits Accelerating Yogurt Uptake

- 4.2.3 Growth of On-the-Go Breakfast Occasion Boosting Drinkable Yogurt Formats

- 4.2.4 Surge in Lactose-Free and Digestive Health Claims Accelerating Non-Dairy Alternatives

- 4.2.5 Clean-Label and Locally Sourced Ingredients Aligning with Sustainability Preferences

- 4.2.6 Functional Fortification Dominating New Product Launches

- 4.3 Market Restraints

- 4.3.1 Volatile Milk Prices Compressing Dairy-Based Yogurt Margins

- 4.3.2 Import Tariffs on Probiotic Cultures Raising SME Costs

- 4.3.3 High Cold-Chain Logistics Costs Hindering Profitability of E-Commerce Channels

- 4.3.4 FDA Added-Sugar Labelling Rules Limiting Formulation Flexibility for Flavored SKUs

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Category

- 5.1.1 Dairy-based Yogurt

- 5.1.2 Non-dairy/Plant-based Yogurt

- 5.2 By Product Form

- 5.2.1 Spoonable/Set Yogurt

- 5.2.2 Drinkable Yogurt

- 5.3 By Flavor Profile

- 5.3.1 Plain/Natural

- 5.3.2 Flavored

- 5.4 By Packaging Type

- 5.4.1 Cups, Containers and Tubs

- 5.4.2 Bottles

- 5.4.3 Tetra Packs and Pouches

- 5.4.4 Others

- 5.5 By Distribution Channel

- 5.5.1 Off-Trade

- 5.5.1.1 Supermarkets/Hypermarkets

- 5.5.1.2 Convenience Stores

- 5.5.1.3 Online Retail

- 5.5.1.4 Other Distribution Channels

- 5.5.2 On-trade

- 5.5.1 Off-Trade

- 5.6 By Geography

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 Italy

- 5.6.4 France

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Poland

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 FAGE International S.A

- 6.4.4 Landgenossenschaft Ennstal e.Gen.

- 6.4.5 Theo Muller Group

- 6.4.6 First Milk Limited

- 6.4.7 Arla Foods amba

- 6.4.8 Groupe Lactalis S.A.

- 6.4.9 Emmi Group

- 6.4.10 Yeo Valley Organic Limited

- 6.4.11 Royal FrieslandCampina N.V.

- 6.4.12 Valio Ltd.

- 6.4.13 Ehrmann SE

- 6.4.14 Roros Dairy AS

- 6.4.15 Andros SNC

- 6.4.16 Bakoma Sp. z o. o. ul.

- 6.4.17 Oatly Group AB

- 6.4.18 The Coconut Collaborative Ltd.

- 6.4.19 Molkerei Sobbeke GmbH

- 6.4.20 Savencia Fromage & Dairy

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK