PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844501

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844501

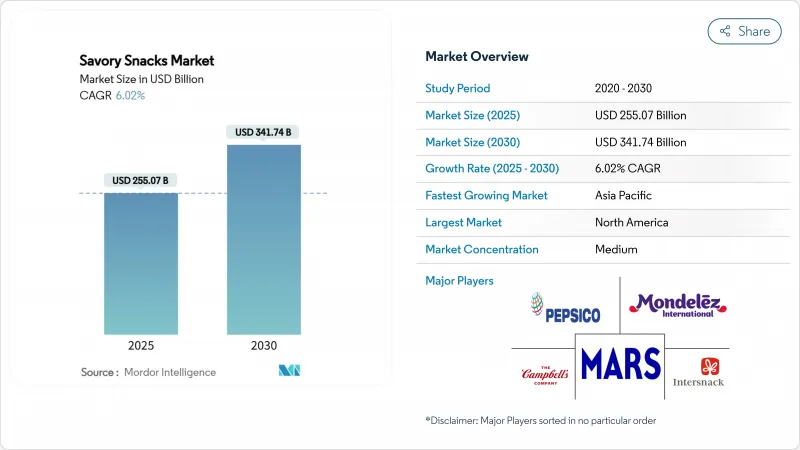

Savory Snacks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The savory snacks market size is projected to be valued at USD 255.07 billion in 2025 and is expected to grow to USD 341.74 billion by 2030, registering a CAGR of 6.02%.

Snacking's growing popularity is reshaping eating habits: children snack more frequently, and adults increasingly replace traditional meals with snacks. Protein-based snacks are redefining traditional categories, while globally inspired flavors are gaining traction. Health-conscious consumers are driving demand for snacks catering to specific dietary needs. Premium offerings and ethnic-fusion flavors are boosting profit margins and attracting diverse consumers. Digital shopping, especially in urban Asia-Pacific, is fueling market growth as online platforms capture more grocery sales. The savory snacks market is moderately concentrated, with leading brands leveraging economies of scale, while smaller firms compete effectively in niches like functional and free-from snacks.

Global Savory Snacks Market Trends and Insights

Changing consumer lifestyles and snacking habits

Modern lifestyles are shifting, with busier schedules, more screen time, and irregular eating habits becoming common. Many now prefer smaller portions throughout the day over traditional meals, driving demand for savory snacks that are satisfying and flavorful. A 2024 Mondelez survey revealed snack consumption now matches traditional meals, with 91% of respondents eating at least one snack daily . Among millennials, snacks are increasingly replacing main meals. Consumers also seek variety, focusing on unique flavors, healthier options, and innovative formats. For instance, in 2024, ITC launched "Bingo! Starters" in India, offering oven-baked snacks for health-conscious millennials. Similarly, U.S.-based HIPPEAS expanded its organic chickpea puff range with globally inspired flavors like Sriracha Sunshine and Thai Chili, catering to the demand for diverse snack choices.

Cross-cultural palate expansion powering ethnic-fusion flavor innovation globally

Gen Z and millennials are reshaping the savory snacks market with their preference for bold, global flavors like Korean gochujang, Mexican salsa verde, and Indian masala. Brands are responding with internationally inspired and localized options, such as ketchup-flavored chips in Canada and tangy tomato crisps in India, to cater to local tastes. Social media trends, including flavor fusions like "swicy" (sweet and spicy), are driving faster product launches. In 2024, Frito-Lay introduced the limited-edition "Lay's Flamin' Hot Dill Pickle" in the U.S., which gained online popularity. Similarly, U.K.-based Made for Drink tapped into niche trends with bar snacks featuring Turkish chili and Spanish paprika.

Intensifying competition from protein bars and meal-replacements

The savory snacks market is facing growing competition from the expanding protein bar and meal-replacement segments, targeting health-conscious, convenience-seeking consumers. Busy professionals, fitness enthusiasts, and millennials with active lifestyles increasingly prefer protein bars, ready-to-drink shakes, and fortified snacks. These products offer balanced nutrition, prolonged satiety, and health benefits in a portable format. Unlike traditional savory snacks, often high in salt and processed ingredients, these alternatives are marketed as healthier, guilt-free options. Brands like Quest, RXBAR, and Huel are growing rapidly with clean-label products featuring low sugar, added vitamins, and functional ingredients like adaptogens, appealing to wellness-focused consumers. To stay competitive, snack manufacturers must innovate with fortified or hybrid snacks that combine health benefits with taste or risk losing market share in the functional snacking category.

Other drivers and restraints analyzed in the detailed report include:

- Health-driven consumers fueling growth of functional and fortified savory snacks

- Rising taste for gourmet experiences driving demand for premium and artisanal snack formats

- Crop and supply chain disruptions elevating snack production costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chips and crisp-based snacks continue to dominate the savory snacks market with a share of 37.38% in 2024, but their growth rate is slower compared to nuts, seeds, and trail mixes, which are growing at a segment CAGR of 6.72%. Today's consumers, especially Gen-Z, are opting for snacks like trail mixes, pretzels, and chips, but they're not just chasing empty calories. They seek value in their snacks. Gen-Z, in particular, gravitates towards health-inspired ingredients, bold flavors, and natural origins. This trend underscores a broader sentiment: consumers want to feel good about their food choices. Smaller brands are using contract manufacturing to test innovative products like salmon jerky or cricket-based puffs in specialty retail stores. This approach allows them to gauge consumer interest before committing to large-scale production. These novel protein snacks are carving out a niche in the market, appealing to health-conscious and adventurous consumers.

Within the chips category, products made from root vegetables and pulses are gaining popularity as they offer higher protein and fiber content, allowing manufacturers to charge premium prices. Extruded snacks are also evolving, with options now including probiotics or pea protein, combining health benefits with the familiar crunchy texture. Popcorn remains a strong performer, benefiting from portion-controlled packaging and its whole-grain appeal, which aligns with weight-management trends. As the demand for functional and protein-rich snacks increases, these emerging products are likely to gain more traction, further diversifying the savory snacks market.

Flavored lines occupy the largest market share of 74.48% also growing with the fastest CAGR of 6.89%, aided by social media virality and rising spice tolerance among Gen Z. Korean gochujang, Mexican chipotle-lime, and Indian masala profiles now appear in mainstream supermarket aisles, supported by encapsulation technologies that stabilize volatile spice oils during high-temperature frying. The savory snacks market share captured by flavored offerings also benefits from premium price tags, often 10-15% above classic salted, funding ongoing R&D in layered seasoning and dual-chamber packaging that separates wet sauces from dry bases until consumption. Manufacturers that synchronize limited-time drops with influencer campaigns can compress concept-to-launch cycles to as little as 90 days, outpacing slower classic-salted refresh rates and enlarging brand footprints across multiple consumption occasions.

Classic salted and plain variants continue to anchor volume because of their broad palate appeal, low formulation complexity, and suitability for price-sensitive shoppers. Retailers favor these SKUs for end-cap displays and multipacks that drive household penetration, while manufacturers appreciate their longer shelf life and simpler supply chains. Yet consumer desire for novelty has pushed even traditionalists to rotate limited-edition salts-Himalayan pink or smoked sea salt-keeping the base segment contemporary without altering taste fundamentals.

The Savory Snacks Market Report is Segmented by Product Type (Pretzels, Popcorn Snacks, and More), Flavor Profile (Classic Salted/Plain and Flavored), Category (Conventional and Free-Form), Distribution Channel (Supermarkets/Hypermarkets, Online Retailers and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominates the savory snacks market with a 37.40% share, supported by robust research and development capabilities. The region shows growth in premium and functional snack products, offsetting slower unit sales growth. The United States market expansion stems from changes in consumer behavior, lifestyle patterns, and dietary preferences. American consumers' fast-paced lifestyles have increased demand for convenient, portable snacks that serve as meal replacements.

Asia-Pacific demonstrates the highest growth rate at 8.08%, driven by urbanization, a young population base, and rising disposable incomes, which increase demand for convenient snacks. Regional manufacturers are enhancing production capabilities to meet international standards. India shows significant growth through expanded modern retail presence and affordable small-pack formats. The region's shift toward ready-to-eat products further strengthens savory snack demand.

The Middle East and Africa market benefits from high per-capita incomes and increasing Western snack brand adoption. GCC countries import over 40% of their snack foods, creating opportunities for companies that offer halal-compliant products aligned with local preferences. Government investment in hypermarkets improves product accessibility and quality. Premium and innovative snack demand contributes to market expansion. Europe maintains its innovation leadership, as consumers incorporate snacks into regular diets and between-meal consumption. South America gains market share through localized flavors and competitive pricing strategies. The region faces challenges from economic instability and currency fluctuations. Global companies address these challenges through diversified sourcing and flexible pricing approaches to maintain market growth across regions.

- PepsiCo, Inc.

- Mars Inc.

- Mondelez International, Inc.

- General Mills, Inc.

- Conagra Brands, Inc.

- Calbee, Inc.

- ITC Limited

- Guiltfree Industries Limited

- Blue Diamond Growers

- Link Snacks, Inc.

- Intersnack Group

- The Campbell's Company

- The Hershey Company

- Balaji Wafers Private Limited

- Grupo Bimbo S.A.B. de C.V.

- Nestle S.A.

- American Pop Corn Company

- Herr Foods Inc

- Simply Good Foods Co.

- Poppin' Z's Gourmet Popcorn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Changing Consumer Lifestyles and Snacking habits

- 4.2.2 Cross-Cultural Palate Expansion Powering Ethnic-Fusion Flavor Innovation Globally

- 4.2.3 Health-Driven Consumers Fueling Growth of Functional and Fortified Savory Snacks

- 4.2.4 Rising Taste for Gourmet Experiences Driving Demand for Premium and Artisanal Snack Formats

- 4.2.5 Youth and Gen Z Consumption Patterns

- 4.2.6 Premiumization and Sustainability Trends

- 4.3 Market Restraints

- 4.3.1 Stricter Sodium-Reduction Mandates Redefining Recipe Reformulations

- 4.3.2 Intensifying Competition from Protein Bars and Meal-Replacements

- 4.3.3 Crop and Supply Chain Disruptions Elevating Snack Production Costs

- 4.3.4 Health Concerns Around High Salt and Fat Content

- 4.4 Regulatory Framework

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Chips and Crisp- Based Snacks

- 5.1.1.1 Potato Chips

- 5.1.1.2 Tortilla and Corn Chips

- 5.1.1.3 Rice and Pulse-Based Chips

- 5.1.1.4 Multigrain Chips

- 5.1.1.5 Cheese and Dairy-Based Chips

- 5.1.1.6 Seaweed and Marine-Based Crisps

- 5.1.2 Nuts, Seeds and Trail Mixes

- 5.1.3 Pretzels

- 5.1.4 Popcorn Snacks

- 5.1.5 Meat and Jerky Snacks

- 5.1.6 Extruded and Puffed Snacks

- 5.1.7 Other Product Types

- 5.1.1 Chips and Crisp- Based Snacks

- 5.2 By Flavor Profile

- 5.2.1 Classic Salted/Plain

- 5.2.2 Flavored

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Free-Form

- 5.4 By Distribution Channel

- 5.4.1 Supermarket/Hypermarket

- 5.4.2 Convenience and Grocery Stores

- 5.4.3 Online Retailers

- 5.4.4 Others Distribution Channel

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PepsiCo, Inc.

- 6.4.2 Mars Inc.

- 6.4.3 Mondelez International, Inc.

- 6.4.4 General Mills, Inc.

- 6.4.5 Conagra Brands, Inc.

- 6.4.6 Calbee, Inc.

- 6.4.7 ITC Limited

- 6.4.8 Guiltfree Industries Limited

- 6.4.9 Blue Diamond Growers

- 6.4.10 Link Snacks, Inc.

- 6.4.11 Intersnack Group

- 6.4.12 The Campbell's Company

- 6.4.13 The Hershey Company

- 6.4.14 Balaji Wafers Private Limited

- 6.4.15 Grupo Bimbo S.A.B. de C.V.

- 6.4.16 Nestle S.A.

- 6.4.17 American Pop Corn Company

- 6.4.18 Herr Foods Inc

- 6.4.19 Simply Good Foods Co.

- 6.4.20 Poppin' Z's Gourmet Popcorn

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK