PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844496

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844496

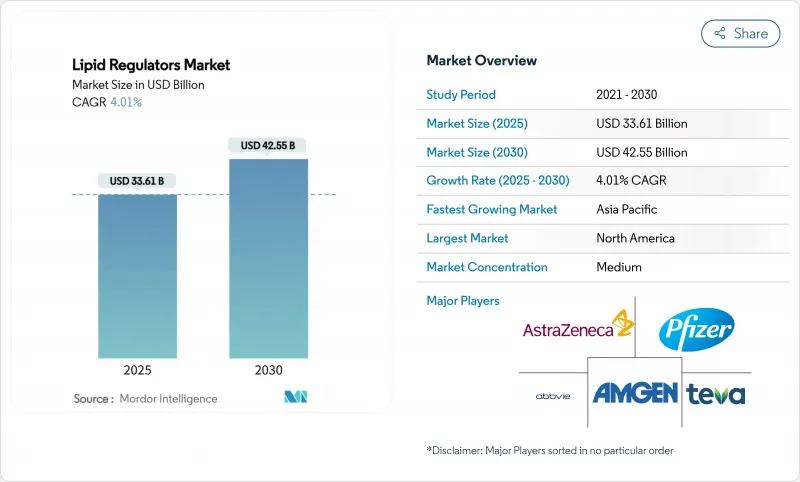

Lipid Regulators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The lipid regulators market size stands at USD 33.61 billion in 2025 and is forecast to advance to USD 42.55 billion by 2030, translating into a 4.01% CAGR.

This controlled expansion follows the post-statin patent-cliff stabilization and reflects the shift toward precision therapeutics such as RNA-interference and oral PCSK9 inhibitors. Demand is underpinned by the escalating global cardiovascular disease burden, where high LDL-cholesterol contributed to 3.81 million deaths in 2021. Growing acceptance of combination therapies, expanding screening initiatives in emerging economies, and payer willingness to reimburse high-risk patients for advanced agents further reinforce momentum. Simultaneously, digital adherence platforms and remote monitoring programs enhance persistence, improving real-world outcomes and supporting steady revenue growth for manufacturers.

Global Lipid Regulators Market Trends and Insights

Escalating Cardiovascular Disease Burden

Cardiovascular disease affects 127.9 million Americans in 2025, with atherosclerotic events driving USD 422.3 billion in annual economic costs. High LDL-cholesterol remains the most modifiable risk factor, producing an addressable global population of more than 1.5 billion adults. Aging demographics in high-income nations and rapid urbanization in Asia combine to push incidence upward. Consequently, healthcare systems intensify focus on preventive lipid control, ensuring the lipid regulators market gains durable volume growth. Multisector partnerships that subsidize screening in community clinics further expand the treated pool and support long-term prescription demand.

Rising Adoption of Combination Lipid-Lowering Therapies

Clinical trials such as TANDEM demonstrated that obicetrapib plus ezetimibe trimmed LDL-cholesterol by 48.6% over placebo. Fixed-dose combinations reduce pill burden and raise adherence, encouraging physicians to initiate dual therapy earlier, especially for familial hypercholesterolemia. Guideline revisions in 2024 introduced LDL-cholesterol targets below 55 mg/dL for very-high-risk patients, accelerating uptake. In response, companies launched products like Nexlizet, winning expanded FDA approval for risk reduction. This shift from stepwise escalation to precision combinations magnifies revenue per treated patient and consolidates brand loyalty in the lipid regulators market.

Intensifying Generic Competition in Statin Segment

Expired patents hand sizeable share to low-cost producers, compressing prices and eroding branded revenue. Many national formularies enforce step-therapy protocols mandating generic statin trials before approving advanced drugs. In emerging markets, aggressive tendering further narrows margins. Manufacturers counter by bundling statins with ezetimibe or bempedoic acid, yet competitive intensity still moderates overall lipid regulators market growth during the forecast window.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in Long-Acting RNAi and Oral PCSK9 Inhibitors

- Increasing Reimbursement Coverage for High-Risk Populations

- High Treatment Costs of Novel Biologics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Statins contributed nearly half of 2024 revenue, yet their growth plateaus under generic commoditization. Fixed-dose combinations such as bempedoic acid plus ezetimibe differentiate through additive efficacy and convenience, cushioning erosion. PCSK9 inhibitors are projected to outpace others with a 6.78% CAGR, driven by mounting cardiovascular outcome evidence and the arrival of self-administered and oral formats. Cholesterol absorption inhibitors maintain relevance as backbone add-on agents. Meanwhile, ATP-citrate-lyase inhibitors gain traction among statin-intolerant populations after the 2024 FDA label expansion. Pipeline entrants targeting lipoprotein(a) could reshape the lipid regulators market size for high-risk genetic subsets once late-stage trials conclude.

Continued R&D investment focuses on oral small molecules and longer-acting injectables that address adherence bottlenecks. Developers emphasize robust endpoint trials, given payer insistence on outcome validation to justify premium costs. As competitor portfolios diversify, cross-class combination strategies proliferate, further boosting average selling prices without compromising tolerability.

Primary hypercholesterolemia remained the anchor cohort, yet hypertriglyceridemia recorded the steepest 6.65% CAGR as clinicians recognize triglycerides' role in residual cardiovascular risk. Familial hypercholesterolemia populations, especially heterozygous variants, gravitate toward RNAi and PCSK9 agents when statins underperform. Secondary prevention after ASCVD events solidifies consistent biologic demand due to stringent guideline targets. Diabetes and obesity prevention segments expand following GLP-1 cardiovascular data, opening cross-selling avenues for lipid-lowering brands.

Precision medicine tools, including polygenic risk scoring, segment patients more finely, informing therapy escalation earlier in the disease continuum. As payers reimburse pharmacogenetic testing, manufacturers tailor educational outreach to physicians, reinforcing guideline-aligned prescribing and elevating lipid regulators market share within high-risk clusters.

The Lipid Regulators Market Report is Segmented by Drug Class (Statins, PCSK9 Inhibitors, and More), Patient Type (Primary Hypercholesterolemia, and More), Route of Administration (Oral, Sub-Cutaneous Injection, and More), Distribution Channel (Hospital Pharmacies, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 43.12% of 2024 revenue, benefitting from broad insurance coverage, mature clinical trial ecosystems, and rapid adoption of digital adherence tools. Strong payer emphasis on outcome-based reimbursement accelerates biologic uptake as long-term cost-offset models gain credibility. Prior authorization complexity still moderates immediate growth, yet streamlined electronic benefit verification systems reduce delays and support stable demand.

Europe follows a value-driven trajectory underpinned by unified EMA approvals and rigorous health technology assessments that reward demonstrable cardiovascular event reduction. Strong generic penetration lowers baseline treatment costs, enabling reinvestment in premium agents for high-risk cohorts. Ongoing post-Brexit regulatory realignment produces temporary launch stagger, but cross-border reference pricing maintains relative affordability and cushions patients from list-price volatility.

Asia-Pacific registers the swiftest 5.43% CAGR, stimulated by rising urban cardiovascular risk, policy-backed screening programs, and expanding middle-class insurance coverage. Local generic statin production ensures baseline access, but affordability gaps for newer agents persist. Evolving regulatory harmonization expedites novel product review, while multinational alliances with domestic firms facilitate market entry. China's Healthy China 2030 agenda and India's Ayushman Bharat scheme are expected to enlarge public funding envelopes for preventive cardiometabolic care, widening the addressable base for premium lipid-lowering therapies.

South America, the Middle East, and Africa witness gradual improvement through donor-supported essential-medicine initiatives. Nevertheless, biologic uptake remains limited by constrained budgets and distribution logistics. Progressive tiered-pricing models and regional manufacturing partnerships are likely prerequisites to meaningful penetration in these territories.

- Abbvie

- Amgen

- AstraZeneca

- Bristol-Myers Squibb

- Merck

- Novartis

- Pfizer

- Sanofi

- Regeneron

- Teva Pharmaceutical Industries

- Daiichi Sankyo

- Esperion Therapeutics

- LIB Therapeutics

- Ionis Pharmaceuticals

- Alnylam Pharmaceuticals

- Novo Nordisk

- CSL Behring

- Viatris

- Dr. Reddy's Laboratories

- Sun Pharmaceuticals Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Cardiovascular Disease Burden

- 4.2.2 Rising Adoption of Combination Lipid-Lowering Therapies

- 4.2.3 Innovation in Long-Acting RNAi and Oral PCSK9 Inhibitors

- 4.2.4 Increasing Reimbursement Coverage for High-Risk Populations

- 4.2.5 Expansion of Preventive Screening Programs

- 4.2.6 Growing Integration of Digital Adherence Tools

- 4.3 Market Restraints

- 4.3.1 Intensifying Generic Competition in Statin Segment

- 4.3.2 High Treatment Costs of Novel Biologics

- 4.3.3 Limited Access In Low- and Middle-Income Countries

- 4.3.4 Manufacturing Complexity of Nucleic Acid Therapies

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Drug Class

- 5.1.1 Statins

- 5.1.1.1 Branded Statins

- 5.1.1.2 Generic Statins

- 5.1.1.3 Fixed-Dose Combinations

- 5.1.2 PCSK9 Inhibitors

- 5.1.2.1 mAbs (Alirocumab, Evolocumab)

- 5.1.2.2 siRNA (Inclisiran)

- 5.1.2.3 Oral Small-Molecule PCSK9i

- 5.1.3 Cholesterol Absorption Inhibitors (Ezetimibe)

- 5.1.4 Bempedoic-acid / ACLY Inhibitors

- 5.1.5 Fibric-acid Derivatives

- 5.1.6 Bile-acid Sequestrants

- 5.1.7 Omega-3 Fatty Acid Derivatives

- 5.1.8 Nicotinic-acid Derivatives

- 5.1.9 Lipoprotein(a) Targeted Agents

- 5.1.1 Statins

- 5.2 By Patient Type

- 5.2.1 Primary Hypercholesterolemia

- 5.2.1.1 Heterozygous FH

- 5.2.1.2 Homozygous FH

- 5.2.2 Mixed Dyslipidemia

- 5.2.3 Hypertriglyceridemia (>=500 mg/dL)

- 5.2.4 ASCVD Secondary Prevention

- 5.2.5 Diabetes / Obesity Preventive Care

- 5.2.1 Primary Hypercholesterolemia

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Sub-cutaneous Injection

- 5.3.3 Intravenous

- 5.3.4 In-vivo Gene Therapy

- 5.4 By Distribution Channel

- 5.4.1 Hospital Pharmacies

- 5.4.2 Retail Pharmacies

- 5.4.3 Online Pharmacies

- 5.4.4 Specialty Clinics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 AbbVie, Inc.

- 6.3.2 Amgen

- 6.3.3 AstraZeneca

- 6.3.4 Bristol-Myers Squibb

- 6.3.5 Merck & Co.

- 6.3.6 Novartis

- 6.3.7 Pfizer, Inc.

- 6.3.8 Sanofi

- 6.3.9 Regeneron

- 6.3.10 Teva Pharmaceutical

- 6.3.11 Daiichi Sankyo

- 6.3.12 Esperion Therapeutics

- 6.3.13 LIB Therapeutics

- 6.3.14 Ionis Pharmaceuticals

- 6.3.15 Alnylam Pharmaceuticals

- 6.3.16 Novo Nordisk

- 6.3.17 CSL Behring

- 6.3.18 Viatris

- 6.3.19 Dr. Reddy's Laboratories

- 6.3.20 Sun Pharma

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment