PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844534

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844534

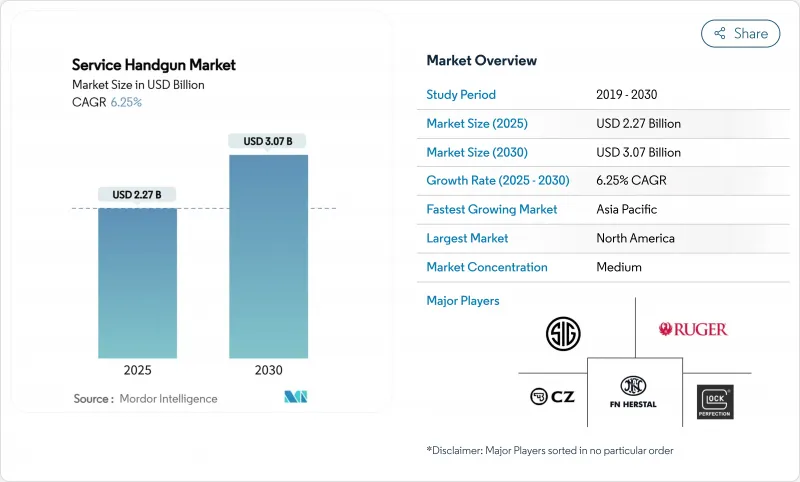

Service Handgun - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The service handgun market size is estimated at USD 2.27 billion in 2025, and is expected to reach USD 3.07 billion by 2030, reflecting a CAGR of 6.25% during the forecast period.

Strong defense modernization, synchronized law-enforcement fleet upgrades, and the rapid displacement of double-action pistols by striker-fired platforms continue to sustain demand across mature and emerging procurement programs. Modular optics-ready designs now dominate specification lists, enabling fast technology refresh without entire weapon replacement. Regional momentum is uneven: North America retains the largest installed base, yet Asia-Pacific exhibits the quickest expansion as Indigenous manufacturing ramps up and strategic stockpiling gains urgency. Consolidation activity led by vertically-integrated ammunition-to-firearm groups and supply-chain fragilities in critical materials such as nitrocellulose reshape bargaining power along the value chain.

Global Service Handgun Market Trends and Insights

Modernization initiatives driving military sidearm upgrades

Defense agencies have moved beyond incremental overhauls, favoring complete sidearm replacement to secure interoperability, accessory rail compatibility, and sensor integration. Germany ordered 3,200 Walther P14 and 3,300 P14K pistols with enclosed-emitter optics and enhanced triggers that standardize special-forces equipment. Australia's Project Land 300 fielded the SIG P320-based F9 system with red-dot sights, tactical lights, and non-lethal training mods under a single architecture. These programs underscore that legacy service pistols cannot absorb future capability inserts, prompting contiguous procurement cycles that underpin the service handgun market.

Law-enforcement fleet renewals boosting demand for striker-fired handguns

Police agencies prioritize consistent trigger pull, straightforward maintenance, and optics readiness. Pennsylvania State Police chose the Walther PDP, citing direct-milled Aimpoint ACRO compatibility and ergonomic improvements. Hartford Police transitioned from .40 caliber Glock 22/23 Gen4 to 9 mm Glock 17/19 Gen5, referencing improved terminal performance, lower recoil, and cheaper ammunition. Notwithstanding isolated safety concerns tied to specific striker-fired models, the broader trajectory still favors striker mechanisms, reinforcing growth across the service handgun market.

Tighter firearm regulations and export compliance limiting market accessibility

Shifting from ITAR to EAR oversight requires a full compliance overhaul even for unchanged product lines. The Bureau of Industry and Security's larger audit force heightens enforcement risk, and most handgun exports still need licenses, extending lead times. Complex dual-use technology rules add bureaucratic friction that deters smaller producers, setting thresholds that inadvertently consolidate the service handgun market around firms with mature compliance infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- Growing adoption of concealed-carry firearms among civilian users

- Procurement preference shifting toward factory-equipped optic-ready pistols

- Unstable ammunition supply chains and rising material costs impacting procurement

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pistols delivered 88.67% of 2024 revenue, cementing their status as the default sidearm for armed professionals thanks to greater magazine capacity and faster reloads than revolvers. Revolvers secured only 11.33% yet will outpace overall service handgun market growth at a 6.98% CAGR because specialized units still value their mechanical simplicity and non-recoverable brass advantages in sensitive operations. Historically, shared stability shows that innovation drives procurement rather than platform switching. The service handgun market continues to reward pistol makers that offer interchangeable backstraps, modular frames, and optics cuts, whereas revolver suppliers carve niche roles in training and covert scenarios.

Although revolvers are making a tactical comeback in limited contexts, pistols retain institutional preference. Large procurement programs like Australia's replacement of Browning Hi-Power variants cited the need for 17-round magazines versus the legacy platform's 13-round capacity. As newer striker-fired pistols furnish enhanced ergonomics and accessory rails, they further distance themselves from alternatives. Nevertheless, revolver makers responding with modern metallurgy and improved double-action triggers will likely keep the sub-segment profitable, sustaining a diverse service handgun market.

Striker-fired pistols captured 72.56% 2024 revenue and are forecasted to notch a 7.01% CAGR, a rare instance where the top-share design is also the fastest grower within the service handgun market. Consistent trigger pull across every shot simplifies training, and fewer parts cut maintenance costs for resource-constrained departments. Single-action pistols at 15.22% share cater to precision-oriented teams, while double-action systems with 12.22% share endure mainly because some agencies have yet to refresh legacy inventories.

The striker-fired rise intensifies as procurement documents embed drop-safety mandates and field-gauge standards that current designs already exceed. The service handgun market, therefore, sees a self-reinforcing loop: agencies switch to striker-fired platforms, aftermarket holster and optic ecosystems concentrate there, and fresh bids lean toward the better-supported configuration. Double-action platforms will persist in limited roles, but capital investment tilts toward striker development roadmaps.

The Service Handgun Market Report is Segmented by Type (Revolvers and Pistols), Operation Mechanism (Single-Action, Double-Action, and Striker-Fired), Caliber (9 Mm, . 40 S&W, . 45 ACP, and Other Calibers), Material (Stainless Steel, Polymer Frame, and Aluminum Alloy), End-User (Military, Law Enforcement, and Others), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 40.10% 2024 revenue thanks to agency modernization budgets and federal grants that support local police upgrades. US Customs and Border Protection's switch to new-generation GLOCK 9 mm pistols reflects procurement programs that ripple across training academies, armorers, and aftermarket suppliers. Canada's CAD 19.4 million (USD 14.22 million) order for SIG P320 pistols underscores regional interoperability aims. Although the region's 5.8% CAGR trails global momentum, its mature acquisition frameworks continue to generate steady baseline demand across the service handgun market.

Asia-Pacific will achieve the fastest 8.21% CAGR as self-reliance policies and threat perceptions accelerate funding. Australia's F9 adoption embeds virtual training modules, while India's "Make in India" doctrine lures foreign primes into local joint ventures. Indigenous machine-pistol programs such as "Asmi" signal that governments see in-country capacity as strategic. These factors combine to make the region the growth engine and potential manufacturing hub of the service handgun market.

Europe closed 2024 with a 28.45% share, powered by NATO harmonization and multi-nation tenders. Germany's P13 competition and Denmark's SIG P320 adoption illustrate rigorous but collective procurement that maximizes volume discounts. The Middle East and Africa, holding 15.20%, remain opportunity centers where large defense budgets converge with domestic manufacturers like Caracal, which doubled export ratios by forging Indonesian and Indian production tie-ups. Supply-chain sovereignty themes mean that even smaller states pursue localized assembly, keeping the region attractive to global OEMs seeking diversified revenue streams across the service handgun market.

- GLOCK, Inc.

- SIG SAUER, Inc.

- Smith & Wesson Brands, Inc.

- Sturm, Ruger & Co., Inc.

- Fabbrica d'Armi Pietro Beretta S.p.A.

- Heckler & Koch GmbH

- FN Browning Group

- Colt's Manufacturing Company LLC

- Springfield, Inc.

- Caracal International (EDGE Group PJSC)

- Walther Arms, Inc.

- Taurus Holdings, Inc.

- Ceska zbrojovka a.s.

- Armscor International, Inc.

- Israel Weapon Industries

- Samsun A.S. (SYS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Modernization initiatives driving military sidearm upgrades

- 4.2.2 Law enforcement fleet renewals boosting demand for striker-fired handguns

- 4.2.3 Growing adoption of concealed-carry firearms among civilian users

- 4.2.4 Procurement preference shifting toward factory-equipped optic-ready pistols

- 4.2.5 Pilot programs exploring biometric smart-gun integration in government use

- 4.2.6 Renewed interest in revolvers for training and specialized operational roles

- 4.3 Market Restraints

- 4.3.1 Tighter firearm regulations and export compliance limiting market accessibility

- 4.3.2 Unstable ammunition supply chains and rising material costs impacting procurement

- 4.3.3 Growing preference for non-lethal tools diminishing handgun adoption in law enforcement

- 4.3.4 Budget prioritization shifting toward wearable tech and conflict de-escalation programs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Revolvers

- 5.1.2 Pistols

- 5.2 By Operation Mechanism

- 5.2.1 Single-Action

- 5.2.2 Double-Action

- 5.2.3 Striker-Fired

- 5.3 By Caliber

- 5.3.1 9 mm

- 5.3.2 .40 S&W

- 5.3.3 .45 ACP

- 5.3.4 Other Calibers

- 5.4 By Material

- 5.4.1 Stainless Steel

- 5.4.2 Polymer Frame

- 5.4.3 Aluminum Alloy

- 5.5 By End-User

- 5.5.1 Military

- 5.5.2 Law Enforcement

- 5.5.3 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 GLOCK, Inc.

- 6.4.2 SIG SAUER, Inc.

- 6.4.3 Smith & Wesson Brands, Inc.

- 6.4.4 Sturm, Ruger & Co., Inc.

- 6.4.5 Fabbrica d'Armi Pietro Beretta S.p.A.

- 6.4.6 Heckler & Koch GmbH

- 6.4.7 FN Browning Group

- 6.4.8 Colt's Manufacturing Company LLC

- 6.4.9 Springfield, Inc.

- 6.4.10 Caracal International (EDGE Group PJSC)

- 6.4.11 Walther Arms, Inc.

- 6.4.12 Taurus Holdings, Inc.

- 6.4.13 Ceska zbrojovka a.s.

- 6.4.14 Armscor International, Inc.

- 6.4.15 Israel Weapon Industries

- 6.4.16 Samsun A.S. (SYS)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment