PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844487

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844487

Food Coating Ingredients - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

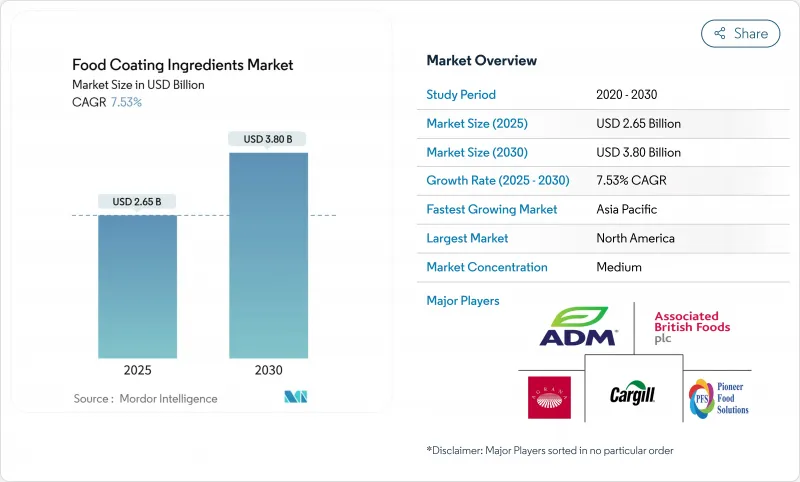

The global food coating ingredients market size is valued at USD 2.65 billion in 2025 and is projected to reach USD 3.80 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.53% during the forecast period.

This growth trajectory reflects the industry's strategic pivot toward functional enhancement and clean-label formulations, driven by evolving consumer preferences and technological advancements in coating application methods. Market dynamics are increasingly influenced by the convergence of regulatory pressures and technological innovation, particularly in antimicrobial coating development. The FDA's recent approval of calcium phosphate and butterfly pea flower extract as color additives, effective June 2025, exemplifies regulatory adaptation to natural ingredient trends . This approval has opened new opportunities for manufacturers to develop innovative coating solutions using natural colorants. The advancement in coating technologies has enabled manufacturers to achieve better adhesion, uniform application, and enhanced functionality. These improvements have led to the development of multi-functional coating ingredients that provide moisture barriers, improved texture, and enhanced nutritional profiles. The industry has also witnessed increased adoption of sustainable coating materials, reflecting the growing environmental consciousness among consumers and manufacturers alike.

Global Food Coating Ingredients Market Trends and Insights

Increasing Demand for Processed and Convenience Foods

The surge in processed and convenience food consumption fundamentally reshapes coating ingredient requirements, with manufacturers prioritizing formulations that maintain product integrity during extended storage and transportation cycles. This trend accelerates in emerging markets where urbanization drives dietary pattern shifts toward packaged foods, creating substantial volume opportunities for coating ingredient suppliers. The convenience food sector's growth directly correlates with coating ingredient innovation, as manufacturers seek solutions that deliver consistent texture, flavor release, and visual appeal across diverse storage conditions. Advanced coating technologies now enable extended shelf life without compromising sensory attributes, addressing the dual challenge of food security and consumer expectations. India's food processing sector exemplifies this transformation, with government initiatives like the Production Linked Incentive Scheme driving capacity expansion and technological adoption .

Expansion of the Bakery, Confectionery, and Snack Food Industries

The bakery and confectionery sector's evolution toward premium and artisanal products creates sophisticated coating ingredient requirements that extend beyond basic preservation to include sensory enhancement and visual differentiation. The surging chocolate market reveals three distinct consumer trends driving coating innovation: intense indulgence focusing on bold flavors, mindful indulgence emphasizing ethical sourcing, and healthy indulgence incorporating functional ingredients. This segmentation forces coating ingredient manufacturers to develop specialized formulations that address each consumer category while maintaining production efficiency. The snack food industry's parallel expansion, particularly in air fryer-compatible products, demands coating ingredients that perform optimally under high-heat, low-oil cooking conditions.

Stringent Regulatory Requirements Related to Additives and Allergens

Regulatory complexity intensifies as global food safety authorities implement increasingly sophisticated testing protocols and documentation requirements for coating ingredients, particularly those containing potential allergens or novel functional compounds. The FDA's comprehensive framework under 21 CFR Parts 170-186 establishes detailed safety evaluation criteria for food additives, requiring extensive toxicological data and manufacturing process validation that can extend product development timelines. FSIS Directive 7120.1's recent updates to approved substances for meat and poultry products demonstrate the ongoing evolution of regulatory requirements, with specific provisions for antimicrobial agents and film-forming compounds that directly impact coating ingredient formulations . Manufacturers must also navigate varying international standards, with some regions maintaining more restrictive policies on certain coating ingredients, limiting global product standardization opportunities.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Coating Application Methods

- Adoption of Clean-Label, Organic, and Plant-Based Ingredients

- Volatility in Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ingredients market segmentation indicates sugars and syrups hold a 35.15% market share in 2024. This dominance stems from their extensive application in confectionery manufacturing and cost-effectiveness. These traditional ingredients maintain their importance in confectionery products by providing essential functions in texture, preservation, and taste. Sugars, including sucrose, glucose, and fructose, serve multiple purposes in confectionery production. They act as bulking agents, enhance shelf life through moisture control, and contribute to the crystallization process in hard candies. Syrups, particularly corn syrup and high-fructose corn syrup, prevent sugar crystallization in soft candies and provide smooth texture in caramels and toffees. The cost-effectiveness of these ingredients is attributed to their widespread availability, established supply chains, and efficient production processes. Additionally, their functional properties in binding, browning reactions, and fermentation make them indispensable in various confectionery applications, from chocolates to gummies and marshmallows.

The cocoa and chocolate segment is projected to grow at a CAGR of 8.15% through 2030. This growth is driven by consumer demand for premium chocolate products, higher disposable incomes, and increased consumption of dark chocolate. Premium chocolate products include single-origin chocolates, organic variants, and specialty flavored bars. The rising health consciousness among consumers has particularly boosted the demand for dark chocolate, which is perceived as a healthier alternative due to its antioxidant properties and lower sugar content. The market expansion is supported by advancements in cocoa processing methods, including improved fermentation techniques, temperature-controlled storage systems, and automated production lines. Additionally, the growth in artisanal chocolate production has introduced diverse flavor profiles and unique product offerings, catering to consumers seeking authentic and high-quality chocolate experiences.

Liquid coatings command 65.12% market share in 2024 and maintain the fastest growth at 9.15% CAGR through 2030, reflecting industry preference for application efficiency and uniform coverage capabilities that reduce material waste while improving product consistency. This dominance stems from liquid coatings' superior penetration characteristics and ability to incorporate heat-sensitive functional ingredients that cannot survive traditional dry coating processes. The liquid segment's growth acceleration reflects technological advances in spray application systems and precision dosing equipment that enable manufacturers to achieve optimal coating thickness with minimal overspray. Dry coatings retain strategic importance in specific applications where moisture sensitivity or extended shelf life requirements favor powder-based formulations, particularly in ambient-stable products destined for emerging markets with limited cold chain infrastructure.

The form segmentation increasingly reflects functional requirements rather than traditional application preferences, with manufacturers selecting coating forms based on specific performance criteria such as adhesion strength, barrier properties, and compatibility with downstream processing steps. Liquid coating innovations include the development of water-based systems that eliminate volatile organic compounds while maintaining application properties, addressing environmental regulations and workplace safety concerns.

The Food Coating Ingredients Market Report Segments the Industry by Ingredient Type (Sugars and Syrups, Cocoa and Chocolate, Fats and Oils, and More), Form (Liquid, Dry), Nature (Conventional, Organic), Application (Bakery and Confectionery Products, Meat and Seafood Products, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds a 42.68% market share in 2024, supported by its advanced food processing infrastructure and regulatory frameworks that promote high-quality coating solutions. Recent FDA approvals of ingredients like calcium phosphate and butterfly pea flower extract as color additives reflect the region's regulatory support for innovation. Strong relationships between coating ingredient manufacturers and food processors facilitate the quick implementation of new formulations and technologies.

Asia-Pacific emerges as the fastest-growing region with 9.96% CAGR through 2030, propelled by the rapid industrialization of food processing sectors and expanding middle-class consumer bases that drive demand for processed and convenience foods. China's food processing industry demonstrates particular strength, with the U.S. ranking as the fourth-largest exporter of consumer-oriented products to China in 2023, indicating substantial import demand for specialized ingredients including coating solutions . The region's growth creates opportunities for coating ingredient suppliers who can adapt formulations to local taste preferences while maintaining international quality standards. Tate & Lyle's launch of an automated laboratory in Singapore for mouthfeel solutions demonstrates multinational commitment to regional innovation capabilities.

Europe maintains a significant market presence through advanced regulatory frameworks and consumer preference for natural and organic ingredients, driving innovation in clean-label coating formulations and sustainable production methods. South America and Middle East & Africa represent emerging opportunities where economic development and urbanization drive processed food consumption, creating demand for coating ingredients that enable shelf-stable products suitable for challenging distribution environments.

- Cargill, Incorporated

- Archer Daniels Midland Company

- Associated British Foods PLC

- Agrana Beteiligungs-AG

- Pioneer Foods

- Cooperatie AVEBE U.A.

- Ingredion Incorporated

- Tate and Lyle PLC

- Kerry Group PLC

- Barry Callebaut AG

- Solina Group

- Dohler GmbH

- Bunge Limited

- McCormick and Company Inc.

- Newly Weds Foods

- Capol GmbH

- Zeelandia Group

- Corbion N.V.

- Griffith Foods

- DSM-Firmenich AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Processed and Convenience Foods

- 4.2.2 Expansion of the Bakery, Confectionery, and Snack Food Industries

- 4.2.3 Technological advancements in coating application methods

- 4.2.4 Adoption of Clean-Label, Organic, and Plant-Based Ingredients

- 4.2.5 Rising Popularity of Frozen, Refrigerated, and Shelf-Stable Products

- 4.2.6 Growing Demand for Functional and Antimicrobial Edible Coatings

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Requirements Related to Additives and Allergens

- 4.3.2 Volatility in Raw Material Prices

- 4.3.3 Rising Competition from Alternative Food Preservation and Processing Methods

- 4.3.4 Limited Shelf Life and Stability of Certain Natural Coating Ingredients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Ingredient Type

- 5.1.1 Sugars and Syrups

- 5.1.2 Cocoa and Chocolate

- 5.1.3 Fats and Oils

- 5.1.4 Salts, Spices and Seasonings

- 5.1.5 Flours and Starches

- 5.1.6 Batter and Crumbs

- 5.1.7 Hydrocolloids

- 5.1.8 Others

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Dry

- 5.3 By Nature

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Application

- 5.4.1 Bakery and Confectionery Products

- 5.4.2 Meat and seafood Products

- 5.4.3 Snacks and Nutritional Bars

- 5.4.4 Dairy Products

- 5.4.5 RTE and RTC Foods

- 5.4.6 Plant-based Meat Alternatives

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cargill, Incorporated

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 Associated British Foods PLC

- 6.4.4 Agrana Beteiligungs-AG

- 6.4.5 Pioneer Foods

- 6.4.6 Cooperatie AVEBE U.A.

- 6.4.7 Ingredion Incorporated

- 6.4.8 Tate and Lyle PLC

- 6.4.9 Kerry Group PLC

- 6.4.10 Barry Callebaut AG

- 6.4.11 Solina Group

- 6.4.12 Dohler GmbH

- 6.4.13 Bunge Limited

- 6.4.14 McCormick and Company Inc.

- 6.4.15 Newly Weds Foods

- 6.4.16 Capol GmbH

- 6.4.17 Zeelandia Group

- 6.4.18 Corbion N.V.

- 6.4.19 Griffith Foods

- 6.4.20 DSM-Firmenich AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK