PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844535

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1844535

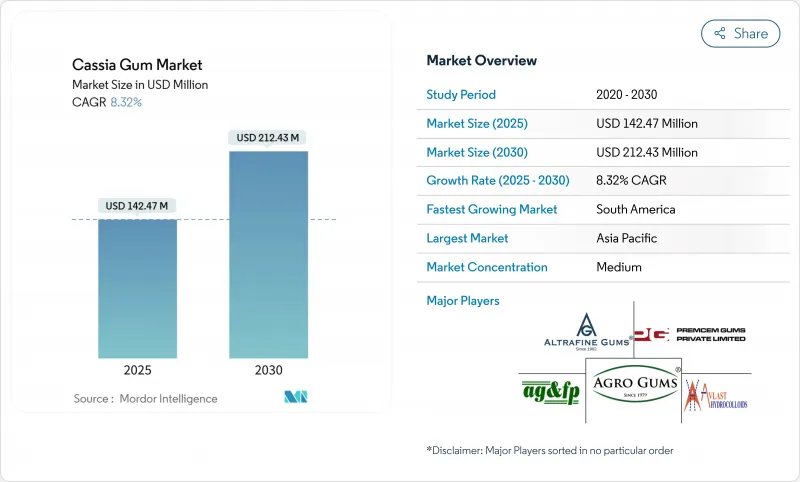

Cassia Gum - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global cassia gum market is valued at USD 142.47 million in 2025 and is forecast to reach USD 212.43 million by 2030, advancing at an 8.32% CAGR over the period.Refined cassia gum, known for its high purity and wide regulatory acceptance, has taken the lead in the market.

Its versatility is evident in food, beverages, and pharmaceuticals, serving as a stabilizer, thickener, and gelling agent. It's commonly found in dairy products, sauces, meat formulations, and even in topical drug delivery. Meanwhile, the technical grade cassia gum, with its minimal processing, finds its niche in industrial applications and animal feed, where there's less regulatory scrutiny. In the food and beverage sector, cassia gum enhances texture, stability, and shelf life in processed meats, dairy desserts, baked goods, and confectionery. The personal care segment is rapidly growing, with cassia gum in demand for its viscosity and natural appeal in skincare and haircare products. The Asia-Pacific region dominates the market, thanks to its raw material availability and processing expertise. However, South America is poised to lead, driven by a rising demand for natural hydrocolloids in food, feed, and personal care.

Global Cassia Gum Market Trends and Insights

Multifunctionality of Cassia Gum and Diverse Applications

The inherent versatility of cassia gum as a thickener, stabilizer, and gelling agent positions it as a multifunctional ingredient capable of meeting diverse formulation needs across food, pharmaceutical, and personal care industries. Its ability to function both independently and synergistically with other hydrocolloids allows formulators to optimize texture, stability, and shelf life with low inclusion rates. This multifunctionality is increasingly valuable as manufacturers prioritize ingredient consolidation to streamline formulations and reduce regulatory complexity, particularly in clean-label product development. In the food and beverage sector, cassia gum supports structural integrity and consistency in products like processed cheese, frozen desserts, and confectionery. Notably, in 2024, U.S. ice cream production reached 1.31 billion gallons, according to the International Dairy Foods Association (IDFA), underlining the scale and relevance of functional hydrocolloids in high-volume categories . Cassia gum's compatibility with both cold and heat-processed systems, along with its plant-based origin, enhances its appeal for clean-label reformulations.

Growing Pet Food Industry Amplifying Demand for Safe Stabilizer

The rising demand for premium, texture-rich pet food is significantly amplifying the need for safe and effective stabilizers like cassia gum. As pet owners become more informed and selective, the industry faces increasing pressure to deliver clean-label, nutritionally balanced, and palatable formulations, particularly in the pet food segment. Cassia gum has emerged as a stabilizer of choice in this space, especially when used in synergy with carrageenan, effectively resolving the technical challenges associated with gel consistency and moisture control in moist feeds. The premiumization trend in the pet food sector underscores this shift, where ingredient quality directly impacts brand credibility and consumer loyalty. According to Pets International (2023), quality was cited as the most important factor when selecting dog food, while 50% of respondents prioritized nutritional intake. Regulatory clarity further strengthens cassia gum's position: the European Food Safety Authority (EFSA), in its 2024 safety assessment, approved cassia gum for use in dog and cat food up to 13,200 mg/kg, provided anthraquinone levels remain below 0.5 mg/kg.

Stringent Regulatory Approvals and Varying Regional Standards

Manufacturers of cassia gum face significant hurdles in accessing global markets due to the regulatory complexities across different jurisdictions. Each region has its distinct approval processes and safety requirements, necessitating substantial investments in compliance. A case in point is China's introduction of GB 2760-2024 in February 2025, which mandates manufacturers to adapt to updated standards while ensuring compliance in their existing markets. Similarly, Brazil's food supplement regulations, updated under ANVISA's Normative Instruction No. 284/2024, highlight how such regulatory shifts can disrupt established supply chains and necessitate costly reformulations. These regulatory discrepancies are especially pronounced in pharmaceutical applications. Furthermore, varying drug approval processes across markets often demand separate safety studies and documentation, leading to significantly longer time-to-market for new applications.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand in the Pharmaceutical Industry for Excipient Use

- Eco-Friendly and Biodegradable Nature of Cassia Gum

- Potential Toxicity at High Concentrations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The refined grade segment commands 66.43% market share in 2024 and projects the fastest growth at 9.32% CAGR through 2030, driven by pharmaceutical and premium food applications that demand consistent quality and minimal impurities. This segment's market dominance reflects the industry's significant shift toward higher-value applications where stringent purity specifications justify premium pricing, particularly in advanced drug delivery systems where excipient quality directly impacts therapeutic efficacy and patient outcomes. Technical grade cassia gum predominantly serves cost-sensitive applications in industrial food processing and animal feed manufacturing, where functional performance and processing characteristics outweigh purity considerations, though increasing regulatory restrictions substantially limit its growth potential compared to refined variants.

The pharmaceutical industry's widespread adoption of natural excipients, accelerated by potential titanium dioxide restrictions in multiple regions, particularly benefits refined grade producers who can consistently meet rigorous drug manufacturing quality standards and compliance requirements. Technical grade applications face mounting pressure from clean-label trends that prioritize ingredient purity and transparency, though significant cost advantages maintain market relevance in price-sensitive segments where basic functional performance meets minimum regulatory and application requirements.

The Global Cassia Gum Market is Segmented by Grade (Refined Grade and Technical Grade), by Application (Food and Beverage, Pharmaceuticals, Animal Feed, Personal Care, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds market leadership with a 42.58% share in 2024, supported by its position as both a primary raw material source and a major manufacturing hub. India's dominance in cassia seed cultivation provides significant cost advantages. China's updated food additive standards under GB2760-2024, effective February 2025, establish clear regulatory pathways for cassia gum applications while expanding market access for compliant manufacturers. The region's growth continues through pharmaceutical applications and increased natural ingredient adoption in food processing, though concentrated supply chains present potential disruption risks.

South America represents the fastest-growing regional market with 9.64% CAGR through 2030. This growth stems from Brazil's evolving regulatory landscape and expanding food processing sector, which increasingly emphasizes natural ingredients. ANVISA's updated Normative Instruction No. 284/2024, effective April 2024, has revised authorized constituents and labeling requirements for food supplements, creating opportunities for natural ingredient suppliers who can meet the new compliance standards.

North America and Europe maintain stable demand patterns and premium pricing for high-quality grades. Growth in these regions stems from regulations favoring natural ingredients and pharmaceutical applications seeking synthetic alternatives. North American demand is particularly strong in pharmaceutical applications and premium pet food segments that emphasize ingredient safety and transparency. The Middle East and Africa markets show growth potential through expanding food processing industries and rising consumer awareness of natural ingredients. However, these regions' regulatory frameworks remain less developed compared to established markets.

- Agro Gums

- Altrafine Gums

- Amba Gums & Feeds Products

- Premcem Gums

- Dwarkesh Industries

- Avlast Hydrocolloids

- Sarda biopolymers

- H.L. Agro Products

- Shree Ram Industries

- Jinan Farming Star Imp&Exp Co. Ltd

- Sarda Gums & Chemicals

- AEP Colloids

- Mahesh Agro Food Industries (MAFI Group)

- Bharat Agro Industries

- Brenntag SE (Colony Gums)

- Wuzhou Jufeng Trading

- JD Gums and Chemicals

- LUBI GEL LIMITED

- Wuhan Jiangshu Food Ingredients Co., Ltd

- Vasundhara Gums and Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Multifunctionality of Cassia Gum and diverse applications

- 4.2.2 Growing Pet Food Industry Amplifying Demand for Safe Stablizer

- 4.2.3 Increasing Deamand in the Pharmaceutical Industry for Excipient Use

- 4.2.4 Eco-Friendly and Biodegradable Nature of Cassia Gum

- 4.2.5 Extended Shelf Life and Stability in Food Products

- 4.2.6 Growing Popularity of Clean-Label and Allergen-Free Ingredients

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory approvals and Varying Regional Standards

- 4.3.2 Potential Toxicity at High Concentrations

- 4.3.3 Complex Extraction and Purification Process

- 4.3.4 Risk of Adultration and Purity in Low-Cost Varients

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Grade

- 5.1.1 Refined Grade

- 5.1.2 Technical Grade

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery and Confectionery

- 5.2.1.2 Dairy and Dairy Products

- 5.2.1.3 Meat Industry

- 5.2.1.4 Others

- 5.2.2 Pharmaceuticals

- 5.2.3 Animal Feed

- 5.2.4 Personal Care

- 5.2.5 Others

- 5.2.1 Food and Beverage

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Agro Gums

- 6.4.2 Altrafine Gums

- 6.4.3 Amba Gums & Feeds Products

- 6.4.4 Premcem Gums

- 6.4.5 Dwarkesh Industries

- 6.4.6 Avlast Hydrocolloids

- 6.4.7 Sarda biopolymers

- 6.4.8 H.L. Agro Products

- 6.4.9 Shree Ram Industries

- 6.4.10 Jinan Farming Star Imp&Exp Co. Ltd

- 6.4.11 Sarda Gums & Chemicals

- 6.4.12 AEP Colloids

- 6.4.13 Mahesh Agro Food Industries (MAFI Group)

- 6.4.14 Bharat Agro Industries

- 6.4.15 Brenntag SE (Colony Gums)

- 6.4.16 Wuzhou Jufeng Trading

- 6.4.17 JD Gums and Chemicals

- 6.4.18 LUBI GEL LIMITED

- 6.4.19 Wuhan Jiangshu Food Ingredients Co., Ltd

- 6.4.20 Vasundhara Gums and Chemicals

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK