PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844513

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844513

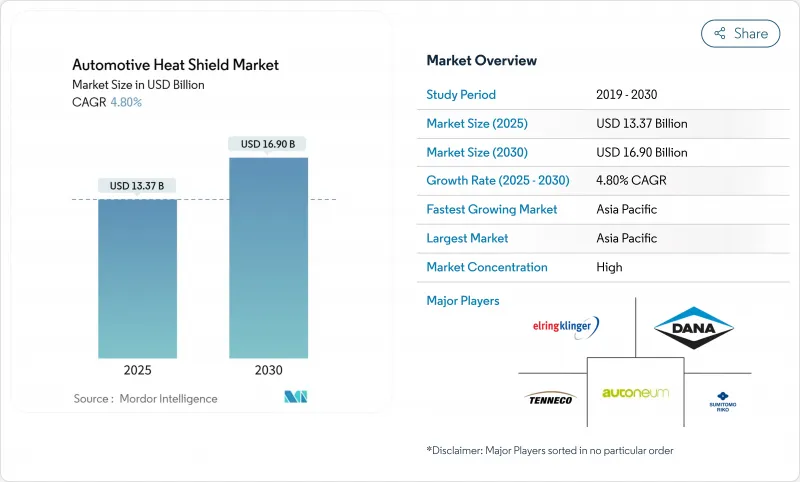

Automotive Heat Shield - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Automotive Heat Shield Market size is estimated at USD 13.37 billion in 2025, and is expected to reach USD 16.90 billion by 2030, at a CAGR of 4.80% during the forecast period (2025-2030).

Stricter emissions regulations and a swift pivot to electric powertrains are shaping the industry's trajectory. Across all vehicle classes, automakers prioritize thermal protection, driven by battery safety mandates, lightweighting goals, and innovative materials. They're adopting composite materials and smart sensors to reduce weight, maintain catalytic converter efficiency, and protect lithium-ion batteries during quick charges. Concurrently, larger tier-one suppliers leverage scale benefits, diversify their material portfolios, and employ hedging strategies.

Global Automotive Heat Shield Market Trends and Insights

Stricter Emission & Fuel-Economy Regulations

Current EPA rules push CO2 limits for new passenger models toward 85 g / mile by 2032, compelling automakers to operate engines hotter and keep catalytic converters at optimal light-off temperatures. Multi-layer metallic shields that capture radiant exhaust heat are pivotal to meeting emissions and corporate average fuel-economy targets. Higher-margin premium shields are seeing the fastest uptake in California, Western Europe, and Japan, whereas cost-driven variants dominate emerging markets with looser rules but converging deadlines.

Surge in Hybrid & EV Battery-Thermal-Management Demand

Lithium-ion packs run safest between 20-40 °C, and containment structures must withstand events exceeding 1,000 °C. New ceramic-fiber and intumescent layers inside battery enclosures limit propagation during thermal runaway, while embedded cooling channels and phase-change inserts handle rapid-charge spikes. Automakers treating thermal shields as safety-critical hardware drive double-digit growth, especially in China and Germany, where electric models launch at the unprecedented cadence.

Raw-Material Price Volatility (Al, SS)

Aluminum prices spiked 15% in early 2025 following bauxite disruptions in Australia and power outages in Yunnan, squeezing margins for stamped-sheet suppliers whose bill-of-materials can exceed 70% metal content. Tier-ones hedge on futures exchanges, but many tier-threes lack credit lines, prompting accelerated R&D into polymer or ceramic alternatives with steadier cost curves.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Aluminum & Composite Material Adoption

- Rising Vehicle Production in APAC

- Durability Challenges of Non-Metallic Shields

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine Compartment Shields controlled 79.56% of the automotive heat shield market in 2024, reflecting the longstanding need to protect wiring, plastic reservoirs, and passenger footwells from engine block and exhaust manifold radiation. Evolving turbo and downsized cylinder heads run hotter, so multilayer aluminum-with-glass-mat designs stay central. Battery & Power-Electronics Shields, though smaller in revenue, are advancing at 12.04% CAGR as every additional kilowatt-hour of energy density raises containment stakes. Flexible ceramic papers and intumescent foams line battery frames, while copper-mesh spreaders move hotspots away from cells during DC-fast-charge phases.

Exhaust System Shields remain the second-largest sub-segment at 15%, driven by Euro 7 and EPA after-treatment temperature windows. These assemblies often carry double-shell construction and dimpled patterns to hold boundary-layer air and slash surface temps by 40 °C. Turbocharger & Intake-Manifold Shields follow, registering 9.6% CAGR thanks to global turbo-gasoline adoption. Underbody & Floor-pan Shields couple thermal and acoustic layers to cut drivetrain hum by up to 3 dB and resist stone impacts in off-road SUVs.

Metallic solutions, hold 87.01% of the market share in 2024-chiefly three xxx aluminum sheet and 409 stainless-still comprise the bulk of automotive heat shield market shipments because of well-known forming, joining, and recycling streams. Variable-thickness hydroforming and laser-perforation now shave weight while venting trapped exhaust heat.

Non-metallic and composite alternatives are seizing share, leveraging 40-60% mass savings and 35% insulation drops. Aerogel-filled blankets push conductivity down to 0.015 W/mK, allowing 2 mm sandwiches that rival 6 mm aluminum shells. Aspen Aerogels' PyroThin(R) panels surround EV cell groups, confining runaway events to single modules and giving pack designers valuable cooling headroom.

Single-shell stampings hold 56.10% of the market share in 2024, remaining popular for splash zones and moderate-heat brackets because their one-piece geometry limits tooling outlay. Yet rising under-bonnet peak temperatures expose their 200 °C ceiling. Double-shell forms insert an air gap that blocks up to 40% radiative flux, meeting stricter cabin soak targets without redesigning firewall geometry.

The fastest growth lies in sandwich composites that pair an aluminum skin with a microporous ceramic center. Morgan Advanced Materials now supplies multi-layer mats that trim 70% of the weight compared with earlier steel pans while holding exhaust-gas ducts at or below 450 °C during hill-climb duty cycles.

The Automotive Heat Shield Market Report is Segmented by Component Type (Engine Compartment Shields and More), Material (Metallic Heat Shields and More), Product Structure (Single Shell and More), Form (Rigid and More), Vehicle Propulsion (ICE Vehicles and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEMs and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific retained a 46.92% share of the automotive heat shield market in 2024 and is expanding at a 9.69% CAGR. Chinese EV assembly hubs in Guangdong and Jiangsu specify ceramic-fiber battery isolators, while Japanese OEMs ship multi-layer acoustic-thermal hybrids that lower drivetrain noise and cabin soak simultaneously. India's localized suppliers produce cost-optimized punched-aluminum forms, meeting small-car price targets while ensuring 500,000-km durability in monsoon climates. South Korean firms specialize in high-density battery pack cooling shields for export SUVs, leveraging domestic cell technology leadership.

Europe followed at 27.22% share, where Euro 7 exhaust rules and stringent OEM lightweighting quotas spur demand for composite and recycled-aluminum designs. German luxury brands pay premiums for ultra-thin titanium-aluminide heat blankets that safeguard turbo housings. French mid-segment programs experiment with end-of-life aluminum feedstock that cuts embedded CO2 by up to 95%. British low-volume performance builders choose 3D-printed Inconel shields for complex turbine scrolls, illustrating the region's appetite for additive manufacturing.

North America contributed 18.13% of 2024 revenue. United States pickup and SUV lines consume traditional stamped aluminum shields in large lots, yet Tesla, GM, and Ford EV platforms drive rapid growth in battery-compartment protection. Canada's freeze-thaw climate elevates durability testing thresholds, pushing composite suppliers toward hybrid metal-ceramic architectures. Mexico's maturing supplier base now molds aerogel-filled flexible wraps for export to Michigan and Ontario assembly plants, diversifying the regional sourcing map.

- Autoneum Holding AG

- Dana Incorporated

- Tenneco Inc.

- ElringKlinger AG

- Sumitomo Riko Co. Ltd.

- DuPont de Nemours, Inc.

- Lydall Inc./Unifrax Thermal Tech

- Denso Corporation

- Nichias Corporation

- Morgan Advanced Materials

- Talbros Automotive Components Ltd.

- Trelleborg AB

- 3M Company

- Toyobo Co., Ltd.

- Zhuzhou Times New Material Technology Co., Ltd.

- Thermo-Tec Automotive Products Inc.

- Happich GmbH (Alutec)

- Robert Bosch GmbH

- Sanko Gosei Ltd.

- HKO Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter Emission & Fuel-Economy Regulations

- 4.2.2 Surge in Hybrid & EV Battery-Thermal-Management Demand

- 4.2.3 Lightweight Aluminum & Composite Material Adoption

- 4.2.4 Rising Vehicle Production in APAC

- 4.2.5 Emergence of Active / Smart Heat Shields

- 4.2.6 Up-Cycling of ELV Aluminum for Low-Carbon Heat Shields

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility (Al, SS)

- 4.3.2 Durability Challenges of Non-Metallic Shields

- 4.3.3 Compliance Costs From Global Auto-Parts-Cartel Probes

- 4.3.4 Diesel-Vehicle Phase-Down in Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Component Type

- 5.1.1 Engine Compartment Shields

- 5.1.2 Exhaust System Shields

- 5.1.3 Turbocharger & Intake-Manifold Shields

- 5.1.4 Underbody & Floor-pan Shields

- 5.1.5 Battery & Power-Electronics Shields

- 5.1.6 Other Component Shields

- 5.2 By Material

- 5.2.1 Metallic Heat Shields

- 5.2.2 Non-metallic / Composite Heat Shields

- 5.2.3 Insulation Blankets / Multi-layer

- 5.3 By Product Structure

- 5.3.1 Single Shell

- 5.3.2 Double Shell

- 5.3.3 Sandwich Composite

- 5.4 By Form

- 5.4.1 Rigid

- 5.4.2 Flexible

- 5.5 By Vehicle Propulsion

- 5.5.1 ICE Vehicles

- 5.5.2 Hybrid Electric Vehicles

- 5.5.3 Battery Electric Vehicles

- 5.6 By Vehicle Type

- 5.6.1 Passenger Cars

- 5.6.2 Light Commercial Vehicles

- 5.6.3 Heavy Commercial Vehicles

- 5.6.4 Off-Highway & Agricultural Vehicles

- 5.7 By Sales Channel

- 5.7.1 OEMs

- 5.7.2 Aftermarket

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Spain

- 5.8.3.5 Italy

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 APAC

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 ASEAN

- 5.8.4.6 Rest of APAC

- 5.8.5 Middle East and Africa

- 5.8.5.1 Saudi Arabia

- 5.8.5.2 United Arab Emirates

- 5.8.5.3 South Africa

- 5.8.5.4 Rest of Middle East and Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Autoneum Holding AG

- 6.4.2 Dana Incorporated

- 6.4.3 Tenneco Inc.

- 6.4.4 ElringKlinger AG

- 6.4.5 Sumitomo Riko Co. Ltd.

- 6.4.6 DuPont de Nemours, Inc.

- 6.4.7 Lydall Inc./Unifrax Thermal Tech

- 6.4.8 Denso Corporation

- 6.4.9 Nichias Corporation

- 6.4.10 Morgan Advanced Materials

- 6.4.11 Talbros Automotive Components Ltd.

- 6.4.12 Trelleborg AB

- 6.4.13 3M Company

- 6.4.14 Toyobo Co., Ltd.

- 6.4.15 Zhuzhou Times New Material Technology Co., Ltd.

- 6.4.16 Thermo-Tec Automotive Products Inc.

- 6.4.17 Happich GmbH (Alutec)

- 6.4.18 Robert Bosch GmbH

- 6.4.19 Sanko Gosei Ltd.

- 6.4.20 HKO Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment