PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844516

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844516

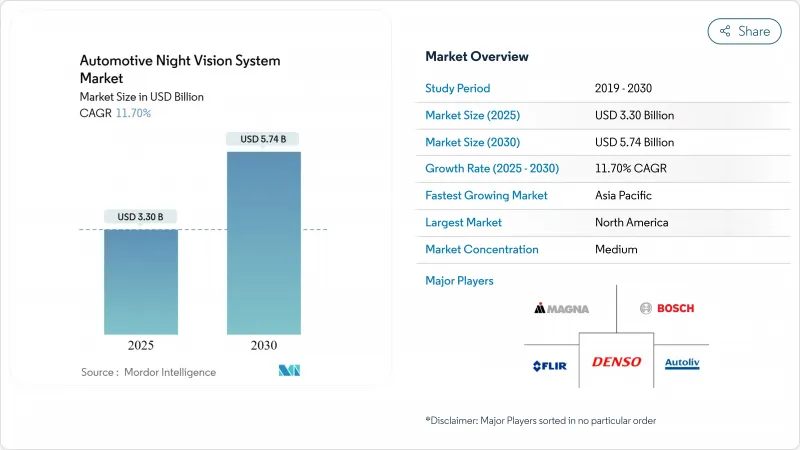

Automotive Night Vision System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The automotive night vision systems market is valued at USD 3.30 billion in 2025 and is projected to reach USD 5.74 billion by 2030, registering an 11.70% CAGR.

Mandatory pedestrian-protection rules in the United States and the European Union, expanding premium battery-electric portfolios, and steady cost reductions in thermal imaging components underpin this outlook. For instance, the National Highway Traffic Safety Administration's Federal Motor Vehicle Safety Standard No. 127, requires pedestrian automatic emergency braking systems by September 2029. Automakers respond by embedding thermal sensors into advanced driver assistance systems (ADAS) stacks, while suppliers exploit wafer-level optics to ease price pressures. Competitive momentum intensifies as traditional Tier-1 suppliers ally with infrared specialists to defend dashboards from disruptive entrants. Over the forecast window, the automotive night vision systems market is set to move from a luxury differentiator to a broadly adopted compliance feature, especially in North America, Europe, and high-tier Chinese platforms.

Global Automotive Night Vision System Market Trends and Insights

ADAS Mandates in US-FMVSS 111 and EU GSR 2029

Regulatory convergence between US Federal Motor Vehicle Safety Standard No. 127 and EU General Safety Regulation 2029 creates a synchronized compliance deadline that fundamentally reshapes automotive night vision adoption economics. The NHTSA mandate requiring pedestrian automatic emergency braking systems by September 2029 exposes a critical performance gap, as testing by Teledyne FLIR and VSI Labs demonstrated that thermal-fused PAEB systems passed all nighttime scenarios while three major 2024 vehicle models failed multiple tests. This regulatory pressure transforms night vision from luxury feature to compliance necessity, with 77.7% of pedestrian fatalities occurring at night in 2022 providing the safety justification. The EU's parallel timeline ensures global automakers cannot regionalize their approach, creating economies of scale that accelerate cost reduction across thermal imaging supply chains. Small-volume manufacturers receive a one-year extension until September 2030, creating a two-tier market dynamic that may advantage established players with existing thermal sensing capabilities.

Premium-segment Penetration in BEVs and Luxury ICE Models

High-end EVs now integrate thermal cameras to justify price premiums and differentiate against conventional rivals. Mercedes-Benz Night View Assist Plus identifies pedestrians and wildlife up to 160 m ahead and applies a spotlight beam without dazzling on-coming traffic. BMW's far-infrared solution reaches 300 m and remains effective without external illumination. Luxury ICE models such as the Audi A6 and Q7 mirror this practice, each offering a USD 2,500 option. Because premium buyers accept equipment lists that push the USD 2,300-2,500 threshold, they provide the seed volumes necessary for supply-chain learning curves, thereby paving the way for cost-optimized trims in volume segments.

High ASP of Uncooled LWIR Modules and HUD Integration

Thermal cores and associated optics remain expensive relative to camera and radar units. Integrating head-up projections adds further expense because each display demands optical combiners and elaborate calibration. OEM cost-engineering teams must choose between full LWIR coverage or radar-camera fusion pathways that promise compliance at lower bill-of-material counts. Emerging shutter-free algorithms and wafer-level manufacturing can relieve pressure, but the transition period keeps mainstream segments price-sensitive

Other drivers and restraints analyzed in the detailed report include:

- Cost Downshift via Wafer-Level Optics and AI-Only Solutions

- Thermal/visible Sensor Fusion Enabling L3 Autonomy at Night

- US ITAR / Wassenaar Export Controls on More Than 9 Hz Thermal Cores

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The automotive night vision systems for LWIR solutions contributed 63.24% of the global value. Strong thermal contrast enables reliable pedestrian recognition beyond headlight beams, explaining sustained uptake in regulatory test cycles. SWIR sensors are scaling at a high CAGR of 16.20% as wafer-level photodiodes have crossed the USD 100-per-unit threshold. Semiconductor processes familiar to camera fabs supply attractive cost curves, and SWIR's ability to see through snow spray and light fog is compelling for autonomous highway duty. The automotive night vision systems market share held by LWIR is expected to erode gradually, though it remains the benchmark for compliance certification. Active Near-Infrared occupies a middle path, supplying monochrome imagery at 600 ft ranges when paired with discreet LED emitters.

R&D pipelines continue to broaden spectral reach. Aalto University delivered germanium photodiodes with 35% higher responsivity at 1.55 µm, ideal for SWIR automotive bands. At the extreme, quantum-dot detectors have logged detectivity up to 18 µm wavelengths, demonstrating the future ceiling for sensor designers. For the next five years, dual-band arrays that blend LWIR and SWIR on common logic will likely headline premium packages, assuring redundancy while tempering total cost of ownership.

Head-up displays secured 43.68% of the market share in 2024, contributing to the market size of automotive night vision systems. Drivers value forward-view retention and reduced glance time. Even so, center-stack displays capture budget placements because automakers already embed 12-inch or larger touchscreens for navigation and streaming. A CAGR of 18.40% sets infotainment-based feeds on course to meet HUD installations by the decade's end. Therefore, the automotive night vision systems market share of HUD modules is forecast to slip to the mid-30% band by 2030.

Future cockpits will reinforce augmented-reality overlays. Continental, Bosch, and HARMAN previewed display controllers that highlight warm-body silhouettes in color-coded boundaries. In lower trims, instrument-cluster views or split-screen widgets may suffice. Because windshield-projected data demands stringent optical alignment, some mass-volume badges bypass HUD architecture until component prices fall. Dual-mode strategies allow premium marques to sustain HUD as a headline feature while mid-range nameplates repurpose center panels, preserving functional consistency across line-ups.

The Automotive Night Vision System Market Report is Segmented by Technology Type (Far Infrared, Near Infrared, and Short-Wave Infrared), Display Type (Navigation System, Instrument Cluster, and More), Component Type (Night Vision Cameras and More), Vehicle Type (Passenger Cars and More), Sales Channel (OEM Factory-Fit and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 41.73% of the 2024 automotive night vision systems market turnover. Legislative clarity is the decisive edge. The NHTSA stipulation that pedestrian AEB operate in darkness by September 2029 forces automakers to lock in sourcing roadmaps now. Domestic suppliers such as Teledyne FLIR and L3Harris furnish mature thermal cores, keeping value added onshore. Premium-SUV demand in the United States compounds volume, while Canadian assembly plants mirror U.S. specifications thanks to shared vehicle architectures.Teledyne FLIR's collaboration with VSI Labs in FMVSS No. 127 compliance testing positions North American suppliers advantageously for global market expansion.

Asia-Pacific is projected to record a 14.60% CAGR. China leads the regional charge as it scales level-2+ ADAS for domestic brands. GAC, NIO, and BYD incorporate AI-powered image enhancement that elevates standard CMOS sensors toward pseudo-thermal output, yet true LWIR adoption is accelerating in flagship trims. Local fabrication of chalcogenide lenses and low-cost wafers is underway to reduce exposure to export controls. Japan and South Korea add premium penetration via Toyota, Lexus, Hyundai, and Genesis nameplates, each pairing night vision with surround-view camera suites.

Europe exhibits balanced growth built on its own General Safety Regulation 2029. German marques led with early-2000s deployment and now refine sensor fusion for conditional autonomy. Valeo's supply agreement with Teledyne FLIR covers series production thermal cameras that meet ASIL B objectives. France's Lynred is doubling clean-room area under an EUR 85 million program to secure detector capacity against geopolitical shocks. Scandinavian markets display above-average uptake because of prolonged winter darkness, while southern European volume hinges on upscale imports. Although the region trails North America in share, synchronous regulation and supplier investments lock in dependable growth.

- Magna International Inc.

- DENSO Corporation

- Robert Bosch GmbH

- Valeo SA

- Autoliv Inc.

- FLIR Systems Inc.

- L3Harris Technologies Inc.

- Aptiv PLC

- Hella KGaA Hueck and Co.

- Visteon Corporation

- Aisin Corporation

- Raytheon Technologies

- Continental AG

- Mobileye Global Inc.

- Renesas Electronics Corp.

- Veoneer AB

- OmniVision Technologies

- Teledyne Technologies Inc.

- Nidec-ELV Automotive Vision

- Pioneer Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ADAS mandates in US-FMVSS 111 and EU GSR 2029

- 4.2.2 Premium-segment penetration in BEVs and luxury ICE models

- 4.2.3 Cost downshift via wafer-level optics and AI-only solutions

- 4.2.4 Thermal/visible sensor fusion enabling L3 autonomy at night

- 4.2.5 Insurance telematics discounts for infrared-equipped fleets

- 4.2.6 Military-grade LWIR sensors entering civilian supply chains

- 4.3 Market Restraints

- 4.3.1 High ASP of uncooled LWIR modules and HUD integration

- 4.3.2 US ITAR/Wassenaar export controls on more than 9 Hz thermal cores

- 4.3.3 Consumer data-privacy pushback on cabin IR imaging

- 4.3.4 Reliability drift of MEMS shutters in uncooled detectors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Technology Type

- 5.1.1 Far Infrared (LWIR, uncooled)

- 5.1.2 Near Infrared (NIR)

- 5.1.3 Short-Wave Infrared (SWIR)

- 5.2 By Display Type

- 5.2.1 Navigation System

- 5.2.2 Instrument Cluster

- 5.2.3 Head-Up Display (HUD)

- 5.2.4 Central Infotainment/IVI Screen

- 5.3 By Component Type

- 5.3.1 Night Vision Cameras (Thermal, NIR)

- 5.3.2 Control/Processing Units

- 5.3.3 Display Modules

- 5.3.4 IR Illumination Sources (LED/VCSEL)

- 5.3.5 Sensors and Other Components

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Light Commercial Vehicles

- 5.4.3 Medium and Heavy Commercial Vehicles

- 5.5 By Sales Channel

- 5.5.1 OEM Factory-fit

- 5.5.2 Aftermarket Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 South Africa

- 5.6.5.4 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Magna International Inc.

- 6.4.2 DENSO Corporation

- 6.4.3 Robert Bosch GmbH

- 6.4.4 Valeo SA

- 6.4.5 Autoliv Inc.

- 6.4.6 FLIR Systems Inc.

- 6.4.7 L3Harris Technologies Inc.

- 6.4.8 Aptiv PLC

- 6.4.9 Hella KGaA Hueck and Co.

- 6.4.10 Visteon Corporation

- 6.4.11 Aisin Corporation

- 6.4.12 Raytheon Technologies

- 6.4.13 Continental AG

- 6.4.14 Mobileye Global Inc.

- 6.4.15 Renesas Electronics Corp.

- 6.4.16 Veoneer AB

- 6.4.17 OmniVision Technologies

- 6.4.18 Teledyne Technologies Inc.

- 6.4.19 Nidec-ELV Automotive Vision

- 6.4.20 Pioneer Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment