PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844488

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844488

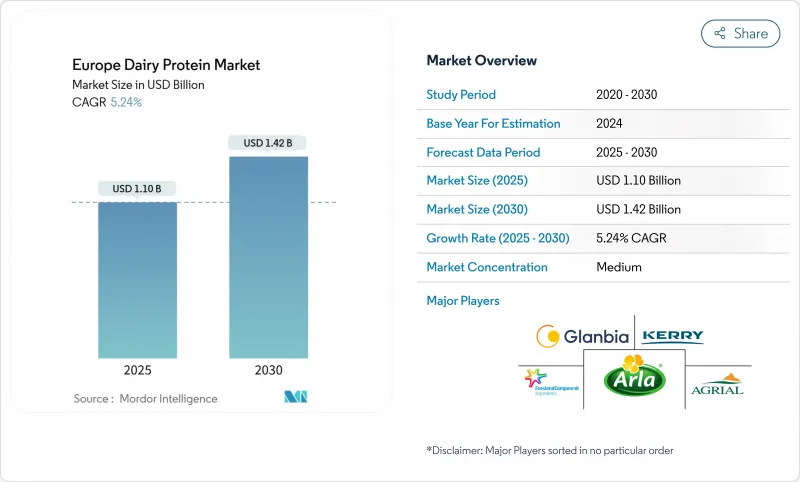

Europe Dairy Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The European Dairy Protein Market is valued at USD 1.10 billion in 2025 and is projected to reach USD 1.42 billion by 2030, registering a CAGR of 5.24% during the forecast period (2025-2030).

The market's expansion is supported by the growing middle-class population and increased consumption of health drinks and protein-based diets. The European dairy industry maintains a strong position in meeting consumer demands for clean labels and convenience in production, while adapting to sustainability initiatives through hybrid formulations that combine dairy and plant proteins. However, the market faces challenges from the growing popularity of plant-based alternatives and increasing instances of lactose intolerance. The industry's response to these challenges includes investment in research and development to improve protein digestibility and reduce allergenicity in dairy products. Additionally, manufacturers are focusing on innovative processing technologies to enhance the functional properties of dairy proteins, making them more suitable for various food applications. European dairy protein producers are also emphasizing transparency in their supply chains and implementing sustainable practices to maintain consumer trust and market competitiveness. Despite the challenges, the market is expected to maintain its growth trajectory, driven by continuous innovation, increasing health consciousness among consumers, and the adaptability of manufacturers to evolving market demands.

Europe Dairy Protein Market Trends and Insights

Rising adoption of high-protein diets among aging europeans

The aging demographic trend in Europe is a significant driver of dairy protein market expansion. Research demonstrates that elderly individuals have increased protein requirements, with the European Food Safety Authority (EFSA) establishing a Population Reference Intake (PRI) of 0.83 g protein/kg body weight per day. The PROT-AGE Study Group, supported by the European Union Geriatric Medicine Society, recommends even higher protein consumption: 1.0-1.2 g per kilogram daily for individuals over 65, and 1.2-1.5 g/kg for those with existing health conditions. According to recent Eurostat data from January 2024, the EU population stands at 449.3 million, with more than one-fifth being 65 years or older. The European Commission has identified sedentary elderly populations as particularly vulnerable to protein deficiency, creating substantial opportunities for protein-fortified dairy products. This demographic shift has prompted dairy manufacturers to develop specialized product lines targeting older consumers' nutritional needs. The increasing awareness of protein's role in maintaining muscle mass and preventing sarcopenia in older adults has further stimulated market growth.

Clean-label demand in infant and clinical nutrition

Clean-label dairy proteins are experiencing increasing demand in the European market, particularly in infant nutrition products. Parents seek products with simple, recognizable ingredients, prompting manufacturers to reformulate with clean-label dairy proteins. The trend also influences clinical nutrition products, where healthcare providers and patients prefer transparent ingredient declarations and natural protein components. The European Commission's regulations on infant formula composition provide specific guidelines for ingredients and additives. With 3.67 million babies born in the European Union in 2023, according to Europe's Fertility Statistics, this substantial infant population drives demand for natural, minimally processed dairy protein ingredients in baby formula and infant nutrition products. Manufacturers are responding to this demand by investing in research and development to create innovative dairy protein formulations that meet both regulatory requirements and consumer preferences for clean-label products. Additionally, the growing awareness of the nutritional benefits of dairy proteins continues to support the expansion of the clean-label dairy protein market in infant nutrition.

Growing popularity of plant-based and vegan alternative proteins

The shift toward plant-based and vegan protein alternatives presents a significant challenge to the dairy protein market. Consumer adoption of vegan and flexitarian diets, especially among younger demographics, has reduced the demand for traditional dairy proteins. This transition is driven by environmental sustainability concerns, animal welfare considerations, and the perceived health advantages of plant-based options. Food manufacturers have responded by developing protein alternatives from soy, pea, and other plant sources. Improvements in plant protein processing technology have enhanced the taste and texture of these alternatives. The increased retail availability and competitive pricing of plant-based proteins create additional pressure on traditional dairy protein products in the European market. This market shift represents a significant restraint for dairy protein manufacturers, requiring them to adapt their strategies to maintain their market position.

Other drivers and restraints analyzed in the detailed report include:

- Growth of hybrid (plant-dairy) formulations

- Rising demand for functional and sports nutrition

- Price fluctuations and raw material volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Whey Protein Concentrates maintain the largest market share at 35.66% in 2024. This dominance stems from their versatility in food applications and cost-effectiveness compared to isolates. The segment's position is strengthened by its integration with cheese production, providing operational efficiencies for dairy processors. Milk Protein Isolates represent the fastest-growing segment with a projected CAGR of 8.23% (2025-2030). This growth is attributed to their superior amino acid profile and functional properties in premium applications. Improvements in filtration and separation technologies have enhanced product quality while reducing production costs for high-purity isolates.

The Casein and Caseinates segment maintains significant market presence, particularly in cheese analogues and processed foods, though with slower growth than whey and milk protein segments. Hydrolyzed proteins are increasing in demand across categories, particularly in clinical nutrition and infant formula applications, due to their enhanced digestibility and reduced allergenicity. The market for hydrolyzed proteins benefits from increasing consumer awareness about protein absorption rates and digestive health. Manufacturers are responding to this trend by expanding their hydrolyzed protein product portfolios and investing in research and development to improve production processes.

Powder formats account for 79.00% of the European dairy protein market in 2024. This dominance is attributed to their longer shelf life, efficient transportation, and versatile applications. The powder segment maintains its market leadership through cost-effective formulation processes and accurate protein concentration control in end products. The Liquid (RTD) segment is expected to grow at a CAGR of 10.40% during 2025-2030, emerging as the fastest-growing format. This growth is driven by increasing consumer demand for convenient, ready-to-consume products, particularly in sports nutrition and functional beverages.

Manufacturers are implementing advanced technologies to overcome protein stability challenges in liquid formats. These innovations enable the production of ready-to-drink beverages with enhanced texture and reduced viscosity at neutral pH. The technological advancements address traditional formulation constraints in ready-to-drink applications, supporting the liquid segment's growth. As technology continues to evolve, liquid formats are gradually expanding their market presence alongside traditional powder formats.

The Europe Dairy Protein Market is Segmented by Ingredient (Milk, Whey, and Casein and Caseinates), Form (Powder and Liquid), Nature (Conventional and Organic), Application (Foods and Beverage, Sports and Performance Nutrition, Infant and Early-Life Nutrition, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Arla Foods amba

- Glanbia plc

- Kerry Group plc

- FrieslandCampina Ingredients

- Agrial Group

- Saputo Inc.

- Lactalis Ingredients

- Fonterra Co-operative Group

- Carbery Group

- Volac International Ltd.

- Hilmar Cheese Company Europe

- Idaho Milk Products

- Milk Specialties Global

- LAITA Group

- Sachsenmilch Leppersdorf GmbH

- Euroserum SAS

- Ornua Ingredients Europe

- Agropur Cooperative

- Milcobel n.v.

- Leprino Foods Company

- Davisco Foods International

- Meggle Group

- Tatura Milk Industries Pty Ltd

- Ingredia SA

- Armor Proteines

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of high-protein diets among aging europeans

- 4.2.2 Clean-label demand in infant and clinical nutrition

- 4.2.3 Growth of hybrid (plant-dairy) formulations driving protein innovation

- 4.2.4 Rising demand for functional and sports nutrition

- 4.2.5 Technological advancements in protein processing

- 4.2.6 Sustainable production practices supporting market growth

- 4.3 Market Restraints

- 4.3.1 Growing popularity of plant-based and vegan alternative proteins

- 4.3.2 Rising lactose intolerance and allergies

- 4.3.3 Price fluctuations and raw material volatility

- 4.3.4 Supply chain disruptions impact european dairy protein market

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Ingredient

- 5.1.1 Milk

- 5.1.1.1 Isolate

- 5.1.1.2 Concentrates

- 5.1.1.3 Hydrolyzed

- 5.1.2 Whey

- 5.1.2.1 Concentrates

- 5.1.2.2 Isolates

- 5.1.2.3 Hydrolyzed

- 5.1.3 Casein and Caseinates

- 5.1.1 Milk

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Nature

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Application

- 5.4.1 Food and Beverage

- 5.4.1.1 Bakery and Confectionery

- 5.4.1.2 Dairy Products and Desserts

- 5.4.1.3 Beverages

- 5.4.2 Sports and Performance Nutrition

- 5.4.3 Infant and Early-Life Nutrition

- 5.4.4 Elderly Nutrition and Medical Nutrition

- 5.4.5 Other Applications

- 5.4.1 Food and Beverage

- 5.5 Geography

- 5.5.1 Germany

- 5.5.2 France

- 5.5.3 United Kingdom

- 5.5.4 Spain

- 5.5.5 Netherlands

- 5.5.6 Italy

- 5.5.7 Sweden

- 5.5.8 Poland

- 5.5.9 Belgium

- 5.5.10 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Arla Foods amba

- 6.4.2 Glanbia plc

- 6.4.3 Kerry Group plc

- 6.4.4 FrieslandCampina Ingredients

- 6.4.5 Agrial Group

- 6.4.6 Saputo Inc.

- 6.4.7 Lactalis Ingredients

- 6.4.8 Fonterra Co-operative Group

- 6.4.9 Carbery Group

- 6.4.10 Volac International Ltd.

- 6.4.11 Hilmar Cheese Company Europe

- 6.4.12 Idaho Milk Products

- 6.4.13 Milk Specialties Global

- 6.4.14 LAITA Group

- 6.4.15 Sachsenmilch Leppersdorf GmbH

- 6.4.16 Euroserum SAS

- 6.4.17 Ornua Ingredients Europe

- 6.4.18 Agropur Cooperative

- 6.4.19 Milcobel n.v.

- 6.4.20 Leprino Foods Company

- 6.4.21 Davisco Foods International

- 6.4.22 Meggle Group

- 6.4.23 Tatura Milk Industries Pty Ltd

- 6.4.24 Ingredia SA

- 6.4.25 Armor Proteines

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK