PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844480

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844480

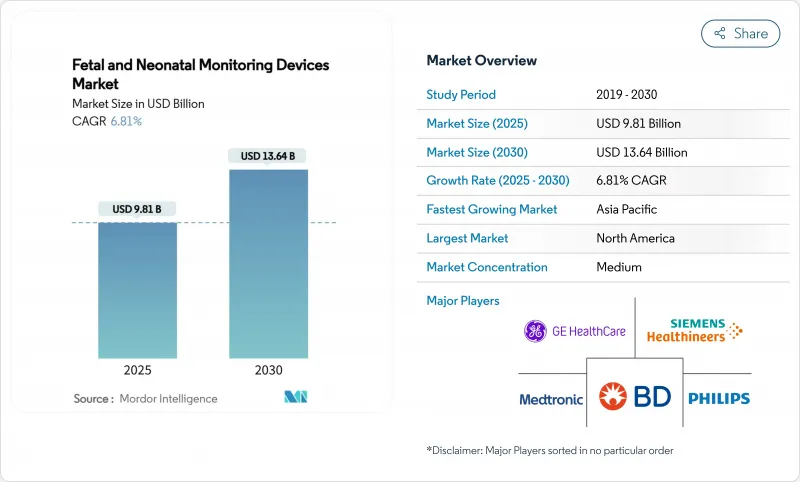

Fetal And Neonatal Monitoring Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The fetal and neonatal monitoring market size is USD 9.81 billion in 2025 and is forecast to reach USD 13.64 billion by 2030, reflecting a 6.81% CAGR over the period.

Demand is propelled by a global rise in pre-term deliveries, the spread of AI-enabled cardiotocography, and steady improvements in hospital and home-care infrastructure. Vendors are shifting from single-function machines to integrated platforms that connect bedside, cloud, and smartphone interfaces, which reshapes price competition and encourages service-based revenue models. Large private hospital chains in Asia-Pacific continue to add neonatal intensive-care beds, while North American health systems focus on remote monitoring programs that shorten average length of stay. At the same time, consumer acceptance of wearable fetal belts is expanding total addressable demand beyond the traditional hospital channel.

Global Fetal And Neonatal Monitoring Devices Market Trends and Insights

Rising Pre-Term & Low-Birth-Weight Deliveries

Pre-term births rose to 10.4% of live births in the United States during 2024, with notable racial disparities. The direct medical cost of care for these infants averaged USD 49,140 in the first year versus USD 13,024 for full-term infants. These figures elevate the fetal and neonatal monitoring market as health systems move from reactive to predictive care models. Hospitals increasingly purchase analytics software that flags pregnancy risk weeks earlier than standard screening. Device makers are partnering with payers to align reimbursements with outcome-based thresholds that reward early detection.

Increasing Penetration of Advanced Intrapartum CTG & Ultrasound

Computerized CTG platforms now reach 94.5% accuracy in identifying fetal head position, reducing reliance on subjective visual interpretation. Integrating maternal pulse data with fetal heart-rate traces cuts neonatal encephalopathy risk by 1.6-fold, which strengthens the clinical case for combined sensors. Vendors embed real-time traffic-light alerts that guide clinicians in high-pressure delivery rooms. Hospitals adopting these systems report shorter decision-to-incision times for emergency Caesarean sections, which reinforces repeat procurement and long-term service contracts within the fetal and neonatal monitoring devices market.

Limited Device Accessibility in Rural LMIC Facilities

Guinea-Bissau's Casa das Maes program reached 94,000 women by 2025, yet many rural posts still lack stable power supply for bedside monitors. Transport delays and patchy mobile networks hinder remote data uploads, restricting tele-monitoring benefits. Donor-funded pilot projects often stall once grant cycles end, leaving facilities with unsupported equipment. The fetal and neonatal monitoring market therefore relies on durable, low-maintenance designs that operate offline and synchronize when network strength permits. Manufacturers responding with solar-charged batteries and multilingual user interfaces gain early mover advantage.

Other drivers and restraints analyzed in the detailed report include:

- Government Maternity-Care Initiatives in Emerging Economies

- Expanding Neonatal-ICU Capacity Across Private Hospital Chains

- Lengthy Device 510(k)/CE Approval Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Neonatal monitoring devices are projected to grow at a 13.25% CAGR, almost double the overall fetal and neonatal monitoring market growth rate, reflecting intensifying clinical focus on first-week outcomes. Cardiac monitors within this category now use contactless imaging photoplethysmography that registers heart rate within -0.2 beats per minute, a leap that lessens skin irritation risk in very-low-birth-weight infants. The fetal and neonatal monitoring market size for neonatal pulse oximeters stood at USD 1.21 billion in 2025 and is forecast to rise to USD 2.09 billion by 2030, buoyed by soft-sensor technologies that avoid adhesive burns. Capnographs integrate CO2 trends with machine-learning alerts that predict apnea episodes before oxygen saturation dips, giving nurses a longer response window. Blood-pressure modules now pair inflatable cuffs with optical sensors, which cuts calibration time and reduces handling stress. Vendors increasingly bundle these sensors with cloud dashboards, creating subscription layers that elevate lifetime revenue per newborn. High-resolution video analytics further merge with standard vitals, allowing early-stage retinopathy surveillance within the same platform and enlarging the neonatal share inside the fetal and neonatal monitoring market.

Fetal monitoring devices retained 66.51% fetal and neonatal monitoring market share in 2024, supported by entrenched cardiotocography protocols across labor wards. AI overlays transform legacy CTG plots into actionable risk indexes, prompting procurement of software upgrades rather than outright hardware replacement. Portable dopplers remain mainstays in resource-constrained clinics due to their low acquisition cost and long battery life. The addition of voice prompts in multiple languages helps new midwives interpret heart-rate variability, which opens new rural sales channels. Demand for integrated ultrasound-CTG workstations is rising among tertiary hospitals seeking single-vendor standardization. As these trends converge, the fetal and neonatal monitoring market maintains a dual-speed profile, where high-end digital suites surge in advanced centers while basic dopplers furnish first-contact care sites.

The Fetal and Neonatal Monitoring Devices Market Report is Segmented by Product (Fetal Monitoring Devices [Heart Rate Monitors, Pulse Oximeters, and More] and Neonatal Monitoring Devices [Cardiac Monitors, Capnographs, and More]), End-User (Hospitals, Neonatal Care Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific is forecast to record an 8.17% CAGR through 2030, the highest regional pace within the fetal and neonatal monitoring market. Governments in India, Indonesia, and Vietnam link maternal-health goals with capital-equipment subsidies, leading public hospitals to standardize on integrated fetal and neonatal suites. Private maternity chains secure bulk-purchase agreements that include multi-year service contracts, while local start-ups provide bilingual user interfaces that accelerate nurse uptake. Urban fertility centers invest in wireless CTG belts that improve patient mobility during labor, adding differentiation in competitive metro markets.

North America retained 32.32% revenue in 2024, sustained by early adoption of AI analytics and strong payer coverage. Hospitals advance "virtual ward" programs that discharge stable premature infants with connected home kits. The fetal and neonatal monitoring market share for North American cloud services is projected to rise as device makers embed subscription fees into extended warranties. Heightened cyber-security mandates push providers toward suppliers with track records in encryption and patch support. Venture capital targets software-first firms, favouring asset-light business models that can scale across state lines without physical warehouse expansion.

Europe shows mid-single-digit growth, underpinned by harmonized Medical Device Regulation that promotes consistent quality standards. Scandinavian health systems pilot outcome-based procurement where suppliers receive bonuses for reduced readmission rates, creating a feedback loop that spurs algorithm refinement. Southern European markets invest EU-funded recovery grants into rural tele-obstetrics, closing urban-rural gaps and spreading the fetal and neonatal monitoring market to previously under-penetrated regions. German insurers compensate midwives for remote fetal monitoring sessions, signalling mainstream reimbursement acceptance.

Middle East and Africa progress along two paths. Gulf Cooperation Council members import top-tier wireless monitors and bundle them with luxury birthing suites, carving a premium niche. Sub-Saharan Africa focuses on solar-powered dopplers and rugged pulse oximeters that can tolerate heat and dust. Development agencies coordinate volume purchases to lower unit costs, gradually enlarging the fetal and neonatal monitoring market across district hospitals. Latin America accelerates digital health adoption, with 82% of surveyed facilities using information and communication technologies for maternal services in 2024.

- GE Healthcare

- Koninklijke Philips

- Medtronic

- Dragerwerk

- Beckton Dickinson

- FUJIFILM

- Siemens Healthineers

- Natus Medical

- The Cooper Companies

- Cardinal Health

- Huntleigh Healthcare Ltd.

- Phoenix Medical Systems Pvt Ltd.

- Nihon Kohden

- Mindray Bio-Medical Electronics

- Atom Medical

- Masimo

- Getinge

- ArjoHuntleigh AB

- EDAN Instruments Inc.

- Spacelabs Healthcare

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Pre-Term & Low-Birth-Weight Deliveries

- 4.2.2 Increasing Penetration Of Advanced Intrapartum CTG & Ultrasound

- 4.2.3 Government Maternity-Care Initiatives In Emerging Economies

- 4.2.4 Expanding Neonatal-ICU Capacity Across Private Hospital Chains

- 4.2.5 AI-Powered Predictive Analytics For Foetal Distress

- 4.2.6 Consumer-Grade Wearable Foetal Monitors Enabling Home Telemetry

- 4.3 Market Restraints

- 4.3.1 Limited Device Accessibility In Rural LMIC Facilities

- 4.3.2 Lengthy Device 510(K)/CE Approval Timelines

- 4.3.3 Cyber-Security Risks In Networked NICU Monitoring

- 4.3.4 Shortage Of Neonatologists & Trained Technicians

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Fetal Monitoring Devices

- 5.1.1.1 Heart Rate Monitors

- 5.1.1.2 Uterine Contraction Monitors

- 5.1.1.3 Pulse Oximeters

- 5.1.1.4 Other Fetal Monitoring Devices

- 5.1.2 Neonatal Monitoring Devices

- 5.1.2.1 Cardiac Monitors

- 5.1.2.2 Capnographs

- 5.1.2.3 Blood Pressure Monitors

- 5.1.2.4 Pulse Oximeters

- 5.1.2.5 Other Neonatal Monitoring Devices

- 5.1.1 Fetal Monitoring Devices

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Neonatal Care Centres

- 5.2.3 Home-care Settings

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE Healthcare

- 6.3.2 Koninklijke Philips N.V.

- 6.3.3 Medtronic plc

- 6.3.4 Dragerwerk AG & Co. KGaA

- 6.3.5 Becton, Dickinson and Company

- 6.3.6 Fujifilm Holdings Corporation

- 6.3.7 Siemens Healthineers

- 6.3.8 Natus Medical Incorporated

- 6.3.9 CooperSurgical Inc.

- 6.3.10 Cardinal Health

- 6.3.11 Huntleigh Healthcare Ltd.

- 6.3.12 Phoenix Medical Systems Pvt Ltd.

- 6.3.13 Nihon Kohden Corporation

- 6.3.14 Mindray Bio-Medical Electronics

- 6.3.15 Atom Medical Corporation

- 6.3.16 Masimo Corporation

- 6.3.17 Getinge AB

- 6.3.18 ArjoHuntleigh AB

- 6.3.19 EDAN Instruments Inc.

- 6.3.20 Spacelabs Healthcare

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment