PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844479

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844479

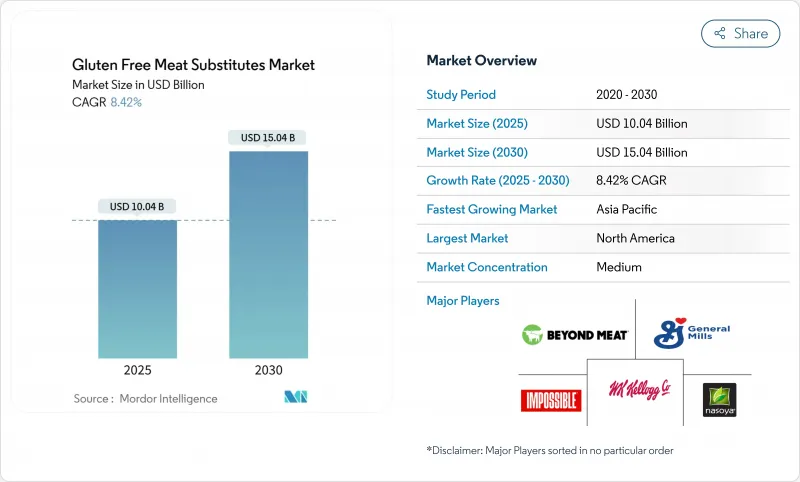

Gluten Free Meat Substitutes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The gluten-free meat alternatives market is estimated to be USD 10.04 billion in 2025 and is forecast to reach USD 15.04 billion by 2030, advancing at an 8.42% CAGR.

Improvements in ingredient processing-especially high-moisture extrusion and precision flavor masking-have closed historical taste and texture gaps, while younger shoppers show higher intent to pay a premium for certified products. Manufacturers also benefit from capital inflows triggered by government sustainability mandates and corporate decarbonization targets, which position plant-based proteins as cost-effective climate tools. Product launches that highlight reduced saturated fat or allergen-friendly positioning attract health-centric buyers and help the gluten-free meat alternatives market penetrate mainstream retail assortments.

Global Gluten Free Meat Substitutes Market Trends and Insights

Increasing gluten intolerance and celiac disease cases

The escalating prevalence of celiac disease in developed markets creates sustained demand for gluten-free alternatives that extends beyond traditional dietary restrictions. European countries, particularly Finland and Italy, demonstrate significant celiac disease populations. In 2023, the prevalence of celiac disease in the Italian population was 1%, according to the Ministry of Health . The data indicates that Aosta Valley, the Autonomous Province of Trento, and Tuscany registered the highest prevalence of this disease. Market expansion is driven by healthcare providers improving diagnostic pathways and increasing awareness of gluten-related disorders through patient awareness campaigns. The FDA's gluten-free labeling requirements strengthen consumer confidence in product safety and enable manufacturers to command premium pricing for certified alternatives. The long-term market potential is further amplified by the demographic shift toward younger consumers, who demonstrate higher rates of dietary restriction adoption and maintain purchasing power as these cohorts age.

Innovations in product development and flavor enhancement

Technological breakthroughs in protein texturization and flavor masking have transformed gluten-free meat alternatives from specialized health products to mainstream food options that compete with conventional meat on taste and texture. The combination of 3D printing technology and simultaneous infrared cooking allows manufacturers to create complex textures that replicate muscle fiber structures while maintaining gluten-free formulations. High-moisture extrusion processes enable plant proteins to achieve meat-like textures, while artificial intelligence optimization improves consistency and reduces production variations. Companies like Roquette have developed specialized ingredients such as NUTRALYS(R) Fava S900M, a fava bean protein isolate with 90% protein content, designed for gluten-free applications with enhanced gel strength and viscosity control. These technical improvements address consumer concerns about taste and texture, facilitating wider market acceptance beyond health-conscious consumers.

High production costs compared to conventional meat products

Gluten-free meat alternatives cost 2 to 2.5 times more than conventional meat products, limiting their widespread adoption and market penetration among price-sensitive consumers . The higher costs stem from specialized ingredients such as quinoa, chickpea flour, and rice protein, along with dedicated manufacturing facilities to prevent cross-contamination, and smaller production scales compared to traditional meat processing. The gluten-free certification process requires extensive testing, documentation, and regular audits, adding substantial compliance costs that manufacturers must absorb or pass on to consumers. These pricing factors particularly affect emerging markets, where lower disposable incomes restrict consumer access to premium products, limiting global market growth. The price disparity also impacts retail distribution channels, as many retailers allocate limited shelf space to higher-priced alternatives, further constraining market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Growing adoption of vegan and vegetarian diets

- Increased availability of gluten-free products in retail stores

- Intense competition from traditional meat products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Burgers dominate the market with a 35.55% share in 2024, driven by consumer familiarity and manufacturers' success in replicating conventional meat characteristics. The segment's growth is supported by extensive foodservice partnerships with major restaurant chains and strategic retail positioning in high-traffic store locations. This positioning increases product visibility and enables consumer trial across multiple channels, including quick-service restaurants, casual dining establishments, and retail stores. The burger segment's success is further enhanced by continuous product improvements in taste, texture, and cooking performance, making them increasingly comparable to traditional meat options.

Nuggets are emerging as the fastest-growing segment with a projected CAGR of 10.67% through 2030. This expansion reflects convenience-driven consumption patterns and successful product launches, including Impossible Foods' Disney-themed products that target families and address the growing demand for accessible plant-based options. Sausages maintain steady growth through diversification into breakfast and snack categories while retaining strong performance in traditional meals. Patties continue to see robust demand in foodservice, where restaurants can integrate plant-based alternatives without substantial menu modifications.

Tofu commands a 27.43% market share in 2024, supported by well-established supply chains and strong acceptance in Asian markets where soy-based proteins are integrated into traditional cuisines and daily diets. Its versatility in cooking applications, from stir-fries to desserts, combined with its high protein content and affordable price point, maintains its market leadership position. Additionally, tofu's minimal processing requirements and established manufacturing infrastructure contribute to its cost-effectiveness and widespread availability. Pea protein appeals to consumers with dietary restrictions due to its hypoallergenic and gluten-free properties, while its neutral taste enables broad application across product categories.

Pea protein exhibits the strongest growth trajectory with a 9.54% CAGR through 2030, driven by advancements in protein extraction and processing technologies that improve its functionality and taste. Tempeh presents substantial growth opportunities, offering enhanced digestibility and nutritional benefits through fermentation compared to standard protein isolates. Emerging protein sources, including fava beans and lupins, contribute to addressing sustainability requirements while delivering improved product functionality.

The Global Gluten-Free Meat Substitutes Market is Segmented by Product Type (Burgers, Sausages, Nuggets, Patties, and Other Product Types), by Source (Pea, Tofu, Tempeh, and Other Sources), by Form (Fresh/Chilled, and Frozen), by Distribution Channel (Off-Trade, and On-Trade), and by Geography (North America and More). Market Sizing is Presented in USD Value Terms for all the Abovementioned Segments.

Geography Analysis

North America dominates with a 35.11% market share in 2024, supported by well-established celiac advocacy groups and stringent labeling regulations. The region's retail infrastructure demonstrates significant market penetration, with stores maintaining approximately 150 plant-based product variants per location. Venture capital funding plays a crucial role in the market's development, enabling startups to accelerate product innovation and efficiently bring new offerings to consumers. The strong presence of health-conscious consumers and increasing dietary awareness further reinforces North America's market position.

Asia-Pacific emerges as the fastest-growing region with a 9.37% CAGR through 2030. The market expansion is primarily driven by state climate policies that actively encourage institutional buyers to reduce animal protein consumption. The region's evolving market infrastructure, combined with increasing consumer awareness of health benefits and environmental sustainability, strengthens its industry position. Growing urbanization and rising disposable incomes in key markets contribute to the sustained demand for plant-based alternatives.

Europe maintains its position as the second-largest market, supported by EU investments of EUR 38 million in sustainable protein research and development for 2024. Germany's funding for texture research facilities and retail restrictions in Sweden and the Netherlands contribute to increased plant-based sales. While South America and the Middle East/Africa show initial interest from urban millennials, market expansion depends on competitive pricing and consumer awareness. Public procurement policies and evolving consumer preferences across these regions establish a foundation for future growth.

- Beyond Meat Inc.

- Impossible Foods Inc.

- Conagra Brands, Inc.

- Abbot's Butcher, Inc.

- Maple Leaf Foods Inc.

- Monde Nissin Corporation

- Hain Celestial Group Inc.

- Hodo, Inc.

- Dr. Praeger's Sensible Foods, Inc.

- Amy's Kitchen Inc.

- Tofurky Company Inc.

- NoBull Burger

- The Jackfruit Company

- Gosh! Food Limited

- The Livekindly Company, Inc.

- VFC Foods Ltd

- MyForest Foods Co.

- Switch Foods

- Daring Foods Inc.

- Foods For Tomorrow S.L.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Gluten Intolerance and Celiac Disease Cases

- 4.2.2 Innovations In Product Development and Flavor Enhancement

- 4.2.3 Growing Adoption of Vegan And Vegetarian Diets Drives Growth

- 4.2.4 Increased Availability of Gluten-Free Products In Retail Stores

- 4.2.5 Advancements in Food Processing Technologies Enhances Market Growth

- 4.2.6 Strategic Advertisements and Brand Promotions Boosts Growth

- 4.3 Market Restraints

- 4.3.1 High Production Costs Compared to Conventional Meat Products

- 4.3.2 Perception Challenges Related To Nutritional Value

- 4.3.3 Intense Competition From Traditional Meat Products

- 4.3.4 Limited Consumer Awareness In Emerging Markets

- 4.4 Regulatory Outlook

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Burgers

- 5.1.2 Sausages

- 5.1.3 Nuggets

- 5.1.4 Patties

- 5.1.5 Other Product Types

- 5.2 By Source

- 5.2.1 Pea

- 5.2.2 Tofu

- 5.2.3 Tempeh

- 5.2.4 Other Sources

- 5.3 By Form

- 5.3.1 Fresh/Chilled

- 5.3.2 Frozen

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience Stores

- 5.4.1.3 Online Retail Stores

- 5.4.1.4 Other Distribution Channels

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Spain

- 5.5.2.5 Netherlands

- 5.5.2.6 Italy

- 5.5.2.7 Sweden

- 5.5.2.8 Poland

- 5.5.2.9 Belgium

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Indonesia

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Saudi Arabia

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Beyond Meat Inc.

- 6.4.2 Impossible Foods Inc.

- 6.4.3 Conagra Brands, Inc.

- 6.4.4 Abbot's Butcher, Inc.

- 6.4.5 Maple Leaf Foods Inc.

- 6.4.6 Monde Nissin Corporation

- 6.4.7 Hain Celestial Group Inc.

- 6.4.8 Hodo, Inc.

- 6.4.9 Dr. Praeger's Sensible Foods, Inc.

- 6.4.10 Amy's Kitchen Inc.

- 6.4.11 Tofurky Company Inc.

- 6.4.12 NoBull Burger

- 6.4.13 The Jackfruit Company

- 6.4.14 Gosh! Food Limited

- 6.4.15 The Livekindly Company, Inc.

- 6.4.16 VFC Foods Ltd

- 6.4.17 MyForest Foods Co.

- 6.4.18 Switch Foods

- 6.4.19 Daring Foods Inc.

- 6.4.20 Foods For Tomorrow S.L.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK