PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844509

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844509

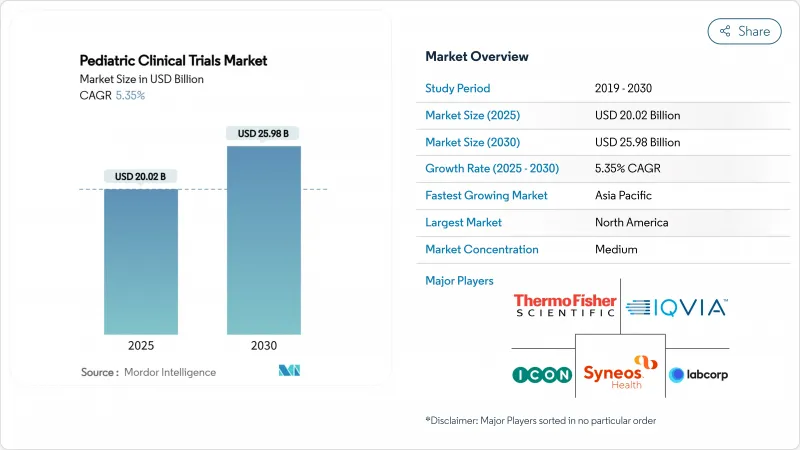

Pediatric Clinical Trials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The pediatric clinical trials market size stands at USD 20.02 billion in 2025 and is forecast to reach USD 25.98 billion by 2030, registering a CAGR of 5.35%.

Strong regulatory incentives, notably the US Pediatric Research Equity Act (PREA) and the EU Paediatric Regulation, keep trial volumes rising as every new molecular entity targeting children must present age-appropriate evidence. Mandatory early evaluation of oncology drugs under the RACE for Children Act sustains a high share of cancer-focused protocols. Parallel trends-including rising chronic disease prevalence among children, the shift toward decentralized and AI-enabled study designs, and deeper outsourcing to pediatric-specialist contract research organizations (CROs)-are expanding both the scope and geographic reach of the pediatric clinical trials market. North America remains the largest regional hub, but Asia-Pacific is accelerating fastest as regulators in South Korea, Taiwan, and Australia streamline review pathways and introduce fiscal incentives for sponsors.

Global Pediatric Clinical Trials Market Trends and Insights

Regulatory Incentives (US PREA, EU Paediatric Regulation)

Long-standing mandates have reshaped drug-development economics by requiring Pediatric Investigation Plans in Europe and pediatric study plans under PREA in the United States. Convergence continues with the FDA's 2024 acceptance of ICH E11A extrapolation guidelines, enabling streamlined dose-finding that leverages adult data where scientifically justified. These policies reduce sequential adult-to-child timelines, lifting demand for specialized pediatric protocols, and the 2025 Innovation in Pediatric Drugs Act proposes stronger enforcement, signaling durable growth.

Rising Prevalence of Chronic Pediatric Diseases

US survey data show persistent increases in asthma and mental-health diagnoses among youth, directly expanding the therapeutic pipeline for pediatric respiratory, endocrine, and neurological agents. Asthma alone continues to impose disparate burdens on non-Hispanic Black children, highlighting equity gaps that prospective studies are beginning to address. The earlier onset and longer treatment windows typical of chronic childhood diseases amplify the requirement for child-friendly formulations and robust long-term safety datasets, prompts that collectively boost the pediatric clinical trials market.

Ethical Complexities & Informed-Consent Hurdles

Dual requirements for parental permission and age-appropriate assent introduce added administrative layers that can delay study start-up and drive costs. A multicenter Canadian survey found wide divergence in feasibility perceptions for obtaining assent within 48 hours of PICU admission. International trials face further institutional review board variation; the PARITY orthopedic oncology study secured approvals from only 46 of 91 interested sites due to resource constraints. Harmonized consent templates and electronic documentation are gradually easing this burden but will remain a headwind for the pediatric clinical trials market.

Other drivers and restraints analyzed in the detailed report include:

- Outsourcing Surge to Pediatric-Specialist CROs

- Decentralized/Virtual Trial Adoption for Children

- Limited Recruitable Patient Pools

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Phase II maintained the largest slice of the pediatric clinical trials market size at 40.51% in 2024 as sponsors used proof-of-concept readouts to fine-tune age-appropriate dosing and accrual strategies. Phase I trials, spurred by the RACE Act and ICH E11A framework, are projected to deliver a 7.25% CAGR by 2030 as sponsors move earlier to test mechanism-based therapies in children. Adaptive, model-based escalation designs minimize exposure while accelerating go/no-go decisions-a practice now standard in oncology and rare metabolic disorders.

Phase III programs remain pivotal for labeling, yet heightened reliance on extrapolation data permits smaller randomized cohorts. As a result, Phase III's proportional pediatric clinical trials market share could erode marginally even though absolute study counts rise. Post-marketing Phase IV surveillance is expanding for chronic therapies where lifetime exposure necessitates pharmacovigilance across developmental stages, leveraging real-world data and registries to capture growth and neurocognitive endpoints.

Interventional drug protocols held 65.53% pediatric clinical trials market share in 2024, reflecting regulatory imperatives for child-specific pharmacokinetic and safety data. Observational cross-sectional studies will contribute the fastest 7.85% CAGR to 2030 as regulators accept real-world evidence to support supplemental labeling, especially in ultra-rare diseases where randomized trials are infeasible.

Device interventions, although smaller in count, are rising steadily in diabetes tech and neuromonitoring, propelled by the need to validate sensor accuracy and alert thresholds in infants. Behavioral and cohort studies complement drug trials by characterizing adherence patterns, school attendance impacts, and psychosocial outcomes critical to holistic benefit-risk assessment in the pediatric clinical trials industry.

The Pediatric Clinical Trials Market Report is Segmented by Phase (Phase I, Phase II, Phase III, and Phase IV), Study Design (Interventional - Drug, Interventional - Device and More), Therapeutic Area (Respiratory Diseases, Infectious Diseases, Oncology, Diabetes and More), Sponsor Type (Pharma & Biopharma Companies and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 39.32% of the pediatric clinical trials market in 2024 due to PREA-driven mandates, a dense network of children's hospitals, and reliable reimbursement for trial-related procedures. Institutional capacity initiatives, such as Lurie Children's plan to open a specialty pharmacy in 2026, reinforce integrated research-to-care models. Staffing shortages persist but are mitigated by remote-monitoring adoption and site-support alliances.

Asia-Pacific will post a 7.61% CAGR through 2030, buoyed by South Korea's centralized IRB review, Taiwan's fast-track approvals, and Australia's decentralized trial guidelines that slash start-up times by up to three months. China's expansion of its National Rare Disease List and investment in provincial referral networks further enlarge patient pools. Lower operational costs and rapidly digitizing healthcare records enhance the region's attractiveness to multinational sponsors aiming to diversify recruitment.

Europe benefits from a harmonized regulatory environment via the Paediatric Committee (PDCO) and maintains robust academic-industry collaboration. Still, post-Brexit regulatory divergence demands duplicate submissions for UK sites, prolonging timelines compared with EU27. Emerging regions such as Latin America and the Middle East show incremental gains as governments upgrade research infrastructure and introduce tax incentives, but limited pediatric specialist density constrains complex trial execution for now.

- IQVIA

- ICON

- LabCorp

- Syneos Health

- Thermo Fisher Scientific (PPD)

- Charles River

- Parexel International

- Medpace Holdings

- WuXi App Tec

- Premier Research

- PRA Health Sciences

- Genentech

- GlaxoSmithKline

- Novartis

- Pfizer

- Johnson & Johnson

- Sanofi

- Abbvie

- AstraZeneca

- The Emmes Company LLC

- Paidion Research Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory Incentives (US PREA, EU Paediatric Regulation)

- 4.2.2 Rising Prevalence Of Chronic Pediatric Diseases

- 4.2.3 Outsourcing Surge To Pediatric-Specialist Cros

- 4.2.4 Decentralized/Virtual Trial Adoption For Children

- 4.2.5 AI-Driven Adaptive Designs Cutting Sample Size

- 4.2.6 RACE For Children Act-Led Oncology Trial Boom

- 4.3 Market Restraints

- 4.3.1 Ethical Complexities & Informed-Consent Hurdles

- 4.3.2 Limited Recruitable Patient Pools

- 4.3.3 Scarcity Of Child-Friendly Drug Formulations

- 4.3.4 Post-Pandemic Site Staffing Shortages

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Phase

- 5.1.1 Phase I

- 5.1.2 Phase II

- 5.1.3 Phase III

- 5.1.4 Phase IV

- 5.2 By Study Design

- 5.2.1 Interventional - Drug

- 5.2.2 Interventional - Device

- 5.2.3 Behavioral Trials

- 5.2.4 Observational - Cohort

- 5.2.5 Observational - Case-Control

- 5.2.6 Observational - Cross-Sectional

- 5.3 By Therapeutic Area

- 5.3.1 Oncology

- 5.3.2 Infectious Diseases

- 5.3.3 Respiratory Diseases

- 5.3.4 Endocrine & Metabolic (Diabetes)

- 5.3.5 Neurology

- 5.3.6 Rare Diseases

- 5.4 By Sponsor Type

- 5.4.1 Pharma & Biopharma Companies

- 5.4.2 Contract Research Organizations

- 5.4.3 Government & Academic Institutions

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 IQVIA

- 6.3.2 ICON plc

- 6.3.3 Labcorp Drug Development (Covance)

- 6.3.4 Syneos Health

- 6.3.5 Thermo Fisher Scientific (PPD)

- 6.3.6 Charles River Laboratories

- 6.3.7 Parexel International

- 6.3.8 Medpace Holdings

- 6.3.9 WuXi AppTec

- 6.3.10 Premier Research

- 6.3.11 PRA Health Sciences

- 6.3.12 Genentech Inc.

- 6.3.13 GSK plc

- 6.3.14 Novartis AG

- 6.3.15 Pfizer Inc.

- 6.3.16 Johnson & Johnson

- 6.3.17 Sanofi S.A.

- 6.3.18 AbbVie Inc.

- 6.3.19 AstraZeneca plc

- 6.3.20 The Emmes Company LLC

- 6.3.21 Paidion Research Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment