PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844533

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844533

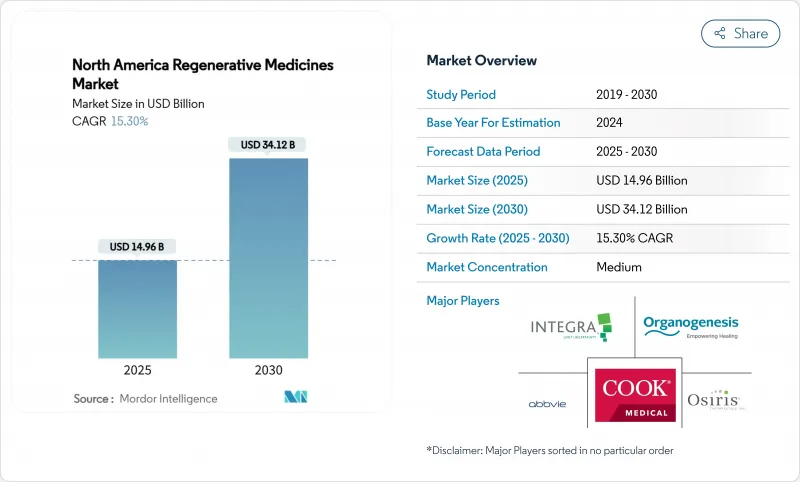

North America Regenerative Medicines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America Regenerative Medicines Market size is estimated at USD 14.96 billion in 2025, and is expected to reach USD 34.12 billion by 2030, at a CAGR of 15.30% during the forecast period (2025-2030).

Commercial adoption is accelerating as therapies that were once confined to academic settings now secure reimbursement for high-burden conditions such as osteoarthritis, hemophilia A and relapsed multiple myeloma. The United States accounts for 84.11% of total 2024 revenue, while Mexico delivers the highest growth trajectory on the continent as regulatory modernization and medical-tourism flows converge. Cell therapies retain leadership on volume, yet gene therapies deliver the steepest revenue ramp as manufacturing economies of scale materialize, particularly in viral-vector production. Heightened strategic investment in in-house manufacturing, spurred by the need for batch-control and intellectual-property protection, is reshaping site-selection patterns throughout the North America regenerative medicine market.

North America Regenerative Medicines Market Trends and Insights

Growing Prevalence of Chronic Degenerative & Age-Related Disorders

An expanding cohort of older adults is amplifying the clinical urgency behind regenerative solutions. More than 54 million Americans live with arthritis, and projections place the figure at 78 million by 2040, driving orthopedic demand within the North America regenerative medicine market. Parallel surges in cardiovascular and neurodegenerative conditions add to the therapeutic backlog, prompting sponsors to pursue FDA's Regenerative Medicine Advanced Therapy (RMAT) designation for age-related indications. The cumulative economic burden, measured in lost productivity and direct medical expenditure, intensifies payer willingness to underwrite curative options that offset lifetime costs. Collectively, these epidemiological factors add substantial momentum to pipeline activity across cell, gene and tissue-engineered modalities.

Robust Government & Private Funding for Advanced Therapies

Funding velocity underscores the maturing innovation cycle. The National Institutes of Health allocated USD 2.8 billion to regenerative-medicine projects for fiscal-year 2024, a 23% budgetary rise over 2023. Simultaneously, Canada's Strategic Innovation Fund committed CAD 1.2 billion (USD 890 million) to construct three advanced-therapy manufacturing hubs, a move designed to anchor domestic capacity and attract technology transfer agreements. Venture investors are mirroring the trend by preferentially channeling capital toward late-stage assets with defined regulatory pathways, signaling confidence in near-term revenue realization within the North America regenerative medicine market.

High Cost & Complex GMP Manufacturing Infrastructure

Specialized clean-room construction averages USD 2,000 per square foot, quadruple that of conventional biologics facilities, and skilled-labor shortages persist, with two-thirds of regenerative-medicine firms citing hiring difficulties in 2024. Manual processing steps amplify batch variability; industry surveys place 15% of runs outside release specifications, five-times the failure rate observed for monoclonal antibodies. While automation is advancing, capital intensity remains a formidable hurdle stifling wider roll-out across the North America regenerative medicine market.

Other drivers and restraints analyzed in the detailed report include:

- Expanded FDA Expedited Pathways Fueling Pipeline

- Big-Pharma-Biotech Alliances Accelerating Commercialization

- Stringent & Evolving Regulatory Compliance for ATMPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cell therapies led the revenue tables in 2024 with 42.61% North America regenerative medicine market share, benefitting from established reimbursement in oncology and orthopedics. Gene therapies, however, post a 24.81% CAGR outlook, propelled by manufacturing efficiencies that have trimmed viral-vector costs by 35% since 2023.

Across 2024 pipelines, 43% of candidates now blend multiple regenerative modalities, reflecting a strategic pivot toward combination constructs. Three such hybrid products gained FDA clearance in early 2025, confirming regulatory openness to category-blurring solutions that will likely enlarge the North America regenerative medicine market.

Allogeneic therapies commanded 55.85% of the North America regenerative medicine market size in 2024, aided by off-the-shelf scalability and established distribution chains. Autologous approaches are closing the gap, advancing at 21.17% CAGR as process optimization compresses vein-to-vein timelines from 28 days in 2023 to 14 days in early 2025.

Efficacy differentials remain indication-specific: autologous CAR-T retains a clinical edge in hematologic malignancies, whereas allogeneic constructs offer rapid deployment in cardiovascular emergencies. Hybrid sourcing models, marrying autologous targeting with allogeneic manufacturing, received their first approval in March 2025, further diversifying the North American regenerative medicine market.

The North America Regenerative Medicine Report is Segmented by Product Type (Cell Therapies, Gene Therapies, and More), Origin of Cells (Autologous, and More), Source (Adult Stem Cells, and More), Application (Orthopedics & Musculoskeletal, and More), End User (Hospitals & Surgical Centers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AbbVie Inc (Allergan Aesthetics)

- Smiths Group

- Organogenesis

- Medtronic

- Thermo Fisher Scientific

- Merck

- Cook Group

- MiMedx Group Inc.

- Vericel

- Integra LifeSciences

- Mesoblast Limited

- Novartis

- Bristol Myers Squibb (Celgene)

- Gilead Sciences

- bluebird bio Inc.

- Spark Therapeutics Inc. (Roche)

- CRISPR Therapeutics AG

- Sangamo Therapeutics

- Takeda Pharmaceuticals

- 3-D Systems Corp. (Allevi)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Prevalence of Chronic Degenerative & Age-Related Disorders

- 4.2.2 Robust Government & Private Funding for Advanced Therapies

- 4.2.3 Expanded FDA Expedited Pathways Fueling Pipeline

- 4.2.4 Big-Pharma-Biotech Alliances Accelerating Commercialization Roadmaps

- 4.2.5 Increasing Adoption of Stem Cell Technology

- 4.2.6 Advancements in 3D Bioprinting and Tissue Engineering Technologies

- 4.3 Market Restraints

- 4.3.1 High Cost & Complex GMP Manufacturing Infrastructure

- 4.3.2 Stringent & Evolving Regulatory Compliance for ATMPs

- 4.3.3 Limited Long-Term Clinical Evidence and Outcome Data

- 4.3.4 Ethical and Public Perception Challenges Around Cell-Based Therapies

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Cell Therapies

- 5.1.2 Gene Therapies

- 5.1.3 Tissue-Engineered Products

- 5.1.4 Biomaterials

- 5.1.5 Acellular Regenerative Products

- 5.2 By Origin of Cells

- 5.2.1 Autologous

- 5.2.2 Allogeneic

- 5.2.3 Xenogeneic

- 5.3 By Source

- 5.3.1 Adult Stem Cells

- 5.3.2 Induced Pluripotent Stem Cells

- 5.3.3 Embryonic Stem Cells

- 5.3.4 Hematopoietic Stem Cells

- 5.4 By Application

- 5.4.1 Orthopedics & Musculoskeletal

- 5.4.2 Dermatology & Wound Care

- 5.4.3 Cardiovascular

- 5.4.4 Neurology

- 5.4.5 Oncology

- 5.4.6 Ophthalmology

- 5.4.7 Others (Endocrine, Renal etc.)

- 5.5 By End User

- 5.5.1 Hospitals & Surgical Centers

- 5.5.2 Specialty Clinics

- 5.5.3 Academic & Research Institutes

- 5.5.4 Biobanks & Cell Banks

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie Inc (Allergan Aesthetics)

- 6.3.2 Smith & Nephew plc (Osiris Therapeutics)

- 6.3.3 Organogenesis Holdings Inc.

- 6.3.4 Medtronic

- 6.3.5 Thermo Fisher Scientific Inc.

- 6.3.6 Merck KGaA (Sigma-Aldrich)

- 6.3.7 Cook Medical (Cook Biotech Incorporated)

- 6.3.8 MiMedx Group Inc.

- 6.3.9 Vericel Corporation

- 6.3.10 Integra Lifesciences

- 6.3.11 Mesoblast Limited

- 6.3.12 Novartis AG

- 6.3.13 Bristol Myers Squibb (Celgene)

- 6.3.14 Gilead Sciences Inc. (Kite Pharma)

- 6.3.15 bluebird bio Inc.

- 6.3.16 Spark Therapeutics Inc. (Roche)

- 6.3.17 CRISPR Therapeutics AG

- 6.3.18 Sangamo Therapeutics Inc.

- 6.3.19 Takeda Pharmaceutical Co. Ltd.

- 6.3.20 3-D Systems Corp. (Allevi)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment