PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844498

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844498

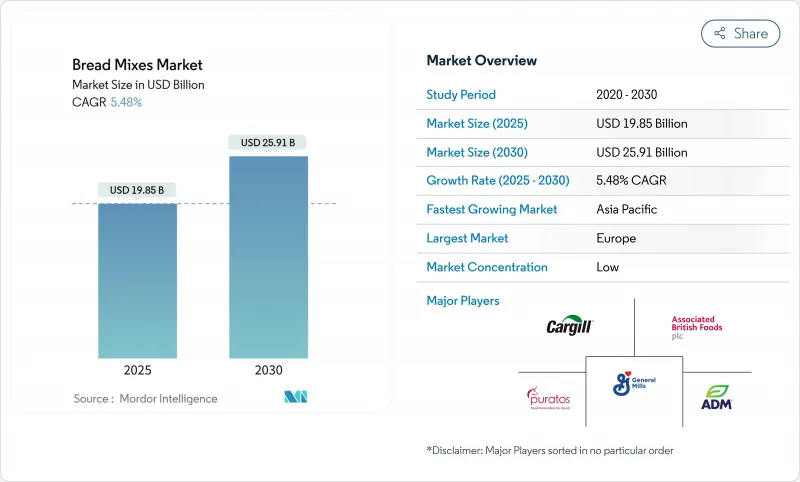

Bread Mixes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bread mixes market, valued at USD 19.85 billion in 2025, is projected to grow to USD 25.91 billion by 2030, marking a steady CAGR of 5.48%.

This growth is largely driven by consumers' heightened emphasis on health, clean-label ingredients, and convenient meal solutions. In response, product developers are rolling out gluten-free, organic, and protein-enriched variants. These not only mimic artisanal textures but also reduce preparation times. With clearer regulations on gluten-free labeling and organic certifications, there's a surge in investments towards specialized production lines. Meanwhile, social media's influence has bolstered the home-baking trend, expanding the market's consumer base. Digitalization in supply chains, coupled with cutting-edge mixing technologies, has enhanced consistency. This advancement aids producers in maintaining their margins, even amidst fluctuations in raw material prices. The market's competitive landscape is bustling, with regional specialists, direct-to-consumer newcomers, and established food giants all vying for a slice of the bread mixes pie.

Global Bread Mixes Market Trends and Insights

Growing popularity of home baking

Home baking's resurgence has reshaped consumer buying habits, elevating bread mixes from mere conveniences to essential pantry staples. This shift, which took off during the pandemic, now resonates with evolving lifestyle choices that prioritize experiential cooking and family bonding. Data from the National Agricultural Statistics Service underscores this trend, showing a notable uptick in wheat flour consumption at retail outlets, a testament to the home baking boom in American homes. The U.S. Department of Agriculture reports that per capita wheat flour consumption in the U.S. hit over 130.5 pounds in 2023, a rise from 129.4 pounds in 2020, signaling a growing appetite. Today's consumers, moving beyond mere convenience, are on the lookout for products that not only hone their baking skills but also guarantee top-notch results. Social media has played a pivotal role in this baking renaissance, cultivating lively communities that celebrate home baking milestones. These platforms have heightened the demand for visually appealing, Instagram-ready bread types, a demand that traditional bread mixes are adeptly meeting with their innovative formulations.

Increasing demand for convenient baking solutions

Time-pressed consumers are increasingly seeking products that deliver artisanal-quality results without requiring extensive expertise or lengthy preparation. This trend has prompted manufacturers to focus on innovations in packaging formats, simplified mixing instructions, and ingredient pre-treatment methods. Dual-income households and urban professionals, in particular, find these solutions appealing as they aspire to enjoy the experience of homemade bread but often lack the time or traditional baking skills. According to Statistics South Korea, in 2023, approximately 48.2% of households in South Korea were dual-earner families, reflecting a slight increase from 46.1% in 2022. To meet these evolving consumer needs, manufacturers are adopting advanced processing technologies. For instance, high-pressure hydration systems enhance the hydration process by increasing the surface area of dry ingredients, enabling faster and more uniform mixing. By integrating such innovations, the industry is successfully bridging the gap between convenience and quality, addressing the shifting preferences of modern consumers and reinforcing its commitment to delivering value through technological advancements.

Competition from alternative carbohydrate foods

The growing popularity of low-carbohydrate and ketogenic diets has significantly impacted traditional bread consumption patterns. Consumers are increasingly opting for alternatives such as cauliflower-based products, almond flour, and other low-carbohydrate options. This trend reflects a broader shift toward health-conscious eating, where traditional wheat-based products are perceived as less desirable, even when they offer convenience. USDA dietary intake data highlights a persistent gap between actual consumption and federal dietary recommendations, particularly in whole grain intake. This suggests that even bread mixes marketed as health-focused face challenges due to these fundamental changes in dietary habits. Furthermore, the shift goes beyond direct substitution; it reflects evolving meal composition preferences. Consumers are increasingly favoring protein-rich or vegetable-forward meals, leading to a noticeable decline in overall bread consumption.

Other drivers and restraints analyzed in the detailed report include:

- Rising demand for gluten-free and clean-label bread mixes

- Growth of foodservice and artisan bakery sectors

- Fluctuating raw material costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, conventional wheat-based formulations command a dominant 62.42% market share, capitalizing on established taste preferences, cost efficiency, and reliable baking performance across various applications. This segment's stronghold is a testament to decades of product development and a deep-rooted consumer familiarity with wheat-based bread. According to USDA wheat outlook data, U.S. wheat production is poised to hit an 8-year high, bolstering the availability and cost competitiveness of raw materials for these conventional formulations. Moreover, ongoing technological advancements in wheat processing and milling are not only elevating product quality but also ensuring cost efficiency, allowing conventional wheat products to stand their ground against specialty alternatives.

Meanwhile, gluten-free alternatives are on a rapid ascent, boasting a 7.56% CAGR growth rate projected through 2030. This surge is buoyed by clearer regulatory guidelines on gluten-free labeling and a growing public awareness of celiac disease and gluten sensitivities. The swift rise of the gluten-free segment underscores its dual appeal: a medical imperative for those with celiac disease and a lifestyle choice for many others. The FDA's enforcement of a 20 parts per million gluten threshold offers manufacturers a clear compliance benchmark, simultaneously bolstering consumer trust in product claims. Furthermore, innovations in processing-like advanced ingredient treatments and specialized mixing techniques-are enabling gluten-free products to closely mimic the taste and texture of their traditional wheat counterparts.

The Global Bread Mixes Market Report Segments the Industry by Nature (Organic, Conventional); Product Type (Conventional Wheat-Based, Whole Grain and Multigrain, Gluten Free, and More); Application (Food Processing Industry, Foodservice (HoReCa), Retail/Household Use); and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Europe commands a 31.64% share of the market, underscoring its rich baking traditions and a discerning consumer base that prioritizes quality and authenticity over mere price. By 2030, Europe's growth is bolstered by regulatory frameworks championing premium positioning, especially in organic certification and clean-label mandates, resonating with consumers' demand for ingredient transparency. European consumers are willing to pay a premium for specialized formulations, paving the way for innovations in gluten-free, organic, and artisanal products. Furthermore, Europe's well-established retail infrastructure and distribution channels offer a competitive edge to both domestic and international manufacturers targeting affluent consumers.

Asia-Pacific is on track to be the fastest-growing region, boasting a 6.36% CAGR through 2030, driven by economic and cultural shifts leaning towards convenience foods and Western dietary habits. With rapid urbanization, there's a burgeoning demand for products that simplify home baking, especially among younger consumers who cherish experiential cooking and social media moments. Rising disposable incomes in markets like China, India, and Southeast Asia are fueling the adoption of premium products, further supported by an expanding retail infrastructure. Given the region's currently low penetration rates, there's a vast potential for growth as consumer awareness and distribution networks evolve.

North America stands as a mature market, characterized by established consumption patterns and a competitive landscape that prioritizes innovation and brand differentiation. The foodservice sector remains robust, highlighted by General Mills' 8% growth in foodservice net sales in Q2 of fiscal 2025, underscoring a steady demand for dependable baking solutions. As consumers increasingly gravitate towards clean-label and organic products, regulatory clarity on labeling and broader retail distribution channels bolster this trend. Moreover, North America's prowess in food processing innovation not only benefits domestic manufacturers but also opens doors for exports, especially with USDA data showcasing enhanced wheat price competitiveness.

- General Mills, Inc

- Archer Daniels Midland Company

- Cargill, Incorporated

- Puratos Group

- Associated British Foods Plc

- The Krusteaz Company

- Corbion N.V

- Lesaffre

- Bakels Group

- Dawn Food Products, Inc.

- King Arthur Baking Company, Inc.

- Bob's Red Mill Natural Foods, Inc.

- Simple Mills, Inc.

- Koninklijke Zeelandia Groep B.V.

- Angel Yeast Co., Ltd.

- Oy Karl Fazer Ab

- Laucke Flour Mills Pty Ltd

- International Flavors & Fragrances Inc. (Frutarom)

- TCHO Ventures, Inc.

- Grupo Bimbo, S.A.B. de C.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing popularity of home baking

- 4.2.2 Increasing demand for convenient baking solutions

- 4.2.3 Rising demand for gluten-free and clean-label bread mixes

- 4.2.4 Growth of foodservice and artisan bakery sectors

- 4.2.5 Technological advancements in bread mix formulations

- 4.2.6 Widening adoption of plant-based and vegan bread mixes

- 4.3 Market Restraints

- 4.3.1 Competition from alternative carbohydrate foods

- 4.3.2 Price competition and low profit margins

- 4.3.3 Competition from local bakeries and ready-to-eat bread products

- 4.3.4 Fluctuating raw material costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE IN USD Mn)

- 5.1 By Product Type

- 5.1.1 Conventional Wheat-based

- 5.1.2 Whole Grain and Multigrain

- 5.1.3 Gluten Free

- 5.1.4 Functional and High Protein

- 5.2 By Nature

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Application

- 5.3.1 Food Processing Industry

- 5.3.2 Foodservice (HoReCa)

- 5.3.3 Retail/Household Use

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Colombia

- 5.4.2.4 Chile

- 5.4.2.5 Peru

- 5.4.2.6 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Netherlands

- 5.4.3.6 Poland

- 5.4.3.7 Belgium

- 5.4.3.8 Sweden

- 5.4.3.9 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 Indonesia

- 5.4.4.6 South Korea

- 5.4.4.7 Thailand

- 5.4.4.8 Singapore

- 5.4.4.9 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 General Mills, Inc

- 6.4.2 Archer Daniels Midland Company

- 6.4.3 Cargill, Incorporated

- 6.4.4 Puratos Group

- 6.4.5 Associated British Foods Plc

- 6.4.6 The Krusteaz Company

- 6.4.7 Corbion N.V

- 6.4.8 Lesaffre

- 6.4.9 Bakels Group

- 6.4.10 Dawn Food Products, Inc.

- 6.4.11 King Arthur Baking Company, Inc.

- 6.4.12 Bob's Red Mill Natural Foods, Inc.

- 6.4.13 Simple Mills, Inc.

- 6.4.14 Koninklijke Zeelandia Groep B.V.

- 6.4.15 Angel Yeast Co., Ltd.

- 6.4.16 Oy Karl Fazer Ab

- 6.4.17 Laucke Flour Mills Pty Ltd

- 6.4.18 International Flavors & Fragrances Inc. (Frutarom)

- 6.4.19 TCHO Ventures, Inc.

- 6.4.20 Grupo Bimbo, S.A.B. de C.V.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK