PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844508

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844508

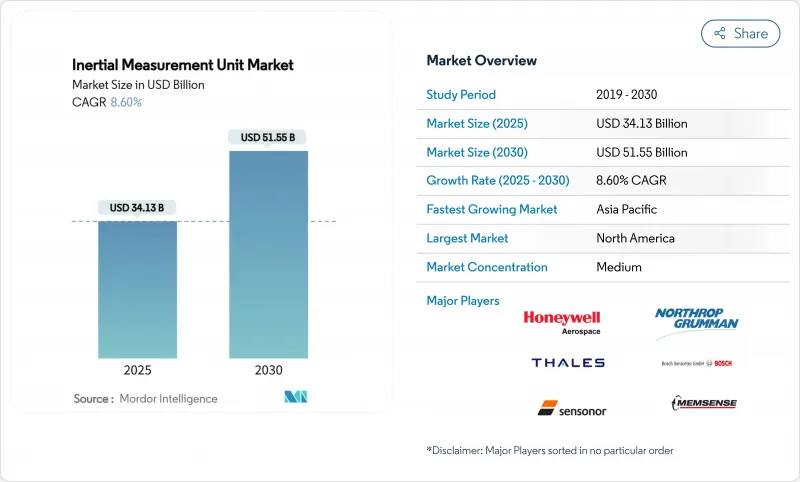

Inertial Measurement Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The inertial measurement unit market size stood at USD 34.13 billion in 2025 and is forecast to reach USD 51.55 billion by 2030, reflecting an 8.60% CAGR.

Demand gains stem from hybrid quantum-MEMS sensor fusion, which is reshaping precision navigation for defines, aerospace, and autonomous platforms. Boeing validated this shift when its 2024 flight test of a quantum IMU cut unaided-GPS navigation error from tens of kilometres to tens of meters. Escalating geopolitical risk, the spread of unmanned systems, and the maturity of quantum photonics all reinforce the near-term growth outlook for the inertial measurement unit market. Consumer pull is equally strong. China shipped 494,000 smart-glass units in Q1 2025, up 116.1% year over year, signalling record demand for low-cost six-axis sensors that balance accuracy and battery life. Maritime, mining, and LNG operators are adding tactical-grade MEMS IMUs to meet sub-degree dynamic-positioning tolerances, widening the addressable base for the inertial measurement unit market.

Global Inertial Measurement Unit Market Trends and Insights

Accelerated deployment of counter-UAS platforms amid Middle East drone incursions

Low-cost drones now outnumber legacy air defenses across several Middle East theatres. Nordic Air Defence's Kreuger 100 interceptor relies on a simplified IMU-only flight computer, reaches 270 km/h, and cuts unit costs for swarm engagements. The U.S. Marine Corps selected Epirus microwave systems that couple agile IMUs with software-defined emitters to disable drone electronics. These moves signal a procurement pivot toward modular, software-centric weapons built around inertial cores rather than expensive radar or optical guidance. Suppliers that offer scalable IMU modules and open APIs stand to gain as militaries transition to volume-deployment counter-UAS doctrine.

Rising adoption of MEMS tactical-grade IMUs in European LNG tankers for dynamic positioning

European LNG shippers face tighter port queues and harsher Atlantic swells. Bourbon vessels now carry Exail Octans AHRS, based on fiber-optic gyros, to maintain roll, pitch, and heave integrity during crane operations. MEMS designs are also displacing ring-laser gyros on retrofit jobs because they slash purchase price by half while meeting sub-degree accuracy. Advanced Navigation's Hydrus AUV lowered subsea survey costs 75% and removed the need for team-based diving missions. Such savings encourage fleet-wide sensor upgrades, expanding the inertial measurement unit market across commercial shipping.

Design-in cycles less than 7 years limiting supplier switch-over in commercial aircraft

Certification risk makes air-framers conservative. Boeing flight-tested quantum IMUs for four hours but must still complete multi-year qualification before line-fit adoption. Honeywell's miniature IMU that flew on Mars probes underscores how aerospace buyers favour proven designs that demonstrate multi-decade reliability. Lengthy validation locks in incumbent vendors and slows unit-price erosion, tempering the inertial measurement unit market growth rate in commercial aviation.

Other drivers and restraints analyzed in the detailed report include:

- Integration of cold-atom IMUs in ESA small-satellite constellations

- Expansion of photonic IMUs for autonomous mining vehicles in Australia

- ITAR restrictions curtailing U.S. space-grade IMU exports to APAC new-space players

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gyroscopes contributed 40% of inertial measurement unit market revenue in 2024 and remain foundational for dead-reckoning accuracy. Magnetometers, though smaller in absolute value, compound at 10.9% CAGR as augmented-reality developers embed digital compasses inside every headset. Accelerometers maintain consistent volume in vibration and ADAS roles. The inertial measurement unit market now leans toward single-package sensor fusion. STMicroelectronics' LSM6DSV16X adds a machine-learning core that recognizes gestures while lowering standby power to extend battery life. Component vendors that offer on-chip analytics can charge premiums despite commoditization pressure.

Emerging packages combine gyro, accelerometer, and magnetometer data inside secure enclave micro-controllers. Integrated timing eliminates inter-sensor latency and hardens systems against spoof signals. As design teams adopt these modules, bill-of-materials simplicity overtakes raw component cost as the main selection factor. That transition supports steady pricing in the inertial measurement unit market despite rising shipment volumes.

Commercial-grade devices captured 35% of inertial measurement unit market size in 2024 thanks to smartphone and auto-ADAS scale. Space-grade shipments, though smaller, are projected to climb 12.4% CAGR on the back of proliferated low-Earth-orbit (LEO) constellations. Northrop Grumman's LR-450 uses milli-HRG gyros that log more than 70 million fault-free hours in orbit while halving size, weight, and power over ring-laser counterparts. That reliability attracts constellation operators who must launch hundreds of identical satellites.

Grade boundaries blur as commercial MEMS precision improves. Automotive suppliers now request tactical-grade bias stability, while drone makers procure space-qualified parts for radiation robustness. Vendors that master flexible production lines able to pivot from consumer to defense volumes gain resilience during sector downturns, reinforcing their share within the inertial measurement unit market.

Inertial Measurement Unit Market Report is Segmented by Component (Gyroscopes, Accelerometers, and More), Grade (Marine, Navigation and More), Technology (MEMS, FOG, and More), End User (Aerospace & Defense, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38% of inertial measurement unit market revenue in 2024. U.S. defense budgets fund quantum interferometer research at the Naval Research Laboratory, extending navigation run-time without drift. Boeing's quantum-IMU flight validated commercial-aviation use cases and keeps local OEMs ahead of European rivals. Export-control reforms in 2024 eased transfers to Australia, Canada, and the United Kingdom, giving North American vendors privileged access to allied aerospace programs.

Asia-Pacific posts the strongest 11.8% CAGR through 2030. Chinese smart-glass makers, buoyed by domestic subsidies, order tens of millions of six-axis MEMS sensors each quarter. Australia's remote mines serve as live testbeds for photonic IMU trucks, encouraging regional universities to spin out navigation start-ups. New-space launch firms across India, Japan, and South Korea seek ITAR-free space-grade parts, fostering indigenous supply chains that challenge U.S. incumbents in cost-sensitive missions.

Europe retains strategic niches in marine, energy, and high-precision satellite payloads. The ESA GENESIS satellite will use cold-atom IMUs to underpin centimeter-level sea-level monitoring. Exail won Bourbon vessel contracts for fiber-optic gyro dynamic-positioning upgrades, reflecting regional expertise in harsh-sea sensor packaging. Honeywell's EUR 200 million purchase of Civitanavi in 2024 gives the firm a deep European production base, ensuring continuity for aircraft programs even amid trans-Atlantic trade frictions.

- Honeywell International Inc.

- Northrop Grumman Corp.

- Bosch Sensortec GmbH

- Analog Devices Inc.

- Safran Sensing Technologies

- Thales Group

- STMicroelectronics N.V.

- ACEINNA Inc.

- Sensonor AS

- Silicon Sensing Systems Ltd.

- KVH Industries Inc.

- Xsens Technologies B.V.

- VectorNav Technologies LLC

- SBG Systems SAS

- Gladiator Technologies

- Trimble Inc.

- Moog Inc.

- EMCORE Corp.

- TDK-InvenSense

- Murata Manufacturing Co. Ltd.

- Continental AG

- Raytheon Technologies Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Deployment of Counter-UAS Platforms amid Middle-East Drone Incursions

- 4.2.2 Rising Adoption of MEMS-based Tactical-Grade IMUs in European LNG Tankers for Dynamic Positioning

- 4.2.3 Integration of Cold-Atom IMUs in ESA Small-Satellite Constellations

- 4.2.4 Expansion of Photonic IMUs for Autonomous Mining Vehicles in Australia

- 4.2.5 Demand Spike for Retrofit Navigation Upgrades in U.S. Gen-II Fighter Fleet

- 4.2.6 High-volume Consumer-Electronics IMU Orders Driven by Asia's XR Headset Race

- 4.3 Market Restraints

- 4.3.1 Design-in Cycles >7 Years Limiting Supplier Switch-Over in Commercial Aircraft

- 4.3.2 ITAR Restrictions Curtailing U.S. Space-grade IMU Exports to APAC New-Space Players

- 4.3.3 Cumulative Bias Drift in MEMS Arrays Exceeding +-0.3°/hr for Long-haul Maritime Routes

- 4.3.4 Scarcity of Radiation-Hardened ASICs Raising BOM Costs in LEO Satellite IMUs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.5.1 Technology Snapshot - MEMS, FOG, RLG, HRG, Cold-Atom, Photonic

- 4.5.2 Standardization Roadmap (SAE, RTCA/DO-334, NATO STANAG 4671)

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Gyroscopes

- 5.1.2 Accelerometers

- 5.1.3 Magnetometers

- 5.2 By Grade

- 5.2.1 Marine Grade

- 5.2.2 Navigation Grade

- 5.2.3 Tactical Grade

- 5.2.4 Space Grade

- 5.2.5 Commercial Grade

- 5.3 By Technology

- 5.3.1 MEMS

- 5.3.2 Fiber-Optic Gyro (FOG)

- 5.3.3 Ring-Laser Gyro (RLG)

- 5.3.4 Hemispherical Resonator Gyro (HRG)

- 5.3.5 Mechanical Gyro

- 5.4 By End User

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive (ADAS and Autonomous)

- 5.4.3 Industrial Automation and Robotics

- 5.4.4 Consumer Electronics and XR

- 5.4.5 Marine and Offshore

- 5.4.6 Energy (Oil and Gas, Wind Turbines)

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Northrop Grumman Corp.

- 6.4.3 Bosch Sensortec GmbH

- 6.4.4 Analog Devices Inc.

- 6.4.5 Safran Sensing Technologies

- 6.4.6 Thales Group

- 6.4.7 STMicroelectronics N.V.

- 6.4.8 ACEINNA Inc.

- 6.4.9 Sensonor AS

- 6.4.10 Silicon Sensing Systems Ltd.

- 6.4.11 KVH Industries Inc.

- 6.4.12 Xsens Technologies B.V.

- 6.4.13 VectorNav Technologies LLC

- 6.4.14 SBG Systems SAS

- 6.4.15 Gladiator Technologies

- 6.4.16 Trimble Inc.

- 6.4.17 Moog Inc.

- 6.4.18 EMCORE Corp.

- 6.4.19 TDK-InvenSense

- 6.4.20 Murata Manufacturing Co. Ltd.

- 6.4.21 Continental AG

- 6.4.22 Raytheon Technologies Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment