PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844483

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844483

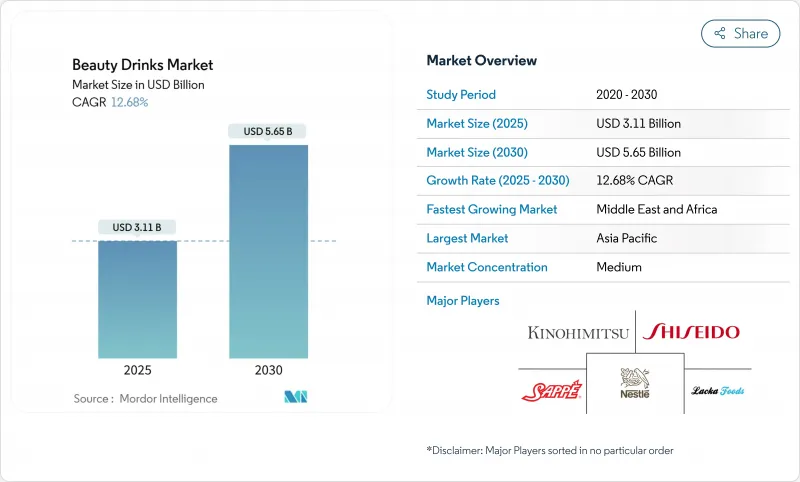

Beauty Drinks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global beauty drinks market size reached USD 3.11 billion in 2025 and is projected to grow to USD 5.65 billion by 2030, at a CAGR of 12.68% during the forecast period.

The market growth is primarily driven by increasing consumer awareness of preventive healthcare measures and a shift from traditional topical applications to ingestible beauty products. The rising aging population in developed countries, coupled with growing concerns about lifestyle-related diseases, has accelerated the adoption of beauty drinks. Additionally, these products have gained significant traction among women seeking to reduce wrinkles and enhance their appearance, with celebrity endorsements further amplifying market growth. n addition to these, the surge of e-commerce platforms has broadened the reach of beauty drinks, allowing brands to engage consumers directly through targeted marketing. Furthermore, the rising inclination towards natural and organic ingredients, coupled with personalized formulations catering to specific health and beauty requirements, is intensifying the demand.

Global Beauty Drinks Market Trends and Insights

Increasing Consumer Focus On Anti-Aging And Inner Wellness Solutions

As populations age and wield greater purchasing power, beauty drinks are witnessing a surge in adoption. Heightened awareness about aging's impact on appearance has spurred demand for functional beverages that promise anti-aging benefits and bolster skin health. The "beauty from within" trend, gaining traction especially among millennials and Gen X, has led to a spike in the consumption of beauty drinks rich in collagen and antioxidants. Consumers' growing preference for holistic wellness is evident in the rising popularity of beauty drinks infused with bioactive ingredients like hyaluronic acid, vitamins, and peptides. According to the World Health Organization, the number of people aged 60 and older worldwide is projected to increase from 1.1 billion in 2023 to 1.4 billion by 2030, further strengthening the market growth potential . This demographic evolution not only broadens the consumer base but also pushes brands to craft innovative formulations targeting specific age-related skin issues. Moreover, with older adults enjoying increased disposable incomes, premium pricing strategies become viable, positioning beauty drinks as a profitable niche in the expansive health and wellness sector.

Expanding Availability of Collagen And Vitamin-Enriched Beauty Beverages

Consumers are increasingly drawn to beauty drinks due to growing evidence supporting their efficacy in improving skin health. According to the National Library of Medicine, collagen supplements can enhance skin properties, including hydration, elasticity, and reduce the visibility of wrinkles .Manufacturers, spurred by scientific validation, are now crafting innovative formulations that blend collagen peptides with vital vitamins, minerals, and bioactive compounds. Market growth is buoyed by notable product launches, including Crushed Tonic's premium marine collagen-infused Korean Broth Beverage, debuting in February 2025. Consumers are increasingly drawn to the convenience of ingesting beauty-boosting nutrients in beverage form, sidestepping traditional supplements or topical applications. This shift resonates especially with those seeking straightforward skincare solutions. Furthermore, as personalized nutrition gains traction, brands are rolling out customizable beauty drinks, fine-tuned to individual skin types and concerns, fostering deeper consumer engagement. The trend also sees a push for natural flavors and transparent, clean-label ingredients, mirroring the beauty and wellness sector's growing emphasis on health-conscious choices and transparency.

High Product Costs Limit Access For Price-Sensitive Consumers

Beauty drinks face a significant market restraint due to their high costs, especially in price-sensitive regions and developing economies. Premium ingredients such as marine collagen, vitamins, antioxidants, and bioactive compounds are pricier than traditional protein sources. Moreover, specialized extraction and processing technologies complicate manufacturing. These heightened production costs lead to steeper retail prices, making beauty drinks a luxury for budget-conscious consumers. This economic sensitivity is especially evident in developing markets, where limited disposable incomes curtail adoption, even amidst a rising interest in wellness products. As a result, many consumers turn to traditional beverages, basic nutritional supplements, or topical products as more affordable alternatives. This creates a tension between the allure of premium ingredient quality and the reality of market accessibility. Furthermore, a lack of widespread consumer education on the long-term benefits of beauty drinks dampens the enthusiasm to invest in these premium products. To navigate these challenges, brands might need to consider cost-effective formulations and tailored pricing strategies to broaden their appeal in emerging markets.

Other drivers and restraints analyzed in the detailed report include:

- Celebrity Endorsements And Influencer Marketing Boosting Brand Credibility

- Shift Toward Preventive Skincare Over Topical Cosmetic Applications

- Lack of Clinical Evidence For Long-Term Beauty Benefit Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Collagen commands a dominant 48.23% share in 2024, bolstered by clinical validations that highlight its hydrolyzed peptides' efficacy in enhancing skin hydration and elasticity. Glutathione, recognized for its antioxidant benefits in promoting cellular health and skin brightness, lacks the extensive clinical backing that collagen enjoys. Nevertheless, glutathione's potential in countering oxidative stress and fostering a luminous complexion has spurred its rising popularity, leading to heightened interest and investment in its scientific exploration. With a growing consumer appetite for natural and effective beauty solutions, both collagen and glutathione are poised to play synergistic roles in the burgeoning beauty drinks market.

The vitamins and minerals segment shows the highest growth potential with a 14.55% CAGR through 2030, driven by consumers seeking comprehensive nutritional solutions. This growth particularly stems from vitamin C's role in collagen synthesis and bioavailability enhancement, while biotin addresses specific hair and nail health requirements, indicating a shift toward more sophisticated, targeted nutritional interventions.

The Beauty Drinks Market Report Segments the Industry by Ingredient Type (Vitamins and Minerals, Collagen, Glutathione, and Other Types), by Functional Benefit (Anti-Ageing, Detoxification, Skin Hydration, Hair and Nail Health, and Others), by Distribution Channel (Specialty Stores, Drug Stores and Pharmacies, Online Retail Stores, and Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds the largest market share at 41.02% in 2024, benefiting from deep-rooted cultural acceptance of functional beverages and well-developed regulatory frameworks. Japan and South Korea stand out as premium market leaders, where consumers readily invest in scientifically validated products. The region's demographic profile, combining an aging population seeking anti-aging solutions with younger consumers adopting preventive beauty approaches, creates a robust market for daily-use beauty drinks.

The Middle East and Africa region demonstrates the highest growth potential with a projected CAGR of 13.83% through 2030. This growth is supported by developing wellness tourism infrastructure and increasing urbanization. South Africa leads the sub-Saharan market with USD 56.9 million in cosmetics imports, showing particular demand for organic and natural beauty drinks. Rising consumer spending power across the region creates new consumer segments seeking convenient wellness solutions.

North America and Europe maintain strong market positions through established nutraceutical awareness and comprehensive regulatory frameworks. These mature markets emphasize transparency in ingredient sourcing and manufacturing processes, particularly favoring clean-label products and sustainable practices. Marine collagen products with environmental credentials receive particular attention, reflecting these regions' focus on both personal wellness and environmental responsibility.

- Nestle SA

- Shiseido Co Ltd (The Collagen)

- Sappe Public Company Ltd

- Kinohimitsu

- Lacka Foods Ltd

- Hangzhou Nutrition Biotechnology Co Ltd

- AmorePacific Corp

- Asterism Healthcare

- Revive Collagen

- Bella Berry

- My Beauty & GO

- Rejuvenated Ltd

- Molecule Beverages

- Big Quark

- On-Group Ltd

- Vital Proteins LLC

- DyDo Drin Co.

- Fine Japan Co. Ltd

- Skinade (Bottled Science Ltd)

- Elasten (Quiris Healthcare)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Consumer Focus on Anti-Aging And Inner Wellness Solutions

- 4.2.2 Rising Demand For Beverages Supporting Skin And Hair Health

- 4.2.3 Expanding Availability of Collagen And Vitamin-Enriched Beauty Beverages

- 4.2.4 Celebrity Endorsements And Influencer Marketing Boosting Brand Credibility

- 4.2.5 Shift Toward Preventive Skincare Over Topical Cosmetic Applications

- 4.2.6 Innovations in Flavors And Formulations Improve Consumer Acceptance

- 4.3 Market Restraints

- 4.3.1 High Product Costs Limit Access For Price-Sensitive Consumers

- 4.3.2 Lack of Clinical Evidence For Long-Term Beauty Benefit Claims

- 4.3.3 Consumer Skepticism Regarding Effectiveness of Ingestible Beauty Solutions

- 4.3.4 Limited Awareness in Developing Economies About Beauty Drinks

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Ingredient Type

- 5.1.1 Vitamins and Minerals

- 5.1.2 Collagen

- 5.1.3 Glutathione

- 5.1.4 Other Types

- 5.2 By Functional Benefit

- 5.2.1 Anti-Ageing

- 5.2.2 Detoxification

- 5.2.3 Skin Hydration

- 5.2.4 Hair and Nail Health

- 5.2.5 Others Functional Benefits

- 5.3 By Distribution Channel

- 5.3.1 Specialty Stores

- 5.3.2 Drug Stores and Pharmacies

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Netherlands

- 5.4.2.6 Italy

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Colombia

- 5.4.4.5 Peru

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Saudi Arabia

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nestle SA

- 6.4.2 Shiseido Co Ltd (The Collagen)

- 6.4.3 Sappe Public Company Ltd

- 6.4.4 Kinohimitsu

- 6.4.5 Lacka Foods Ltd

- 6.4.6 Hangzhou Nutrition Biotechnology Co Ltd

- 6.4.7 AmorePacific Corp

- 6.4.8 Asterism Healthcare

- 6.4.9 Revive Collagen

- 6.4.10 Bella Berry

- 6.4.11 My Beauty & GO

- 6.4.12 Rejuvenated Ltd

- 6.4.13 Molecule Beverages

- 6.4.14 Big Quark

- 6.4.15 On-Group Ltd

- 6.4.16 Vital Proteins LLC

- 6.4.17 DyDo Drin Co.

- 6.4.18 Fine Japan Co. Ltd

- 6.4.19 Skinade (Bottled Science Ltd)

- 6.4.20 Elasten (Quiris Healthcare)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK