PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844494

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844494

China Food Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

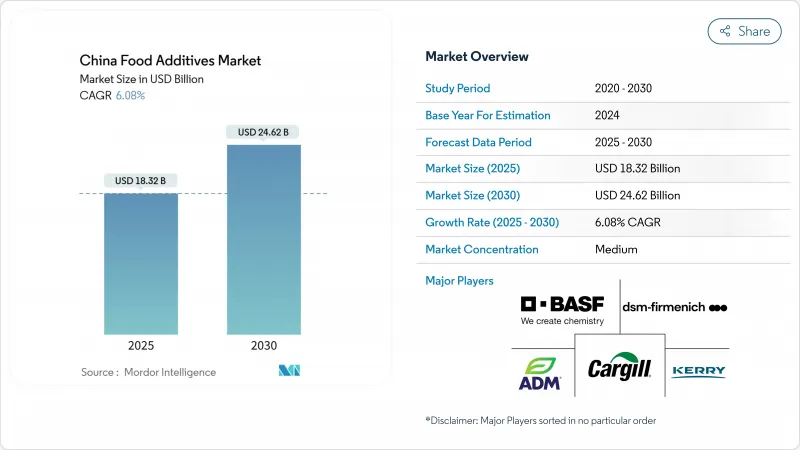

The China food additives market is projected to reach USD 24.62 billion by 2030, advancing at a 6.08% CAGR from USD 18.32 billion in 2025.

Factors such as rapid urbanization, an expanding middle class, and a rising preference for packaged and convenience foods are driving significant changes in purchasing behaviors and spurring innovation in food ingredients. The introduction of GB 2760-2024 in February 2025 has not only redefined classifications and usage limits for additives but has also intensified reformulation efforts across the industry. This regulatory shift underscores the importance of compliance capabilities as a vital competitive edge for market players. Domestic leaders are leveraging their manufacturing scale to maintain dominance, while international suppliers are boosting local production capacities to align with stringent origin-labeling mandates. Additionally, investments from manufacturers are increasingly directed towards advanced technologies such as fermentation and biotechnology. These advancements are enabling the rapid development of natural, clean-label, and functional solutions that cater to the evolving preferences of health-conscious and informed consumers. The market's growth trajectory reflects a dynamic interplay of regulatory changes, technological advancements, and shifting consumer expectations.

China Food Additives Market Trends and Insights

Growing Demand for Shelf Stable and Ready-to-Eat Foods

The growing demand for shelf-stable and ready-to-eat foods is fueling the market growth. This trend is fueled by the increasing urbanization, rising disposable incomes, and changing consumer lifestyles that prioritize convenience. According to the National Bureau of Statistics of China, the urbanization rate in China reached 66.16% in 2023, reflecting a steady increase in urban dwellers who often prefer ready-to-eat food options due to their busy schedules . The shift in dietary habits, particularly among younger consumers, has further amplified the demand for processed and packaged foods. Additionally, the China Food Additives and Ingredients Association (CFAA) has reported a consistent rise in the production and consumption of food additives, driven by the expanding processed food industry. Food additives play a crucial role in enhancing the shelf life, flavor, texture, and nutritional value of ready-to-eat products, making them indispensable in meeting the evolving consumer preferences. These factors collectively contribute to the growing reliance on food additives to support the production of high-quality, convenient food products in the country.

Consumer Inclination Towards Low-Calorie Diet Fuels Sugar Substitutes Additives

The growing consumer preference for low-calorie diets is a key driver in the market, particularly in the sugar substitutes segment. The Chinese government has been actively promoting healthier dietary habits through initiatives such as the "Healthy China 2030" plan, which emphasizes reducing sugar consumption to combat rising obesity and diabetes rates . This initiative aligns with the increasing awareness among consumers about the adverse health effects of excessive sugar intake, further encouraging the shift toward sugar substitutes. Additionally, the China Food Additives & Ingredients Association (CFAA) has reported a steady increase in the production and adoption of sugar substitutes, driven by both consumer demand and regulatory support. The association highlights that advancements in food technology and the introduction of innovative sugar substitute products, such as stevia and erythritol, have also contributed to this growth. These factors are expected to sustain the growth of sugar substitute additives in the forecast period.

Health Concern Associated with Synthetic Sweeteners

Growing health concerns associated with artificial sweeteners is hindering the market growth. These synthetic sweeteners, often used as sugar substitutes, have been linked to various health issues, including metabolic disorders, increased risk of diabetes, and potential long-term effects on gut health. Studies have also suggested that excessive consumption of artificial sweeteners may disrupt the body's natural ability to regulate blood sugar levels, potentially leading to weight gain and other related health complications. Furthermore, there is ongoing debate regarding the carcinogenic potential of certain artificial sweeteners, which has further fueled consumer skepticism. As a result, consumers are becoming increasingly aware of these risks, leading to a shift in preference toward natural sweeteners and clean-label products. This trend is compelling manufacturers to reformulate their products, which could impact the market dynamics and growth potential during the forecast period. Additionally, regulatory scrutiny surrounding the use of artificial sweeteners is intensifying, with authorities imposing stricter guidelines and labeling requirements. These factors collectively pose challenges for the growth of artificial sweeteners within the food additives market in China.

Other drivers and restraints analyzed in the detailed report include:

- Amplifying Demand for Natural and Clean-Label Food Additives

- Adoption of Advanced Technologies Reshaping Food Processing Industry

- Rising Consumer Skepticism Toward Food Additives Influences Market Dynamics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, Bulk Sweeteners secured a dominant 55.25% share of the China food additives market, driven by the country's strong position in MSG and amino acid production. This leadership ensures a stable and consistent demand for bulk sweeteners, particularly in applications such as umami-rich condiments and convenience noodles. These products rely heavily on bulk sweeteners to enhance flavor profiles and meet consumer expectations for taste and affordability. Additionally, the growing popularity of processed and packaged foods in China further supports the demand for bulk sweeteners, as manufacturers seek cost-effective solutions to maintain product quality and appeal.

Food colorants in China's food additives sector are expanding at a notable 7.37% CAGR, fueled by increasing demand from artisanal bakeries and premium confectioners. These businesses are focusing on creating visually appealing, vibrant, and photo-ready products to attract consumers who value aesthetics alongside taste. Government initiatives promoting the use of botanical pigments are further accelerating this growth. Manufacturers are increasingly replacing synthetic colorants, such as tartrazine and sunset yellow, with natural alternatives like gardenia blue and beetroot red. This transition aligns with the rising consumer preference for clean-label products and natural ingredients, as well as the broader trend toward sustainability and health-conscious consumption. The growing adoption of natural food colorants is also supported by advancements in extraction and processing technologies, which ensure consistent quality and stability in food applications.

In 2024, dry forms hold a dominant 67.32% share of the market, reflecting their alignment with China's traditional food processing practices and cost-effectiveness. Their widespread use is attributed to several factors, including their storage stability across China's diverse climate conditions and their compatibility with conventional food processing methods. Dry forms are particularly suited for applications such as seasoning blends, dried food products, and other traditional culinary practices, which continue to play a significant role in the country's food industry.

On the other hand, liquid forms are experiencing a faster growth trajectory, with a projected CAGR of 6.98% through 2030. This growth is driven by the rapid expansion of China's beverage industry and the increasing adoption of automated processing technologies. Liquid forms are gaining traction due to their suitability for Western-style processed foods, which often require liquid-compatible additive systems. Additionally, the growing consumer preference for convenience and ready-to-consume products further supports the rising demand for liquid forms in the market.

The China Food Additives Market Report is Segmented by Product Type (Preservatives, Bulk Sweeteners, Sugar Substitutes, Enzymes and More), Form (Dry, Liquid), Source (Natural, Synthetic), and Application (Bakery and Confectionery, Dairy and Desserts, Beverages, Meat and Meat Products and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Archer Daniels Midland Company

- Cargill, Incorporated

- BASF SE

- DSM-Firmenich AG

- Kerry Group plc

- Corbion N.V.

- International Flavors & Fragrances (IFF)

- Tate & Lyle PLC

- Ajinomoto Co., Inc.

- Ingredion Incorporated

- Angel Yeast Co., Ltd.

- Meihua Holdings Group

- Lonza Group AG

- Novozymes A/S

- Zhucheng Dongxiao Biotech

- Kalsec Inc.

- Fooding Group Limited

- Henan Jinmi MSG

- Tateho Chemical

- Evonik Industries AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Shelf Stable and Ready-to-Eat Foods

- 4.2.2 Consumer Inclination Towards Low-Calorie Diet Fuels Sugar Substitues Additives

- 4.2.3 Amplifying Demand for Natural and Clean-Label Food Additives

- 4.2.4 Adoption of Advanced Technologies Reshaping Food Processing Industry

- 4.2.5 Increasing Consumer Preference for Fortified and Functional Food and Beverages

- 4.2.6 Rise in Traditional Medicine Beverages Using Natural Additives

- 4.3 Market Restraints

- 4.3.1 Health Concerns Assoicated with Synthetic Sweeteners

- 4.3.2 Higher Demand for Fresh and Organic Products

- 4.3.3 Rising Consumer Skepticism Toward Food Additives Influences Market Dynamics

- 4.3.4 Government Regulation and Sugar Tax to Impact the Market Growth

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Preservatives

- 5.1.2 Bulk Sweeteners

- 5.1.3 Sugar Substitutes

- 5.1.4 Emulsifiers

- 5.1.5 Anti-Caking Agents

- 5.1.6 Enzymes

- 5.1.7 Hydrocolloids

- 5.1.8 Food Flavors and Enhancers

- 5.1.9 Food Colorants

- 5.1.10 Acidulants

- 5.2 By Form

- 5.2.1 Dry

- 5.2.2 Liquid

- 5.3 By Source

- 5.3.1 Natural

- 5.3.2 Synthetic

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Dairy and Desserts

- 5.4.3 Beverages

- 5.4.4 Meat and Meat Products

- 5.4.5 Soups, Sauces, and Dressings

- 5.4.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Company Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Archer Daniels Midland Company

- 6.4.2 Cargill, Incorporated

- 6.4.3 BASF SE

- 6.4.4 DSM-Firmenich AG

- 6.4.5 Kerry Group plc

- 6.4.6 Corbion N.V.

- 6.4.7 International Flavors & Fragrances (IFF)

- 6.4.8 Tate & Lyle PLC

- 6.4.9 Ajinomoto Co., Inc.

- 6.4.10 Ingredion Incorporated

- 6.4.11 Angel Yeast Co., Ltd.

- 6.4.12 Meihua Holdings Group

- 6.4.13 Lonza Group AG

- 6.4.14 Novozymes A/S

- 6.4.15 Zhucheng Dongxiao Biotech

- 6.4.16 Kalsec Inc.

- 6.4.17 Fooding Group Limited

- 6.4.18 Henan Jinmi MSG

- 6.4.19 Tateho Chemical

- 6.4.20 Evonik Industries AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK